-

Mikie

7.3kI'm interested in hearing views about the Fed from all. I've heard many conspiracies over the years, and a lot of strong sentiment about it. I have only recently been reading the history of it, but would like to gain a better understanding. This thread is both for that and for general discussion.

Mikie

7.3kI'm interested in hearing views about the Fed from all. I've heard many conspiracies over the years, and a lot of strong sentiment about it. I have only recently been reading the history of it, but would like to gain a better understanding. This thread is both for that and for general discussion.

Do they have too much power? Is it necessary to have a central bank? What the hell is the Fed, anyway? Etc.

[Edit: This was spurred on, in part, by Frontline’s excellent program about the Fed.] -

apokrisis

7.8kThe real story is Bretton Woods and how the US agreed to fund the recovery of the post WW2 broken colonial empires by making the US dollar the world currency. Nixon then abandoned the gold standard and the US could turn the tables by becoming the world’s creditor rather than its banker. The Fed just administers this rigged game. Endless money creation is possible because the debt had to be bought by every other currency.

apokrisis

7.8kThe real story is Bretton Woods and how the US agreed to fund the recovery of the post WW2 broken colonial empires by making the US dollar the world currency. Nixon then abandoned the gold standard and the US could turn the tables by becoming the world’s creditor rather than its banker. The Fed just administers this rigged game. Endless money creation is possible because the debt had to be bought by every other currency.

Some day the worm may turn. The IMF might have the nerve to push through a world Bitcoin. Or maybe we will crash back to gold - China and Russia have built their stocks. However the US has done a good job at creating a hostage situation where any unwinding of dollar hegemony becomes mutually assured destruction for all concerned.

High finance is a political long game. The Fed runs the front office of the US dollar monopoly. -

ssu

9.8kI'm interested in hearing views about the Fed from all. I've heard many conspiracies over the years, and a lot of strong sentiment about it. I have only recently been reading the history of it, but would like to gain a better understanding. This thread is both for that and for general discussion.

ssu

9.8kI'm interested in hearing views about the Fed from all. I've heard many conspiracies over the years, and a lot of strong sentiment about it. I have only recently been reading the history of it, but would like to gain a better understanding. This thread is both for that and for general discussion.

Do they have too much power? Is it necessary to have a central bank? What the hell is the Fed, anyway? Etc. — Xtrix

First thing to remember: all countries with their own currencies have a central bank.

The whole global monetary system is based on fiat currencies and a debt based monetary system. The US central bank and it's currency has played a dominant role on just why the US is a Superpower: without the role of the dollar, the US could not live on issuing new debt as it has for decades now.

The Federal Reserve isn't part of the government and an construct of basically Wall Street banks with the New York Fed being the most important.

Criticism of the bank has a long tradition in the United States. President Jackson's farewell speech is quite astonishing, then it was about a precursor to the Federal Reserve:

Recent events have proved that the paper-money system of this country may be used as an engine to undermine your free institutions, and that those who desire to engross all power in the hands of the few and to govern by corruption or force are aware of its power and prepared to employ it. Your banks now furnish your only circulating medium, and money is plenty or scarce according to the quantity of notes issued by them. While they have capitals not greatly disproportioned to each other, they are competitors in business, and no one of them can exercise dominion over the rest; and although in the present state of the currency these banks may and do operate injuriously upon the habits of business, the pecuniary concerns, and the moral tone of society, yet, from their number and dispersed situation, they can not combine for the purposes of political influence, and whatever may be the dispositions of some of them their power of mischief must necessarily be confined to a narrow space and felt only in their immediate neighborhoods.

But when the charter for the Bank of the United States was obtained from Congress it perfected the schemes of the paper system and gave to its advocates the position they have struggled to obtain from the commencement of the Federal Government to the present hour. The immense capital and peculiar privileges bestowed upon it enabled it to exercise despotic sway over the other banks in every part of the country. From its superior strength it could seriously injure, if not destroy, the business of any one of them which might incur its resentment; and it openly claimed for itself the power of regulating the currency throughout the United States. In other words, it asserted (and it undoubtedly possessed) the power to make money plenty or scarce at its pleasure, at any time and in any quarter of the Union, by controlling the issues of other banks and permitting an expansion or compelling a general contraction of the circulating medium, according to its own will. The other banking institutions were sensible of its strength, and they soon generally became its obedient instruments, ready at all times to execute its mandates; and with the banks necessarily went also that numerous class of persons in our commercial cities who depend altogether on bank credits for their solvency and means of business, and who are therefore obliged, for their own safety, to propitiate the favor of the money power by distinguished zeal and devotion in its service. The result of the ill-advised legislation which established this great monopoly was to concentrate the whole moneyed power of the Union, with its boundless means of corruption and its numerous dependents, under the direction and command of one acknowledged head, thus organizing this particular interest as one body and securing to it unity and concert of action throughout the United States, and enabling it to bring forward upon any occasion its entire and undivided strength to support or defeat any measure of the Government. In the hands of this formidable power, thus perfectly organized, was also placed unlimited dominion over the amount of the circulating medium, giving it the power to regulate the value of property and the fruits of labor in every quarter of the Union, and to bestow prosperity or bring ruin upon any city or section of the country as might best comport with its own interest or policy. -

John McMannis

78This was spurred on, in part, by Frontline’s excellent program about the Fed.] — Xtrix

John McMannis

78This was spurred on, in part, by Frontline’s excellent program about the Fed.] — Xtrix

I'll have to watch that. My understanding is that the federal reserve controls interest rates, but I have no idea what interest rates, like is it the interest rate on a mortgage or credit card? Is it a baseline or minimum for banks...I tried wikipedia but it went in and out of my head.

it is also said that the fed control money supply. but I thought the treasury does that? they definitely print the money. So how does the fed control the amount of coins and paper bills in circulation if they don't actually print them? They give the treasury the go ahead to print?

These are my childish questions I know, but I have no background in this. I just know it's important somehow! -

prothero

514I wonder what the economic and monetary system would look like without the fed?

prothero

514I wonder what the economic and monetary system would look like without the fed?

I wonder what would have happened during the 2008 fiscal crisis without some institution like the fed?

The fed basically controls the central banks interest rate and the monetary supply for the U.S. (not the world) but congress controls taxing and spending policy. The fed is in theory independent of the politics but who thinks that is entirely true. Since government policy regarding spending and taxing is so out of balance there is only so much the fed can do to restore integrity to the system.

Why does everyone buy dollars, what would you rather own, bitcoin, afghan afghanis, angolan kwanzas? -

prothero

514From google

prothero

514From google

At a price of US$1,250 per troy ounce ($40 per gram), reached on 16 August 2017, one metric ton of gold has a value of approximately $64.3 million. The total value of all gold ever mined, and that is accounted for, would exceed $7.5 trillion at that valuation and using WGC 2017 estimates.

also from google

In 2020, global GDP amounted to about 84.54 trillion U.S. dollars, almost three trillion lower than in 2019.

You can perhaps see the imbalance that a gold standard might produce. The value of gold is what people are willing to pay, and the value of fiat currencies is what value and faith people place in the them. The dollar is the world currency because of the stability of our government and our economy. It may not remain that way in the future, especially if we kept using it as a tool of coercion, but alternatives are not yet viable.

Personally I like bitcoin, a digital currency for a digital world economy but it also has no intrinsic value other than that given to it buyers and sellers. -

Mikie

7.3kThe real story is Bretton Woods and how the US agreed to fund the recovery of the post WW2 broken colonial empires by making the US dollar the world currency. — apokrisis

Mikie

7.3kThe real story is Bretton Woods and how the US agreed to fund the recovery of the post WW2 broken colonial empires by making the US dollar the world currency. — apokrisis

But it isn’t the world currency. There are many currencies in the world even today, but certainly in the 40s before the Euro.

It’s true that with Marshall Plan aid, several countries were indebted to the US, but I don’t see what this has to do with currencies. Being a superpower militarily will mean your currency and language and culture are going to have an outsized influence on the world.

Maybe I’m missing something.

I would prefer that you write something yourself rather than spam the thread with links.

without the role of the dollar, the US could not live on issuing new debt as it has for decades now. — ssu

What role do you mean, more specifically?

but I have no idea what interest rates, like is it the interest rate on a mortgage or credit card? — John McMannis

I think it’s the funds rate, or the interest rate of money the Fed lends to banks to cover a certain legal minimum (to prevent bank runs). Banks can also loan excess money to other banks who are low on funds, etc. This trickles down to the interest rates you and I can receive from banks for homes, cars, credit cards, etc. That’s my understanding— happy to be corrected. -

ssu

9.8kWhat role do you mean, more specifically? — Xtrix

ssu

9.8kWhat role do you mean, more specifically? — Xtrix

The deficit spending, which enables the US to spend way more than it gets (in taxes), enables it to fight perpetual wars in other continents. And the situation where the US buys stuff from China and other countries and they then just hold the dollars. Other countries would have a monetary crisis, but the US won't because the role of the dollar.

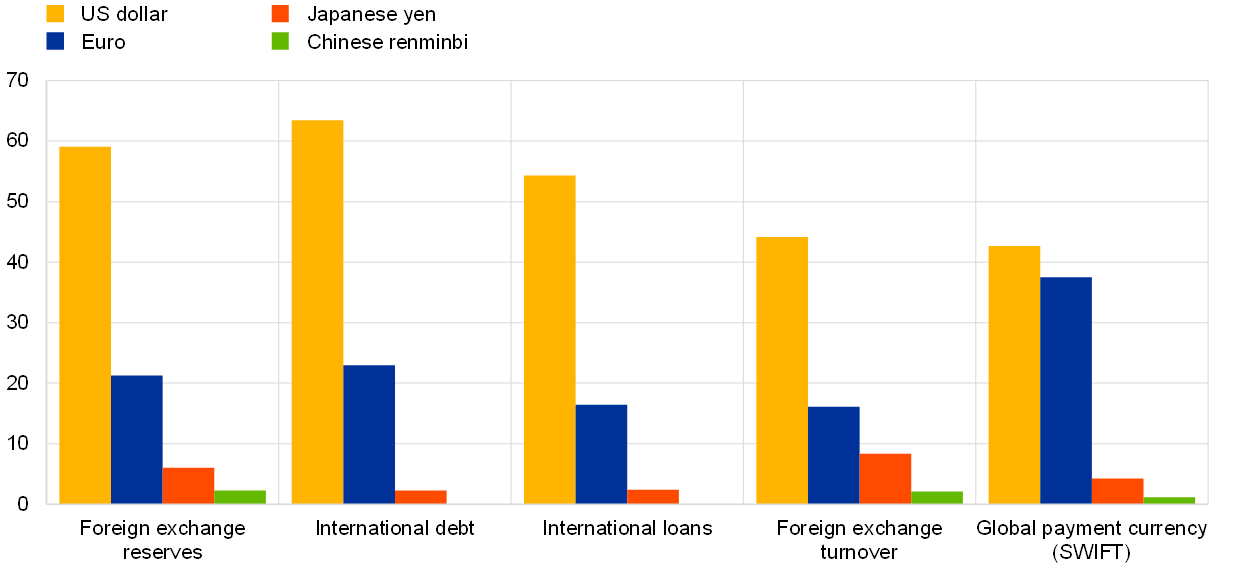

Xtrix, it's the world's reserve currency. Below the situation from this year:But it isn’t the world currency. There are many currencies in the world even today, but certainly in the 40s before the Euro. — Xtrix

This role, being the primary reserve currency for the global economy allows the United States to borrow money more easily and impose painful financial sanctions. If you make larger payments, usually the US dollar is used. And for example major oil producers like Saudi Arabia use the US dollar in selling their oil. Do notice that even if Bretton Woods system isn't anymore (where the US dollar was linked to gold and other currencies were linked to the US dollar), that system basically morphed into the current system where the US dollar still has a important role even without the link to gold, the gold standard.

-

apokrisis

7.8kBut it isn’t the world currency. There are many currencies in the world even today, but certainly in the 40s before the Euro. — Xtrix

apokrisis

7.8kBut it isn’t the world currency. There are many currencies in the world even today, but certainly in the 40s before the Euro. — Xtrix

If you buy and sell internationally, the deals are done in US dollars. To finance exports to the US market, you have buy treasuries or US debt.

World economics is pegged to the value of the dollar. No one wants to be left holding yuan or roubles. Even euros and yen are a distant second.

The history of Bretton Woods is highly entertaining….especially as the US architect was also probably a Soviet asset.

As early as 1936, Harry Dexter White, who was then a little-known official at the Treasury Department, was planning precisely this sort of conference, with the aim of establishing the dollar as the global unit of account of the entire world, and, very importantly, eliminating the pound sterling as a rival.

They were thinking about how if we manage our financial aid to Britain carefully and control it tightly, we can get Britain through the war, but also simultaneously limit its room for maneuver in the postwar world. It was a conscious effort to force liquidation of the British empire after the war.

The United States offers the world a deal. We will establish a new institution, the IMF, which will provide you with short-term balance of payments support if you get into difficulties. In return for which you promise to forswear competitive devaluation, devaluing your currencies against the US dollar without our approval. The world said that's as good a deal as we’re going to get right now, and they took it.

We still mint the currency in which we issue our debt. We've been issuing quite a bit of it in recent years, and we sell it at tremendous prices. We don't have any great incentive to change the system. When we send a dollar to China for Chinese goods, it basically comes back to us in the form of a near-zero interest loan, which gets recycled through the U.S. financial system to create yet more credit, which we can use to buy more Chinese goods.

https://www.washingtonpost.com/news/wonk/wp/2013/03/14/how-a-soviet-spy-outmaneuvered-john-maynard-keynes-and-ensured-u-s-global-financial-dominance/

The IMF’s own historians have returned a verdict of “still not proven” against White though - https://www.imf.org/external/pubs/ft/wp/2000/wp00149.pdf

:chin: -

Mikie

7.3kThe deficit spending, which enables the US to spend way more than it gets (in taxes), enables it to fight perpetual wars in other continents. — ssu

Mikie

7.3kThe deficit spending, which enables the US to spend way more than it gets (in taxes), enables it to fight perpetual wars in other continents. — ssu

We hand $700 billion a year in discretionary spending to defense. It’s true that contributes to the deficit, but that’s a choice. No reason it has to allocate that money in that way. So when you say deficit spending enables wars, that’s not saying much— it also enables us to fund all kinds of things, good or bad.

If you buy and sell internationally, the deals are done in US dollars. — apokrisis

Kind of a lingua franca for currency.

That’s fair though. I’m failing to see how this relates to the function of the Fed.

The Fed’s role is mainly in monetary policy. So maybe I should have titled this thread that— or FOMC. But regardless, it has the power to increase or decrease the money supply and directly or indirectly set interest rates (the discount rate and funds rate, respectively), as well as determine reserve requirements— these are its tools to control inflation and either stimulate or contract the economy.

The fact that 19 people (or 12 with voting power) get to determine what the target fund rate is and how much money should be in circulation is something worth keeping in mind. These are people who make real decisions like you and I— but theirs just so happen to effect millions of people’s lives. -

ssu

9.8k

ssu

9.8k

Yet that is a huge enabler.So when you say deficit spending enables wars, that’s not saying much— it also enables us to fund all kinds of things, good or bad. — Xtrix

That the US can fight wars and intervene everywhere makes it the sole Superpower. When it cannot do that, it's no longer a Superpower as during the Cold War. It's then just the largest among the great powers.

The US can get into to a mess everywhere around the World simply because of this. You see, fighting a low-intensity conflict on the other side of the World (for 20 years) is astoundingly costly. Other countries have limitations. For example, the Russian involvement in Syria is basically one and a half squadrons of fighters, security for the airbase and then private military contractors. And that's basically it.

The US maintaining one ranger company in Afghanistan for a year cost at least as much, likely more, as the country of Estonia spends on defense annually. Germany basically could deploy one battalion (far less than 1000 soldiers) outside Europe. An US active-component Armored Brigade Combat Team, a 4200 strong military unit costs in one year a total of 2,6 billion dollars. Just to sustain one (of the eleven) nuclear aircraft carriers costs annually over 1 billion, with the aircraft wing basically two billion dollars. If the US really would have to cut it's spending the simple fact it could not have the global military presence it now has. -

apokrisis

7.8kThe Fed’s role is mainly in monetary policy. — Xtrix

apokrisis

7.8kThe Fed’s role is mainly in monetary policy. — Xtrix

I’m just pointing out the political context within which the Fed operates. Technically, the Fed just makes rational decisions about matching money supply to US economic growth targets. But if the cost of money creation is being picked up by the rest of the world, then that explains the irrational - or rather, rationally selfish - monetary policy we saw with the GFC and now repeated with the pandemic.

In monetary policy, the Fed was meant to be the tough cop forcing the market to take its medicine. The theory was that money supply could be controlled in a way to maintain the economy within certain bounds. A small and stable amount of inflation. A bit higher and stable rate of interest or money return. Full employment so no capacity was un-utilised. Sensible stuff that was worth a little pain.

But once the US economy was constructed on the premise of dollar hegemony rather than US economic performance in the world market, this monetary idealism was corrupted at root.

And so the Fed administers a rigged game where the US is also lucky enough that it can walk away from the global order as soon as it crashes. The US can say thanks for the fun guys, nail down a North American pact with cheap Mexican manufacturing and cheap Canadian resources, and do fine in that regional sphere.

The Fed will then have a new political context in which to operate.

Your OP mentioned conspiracy talk and strong sentiment, so I presumed it was the real-politik rather than actual monetary theory that was what you wanted to discuss.

Why did he Fed stun the world by chucking out the textbook and providing unlimited bailouts? Where is the social justice in destroying jobs yet driving up the value of the assets of the wealthy and now even pumping up commodity prices and creating the inflation that will produce still greater levels of inequality?

Whose economy does the Fed even serve? Etc, :grin: -

John McMannis

78I think it’s the funds rate, or the interest rate of money the Fed lends to banks to cover a certain legal minimum (to prevent bank runs). Banks can also loan excess money to other banks who are low on funds, etc. This trickles down to the interest rates you and I can receive from banks for homes, cars, credit cards, etc. That’s my understanding— happy to be corrected. — Xtrix

John McMannis

78I think it’s the funds rate, or the interest rate of money the Fed lends to banks to cover a certain legal minimum (to prevent bank runs). Banks can also loan excess money to other banks who are low on funds, etc. This trickles down to the interest rates you and I can receive from banks for homes, cars, credit cards, etc. That’s my understanding— happy to be corrected. — Xtrix

I know it's really late to respond, but thanks for this. I guess I was way off. -

Mikie

7.3k

Mikie

7.3k

Better late than never. Again, I'm no expert in the Federal Reserve, but I think what I presented is the general outline.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum