-

frank

19kcertain hedge funds who were ultra-short Gamestop feel a little pain then that's not my problem. — BitconnectCarlos

frank

19kcertain hedge funds who were ultra-short Gamestop feel a little pain then that's not my problem. — BitconnectCarlos

But some people have their retirement savings in funds like that, right? -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

Who the hell puts all of their retirement savings into a hedge fund? So what now, do we just protect the hedge funds then? Pour billions of taxpayers dollars in to subsidize them and keep them afloat? I'm sorry but when you give your retirement funds to a company that makes a living shorting American businesses and then they get hit because a group of retailer investors steps in to try to help out the struggling business I just don't have much sympathy for you. Just leave your retirement savings in the S&P 500 or some target date index fund or bonds. Why anyone would put an overwhelming portion of their retirement savings with to trust to a risky hedge fund is beyond me. These people saw that Melvin had a great year a year or two ago and they were trying to maximize earnings. Well sometimes greed backfires, deal with it. -

frank

19k

frank

19k

I don't know. I think they just hire financial advisors who invest for them. Point is, it's probably not just certain brokers who get hurt when a fund implodes. Am I wrong? -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

This is why people need to learn to manage their own finances and not trust everything to a "professional." I have a tough time understanding or sympathizing with people who refuse to manage their own finances or savings. If someone's "financial advisor" destroys their retirement savings in a risky hedge fund, then I hate to say it but who allowed that? Who gave them the money? Were they never overseeing their own investments? Or did they just believe that large piles of money would suddenly appear to them upon retirement when they trusted this "financial advisor?" You do know other people's portfolios suffered too while Gamestop was shorted over the course of years? I'm sure people lost retirement savings there too. -

Streetlight

9.1kIf someone's retirement hinges on putting people, say, Gamestop employees, out of a job, then they can die hungry and cold.

Streetlight

9.1kIf someone's retirement hinges on putting people, say, Gamestop employees, out of a job, then they can die hungry and cold. -

frank

19kl." I have a tough time understanding or sympathizing with people who refuse to manage their own finances or savings. If someone's "financial advisor" destroys their retirement savings in a risky hedge fund, then I hate to say it but who allowed that? — BitconnectCarlos

frank

19kl." I have a tough time understanding or sympathizing with people who refuse to manage their own finances or savings. If someone's "financial advisor" destroys their retirement savings in a risky hedge fund, then I hate to say it but who allowed that? — BitconnectCarlos

Yea, it's survival of the fittest all around. I'm just saying, you can't stick it to the Man without sticking it to a lot of little people at the same time. -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

I don't know about Melvin specifically, but with hedge funds generally if you wanted to be accepted as a client you'd need atleast $100k if not $1mm to even get your foot in the door. These are not impoverished families for whatever reason throwing their life savings at Melvin. These are people with money seeking high returns and using their tax-advantaged retirement accounts to do it. -

Pfhorrest

4.6kJust leave your retirement savings in the S&P 500 or some target date index fund or bonds. — BitconnectCarlos

Pfhorrest

4.6kJust leave your retirement savings in the S&P 500 or some target date index fund or bonds. — BitconnectCarlos

An index fund is a kind of mutual fund which is a kind of hedge fund. -

Benkei

8.1kA hedge suggests the original asset continues to be held. You either buy a negatively correlated other asset as a hedge in addition to the original asset, thereby limiting losses depending on the level of correlation and how much you buy of the second asset, or you buy an "insurance" through buying a derivative that covers the (for your position) negative movement of the asset. If that movement doesn't materialise, then the hedge is just a cost. So if they divest and reinvest, it can't be considered a hedge.

Benkei

8.1kA hedge suggests the original asset continues to be held. You either buy a negatively correlated other asset as a hedge in addition to the original asset, thereby limiting losses depending on the level of correlation and how much you buy of the second asset, or you buy an "insurance" through buying a derivative that covers the (for your position) negative movement of the asset. If that movement doesn't materialise, then the hedge is just a cost. So if they divest and reinvest, it can't be considered a hedge. -

Benkei

8.1kIf someone's retirement hinges on putting people, say, Gamestop employees, out of a job, then they can die hungry and cold. — StreetlightX

Benkei

8.1kIf someone's retirement hinges on putting people, say, Gamestop employees, out of a job, then they can die hungry and cold. — StreetlightX

But they'll go or not go out of business regardless of what investors think the market value of the company is. If I short sell a stock because I think it will do badly, my short sell has exactly zero effect on company performance.

Speculation actually fulfils an important role in market function leading to a more efficient allocation of money between borrowers and lenders and better "price" discovery. There's nothing bad about it and it actually serves an important function. It's more obvious in a market for goods, like say grain. If we imagine a bad harvest, a speculator will buy up part of the harvest to profit from the expected shortage. This drives up prices and means consumption of grain will become more rationalised (do more with less, don't buy more than you need, buy alternatives, etc.). The producers are stimulated to invest in more production as a result of the rising prices. Similarly, if then prices rise to a point that a speculator considers too high, he will start selling, leading to lowering prices that will avoid a surplus.

What's really the issue is how much efficiency a market really needs. Do we need to be able to trade stock in a fraction of a millisecond up to .0001 USD? There's a tremendous amount going into making markets efficient but I don't think it benefits society at large. My simple and blunt solution to all this bullshit is to reintroduce liability for shareholders. That limitation of liability originally was only granted to corporation with a public goal and for corporations with a temporary charter - so once the goal was fulfilled, they ended. -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

An index fund is a kind of mutual fund which is a kind of hedge fund. — Pfhorrest

This is not correct. All of these financial products are different. Index funds are different from mutual funds which are different from hedge funds. -

Metaphysician Undercover

14.8kSpeculation actually fulfils an important role in market function leading to a more efficient allocation of money between borrowers and lenders and better "price" discovery. There's nothing bad about it and it actually serves an important function. — Benkei

Metaphysician Undercover

14.8kSpeculation actually fulfils an important role in market function leading to a more efficient allocation of money between borrowers and lenders and better "price" discovery. There's nothing bad about it and it actually serves an important function. — Benkei

It is in a very real sense bad, because it gives the experienced traders, and those with access to specific tools, unfair advantage over the inexperienced and honest investors. The honest investor believes that the rules which govern speculation are in in place to create a fair market place, when actually the rules are strategized to create the illusion of a fair market while providing better predictive capacity to those with the desire to speculate and trade. Predictive capacity in the market, which the rules create, is nothing other than the capacity for traders to take advantage of investors.

It's more obvious in a market for goods, like say grain. If we imagine a bad harvest, a speculator will buy up part of the harvest to profit from the expected shortage. This drives up prices and means consumption of grain will become more rationalised (do more with less, don't buy more than you need, buy alternatives, etc.). — Benkei

You think that this is good, to allow speculators to hoard the necessities of life, only to dole them out on principles of who's willing to pay the most for them, with complete disregard for any consequences of these actions, other than how much money I can make?

My simple and blunt solution to all this bullshit is to reintroduce liability for shareholders. — Benkei

How could this deal with the problem of short sellers who actually hold the stock for a negative period of time, in the attempt to drive down the prices for the sake of personal profit? -

ssu

9.8kBuying $GME isn't so much about making profit - I don't have any price targets or stop losses with my gamestop buy - At the end of the day, what's wrong with a bunch of retail investors coming together and deciding to help out a struggling company? I've been a Gamestop customer plenty of times. If certain hedge funds who were ultra-short Gamestop feel a little pain then that's not my problem. Hedge funds already have enormous advantages over the average retail investor.

ssu

9.8kBuying $GME isn't so much about making profit - I don't have any price targets or stop losses with my gamestop buy - At the end of the day, what's wrong with a bunch of retail investors coming together and deciding to help out a struggling company? I've been a Gamestop customer plenty of times. If certain hedge funds who were ultra-short Gamestop feel a little pain then that's not my problem. Hedge funds already have enormous advantages over the average retail investor.

I also only threw like 1% of my portfolio at this so it's not like failure is the end of the world. — BitconnectCarlos

Talk about animal spirits. Philosophical animal spirits, I would say. Stock investment as a recreation.

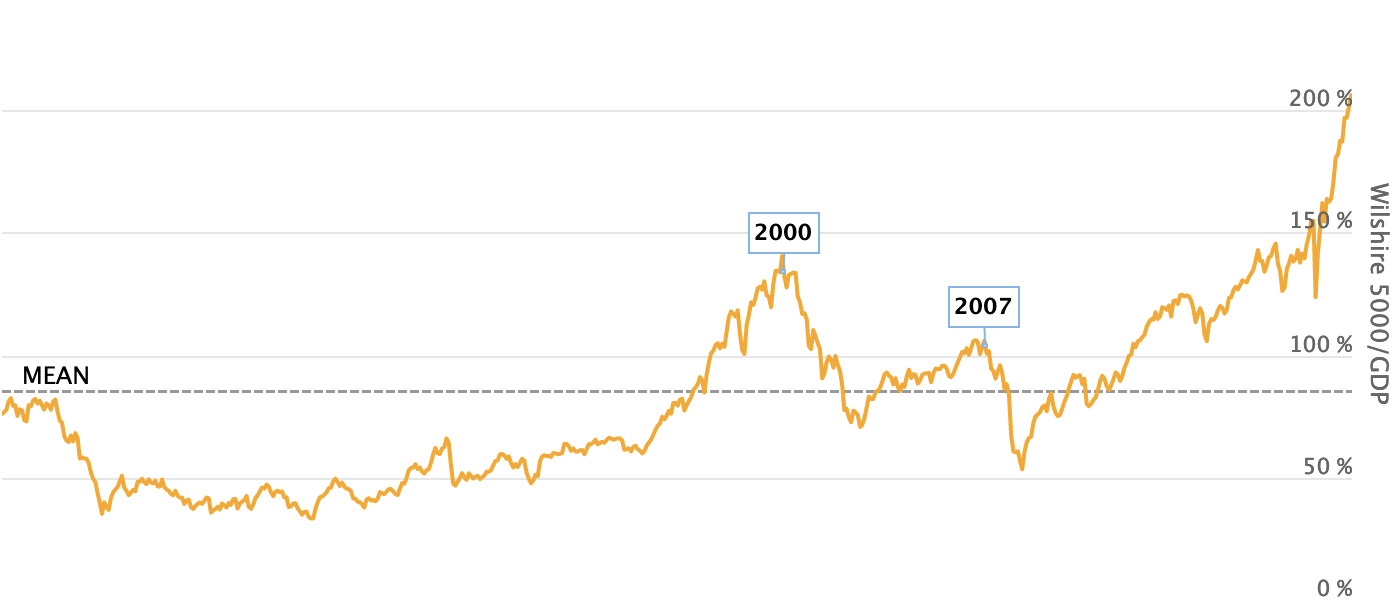

I would take this as an obvious indicator that the market is overpriced, overtly excessive, out of touch, ready for a collapse.

When people wait in lines to buy stocks, that's the traditional indicator of an impending market crash. I don't know where to put this on the scale...

Decreasing my stock portfolio.

One good indicator is the stock market compared to GDP:

-

Benkei

8.1kIt is in a very real sense bad, because it gives the experienced traders, and those with access to specific tools, unfair advantage over the inexperienced and honest investors. The honest investor believes that the rules which govern speculation are in in place to create a fair market place, when actually the rules are strategized to create the illusion of a fair market while providing better predictive capacity to those with the desire to speculate and trade. Predictive capacity in the market, which the rules create, is nothing other than the capacity for traders to take advantage of investors. — Metaphysician Undercover

Benkei

8.1kIt is in a very real sense bad, because it gives the experienced traders, and those with access to specific tools, unfair advantage over the inexperienced and honest investors. The honest investor believes that the rules which govern speculation are in in place to create a fair market place, when actually the rules are strategized to create the illusion of a fair market while providing better predictive capacity to those with the desire to speculate and trade. Predictive capacity in the market, which the rules create, is nothing other than the capacity for traders to take advantage of investors. — Metaphysician Undercover

Your picture of the honest investor is that of an investor who doesn't understand markets. Back in the 17th century Dutch traders would post horseback riders at the southern tip of Holland to look out for incoming ships. These horseback riders would ride all the way back to Amsterdam and inform whoever hired them of what ship was returning and how deep it was running in the water. I don't see a fundamental problem with investing to have an information advantage over other investors. There's nothing unfair about the practice.

You think that this is good, to allow speculators to hoard the necessities of life, only to dole them out on principles of who's willing to pay the most for them, with complete disregard for any consequences of these actions, other than how much money I can make? — Metaphysician Undercover

I think my description was clear about the effects on economic behaviour on other buyers that speculation has. It has nothing to do with hoarding. The speculator introduces price changes earlier and quicker than which would come about if the market is only entered by buyers and producers. It improves efficiency in use and production which actually results in more price stability in the long run because they add liquidity. Liquidity lowers volalitiy which lowers the risk of surplusses and shortages negatively affecting buyers and producers. So in fact, speculators avoid faminine and bankruptcies where it concerns "necessities of life".

How could this deal with the problem of short sellers who actually hold the stock for a negative period of time, in the attempt to drive down the prices for the sake of personal profit? — Metaphysician Undercover

As is clear from my previous post I'm not adverse to short selling. The bullshit I'm talking about is the insane amount of money invested in making "markets" more efficient to the extent it's detrimental to society at large. We don't need high speed trading or tick sizes a fraction of a cent. -

Streetlight

9.1kBut they'll go or not go out of business regardless of what investors think the market value of the company is. If I short sell a stock because I think it will do badly, my short sell has exactly zero effect on company performance. — Benkei

Streetlight

9.1kBut they'll go or not go out of business regardless of what investors think the market value of the company is. If I short sell a stock because I think it will do badly, my short sell has exactly zero effect on company performance. — Benkei

Right, but the play here - as with so many of these predatory hedge funds - was specifically to never have to cover their short positions on account of whatever overshorted company going out of business. In this case GS. This isn't just hedging - this is weaponized hedging, with profits indexed to the literal destruction of companies. -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

Yeah, stock market investing or trading has definitely become recreation, especially during the pandemic when everyone's staying home. While GME and AMC are obviously having a rough day today, the stock market as a whole I'm not too worried about. I'm not a stock trader. I'm an investor. I throw the vast majority of my stock market portfolio into the S&P 500 and I just don't touch it. I made the mistake of selling in March 2020 right near the bottom and had to rebuy higher. In any case, I do touch base with my family's financial advisor at BofA and BofA is anticipating decent annual returns up until 2023. I anticipate holding my S&P 500 position for decades though (I'm 30) so a dip isn't a problem for me unless I do sell and make the same mistake I made last time. There are also tax implications to selling here in the US which makes me even less inclined to do so. -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

Well, you got in cheaper than me. I don't know what a fair price is though given Gamestop was been trading between $4-$15 for the past few years and now it's "crashed" to $86 or so now.

This Gamestop saga is interesting to watch though. On one side you have possibly millions of bourgeoise retail investors, some with quite ample capital, and on the other side you have hedge funds who have been in this business for years and are heavily connected, but there's less of them and their moves are a little more visible than they might desire. Earlier today GME and AMC were both down like 55-60% but just in the last few minutes presumably the retail investors have managed to fight back and Gamestop is now only down 33% halfway through the trading day. Retail investors emerged victorious last week but it'll be an ongoing battle. -

Benkei

8.1kRight, but the play here - as with so many of these predatory hedge funds - was specifically to never have to cover their short positions on account of whatever overshorted company going out of business. In this case GS. This isn't just hedging - this is weaponized hedging, with profits indexed to the literal destruction of companies. — StreetlightX

Benkei

8.1kRight, but the play here - as with so many of these predatory hedge funds - was specifically to never have to cover their short positions on account of whatever overshorted company going out of business. In this case GS. This isn't just hedging - this is weaponized hedging, with profits indexed to the literal destruction of companies. — StreetlightX

I'm not sure what you're saying here. What do you mean with covering a short position? And what is an overshorted stock? -

fdrake

7.2kI don't know what a fair price is though given Gamestop was been trading between $4-$15 for the past few years and now it's "crashed" to $86 or so now. — BitconnectCarlos

fdrake

7.2kI don't know what a fair price is though given Gamestop was been trading between $4-$15 for the past few years and now it's "crashed" to $86 or so now. — BitconnectCarlos

Yeah! I don't know, or really care, what the fair price is. I'd've been fine losing it all if GME crashed to 0 at that point. Not going to pretend I'm "value investing" or whatever. I was trying to make a funny where I framed an investment expecting a loss as a need for a fair price of the thing I wanted, apparently I am not a funny. Should've learned that by now.

What do you mean with covering a short position? — Benkei

Not a direct answer to the question; but in case you've not read what happened to Melvin capital. The number of shares of GME sold short the last few days has been 120% of the number of shares sold otherwise. About 6 months ago that was 240%. When the increase in GME value was triggered, Melvin capital lost over 2 billion USD and was bailed out by other companies. The overall losses inflicted on people's short positions this month has been 20 billion, all the while they are not relinquishing their short positions much going by this.

Edit: To be clear; this isn't just a case of people shorting GME after it blew up then getting owned when it didn't deflate in time, people were shorting it loads before it blew up and it seems that's part of why it blew up. The overall position on it is still very short, so the same thing could very well happen again. -

ssu

9.8k

ssu

9.8k

I think any investor guide gives you the basics for normal investing, which is very good to understand.

I would give one advice: understand where just now the economy is in the business cycle. One good or bad company and it's stock price still goes with the flow of the market, hence this is a crucial question.

A very good thing to know now is what is referred with the Minsky moment. Once you understand that, then go and invest. -

ssu

9.8k

ssu

9.8k

For starters, the P/E ratio would be a good indicator. Or if the company is near bankruptcy in a dead end business sector or not. :roll:I don't know what a fair price is though given Gamestop was been trading between $4-$15 for the past few years and now it's "crashed" to $86 or so now. — BitconnectCarlos

-

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

I find stock investing pretty boring TBH. The basic advice people will give you is to throw everything in the S&P or the Dow and and just capture the returns of the overall market. Things get more interesting when you're able to engage in either newer, emerging markets (like crypto) or more specialized markets like collectibles where people can do their research and find some returns in unexpected places like with Pokemon cards. I personally learn best just by doing, maybe making a few mistakes and learning from those, and then talking with other investors or people in the same space. -

Metaphysician Undercover

14.8kYour picture of the honest investor is that of an investor who doesn't understand markets. Back in the 17th century Dutch traders would post horseback riders at the southern tip of Holland to look out for incoming ships. These horseback riders would ride all the way back to Amsterdam and inform whoever hired them of what ship was returning and how deep it was running in the water. I don't see a fundamental problem with investing to have an information advantage over other investors. There's nothing unfair about the practice. — Benkei

Metaphysician Undercover

14.8kYour picture of the honest investor is that of an investor who doesn't understand markets. Back in the 17th century Dutch traders would post horseback riders at the southern tip of Holland to look out for incoming ships. These horseback riders would ride all the way back to Amsterdam and inform whoever hired them of what ship was returning and how deep it was running in the water. I don't see a fundamental problem with investing to have an information advantage over other investors. There's nothing unfair about the practice. — Benkei

All this does is paint the picture of the difference between investing and trading. What I was talking about is the situation where the rules in the market place are set up such that traders can more readily take advantage of investors. This is not a matter of some investors having an information advantage over other investors, because the information which is useful to the trader (prediction in market volatility) is completely different from the information which is useful to the investor (prediction of a company's success). And if traders make money, that money must come from someone. So it's a matter of traders being engaged in a completely different activity from that of investors. And "taking advantage of", means that the traders treat the investors unfairly, because they know that the rules of the market place will allow them to do so. -

Pfhorrest

4.6k

Pfhorrest

4.6k

“An index fund (also index tracker) is a mutual fund...”

https://en.m.wikipedia.org/wiki/Index_fund

However:

“Hedge funds are not mutual funds as hedge funds cannot be sold to the general public.”

https://en.m.wikipedia.org/wiki/Mutual_fund

Looks like hedge funds and mutual funds are both types of open-ended pooled investments, though, the only difference being whether they are open to the public or not.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum