-

Deleteduserrc

2.8kStray thoughts:

Deleteduserrc

2.8kStray thoughts:

Wittgenstein said famously:

"There is one thing of which one can say neither that it is one metre long, nor that it is not one metre long, and that is the standard metre in Paris"

Similarly, is there one thing the value of which one can say neither that it is one dollar, nor that is not one dollar, and that is the dollar?

Of course, the dollar is subject to fluctuations in a way the meter is not. The dollar, as thing-to-measure-against, is nowhere near as fixed. It's not an object. Still, the idea is that the dollar is the currency least susceptible to flux, and so local transactions, debts etc. can be pegged to it's value. Just as the standard meter asks that all local measurements relate back to it.

State-building, in the past, has been tied to the standarization of measurement. Naturally : If you want to levy a homogenous wheat tax you have to make sure everyone's measuring wheat in the same way. You choose one particular thing to measure against, largely arbitrary (can be a long-standing measure, but its origin is ultimately arbitrary), and make sure all measurements relate back to it.

Empire-building, at least recently, seems linked to something similar. All currencies have to express their value in terms of the reserve currency. For everything to be legit and secure and on the up-and-up, it has to look to the dollar.

Of course, the standard meter is a thick 'dry-good' size object. It is what it is. The dollar was like this, for a while, post-Bretton Woods, linked to a certain amount of gold (close, here, to the standard meter.) But this was still one step-removed. A fixed-weight of gold ---> something convertible to that amount of gold. There is already a kind of 'fiat' here --- it's as though you have the standard meter, and a declaration that another thing, whose length subtly changes, will always be the same length as the meter. Then, 1971, and true fiat. (This has to happen if your ruler keeps slightly shifting shorter and you say that you can use this measure to claim a meter, and there’s only so many meters of gold)

The world order, beginning with the Dutch Empire, tends to be tied to a reserve currency. It seems like global hegemony has something to do with having the currency every other currency relates itself to, and insisting on that focal relationship. Which makes sense: If there's no standard, then currencies can rise and fall, and the debts you hold as assets can evaporate in runaway inflation or whatever else.

This seems all related to Wittgenstein on the meter. Something about power and standardization and money and language, but all I got is that mishmash for now. Something, something about bedrock, tectonic plates, and the magma beneath. Very confused, i'm sure, but maybe there's something there?

(only relevant, because is the dollar on the way out of being the reserve currency? seems like could happen soon?) -

Pfhorrest

4.6kPerhaps just like we've now defined the meter and other standards of measure in terms of objectively observable things -- we can recreate a perfect meter stick by running some experiments -- it would be best if currency was neither fixed to something like gold nor defined by fiat, but tied to some objective measure of economic activity.

Pfhorrest

4.6kPerhaps just like we've now defined the meter and other standards of measure in terms of objectively observable things -- we can recreate a perfect meter stick by running some experiments -- it would be best if currency was neither fixed to something like gold nor defined by fiat, but tied to some objective measure of economic activity.

I have some notes here about something like this, let me dig them out...

A currency backed by an investment passively tracking the cumulative international markets, with new shares (and thus new units of currency) issued in proportion to the growth of the world population, thus assuring that each unit of currency is worth a constant fraction of GDP per capita. (Start it off close to the value of a dollar, so it's worth about 1/30th of an average day's labor).

It's backed by something tangible, like "gold standard" people want.

But it doesn't deflate like a gold standard does.

It doesn't inflate either, except as the ease of producing things in general comes down with progress.

It tracks with the average value of labor, and thus serves as a kind of "time currency". — Forrest's note to himself

Maybe denominate the currency explicitly in times: one Hour (of gross world product per capita), one Day (of gross world product per capita), one Minute (of gross world product per capita), etc.

This also makes it really easy for everyone to see where they stand in the world economy: how many Years (of gross world product per capita) do you make per year? — Forrest's followup to that note to himself -

Outlander

3.2kWhat is the value of your service if only you can perform it and I need it? Well, it depends how badly I need it. What is the value if everyone in the world can do it? Surely much less. Supply and demand they say.

Outlander

3.2kWhat is the value of your service if only you can perform it and I need it? Well, it depends how badly I need it. What is the value if everyone in the world can do it? Surely much less. Supply and demand they say.

As it relates to currency. It is little more than a promissory note. The value is created by the perception of the individual who receives it, backed up and assured by the legitimacy and might of the issuer.

Why is it important? Why don't we just barter? One of the most obvious practical reasons being sometimes items of value are substantial in size. You wouldn't want to enter a market lugging a marble sculpture just to purchase a diamond ring would you? From this realization comes the idea of deeds or contracts ie. written and signed papers that mandate what is who's and for what or why. These documents can be forged, lost, stolen, and much more. It also prevents compartmentalization of value for security. Example, you can put a few thousand in the market, a few thousand in land, a few thousand in material goods, a few thousand buried here, buried there, etc.

There are plenty of downsides but most that can be redeemed. One if not the most important thing about currency in general is that it makes savagery and brutality unnecessary to get and keep what one wants. You need a home, food, stuff, you just rob someone and they will more than likely give you the pieces of paper you need for all that. You no longer have to bash someone over the head for shelter or something to eat or wear. Not to say this stops some cash thieves. It's just after you get what you want you can spend it anywhere as opposed to having to kill a person to stop them from taking the shelter or item back. Again, assuming you get away with the cash robbery. It's just paper. Very different from someone wondering why you suddenly have 50 prime cattle in your yard after hearing about a dozen monks were found slaughtered nearby with their cattle stolen. -

ssu

9.8kSomething about power and standardization and money and language, but all I got is that mishmash for now. Something, something about bedrock, tectonic plates, and the magma beneath. Very confused, i'm sure, but maybe there's something there? — csalisbury

ssu

9.8kSomething about power and standardization and money and language, but all I got is that mishmash for now. Something, something about bedrock, tectonic plates, and the magma beneath. Very confused, i'm sure, but maybe there's something there? — csalisbury

Is there anything? There's the thing we believe now even if we don't, Modern Monetary Theory!

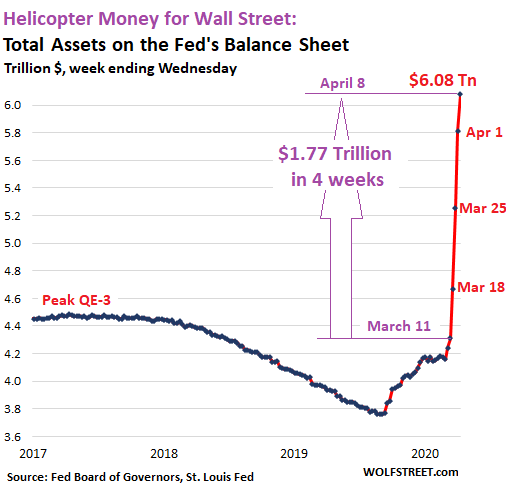

...and a trillion more.

-

Deleteduserrc

2.8kI know very little about economics, been reading this & the OP was just kind of rambling, reflecting on that. Emphasizing again that I have no idea what I'm talking about, those graphs seem to correspond to the last stage in what the author of the linked article describes as a cyclical process : strong currencies inevitably devalue themselves, where finally debt is just too high that the central bank begins feverishly to print money and buy up debt until people start fleeing to other currencies.

Deleteduserrc

2.8kI know very little about economics, been reading this & the OP was just kind of rambling, reflecting on that. Emphasizing again that I have no idea what I'm talking about, those graphs seem to correspond to the last stage in what the author of the linked article describes as a cyclical process : strong currencies inevitably devalue themselves, where finally debt is just too high that the central bank begins feverishly to print money and buy up debt until people start fleeing to other currencies. -

ssu

9.8kI have no idea what I'm talking about, those graphs seem to correspond to the last stage in what the author of the linked article describes as a cyclical process : strong currencies inevitably devalue themselves, where finally debt is just too high that the central bank begins feverishly to print money and buy up debt until people start fleeing to other currencies. — csalisbury

ssu

9.8kI have no idea what I'm talking about, those graphs seem to correspond to the last stage in what the author of the linked article describes as a cyclical process : strong currencies inevitably devalue themselves, where finally debt is just too high that the central bank begins feverishly to print money and buy up debt until people start fleeing to other currencies. — csalisbury

It's good to understand the basics: how money is created through debt and how the fiat system works. Of course there is the "Fed & other central bankers are evil" discourse, which can be viewed critically, yet they tell the basics in a very simple way for the beginners to understand. Once you think you understand what money is and how it's made in a fiat system, then time to look at MMT (modern monetary theory). I think it is useful as we have negative real interest rates and the Federal Reserve is ballooning it's balance sheet with trillions in one of the worst economic depression we have experienced. And Americans don't understand how much of their Superpower status relies on the role of the dollar.

It actually raises many philosophical questions too. -

Deleteduserrc

2.8kty for that, I was following off and on when the thread was current, but fell off out of laziness. I’m reading now but it’s not my wheelhouse so it’ll take me a bit, but eager to digest and respond.

Deleteduserrc

2.8kty for that, I was following off and on when the thread was current, but fell off out of laziness. I’m reading now but it’s not my wheelhouse so it’ll take me a bit, but eager to digest and respond. -

fdrake

7.2k

fdrake

7.2k

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum