-

ssu

9.8kHyperinflation happens when people lose all trust in the currency. I don't think people are at all thinking like that.

ssu

9.8kHyperinflation happens when people lose all trust in the currency. I don't think people are at all thinking like that.

Hence I don't think you or me ought to talk about hyperinflation when you have had what? 9% inflation at the highest was or so. That's a quite an extrapolation. Many countries have had experiences of high inflation without there being hyperinflation. Not everything leads to the worst case happening.

After all, just with 10% inflation in a decade and your money is worth less than a half. Yet paying back those older debts is far more easy.

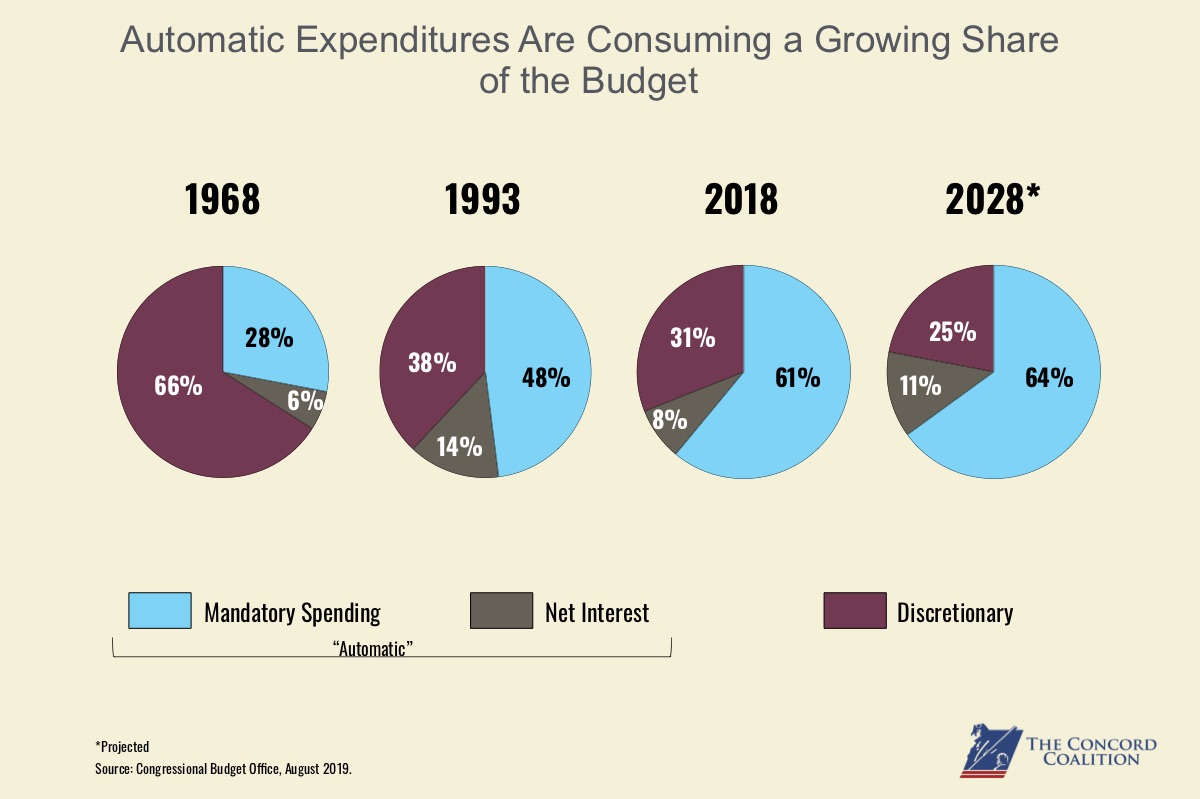

The problem is just how the US government, and typically any Western government, spends. The political problem is that "mandatory" spending is already the majority of the costs and "discretionary" is the smaller part.

Hence the "stimulus packages" will be the new norm. Just as the raising of the debt level. And it simply doesn't add up. Sooner or later you will have the crisis because the spending simply is unsustainable. And what ought to be noticed is that the higher interest rates will mean that the share of the "interest on the debt" will rise. We have started climbing from the lowest interest rates ever recorded in history.

And the spending of "mandatory items" will be changed only through a crisis. Come that before 2030 or after. -

frank

18.9kThe hike hammer comes down tomorrow:

frank

18.9kThe hike hammer comes down tomorrow:

"On Friday, June 16 the Fed released the semiannual monetary policy report to Congress. The report is inclusive of data available through 16:00 ET on June 14. As such it doesn’t include the May data on retail sales, jobless claims for the week ended June 10, the import and export price indexes, or the University of Michigan consumer sentiment index. Policymakers have access to the data on industrial production since that is produced by the Federal Reserve. These reports don’t really change the picture painted by the data which is one of a still tight labor market and inflation at the core which is mainly in non-housing services.

"The monetary policy report serves as a template for the Fed Chair’s prepared remarks before each of the Congressional committees at which the semiannual monetary policy is delivered. For this round, summer testimony begins at 10:00 ET before the House Financial Services Committee and resumes at 10:00 ET before the Senate Banking Committee. Although not on the official schedule, it is typical for the Fed to release the prepared remarks at 8:30 ET when the House committee leads the rotation.

"While the monetary policy is a product of the Board of Governors and issued by it, the contents will be heavily informed by the most recent FOMC meeting of June 13-14.

"The central points of the summary in the report are two. First is, “Bringing inflation back to 2 percent will likely require a period of below trend growth and some softening of labor market conditions.” Second is, “The Federal Reserve is acutely aware that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials. The FOMC is strongly committed to returning inflation to its 2 percent objective.”

"As was the case when Chair Jerome Powell delivered the February testimony, he is likely to get hammered on the potential for job losses in the millions if the FOMC persists in keeping monetary policy restrictive. After the upward revision in the FOMC median forecast for the fed funds target range by about 50 basis points for 2023, he will hear even more about the harm that higher rates does to individuals and businesses. The implication is that the Fed is callously endangering the livelihood of Americans by cutting off credit to individuals and businesses.

"Powell will probably reply along the lines of what he said in February and has reiterated since as recently as his press briefing on June 14. He said, “Without price stability, the economy doesn’t work for anyone.” The Federal Reserve has essentially one tool to fight inflation: raising interest rates — to lower demand and cool the economy. To imply that the central bank should not use it to achieve its Congressional mandate of price stability is disingenuous at best. The Fed would fight inflation without job losses if it could, but its options are limited.

"The Fed has more than enough evidence that the inflation cycle of the 1970’s and early 1980’s was difficult to end and require determined leadership on the part of then-Chair Paul Volcker to accomplish. Tentative monetary policy that tried to avoid unpopular rate hikes and elevated unemployment were unsuccessful. After the Volcker Fed “broke the back” of high inflation, a long period of relative price stability allowed the Fed to keep interest rates at modest levels for a long period. Powell and other Fed officials are almost certainly right to stay the course on tight monetary policy to keep inflation expectations in check and until inflation is tamed even if the lesson has been forgotten in the generation since the last major episode." -

jgill

4kCompensate workers more. — Mikie

jgill

4kCompensate workers more. — Mikie

According to Bing AI, 40% of American seniors rely solely on SS to survive. Many others are on fixed income retirement plans as well. These people are left behind to suffer the most devastating impacts on society from high inflation. Compensating workers more drives up the spiral and leaves retirees behind in the dust. Perhaps that's acceptable since ageism is thriving. -

jgill

4kCompensating workers more drives up the spiral and leaves retirees behind in the dust. — jgill

jgill

4kCompensating workers more drives up the spiral and leaves retirees behind in the dust. — jgill

No it doesn’t.

The excuses for keeping wages low are getting more and more pathetic. Now it’s supposed to hurt old people… :roll: — Mikie

"Perhaps that's acceptable since ageism is thriving"

ego requiem meam causa. -

Mikie

7.3k"Perhaps that's acceptable since ageism is thriving"

Mikie

7.3k"Perhaps that's acceptable since ageism is thriving"

ego requiem meam causa. — jgill

No it doesn’t. — Mikie

I rest my case. I’ll repeat: the idea that workers being paid a living wage in the richest country on Earth somehow hurts older Americans is a lie.

Thus, it has nothing to do with being acceptable because of “ageism,” because it’s complete bullshit. Got it? Cool. -

jgill

4kthe idea that workers being paid a living wage in the richest country on Earth somehow hurts older Americans is a lie — Mikie

jgill

4kthe idea that workers being paid a living wage in the richest country on Earth somehow hurts older Americans is a lie — Mikie

Not talking about a "living wage", only raising wages in general for the purpose of blunting inflation. That's a recipe for leaving older generations on fixed incomes behind.

I don't think the liberal response to rate hikes is ageism. It's just an impotent gesture — frank

Deal with inflation? (1) raise wages (2) raise interest rates.

(1) simply ignores inflation by feeding the wage-inflation spiral. (2) was pretty effective when Volker took the reins. But, admittedly, the country is in unexplored financial territory now. -

Mikie

7.3kNot talking about a "living wage", only raising wages in general for the purpose of blunting inflation. That's a recipe for leaving older generations on fixed incomes behind. — jgill

Mikie

7.3kNot talking about a "living wage", only raising wages in general for the purpose of blunting inflation. That's a recipe for leaving older generations on fixed incomes behind. — jgill

So keeping real wages stagnant helps older people. Is this serious?

Wages can keep up with inflation and social programs like Medicaid / Medicare and SS will be just fine. There’s plenty of money to go around, provided we deal with the $800 billion a year gift to defense contractors and the massive tax cuts Trump gave to the corporate sector. To say nothing about trillions in stock buybacks that could easily be given to the workers who generate the astronomical profits we’ve seen the last…40 years.

Conservative canards aside, this can be done —and, importantly, has been done before.

wage-inflation spiral. — jgill

There’s no law of economics that says if you give workers a raise, you must raise your prices to make up for it. I think Wal Mart making 1 or 10 billion less in profits— i.e., absorbing the cost — would be survivable. Considering they make roughly 150 billion. Or, rather than buy back their own stocks, companies can reinvest in workers — like they did for decades prior to the neoliberal assault.

So there is no “wage-inflation spiral.” It’s just more excuses. It’s a pity you buy into this nonsense. -

jgill

4k

jgill

4k

(Wikipedia)Milton Friedman criticised the concept of wage-price spirals, arguing "It's the external manifestation of inflation, but not its source... the inflation arises from one and only one reason: an increase in a quantity of money.

Oh oh. You mean we can't keep giving money away? -

frank

18.9kDeal with inflation? (1) raise wages (2) raise interest rates.

frank

18.9kDeal with inflation? (1) raise wages (2) raise interest rates.

(1) simply ignores inflation by feeding the wage-inflation spiral. (2) was pretty effective when Volker took the reins. But, admittedly, the country is in unexplored financial territory now. — jgill

Powell seems pretty confident that raising rates with "break the back" of inflation again. He wants it down to 2%. -

Mikie

7.3kCPI Report Shows Inflation Eased to 3% in June

Mikie

7.3kCPI Report Shows Inflation Eased to 3% in June

https://www.wsj.com/articles/consumer-price-index-report-june-inflation-ede7f4b1?mod=mhp

Interesting. -

Benkei

8.1kThe wage inflation spiral is total nonsense. If my bread is made up of grains, water, oven time, heating, bakery space etc. and labor, and the price of labor goes up, then the price will only rise as much as it is part of the cost of making bread. A 10% increase in wages then would cause at most 1% increase in bread prices. Wage price increases are automatically dampened by the fact it's only a component of a resulting price.

Benkei

8.1kThe wage inflation spiral is total nonsense. If my bread is made up of grains, water, oven time, heating, bakery space etc. and labor, and the price of labor goes up, then the price will only rise as much as it is part of the cost of making bread. A 10% increase in wages then would cause at most 1% increase in bread prices. Wage price increases are automatically dampened by the fact it's only a component of a resulting price.

In fact, there are countries that have legally mandatory inflation corrections for salaries in certain sectors, like Belgium, and not once since those laws were passed have they had to deal with a wage inflation spiral.

And that's not even going into the nonsense that's "price stability" in the first place, which benefits no one except financial institutions. -

Mikie

7.3kAlmost a year has passed since the Bureau of Economic Analysis, which estimates gross domestic product, announced that real G.D.P. had declined over the previous two quarters — a phenomenon that is widely, although incorrectly, described as the official definition of a recession.

Mikie

7.3kAlmost a year has passed since the Bureau of Economic Analysis, which estimates gross domestic product, announced that real G.D.P. had declined over the previous two quarters — a phenomenon that is widely, although incorrectly, described as the official definition of a recession.

Right-wingers had a field day, crowing about the “Biden recession.” But it wasn’t just a partisan thing. Even forecasters who knew that recessions are defined by multiple indicators, and that America wasn’t in a recession yet, began predicting one in the near future. As Mark Zandi of Moody’s Analytics, one of the few prominent recession skeptics, put it: “Every person on TV says recession. Every economist says recession. I’ve never seen anything like it.”

By late 2022, members of the Federal Reserve committee that sets monetary policy were predicting an unemployment rate of 4.6 percent by late 2023; private forecasters were predicting 4.4 percent. Either of these forecasts would have implied at least a mild recession.

To be fair, we don’t know for sure that these predictions will be falsified. But with unemployment in June just 3.6 percent, the same as it was a year ago, and job growth still chugging away, the economy would have to fall off a steep cliff very soon to make them right, and there’s little hint in the data of that happening. — Paul Krugman

A few people were screaming about a recession on this very thread. Between that and the constant blather about how we’re “printing too much money,” I think it’s time to simply face the fact that most people don’t have a clue about what they’re talking about, and that the proper action is to ignore them.

There are many factors of inflation— supply chain disruptions, post Covid demand, war, corporate price gouging, monetary policy artificially inflating the three major asset classes, etc.

Now that there’s been no recession and inflation is under control, the new boogeyman will be the national debt, which Republicans suddenly care about again and which therefore all of us are supposed to be scared shitless about.

It never ends.

The fact is that Biden, for all his flaws, has been far more progressive than Obama— and while he’s made maddening decisions on labor and environment, his administration has made attempts to do sensible things in education, regulations, etc— at the SEC, EPA, the NLRB, etc. even saying nice things and appointing good people is a positive message for the country and world. -

Count Timothy von Icarus

4.3kGlad to see not everyone is buying into the "wage price spiral," argument. Rising wages are no doubt part of the cause of inflation, particularly for some sectors, but you don't have record profit margins and declining real wages during a period where inflation is driven by wage growth.

Count Timothy von Icarus

4.3kGlad to see not everyone is buying into the "wage price spiral," argument. Rising wages are no doubt part of the cause of inflation, particularly for some sectors, but you don't have record profit margins and declining real wages during a period where inflation is driven by wage growth.

I think it was the third quarter of 2022 that America's 500 largest companies had almost double the profit margin that they had through the 60s and 70s.

Rather, the most reasonable explanation I can think of is that:

First the pandemic causes a huge supply shock, one that has aftershocks due to China's repeated, draconian shut downs. This puts supply side pressure on prices.

At the same time, people can't consume services in the same way due to COVID restrictions. Demand for durable goods soars at the same time supply is hit hard, so there is a demand side inflationary push as well.

Service workers who were laid off in droves find new production jobs, which are expanding rapidly due to the shift towards durable goods consumption. At the same time, Baby Boomers begin to retire more rapidly due to the pandemic, both due to job conditions and safety fears as it is primarily an illness that is dangerous for the elderly. Migration also slows way down, hurting the labor supply. When things reopen, tons of service jobs are hiring at once but the labor force is smaller. This kicks off wage hikes, and indeed for a while , even with inflation, the bottom 80% of earners are doing better than they have in decades.

This is the initial inflation, but why don't we reach equilibrium quickly? I would argue that in the labor market we did reach equilibrium. Real wage growth slowed and then actually reversed. Did we have a labor shortage with a decling price for labor?

So why the continued inflation? I think the answer is lies in the surge in corporate profits. The pandemic forced many industries to raise prices and made people accept large price hikes. At the same time, the short period of real wages growth and the stimulus left households with more money to spend making demand less inelastic. Companies now had an excuse to raise prices that consumers buy and because prices have not recently surged like this consumer habits are lax. First some firms hike prices because they have to in order to survive, but then this solved the collective action problem of who raises prices first in an oligopoly.

Huge market concentration over the past decades makes this worse. When 4 firms control 80% of meat and over half the value of the average grocery cart goes to 6 conglomerates, it is much easier for oligopolies to realize monopoly profits once their collective action problem is fixed. Obviously the war in Ukraine hit energy supplies too.

Then you have the housing market which goes up for a whole different set of reasons, but adds to all this.

If this is the case, or at least a close approximations, fiscal policy should play a larger role. We should be taxing those who benefited from the windfall monopoly-like profits to reduce aggregate demand instead of using a brute force tool like rate hikes (of course, you might still do hikes, very low rates appear to increase inequality long term in a corrosive way). We should also be looking at market share and trust busting with renewed vigor.

Ageism has nothing to do with it. Some economic policies hurt some classes and help others, that is the nature of the beast. Accumulating $32 trillion in debt hurts younger adults and children. Having almost half the Federal budget be transfer payments to seniors (universal basic income in the form of Social Security and universal healthcare in the form of Medicare) necessarily hurts other classes. There is only so much to go around. But this doesn't make "think of the children," necessarily a good way to look at monetary policy.

We gave seniors these benefits largely because of the assumption that, once someone reaches a certain age they can no longer work in many professions. SS was in the context of the 1930s when lifespans were much lower and most work was manual labor. The problem being addressed was widespread senior poverty.

The programs worked. Today seniors are the group least likely to live in poverty. Children are the most likely group to live in poverty. During the pandemic we experimented with a child tax credit that gave families about 35% of the average Social Security payment per month, per child. But we also ran astounding deficits during this period.

The arguments for children deserving support, that they cannot support themselves, seem at least as good as the argument for seniors. The argument that it is an investment is even better. However, we can't afford current spending levels, so it's not like this is a real option unless we dramatically hike revenues or cut spending. To the extent transfers to seniors crowd out funding for other classes, veterans' benefits, support for children, even ideas like reparations for slavery, they "hurt," those classes.

To my mind, seniors already have the largest share of wealth of any group, a much larger share of wealth than their parents did at their age, receive the lion's share of all transfer payments, hold most high offices at the federal level, and so I wouldn't be particularly worried about them as a class per say, at a least not more than any other age group. I would be worried about a particular subset of seniors, those with inadequate savings for a basic standard of living. But the easiest way to help them is with targeted transfer payments, not monetary policy. Monetary policy is inherently a blunt tool and needs to focus on the big picture.

That many seniors don't have adequate savings, is to my mind definitive proof that our national pension system is simply inadequate. It is highly unlikely that current generations will live through the high rates of growth and wage growth that Baby Boomers did and even many Baby Boomers have trouble covering their retirement. That points to a fundementally structural issue.

We have traditionally prioritized older generations over younger ones on the assumption that economic growth and technological changes will mean that younger generations end up far better off than prior ones. That assumption no longer appears to be true, real wages have stagnated for half a century, falling for lower quintiles, life expectancy is declining for babies born today, growth hasn't returned to old levels.

Plus, IDK if inflation even does hurt seniors more as a class. That's common wisdom but they own the most real estate and equities relative to their share of the population by a solid margin and these are gaining value faster than inflation. -

frank

18.9kIf this is the case, or at least a close approximations, fiscal policy should play a larger role. We should be taxing those who benefited from the windfall monopoly-like profits to reduce aggregate demand instead of using a brute force tool like rate hikes (of course, you might still do hikes, very low rates appear to increase inequality long term in a corrosive way). We should also be looking at market share and trust busting with renewed vigor. — Count Timothy von Icarus

frank

18.9kIf this is the case, or at least a close approximations, fiscal policy should play a larger role. We should be taxing those who benefited from the windfall monopoly-like profits to reduce aggregate demand instead of using a brute force tool like rate hikes (of course, you might still do hikes, very low rates appear to increase inequality long term in a corrosive way). We should also be looking at market share and trust busting with renewed vigor. — Count Timothy von Icarus

In order to do that, taxation would have to be controlled by a body of experts the way rates are. In principle, people shouldn't be taxed unless they approve, so this is a side effect of founding principles, not a lack of wisdom on anyone's part. What is available to take action is rate hikes. Powell specifically mentioned Volcker in his last set of comments, so he's saying "Don't doubt me." -

ssu

9.8kAustralians know him as Timbo. Best example of a media troll who says this to get popularity (and notoriety) he is happy with. Earlier he was suggesting that people priced out of the property market should simply eat less brunch. Hence a troll. Or perhaps the guy is just irritated about how difficult it is for him to get good employees.

ssu

9.8kAustralians know him as Timbo. Best example of a media troll who says this to get popularity (and notoriety) he is happy with. Earlier he was suggesting that people priced out of the property market should simply eat less brunch. Hence a troll. Or perhaps the guy is just irritated about how difficult it is for him to get good employees.

At least he said unemployment has to rise 40% to 50%, not meaning unemployment has to be 40% to 50%. Well, unemployment (if the stats are genuine) in Australia is something like 3,7%. An unemployment of 5,55% isn't bad, double digits unemployment is bad. But then unemployment figures are notoriously understated (with unemployed when they stop looking for a job or after some time falling from the unemployed statistics).

But here's the issue:

The unemployment - inflation argument goes a long way and is mainstream economics. Basically meaning that with high unemployment you have a recession and prices don't rise because people cannot afford higher prices and they cut spending. Then when unemployment is low, economy is roaring and guess what, with high demand those prices rise! This is quite straightforward and simple.

Yet the model doesn't take into account (of course) in any way the government and especially not the central bank. Because you can have stagflation: both high unemployment and high inflation. Hence if the government recklessly borrows or prints money to cover it's expenses, it's totally possible to have both unemployment and inflation.

Now I guess the game is to have the modest inflation that will take care of the excessive spending while not being so hot that the voter will jump out of the boiling water in the next elections.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum