-

saw038

69“I believe that banking institutions are more dangerous to our liberties than standing armies" - Thomas Jefferson

saw038

69“I believe that banking institutions are more dangerous to our liberties than standing armies" - Thomas Jefferson

In 1913, the Federal Reserve Act was put into action by President Woodrow Wilson.

What do you think about this quote?

And, what do you think about the idea of centralized banking system?

-

PunshhhAccepted Answer

3.5kBanks should seperate the gambling wing from the primary role of the bank which should be to provide banking facilities to their private customers etc. If they are going to gamble they should do it only with profits they have made and separated from their banking responsibilities and capital.

PunshhhAccepted Answer

3.5kBanks should seperate the gambling wing from the primary role of the bank which should be to provide banking facilities to their private customers etc. If they are going to gamble they should do it only with profits they have made and separated from their banking responsibilities and capital.

Hopefully appropriate regulation is being put into place. -

Cavacava

2.4kIt is a posthumous attribution, he did not say it. He may not have liked Banks, but he did like credit.

http://www.snopes.com/quotes/jefferson/banks.asp -

saw038

69The article you provided was about this quote "banks and corporations will deprive the people of all property." Which is not my quote.

saw038

69The article you provided was about this quote "banks and corporations will deprive the people of all property." Which is not my quote.

Here is a Forbes article citing my quote:

http://www.forbes.com/sites/robertlenzner/2011/11/06/thomas-jefferson-warned-the-nation-about-the-power-of-the-banks/#516691642aac -

Cavacava

2.4kI saw the difference, however the article I cited goes on to state:

Jefferson's 28 May 1816 letter to John Taylor:

And I sincerely believe, with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.

The latter statement is both undocumented and not in accordance what Jefferson wrote in a 24 June 1813 letter to John Wayles Eppes. -

BC

14.2k

BC

14.2k-

The first part of the quotation ("If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered") has not been found anywhere in Thomas Jefferson's writings, to Albert Gallatin or otherwise. It is identified in Respectfully Quoted as spurious, and the editor further points out that the words "inflation" and "deflation" are not documented until after Jefferson's lifetime.

This first known occurrence in print of the spurious first part with the two other quotations is in 1948, although the spurious portion actually appears after the two other quotations.

From here...

I don't think the banking situation of 1813 is quite analogous to the banking situation 200 years later.

There has been a dispossessing the property of The People, but the desperadoes who were doing the stealing were people in the wealthy slave- and land-owning class to which Jefferson and other founding fathers belonged, as well as banks and corporations. -

Erik

605Good question. I'm not exactly sure what the answer is other than the fact that reverence for the 'founding fathers' - within the wider narrative of their risking everything in order to free us from the perceived despotism of Great Britain - has been inculcated through a variety of myths from an early age. It becomes a thoughtless and automatic association, and we assume that any deviation from their sacred thoughts is tantamount to a betrayal of freedom and the principles upon which this country was supposed to have been founded.

Erik

605Good question. I'm not exactly sure what the answer is other than the fact that reverence for the 'founding fathers' - within the wider narrative of their risking everything in order to free us from the perceived despotism of Great Britain - has been inculcated through a variety of myths from an early age. It becomes a thoughtless and automatic association, and we assume that any deviation from their sacred thoughts is tantamount to a betrayal of freedom and the principles upon which this country was supposed to have been founded.

The interesting thing that I found out later was how little they agreed upon. That being the case, appealing to the founders' 'intentions', which is typically done in an attempt to buttress popular support for a specific policy, is an emotional ploy used to discredit opponents. By disagreeing with the founders, you are ipso facto un-American. But that's absurd since the men who wrote the constitution could not agree on essentials after the fact.

If I recall correctly, their disagreements got so intense that the election of 1800 (between two primary founders, John Adams and Thomas Jefferson) was known as the Second American Revolution, pitting the Federalists versus the Anti-Federalists. The competing parties had widely divergent visions of such matters as who should be included in the democratic process, the scope of government generally, banking policy, standing army, etc. -

ssu

9.8kBasically the centralized banking system, basically a fiat monetary system, has created for us a big problem.

ssu

9.8kBasically the centralized banking system, basically a fiat monetary system, has created for us a big problem.

The most important price formation by supply and demand doesn't exist: Money has no price as the supply is infinate. First one might think this would lead to rampant inflation, but that isn't the case. The money has created a huge financial bubble and when this bubble bursts or even disinflates, it creates deflation. Now likely the system will collapse in a decade or two (or earlier), just like it did before in the 1970s, but we won't call it a collapse or even a default.

As of the quote, it does have a truth to it and it should be noted that not only Jefferson has been a US President that has been against the central bankers. President Andrew Jackson in his farewell adress, put an extensive effort on warning about the central bankers and their paper-money.

Recent events have proved that the paper-money system of this country may be used as an engine to undermine your free institutions, and that those who desire to engross all power in the hands of the few and to govern by corruption or force are aware of its power and prepared to employ it.

-

It is one of the serious evils of our present system of banking that it enables one class of society--and that by no means a numerous one--by its control over the currency, to act injuriously upon the interests of all the others and to exercise more than its just proportion of influence in political affairs. The agricultural, the mechanical, and the laboring classes have little or no share in the direction of the great moneyed corporations, and from their habits and the nature of their pursuits they are incapable of forming extensive combinations to act together with united force.

-

The paper-money system and its natural associations--monopoly and exclusive privileges--have already struck their roots too deep in the soil, and it will require all your efforts to check its further growth and to eradicate the evil. The men who profit by the abuses and desire to perpetuate them will continue to besiege the halls of legislation in the General Government as well as in the States, and will seek by every artifice to mislead and deceive the public servants. It is to yourselves that you must look for safety and the means of guarding and perpetuating your free institutions. In your hands is rightfully placed the sovereignty of the country, and to you everyone placed in authority is ultimately responsible. It is always in your power to see that the wishes of the people are carried into faithful execution, and their will, when once made known, must sooner or later be obeyed; and while the people remain, as I trust they ever will, uncorrupted and incorruptible, and continue watchful and jealous of their rights, the Government is safe, and the cause of freedom will continue to triumph over all its enemies.

But it will require steady and persevering exertions on your part to rid yourselves of the iniquities and mischiefs of the paper system and to check the spirit of monopoly and other abuses which have sprung up with it, and of which it is the main support.

Obviously the profiteers of the system have gained control and even can write the present economic history on the subject, basically. -

saw038

69Now likely the system will collapse in a decade or two (or earlier), just like it did before in the 1970s, but we won't call it a collapse or even a default. — ssu

saw038

69Now likely the system will collapse in a decade or two (or earlier), just like it did before in the 1970s, but we won't call it a collapse or even a default. — ssu

I think the current fiat monetary system is truly unstable and it is not a matter of if it will collapse, but rather when.

However, why do you say that it wont' be called a collapse or a default? -

ssu

9.8kWas it officially termed a default when Nixon got off the gold standard? No. And in many places it is argued that the US has never defaulted. Technically you can create a lot of ways to hide what actually happens: call it a tax on people holding US debt, for example...

ssu

9.8kWas it officially termed a default when Nixon got off the gold standard? No. And in many places it is argued that the US has never defaulted. Technically you can create a lot of ways to hide what actually happens: call it a tax on people holding US debt, for example...

And of course the obvious present example is Greece. It has been called only a "restructuring" when of course it obviously has been a default. It's actually an important aspect in the discourse in the media how events are portrayed. After all, during the financial crisis of 2007-2008 we actually came close to the collapse of the whole international monetary system, but it was only far later revealed that this had happened. And not something that is publicly talked about.

The real interesting phenomenon, which actually is even philosophically interesting, is now the event that there are negative interest rates. Taking a loan and having been paid for it makes to me and many people no sense. Of course for a country like Japan that has a massive debt burden which simply cannot pay normal interest for it's debt it's a saviour. Another thing is the fact that central banks now are investing in the stock market. -

swstephe

109From what I recall, Jefferson made comments against private banks and was warning on the dangers of not having a federal regulating bank like other countries. So he would probably have been partially relieved if he had seen the Federal Reserve, but maybe thought it was still too private. By definition, he would probably have no problem with fiat currency. Instead, he would probably have more concerns about many things taken for granted these days, like usury, or charging interest instead of a flat fee for loans. At the time, it was considered immoral.

swstephe

109From what I recall, Jefferson made comments against private banks and was warning on the dangers of not having a federal regulating bank like other countries. So he would probably have been partially relieved if he had seen the Federal Reserve, but maybe thought it was still too private. By definition, he would probably have no problem with fiat currency. Instead, he would probably have more concerns about many things taken for granted these days, like usury, or charging interest instead of a flat fee for loans. At the time, it was considered immoral. -

BC

14.2kA question from someone not from the USA: why do purported remarks by the founding fathers have a quasi-religious importance to so many Americans? This stuff can have an irrationalist edge, as seen from Abroad. — mcdoodle

BC

14.2kA question from someone not from the USA: why do purported remarks by the founding fathers have a quasi-religious importance to so many Americans? This stuff can have an irrationalist edge, as seen from Abroad. — mcdoodle

When Lincoln (not a founding father) wrote the Gettysburg Address, briefly referencing founding documents, Jefferson (a founding father) had been dead only 37 years--not a long time. The Revolution of 1776 was only 87 years before. The past (which Faulkner says is never past anyway) just wasn't that far back. The rhetorical connections between founding documents, founding authors, and later rhetoric and authors has been continuous.

between the 11th century (like... 1066) and the present there have been 1000+ years and some very significant discontinuities to British history. (Plus there were hundreds of years of British history before Bill the Bastard arrived on the scene.) Specifically American and not British Colonial history dates back to 1783--233 years -- 240 if you count 1776 as the beginning. Our founding documents are much younger than yours are.

In our jurisprudence, yours too--no? precedent is important and our most important precedent is the constitution. In political rhetoric, claiming authority from the founding documents is still feasible -- that's what the gun lobby and the Amendment II is all about. The Brexit campaign wisely didn't reach back to 1066 for guidance. You don't have a constitution whose sacred meaning you can squabble over.

There is a certain amount of cultic attention being paid to the founding documents. Our sacred documents are over protected (like they were the tablets from Mount Sinai) while you have yours out on a table -- covered by glass, but still, sitting on a wooden table. At least they were in 1989. Britain has an abundant supply of cultic documents, objects, battlefields, castles, crypts, cathedrals, saints, palaces, princes (of varying caliber), actual crown jewels, great estates belonging to the once fabulously wealthy ruling elite, and so on. Our relatively puny list of sacred objects, documents, and places must bear a lot of heavy traffic. Plus none of our stuff is very old, unless we start counting aboriginal stuff, whom we all tried very hard to get rid of.

You have the royal family and we have the Daughters of the American Revolution--more than a few of whom are dingbats.

So, there you are. That's why. -

mcdoodle

1.1kSo, there you are. That's why. — Bitter Crank

mcdoodle

1.1kSo, there you are. That's why. — Bitter Crank

Thanks, BC. I appreciate that no-one with a royal family to revere like us Brits can really argue that to worship your founding fathers is any more irrational than we are.

The 'us'-ness of history is interesting too, of course. My family roots are in Ireland but when you migrate to a land you bequeath to your children the duty to have a new 'us', unless you're a separatist-leaning community. Once one explores the other histories, the histories of one's ancestors, new angles on things turn up all the time. I was trying to understand the history of the song 'Kelly the boy from Killane' which I have been known to sing lustily at parties when not curbed by sensible people - and found that 'Forth and Bargy', two areas mentioned in the song, is also a collective name for a dialect of English that lasted from the 11th to the 19th centuries in that part of Ireland.

Pardon me, I'm allowing my mind to drift off. -

ssu

9.8k

ssu

9.8k

You don't recall it correct this time, swstephe.From what I recall, Jefferson made comments against private banks and was warning on the dangers of not having a federal regulating bank like other countries. So he would probably have been partially relieved if he had seen the Federal Reserve, but maybe thought it was still too private. — swstephe

First: Central Banks usually aren't the bank regulating bodies. In the EU I think the regulatory body is the EBA, European Banking Authority, which actually isn't part of the ECB. In the US regulation has been even more dispersed, but now after the 2008 financial crisis and Dodd-Frank, there is new bodies to control the banks. Quote from the Congress Research Service:

The Dodd-Frank Act created the interagency Financial Stability Oversight Council (FSOC) and authorized a permanent staff to monitor systemic risk and consolidated bank regulation from five agencies to four. The DFA granted the Federal Reserve oversight authority and the Federal Deposit Insurance Corporation (FDIC) resolution authority over the largest financial firms. The Dodd-Frank Act consolidated consumer protection rulemaking, which had been dispersed among several federal agencies, in the new Consumer Financial Protection Bureau.

The Fed is the lender of the last resort... not the overseeing regulator (although it has some task in this area too).

Second, the Federal Reserve is a Private bank, not part of the government, and formed de facto by the private banks themselves. Now the President does appoint the Chairman, but for example the President of the largest and most important Federal Reserve Bank, the Federal Reserve Bank of New York, is appointed by the Wall Street Banks themselves (with current President being William Dudley from Goldman Sachs). This is actually quite typical as it's well understood that a central bank should not be a part of the government. Otherwise, the theoretical thinking would go, it would be too close to the government and not independent. Which naturally is important for it's credibility. The reality is then another thing... as basically the Federal Reserve is already the biggest owner of the US public debt.

Thirdly and most importantly, the topic that Jefferson disagreed with was about the the First Bank of United States, not just some private bank, but a national bank, a proto-central bank just like the Federal Reserve is now. The First Bank of United States was modelled after the Bank of England and Jefferson was totally against it and saw it as an engine for speculation, financial manipulation, and corruption. On one side was Jefferson and on the other side Alexander Hamilton and the basic thing was about what is the de facto historical role of central banks: to finance wars.

(see The Battle over the Bank: Hamilton v. Jefferson)In 1791, Hamilton proposed that the United States charter a national bank in order to take care of Revolutionary War debt, create a single national currency, and stimulate the economy. Jefferson argued that the creation of a national bank was not a power granted under the enumerated powers, nor was it necessary and proper. Both gentlemen presented their arguments to Washington, and ultimately Washington agreed with Hamilton.

Now unfortunately the whole discourse of the subject has turned in the US to quite venomous arguing as some in the US are very much against the Fed and usually come from the libertarian right (the don't-tread-on-me teabaggers etc), which make the discourse politically heated on the left-right axis, but that shouldn't hinder actual non-politically motivated discussion of the subject. Central banks are the way how our financial system is established. And yes, it does create problems which are obvious in the present...

-

Mongrel

3kThe Fed is the lender of the last resort... not the overseeing regulator — ssu

Mongrel

3kThe Fed is the lender of the last resort... not the overseeing regulator — ssu

The Fed does regulate (though not in the legislative sense, obviously). It's along the lines of a fuel regulator in a car.

Jefferson thought public money should be controlled by Congress. That attitude changed dramatically when he became the president and he used legal mechanisms set up by Hamilton to access treasury funds. So Jefferson proved that he was flexible enough to turn 180 degrees if the topic was survival.

I think his opinion of the US having a $19 trillion debt would be the same as that of the rest of us... we're probably at the end of the ability of the US to prop up the global economy. The next time the shit hits the fan, there will either be a global economic collapse or there will be a run on the dollar.

More interesting is: how did the debt get so big? It's partly to do with the bail out, but it started ballooning out before that when GW Bush lowered taxes during the invasion of Iraq. -

ssu

9.8kWhen it's the easiest way and there has been basically no risk to increase the debt, why wouldn't the politicians use debt financing? And if (when) the crisis hits, you can blame a) foreigners, b) speculators, c) foreign speculators, d) the last President from the opposing party. And solve the situation in crisis mode. And that is surely what will happen: nothing serious will be done about the debt until there is a market revolt and crisis. Then the President can use the excessive powers that he has in times of national peril.

ssu

9.8kWhen it's the easiest way and there has been basically no risk to increase the debt, why wouldn't the politicians use debt financing? And if (when) the crisis hits, you can blame a) foreigners, b) speculators, c) foreign speculators, d) the last President from the opposing party. And solve the situation in crisis mode. And that is surely what will happen: nothing serious will be done about the debt until there is a market revolt and crisis. Then the President can use the excessive powers that he has in times of national peril.

And why it has grown? If you expand health care when the population is getting older, fight several wars without raising taxes, naturally the debt increases. As Dick Cheney said, deficits don't matter. Deficits surely matter for a small country, but not for the US.

The ultimate reason is that there isn't something to replace the dollar for now and countries like China don't want a global monetary crisis and to lose it's wealth what it has in Treasuries. Last time it was basically DeGaul who said "enough" alongside the Germans and Nixon had to go off the gold standard (or the remnants of it).

I think a change could happen if some Japan got into a serious crisis, if the yen did collapse and finally, finally got inflation what it has wanted for so long, only then the whole mindset could change in the markets. -

ssu

9.8kIt will happen someday, but it won't be the end of the World.

ssu

9.8kIt will happen someday, but it won't be the end of the World.

And that's what has to be understood. The financial crisis is well, just like any other financial crisis we have already endured. We just experienced one of the worst banking crises and financial collapses in history totally comparable to the 1929 crash. People think of it perhaps too much as the whole society will collapse. It won't. People that just have made the wrong investments will get a haircut (lose money). Some people who were more affluent earlier will not be so. Perhaps there's a recession, more unemployed, more people that are poor.

But then the turnaround is quick: assume just how powerfull and good looking the US economy when it's making a surplus and the debt is modest. Because once you default, the turnaround for some US can be great because it likely isn't going to be put into something like Greece. For example Russia defaulted in it's debt, then was very prosperous and looking great until Putin decided to invade Crimea and the price of oil went south.

With the US it's even more easy. The simple reason is that the bankers simply will come back. Where else would they put their money? -

Mongrel

3kA run on the dollar would cause a great depression. Not the end of the world, but quite a bit more than a haircut.

Mongrel

3kA run on the dollar would cause a great depression. Not the end of the world, but quite a bit more than a haircut.

We just experienced one of the worst banking crises and financial collapses in history totally comparable to the 1929 crash. — ssu

Actually, we just put it off. The bail-out was designed to counter loss of confidence. With a $19 trillion debt, the capacity for warding off that sort of loss is diminished. -

ssu

9.8k

ssu

9.8k

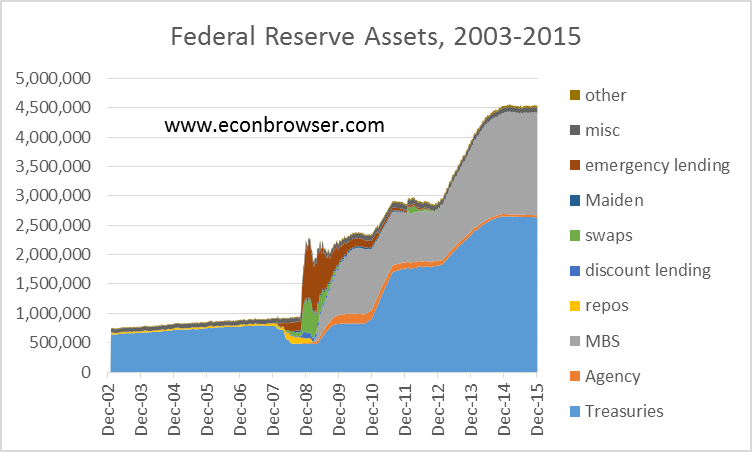

Or the crisis morphed into another... in Europe, for example. But yes, the balance sheet of the Federal Reserve is quite as big as it was during the financial crisis. It hasn't increased lately, but the mortrage back securities garbage is still there. And so are the US treasuries, which have increased since the financial crises.Actually, we just put it off. The bail-out was designed to counter loss of confidence. With a $19 trillion debt, the capacity for warding off that sort of loss is diminished. — Mongrel

Basically what happened is that the US did what Japan had done (on steroids) after it's bubble economy burst late 1980's. And the results have been more like the same in my view. It's ironic that then the US advised to do what it had done with the S&L crisis, tackle the crisis basically head on, put people into jail. But that of course was possible because the S&L banks weren't in power, they weren't running the show as Wall Street does. This time the US went with the create-Zombie-banks option.

Now of course everybody has done basically the same. And this is important as one shouldn't just look at the US in isolation. -

ssu

9.8kAnd btw this topic could get back to the focus of the media, if something happens with Deutsche Bank and they need to be bailed out. The bank is one of the few mega-traders of derivatives. So the mess of 2007/2008 is still out there as noted.

ssu

9.8kAnd btw this topic could get back to the focus of the media, if something happens with Deutsche Bank and they need to be bailed out. The bank is one of the few mega-traders of derivatives. So the mess of 2007/2008 is still out there as noted.

(CNBC, 29th September 2016) German officials could be about to find themselves in an uncomfortable position: Being called on to show they're ready to rescue a bank in a part of the world where such operations are considered taboo.

Deutsche Bank came under intensified market fire Thursday, the latest salvo being a Bloomberg report that a small number of hedge funds are trimming their sails at the German bank.

IMF came out last june and said about Deutsche Bank that "the bank is the greatest contributor to systemic risk in the world's biggest lenders." The share price has halved this year.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum