Comments

-

Psychiatry’s Incurable HubrisI hope this was sarcasm and I hope there was a method to this madness. I take offense at someone who pokes fun at someone's mental health whether they are going through some form of mental abnormality or not. — Anaxagoras

Hanover and I have been trading sarcastic broadsides for years. -

Unconditional love.Is a male desireable or evolutionarily "fit" if he is to live with his mother after the age of adolescence? If not, then what is he treated as? — Wallows

I don't know. Is he? Yes? No? Maybe?

What should you do to prove your evolutionary fitness? Beat up every other guy in the neighborhood and become King of the Hill? Go hunting and kill a nice big buck, butcher it in the woods, and bring it home tied to the hood of your car? Go find a woman and drag her to your bed by her hair? Win a blue ribbon at the state fair for the biggest pumpkin? Hold up a gas station?

I'm just not sure the question of evolutionary fitness helps clarify anything here. -

Unconditional love.Thoughts? — Wallows

You will live your life as you see fit, of course, and you are entitled to do that.

At least in southern Italian families just a few generations back it was not unusual for one son to remain at home with his mother, for her benefit (assuming the father had died).

My guess is that over the eons, many families have remained together into the adulthood of their children and even grandchildren. The famous "extended family". So, historically there is nothing particularly unusual about you remaining at home with your mother.

On the other hand, we don't live in a traditional culture. American or European culture seems to support the notion that children should leave home, at some point, and make their own way in the world. There is nothing inordinately superior about this plan over a traditional plan, but it's the one that we (mostly) live with.

If there is a fly in your ointment it would be this: is the unconditional love your mother gives to you preparing you to give it to others? Unconditional love (as I understand it, anyway) takes practice. We have to build our capacity to give unconditional love, through experiences that may sometimes be painful.

The crude analogy would be the capacity to run a marathon. Usually we have to work up to running for 26 miles; we have to work fairly hard if we plan on finishing close to the front. It will be unpleasant at times; sometimes quite unpleasant.

Unconditional love and feminism seem like an unfortunate combination of ingredients for a good cocktail. Unconditional love and Christ go well together, and fear and loathing of the nuclear family is a good base for a feminist intoxicant. -

You're not exactly 'you' when you're totally hammeredI don't know whether or not drinking alcohol produces a Jekyll and Hyde change. I just don't know enough people well enough who have been both alcoholic and sober to make a good comparison judgement. As one would expect, my experience with alcoholics tended to be kind of negative, so I kept my distance.

One guy I knew (a partner for a couple of years) seemed to exhibit a Jekyll and Hyde pattern, but in fact he was doing a slow burn most of the time, and the first drink just turned up the heat and he'd boil over. He was pissed off at the Benedictines (he was an ex-monk), the church, his parents, his relatives, work, me -- pretty much everybody. He was Mr. Hyde all the time, really.

It seems to me that a lot of people drink to live with themselves. Their sober lives are just too laden with anger, bitter disappointments, frustrated aspirations, fear, etc. to deal with. So, a bottle of gin down the hatch. Heavy drinking makes life worse, so down the drain they go. -

What is wrong with social justice?It is possible to believe in free speech and at the same time believe that speech has consequences. If we want to have zero limits on speech, it seems to me we have to accept that a certain amount of collateral damage may occur as a result of all that free speech.

-

What is wrong with social justice?Many people believe they should lose weight and eat better, but they do not. — Terrapin Station

You cite a good example of belief and behavior. People have to actually eat differently to have effective beliefs about diet and/or weight loss. Actually eating a lower calorie meal strengthens belief.

Believing one should quit smoking without so much as smoking 1 less cigarette a day is not an effective belief. It's idle. IF they stop smoking for a day, the whole project will have more reality.

Safer sex programs rest on the idea that guys will actually put the condom on and discover that pleasure still happens. Efficacious belief can not happen in the absence of behavior.

You might object that bringing behavior up is either more hocus pocus or it is only relevant to after-the-fact behavior change, which could always be the case, of course.

Williams James pointed out the relationship between behavior and beliefs, emotions, and so forth. ACTING reinforces or undermines belief, depending on whether it is consonant. If we wish to overcome a fearful belief ("There are monsters in the dark cellar") we have to actually go into the dark cellar with a light and discover that there are no monsters there. Turn the light off while we are in the cellar to learn that monsters do not suddenly pounce on us when the light is off. Eventually go into the dark cellar without a light.

By so behaving, we can strengthen our belief in a monster-free cellar. By avoiding the cellar at all costs, we confirm our belief that ghastly creatures are lurking down there. -

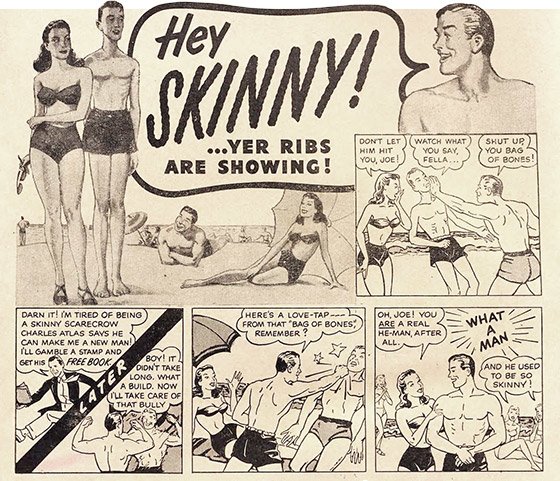

Are bodybuilders poor neurotic men?Heck why don't you at least do a martial art, then? Sure can see a number of situations where it would be more beneficial than bodybuilding — gumi

Of course, a 90 lb. weakling is at a disadvantage in martial arts. The guys in the karate club at the U were a pretty lean muscular bunch (drool). -

Are bodybuilders poor neurotic men?This to me is "artificial". — gumi

Of course it is artificial. In the good old days, men got magnificent physiques by building temples and city walls and houses out of stone with their bare hands and a minimum of tools. Or by working in steel mills, or iron mines, or coal fields, or plowing, planting, and harvesting, and so forth. All that has changed.

Modern "Body building" got going as a specialty in the late 19th century. Eugene Sandow, born 1867, was the modern promoter. Of course, the Greeks were interested in physical culture long before us, and they worked on their physiques competitively (I think more for olympic performance than S & M -- Stand & Model.

Historically, industrial revolution era working class men didn't have the leisure or necessity to body build. Work took care of that. They worked hard and then they died. Bodybuilding and athletic practice takes a certain amount of leisure. The more time that one puts into it, the more free time one needs. Most likely athletes have belonged to a somewhat higher class, where leisure was more plentiful.

In our era (century or two) quite a few people no longer engaged in heavy labor, and had more leisure time. Athletic activities could become a specialty for a broader spectrum of classes.

-

Justification for harming othersAccording to some good, sound ethical systems, we can not justify harming others beyond self defense. Some ethical systems even rule self defense out (like Jesus' system).

In practice (and facts on the ground can be quite compelling) proactively harming others is routine and customary policy. I wasn't thinking of any particular recent bombing raids. We've been bashing each other's brains out for a very long time.

As for procreation, soldiers will be needed to continue the policy of proactively harming others, so it's OK. Offspring are needed to keep the system going -- as drudges in factories, as drudges buying stuff in stores, and/or as drudges on the battle field. There is a lot of drudgery to be done, and somebody has to do it. It might as well be your children.

"Your failing to procreate just makes more procreative work for other people. Do your share, you lazy bastards!" he said with irony. -

The Meaning of LifeDarwin's discovery of evolution showed us a meaningless universe. — Chris Liu

Darwin investigated the mechanisms of nature. That fact that life in the universe changes over time need not lead us to the conclusion that the universe is meaningless. It might be meaningless, but at least one species spends a lot of time generating meaning.

So what should humans do according to this meaning of life? Somethings are obvious. For example, humans should colonize outer space... — Chris Liu

And, actually, we have. Our planet is in outer space, out on the edge of our galaxy, and we have colonized this planet. There are inordinate difficulties in colonizing distant planets; like, they're not at all suitable for us or they are just too far away. -

The Meaning of Lifeperdure — Chris Liu

Congratulations are in order. You appear to be the first person to have used the word "perdure" in The Philosophy Forum. Also, welcome.

Perdure entered the English language in the late 15th century: from Old French perdurer, from Latin perdurare ‘endure’, from per- ‘through’ + durare ‘to last’. As words go, it's doing well. Here's a Google Ngram of its usage in recent print:

Peak perdurage seems to have occurred around 1979.

There. It may not have done much for you, but I feel much better. -

What is wrong with social justice?Tons of beliefs simply have nothing to do with any way many people would act, other than the person reporting that they have the belief if you should ask them. For example, a belief about who was the second U.S. president, a belief about how far away the moon is from the Earth, a belief about what a plagal cadence is (re music theory). — Terrapin Station

OK, you are using the term "belief" somewhat differently than I am using it. Your examples of president, distance to the moon, or plagal cadence are what I would classify as information that I know I would have to look up to state precisely. This knowledge doesn't entail any action. What would prompt me to look up who the second president was is the BELIEF that I should display such information accurately. As it happens, I did have to look it up because I couldn't remember (John Adams). The moon is around 250,000 miles away -- close enough for philosophy. Were this an astronomy forum, I'd am pretty sure I'd believe I had to be more precise -- 238,855 miles away on average. I believe that NASA would be a lot pickier about distance than I am, but it doesn't affect what I do for a living. I haven't the faintest idea what a plagal cadence is. Something to do with the plague?

I believe I should pay my utility bills on time. This belief entails an action. I believe I should bathe regularly, so I do. We quickly get into the territory of habitual behavior (I put my keys in my right front pocket, my comb in my back right pocket, my wallet in my back left pocket...) which are not related to belief at all.

I believe that certain behaviors are meet, right, and salutary and others are just plain wrong. These beliefs have something to do with behavior--we can agree that they aren't as controlling as habits or reflexes. As I said earlier, belief and behavior are related. If one acts contrary to one's beliefs often enough, the belief will be degraded, and it will be less related to behavior than it was. The belief may even disappear. -

If governments controlled disposable income of the .1 %, would poverty end?Are you an authentic old-time Marxist? Karl — fishfry

Workers of the world unite. You have a world to gain and nothing to lose but your chains.

Yes. -

If governments controlled disposable income of the .1 %, would poverty end?That is my claim. Go ahead and prove me wrong with hard numbers. How much are you taking, and from whom? — fishfry

I already told you: all of it. The multi-millionaires and billionaires will be financially cleaned out. You can find your own list of very wealthy people.

It isn't necessary to make me Grand Commissar of the New American People's Republic. Commissar is sufficient. And it won't be a republic any more, it will be an industrial democracy. The workers will be in charge of the means of production and distribution (and of course they will also be the consumers). It will be up to them to decide what to do.

Since you are getting testy about my civility in referencing your cranium... What have you got against pre-cast concrete? It's splendid material. If I had really meant to impugn your intelligence, I would have said something cruder and crueler. But I wasn't impugning your intelligence or knowledge, and I didn't wish to do so. So I beg pardon for my fault, for my most grievous fault.

I've cited the amount of wealth that the richest portion of the United States owns. Several million people compose that class. I don't plan on looking for a list of them all. Neither do you. I told you what I would do with it -- distribute it to The People.

This is all fantasy anyway. I even pointed out that we have no idea what the upshot of distributing $94 trillion dollars to the 124 million households would be. My guess is that it would be economically catastrophic. It would be catastrophic NOT because it had been taken away from the rich. It would be ruinous if 124 million households started spending it all at once (or even somewhat slowly). The tri$$ions would have to be IV dripped very slowly. Just as you can't restore a starving person by feeding them a huge meal, you can't undo poverty and economic insufficiency by dumping tons of money on the economy all at once.

Oh, look: There's my exit ramp. -

You're not exactly 'you' when you're totally hammeredWell, I have never had so much to drink that I behaved inappropriately. Ever! What! Never? Well, hardly ever. Well there was that one time... and then another time... oh yes--and that party at the pastor's house...

How old is your boyfriend and how long has he been drinking? Maybe he hasn't yet learned the benefits of metering one's alcohol for best results.

He doesn't sound crazy; he sounds pretty much like everybody who has a few drinks.

At a bar, I'm not really me until I have had a beer or two. If I have 6 beers, I'm not really me either--I'm on my way to comatose. 4 beers is about right, and not too fast -- except for the first one. Hard liquor with a beer chaser produces instant oblivion, so that doesn't work either.

Try to help your boyfriend learn how to be more of a "reflective drinker" (Ah, the next thing--reflective drinking!) Once one is drunk it's too late; before one has had anything to drink it's too early. One has to learn the effects of 1, 2, 3, 4... drinks over time, bearing in mind the strength, intake of food, what one's objective is (unwinding, a buzz, oblivion, whatever). Beer is pretty consistent in alcohol by volume. Some bars suit the needs of chronic alcoholics and pour very strong drinks, and others pour weak drinks to suit the needs of the bottom line.

Does he eat before he drinks? Food in the stomach (more than a cracker and cheese--more like pork roast and potatoes au gratin) slows the absorption of alcohol. Carbonated drinks are soaked up faster than still drinks. Loud bars encourage heavier fasting drinking -- that's why most bars tend to be pretty noisy.

Are you dancing or sitting still? I don't know what difference that makes. It's hard to drink and dance at the same time. -

Is criticism of the alt-right inconsistent?Gosh, speak of the devil and she appears. This week's New Yorker has a piece on Dworkin's bloated corpse.

Shudder. -

What is wrong with social justice?Wait a minute. Are you claiming that behaviors in the social realm of politics, culture, and so on are unrelated to belief?

— Bitter Crank

Lots of people have lots of beliefs, desires, etc. that they never act on at all. — Terrapin Station

I have my doubts about people not acting on their beliefs. My theory is that a person can have an idea that they don't act on, but that beliefs are related to action in a reciprocal relationship. Executing a belief contributes to the strength of beliefs that require execution. In other words, if one believes in mercy, one has to demonstrate it. Is it possible to really believe in mercy on the one hand and enthusiastically work as a guard at Auschwitz? I don't think so. If the guard arrived at Auschwitz believing in mercy, he won't believe it for long. A belief in the existential threat to Germany posed by Jews will trump his belief in Mercy as long as he works there. After the war he will probably revert to a belief in mercy and forget about Jewish threats to Germany (well, partly because they mostly don't exist any more).

I've never believed in tithing to the church, because actually giving 10% of my income was always too painful. 3 or 4%, OK, but 10% -- OUCH!!! I've been on church boards, and as such thought tithing was a great idea. Great for the budget. I never did it, however. It was a good idea, not a belief. In order to believe in tithing, I would have to actually tithe. Behavior and belief go together, and belief is not necessarily the prima mobile. -

What is wrong with social justice?The term “Gay” for homosexuals originates from women prostitutes. The etymology of phrases and terms is interesting, but once they become popular they mean what they mean. — I like sushi

According to Wikipedia, "gay" in the context of which you are speaking...

Cartoon from Punch magazine in 1857 illustrating the use of "gay" as a colloquial euphemism for being a prostitute.[8] One woman says to the other (who looks glum), "How long have you been gay?" The poster on the wall is for La Traviata, an opera about a courtesan.

So, it was a euphemism for "whore"; just like "courtesan" is a nicer term than prostitute, whore, kept woman, and so on. Gay guys had nothing to do with it.

The straight arrow Box Tops called them "Sweet Cream Ladies". -

Psychiatry’s Incurable HubrisI've seen psychiatrists and three different therapists. — Bitter Crank

And you're still crazy as shit — Hanover

Well, that wasn't all in the same week! It took 25 years to stumble on the last one who was really quite good.

You are supposed to do most of the talking. Only you, after all, know just how fucked up your family life was, the horrible things that happened in the cradle, and so on. The therapist is there as a guide, a mirror, and an echo chamber, in whom you see and hear yourself, and come to understand just how horribly wrong it all went.

Then, after you have finally collapsed in a paroxysm of weeping, wailing, rending your polyester double knit shirt and sprinkling the ash tray's cigarette butts on your head, have really used that box of Kleenex, you're reading for Phase II, where the silent therapist who listened to you for 3 years comes to life and instructs you in detail in how to get your shit reorganized, and to move on to finally become a whole, integrated, and somewhat satisfactory person. That may take another 5 years. -

Psychiatry’s Incurable HubrisI've been to a therapist before and it did offer some insight. — Hanover

I've seen psychiatrists and three different therapists. The best one was finishing her therapy doctorate at St. Thomas University. We met weekly for a year; her approach was non-directive psychotherapy. That year actually produced significant progress. 6 or 8 week workbook based counseling programs aren't much. If you could solve a psychological problem with a workbook, you didn't have much of a problem to begin with. -

Psychiatry’s Incurable HubrisThere are fairly strict laws regulating the imposition of unwanted treatment, requiring judicial intervention. — Hanover

Up until the late 60s and early 70s, it was possible for a family or a state agency to commit a problematic person to a psychiatric hospital without much concern about civil rights. As bad as that was, it was just as bad that most state hospitals were not really doing much to effectively treat patients. They were, for all practical purposes, merely custodial. -

What is wrong with social justice?Do you have any clue about the history of the slave trade? I can absolutely assure you that the reason people thought it OK to enslave black people was not because they changed the meaning of the word "person". — Isaac

Well of course. People traded in slaves because it was a profitable, low-overhead, and sustainable business. And, important point, it began and was firmly established way before the issue of defining 'person' became an issue in the English Colonies, late 18th Century.

My guess is that classifying black slaves as less than human made it easier to exploit them in a totally dehumanizing way.

I haven't taken a course in Comparative Slavery. I'm guessing that Moslem slave traders who traded both black and white slaves didn't discount their humanity in the same way. (Partly because Moslem slavers already counted heathens as less human than Islamic believers. Same thing, only different,) -

What is wrong with social justice?@Anaxagoras, @I like sushi,

the outrage machine — DingoJones

It's the operation of "the outrage machine" that give some advocates for a better world a bad name (trying to avoid the SJW term for a moment).

Outrage that is turned on and off with the flick of a forkéd tongue is disingenuous at best and goes down hill from there. It is a crude social control mechanism more typical of fascist groups (where disagreement is hammered down, rather than engaged in argument). It is an extremism which brooks no limit (something the right has embraced as much as the left).

People who employ the outrage machine are engaging in adolescent behavior. The knee-jerk resort to outrage is caused by (and aggravates) an inability to tolerate dissonance and ambiguity. It is most comfortable in a black and white world. Gray scale drives the SJW types and right wing nuts crazy.

SJW types will probably grow out of regular use of outrage -- just because of their own outrage fatigue [speed the day!!!]. I hope they will develop more nuanced, ambiguity tolerant, thinking -- but don't hold your breath.

That's not why, especially because there's zero evidence of the behavior/belief connection. — Terrapin Station

Wait a minute. Are you claiming that behaviors in the social realm of politics, culture, and so on are unrelated to belief? When one votes, is lever pulling (old fashioned) or circle filling on a ballot merely a behavioral tick, like foot tapping or idly scratching?

You have beliefs which seem to be related to your expression of free speech absolutism behavior. I assume your statements on absolute free speech aren't just knee-jerk typing.

I'll readily grant that I perform behaviors that are not based on belief in areas that involve little cognition, like the way I brush my teeth or tie my shoes. But when it comes to idea-expression-behavior, I don't see how the behavior can be separated from belief. -

Psychiatry’s Incurable HubrisMedicine is supposed to be science based — unenlightened

Medicine is a practice, and in so saying I'm not knocking it. Ditto for psychiatry. Ditto for dentistry. On their way to practice, students study science (like, major in molecular biology), then take more classes, and rotate through clinics. Along the way a good deal of solid science is encountered and (we hope) absorbed. But let us face a fact: The various sciences behind medicine, and all their content, is way too voluminous for the brightest doctor to carry around in his or her head.

Students mostly learn how to be doctors and dentists (and psychiatrists) by practicing on patients. Once they get good at it, they keep 'practicing'. They go with what works, what makes patients happier, or at least not dead.

@Hanover, lawyers used to prepare for the bar just by reading and practicing. Abe Lincoln became a lawyer that way. Worked for him. The Mayo brothers weren't master scientists, they were very good organizers.

So, a psychiatrist is presented with two different patients, The first is clearly out of his mind -- screaming incoherently, flailing about, totally nuts. The other patient is unhappy, is doing poorly in life, but is functional. What to do?

In the first case, administer Thorazine, put him in a padded cell, and wait for the drugs to work. Then out of the cell into a locked ward, then into an unlocked ward, and eventually, home with an Rx for lithium. The psychiatrist doesn't need to know (and doesn't, in fact know) how Thorazine and lithium work, just that they do what they do. Patient gets better.

The unhappy patient doing poorly in life, but who is behaving more or less 'appropriately' presents a lot more difficulty in a way, because there is no particular drug or intervention that will dramatically change his behavior. From his practical experience, the psychiatrist knows that soothing words help, some drug or placebo will help; encouragement, helping the patient develop some insight, and so on may all be helpful--or not.

Where psychiatrists really earn their status is in dealing with major mental illness, where life and death issues are at hand. Their waiting room full of merely unhappy, dissatisfied, pissed off, worried sick patients will mostly get better on their own, as they always have, but he gets paid to help them, so... -

Is criticism of the alt-right inconsistent?Welcome to My[safe]Space.

Well that's an interesting tangent, to say the least.

I know I bring up intersectional feminism more than I should (as if it is a bogeyman), but it's just so damn relevant because it's the ideological and academic source for contemporary identity-based politics. — VagabondSpectre

Keep bringing it up. Is Andrea Dworkin a 3/4th wave feminist? I encountered her loathsomeness back in the 1980s. Quite repellent. She's still around; she gotten written up in some paper recently.

Gay liberation was my entre into this stuff in the early 1970s, and at the time it seemed like gays and women were kind of all on the same side, but I was probably tuning intoolderearlier feminists who were more 2nd wave. "the main thrust that made MLK so effective (peace, love and unity)" God, the issues around sex, race, and class were so much simpler back then! One of the gay groups back then was "Black and White Men Together (BWMT). I was going to say it doesn't exist these days but a quick Google reveals that it still does, sort of. Back then it was about black and white sex, now it's about racism and homophobia (and dining out). I suggest they will have more fun if they stick to sex. And, they might be more successful.

The reason I say that is that by partnering across racial lines, they are the change they want to see. A very unkind critique of BWMT was raised back in the 70s (it's just white guys out slumming). Today the criticisms would be harsher, grinding on power differentials, oppressive roles, exploitation, reverse racism, etc.

"white guilt" — VagabondSpectre

I'm white and I plead NOT GUILTY, your honor, and I am not a white-hyphen-something, other than live-white-male. I only know (for sure) 1 white supremacist--a brother in law. We don't spent much time together--I've been banned for a good 15 years, at least. I'm not a separatist or a nationalist. On the other hand, I like white western culture (English, French, Mozart, Van Gogh, all that). I don't feel guilty about the Amerindians (I feel deep regret) nor do I feel guilty about slavery--again, deep regret -- really. What history and anthropology tells us is that we are one vicious species, as often as not, and we have all employed similar strategies to promote our particular aspirations.

Personally, I think we would be farther ahead of we stopped talking about racism, sexism, homophobia, transphobia and so forth. What we are saying a good share of the time is social justice boiler plate, and it prevents us from seeing nuance or progress. Like, do Somali's in Minneapolis run into racist attitudes? Sure they do. On the other hand, a Somali was elected to Congress from a Minneapolis district that contains more Christian and Jewish voters than Somalis. We also elected a [home grown] Moslem as Attorney General, after he had served in Congress. White (mostly Democrats) people electing a black [home grown] Moslem is progress, no matter how you slice it. -

What does it mean to be part of a country?

We know we belong to the land

And the land we belong to is grand!

Rogers & Hammerstein, Oklahoma!

It's about having roots in the soil, having a particular terroir.

The Jews from Russia and Eastern Europe who came to the United States between roughly 1880 and 1920 didn't immediately belong to this land. They still belonged to land a long ways away. They were, however, here to stay and they sank roots into this soil and where they settled (New York City, in particular) was changed, but remained American. The same thing has happened over and over here before and since.

The Irish came in very battered condition earlier in the 1800s. They came from famine, they were largely rural/village dwellers, and were not seasoned urbanites. The Irish immigrants appalled the established earlier immigrants from the UK and the various German states. In time the Irish sank roots into American soil as deeply as everyone else.

To belong to this country means "sinking roots into the soil" -- coming to stay; giving allegiance to a new government; accepting (even if not liking) the extreme plurality of religions and habits.

Some immigrants have put down roots, and then been pulled up periodically to see whether they really were rooted. The rootedness of Asian immigrants in California seems to have been doubted more than the rooty commitments of Scandinavians on the west coast. Eventually Asian roots were acknowledged (but not so much that Japanese citizens weren't sequestered during WWII). -

Are bodybuilders poor neurotic men?If in circumstances where S would fail to approximate looking a certain way, S would feel deeply inadequate, then S is neurotically vain. — Welkin Rogue

I didn't know @S was neurotic in that way. Let's ask him.

Is this all some neuroticism or "self-actualization"? — Wallows

It follows that an insightful fellow like Wallows will allow that homo sapiens are regular hot houses of neuroticism. Wikipedia provides this handy definition:

Neuroticism is one of the Big Five higher-order personality traits in the study of psychology. Individuals who score high on neuroticism are more likely than average to be moody and to experience such feelings as anxiety, worry, fear, anger, frustration, envy, jealousy, guilt, depressed mood, and loneliness. People who are neurotic respond worse to stressors and are more likely to interpret ordinary situations as threatening and minor frustrations as hopelessly difficult. They are often self-conscious and shy, and they may have trouble controlling urges and delaying gratification.

Right! So, there you go.

Personally, I wanted to look more like Olympic gold swimmers or Tour d'France winners than Schwartzenegger. Fat chance. At this stage of the game, I'm doing strength training so that I'll be able to get into my wheel chair some time down the road.

But you have raised a good point here: Men are not immune to the plague of body image issues. That doesn't mean that guys who want to lift weights should be cleared first by a psychoanalyst. Weight lifting doesn't make people neurotic; neurotics get carried away with it. Neuroticism distorts a healthy activity when it becomes compulsive; when one's sense of psychological well-being is impaired if delineation of some muscle group isn't perfect; when it begins to displace other, important, areas of life.

Don't get me wrong: If one can manage it (and most people can, theoretically) a man should be fairly lean. We should have enough cardio conditioning and be muscular enough to perform certain kinds of tasks like: swimming at least a quarter of a mile (9 laps of an olympic pool); jogging for an hour; bicycling 50 miles on a decent bike; walking 5 miles without difficulty; carrying heavy items; digging up soil for a garden; painting a house; shoveling a heavy snow fall; and so forth. We should maintain some level of fitness into our 60s and 70s, if possible.

In other words, over-all fitness rather than focussing on only 1 area of fitness. -

Is criticism of the alt-right inconsistent?Your observations are very interesting. I finished high school in 1964. In the fairly small middling quality school I attended there was the usual distribution of rank from not-very-bright to smart, as well as social rank. As far as I can remember, there was very little status to be gained by not performing well, or by sneering at classmates who were upward and outward bound. My peers in college and in the early 70s reported pretty much the same thing.

Maybe it was in the late '80s that I started to hear of black children claiming status by "not acting white" -- which meant doing well in school. It's quite possible that I was not in that particular loop and just didn't hear about it earlier, but it seems like a significant cultural change occurred. But it is strange that you would have observed the same thing, because the inner city slums of the US are presumably quite different than Finland.

Did a lot of young people in the late 1980s come to the pessimistic, self-defeating conclusion that there was "no future for them"? (assuming that "no future" actually was a pessimistic view, and not realism...) and that there was no point in excelling? Or was it something else? -

Can we calculate whether any gods exist?I'm with ZhouBoTong, whatever crap I say is good is good. — T Clark

This is sound art theory ever since Marcel Duchamp, which is over a century ago, now. -

Can we calculate whether any gods exist?Well, Pink Flamingoes is definitely not the greatest movie in history (since at least the reign of Nebuchadnezzar). Casablanca would be in the running for the honor of best film of all time. No, Pink Flamingoes is merely one of the top ten most tasteless movies on record. It is funny in its tastelessness (I like an atrociously tasteless comedy sometimes), and the final fecal focused scene at the end of the flick is one among many tasteless scenes. Well, actually all the senes are tasteless.

-

Can we calculate whether any gods exist?Mother's Day - Andy Samberg and Justin Timberlake — T Clark

I couldn't quite rate it as "greatest SNL sketch ever. Greatest television broadcast event ever. High point of all Western culture. No, really, seriously." But that's just me.

It's always a huge and dangerous risk to reveal what one thinks is really, really funny or really, really outrageous. Did you see Pink Flamingoes, by any chance? -

Can we calculate whether any gods exist?Who, other than Bitter Crank, can tell me where that pop culture reference comes from. — T Clark

So as it happens, I had not a clue to where it came from. I have huge gaps in my database of popular culture (just for one example). Somebody at work asked me "Are you sure you are gay?" when I couldn't place Donna Summers. I suppose I heard her at the queer bars a thousand times, but I wasn't there for pop-music appreciation. I was busy pursuing carnal goals.

In my dotage I've been going back (with the help of YouTube) to fill in some holes I don't have enough years left to fill them all in, so a lot of the holes will just stay empty. -

Is criticism of the alt-right inconsistent?Black Americans are now citizens of the country that used to practice slavery, they should view it that way instead of seeing themselves as former slaves. What are your thoughts on this? — Judaka

The side truth of the species is that we are not very nice. We engage in all sorts of bad behaviors: ruthless conquest, mass murder, slavery, exploitation... the list goes on and on. We can, we should, we must accept our species' history as it is, since we can't change it. We can only change things in the present,

I see no benefit in dwelling on one's ancestor's status as slaves. Slavery is now 160 years, or about 8 generations distant. Later, more recent history matters more. Dropping out of high school will cause an individual far more problems than being the descendent of slaves. In fact, if one drops out of school, it won't matter all that much whether one's ancestors were black or white; it is a very stupid move. It's also a stupid move to learn nothing in high school.

Getting involved in drug dealing, drug use, and petty crime is a very bad idea for young people, black white, yellow or red. Don't do it. The measly short-term gains of petty cash and fun aren't worth the longer term downsides, like an addled brain, a criminal record, or getting shot by a rival dealer.

If you want to be a success, dress the part, speak the part, and get some skills to actually play the part. This is just universal good advice for anybody. Employers expect performance and production, and if you fail to deliver, you will get fired, whether you are a privileged white or a disadvantage black or asian.

If you tend to business in school, shape up, and work hard, you too can be successful. Not rich, probably, but even small success is a lot better than getting a poke in the eye with a sharp stick. -

Is criticism of the alt-right inconsistent?HOUSING FIRST is an excellent strategy employed sometimes, but too seldom in the United States. It just rubs some people the wrong way to hand somebody a key to a room and tell them, "this is yours". It takes a significant up-front appropriation to provide funds for rent, and it needs to be followed up with social service. And, of course, there need to be units available which the state can afford to rent. In San Francisco, which has a big homeless population, housing is absurdly expensive.

Your city ignoring the fact that it has hundreds on up to thousands of people living without shelter in the streets is a measure of how dehumanized a place one is living in.

One of the programs I like is an American Indian housing program for "public inebriates". These are people whose alcoholism will be terminal if they are not protected. The residents receive a small unit in a purpose built apartment building with very few strings attached. They can't drink in the hallways, and they can't cause problems in the building (like fighting). There is no expectation that they will stop drinking. It gives protection and a measure of dignity. (Its housing with services.)

A lot of people who are social service recipients need two things: they need some money and they need their own shelter. Give them at least their own shelter and some cash and they can start dealing with their other problems--mental illness, drug addiction, criminal history, history of abuse, maladaptive behavior, etc. -

Is criticism of the alt-right inconsistent?We can at least agree that screwy looniness is evenly distributed across the population.

-

Is criticism of the alt-right inconsistent?Good example of a sensible policy.

A number of housing programs in the United States have started to distribute public housing across urban territory in relatively small units. Chicago, for instance, has demolished several of its giant high-rise concrete ghettos in the sky (Robert Taylor and Cabrini Green). Residents were then relocated in distributed smaller units. At least, that's officially what happened. There is some question about how well that actually worked out there.

Distribution in small public housing units that are well managed and maintained is a desirable strategy.

BC

Start FollowingSend a Message

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum