-

ssu

9.8k

ssu

9.8k

So how long are you going to believe the official "supply chain" argument?That’s not why we have inflation. We have inflation because of the supply chain. — Xtrix

First, no, not in this way. The alphabet soup of programs they went through wasn't at this level and intensity AND the money basically went to uphold the banks, which sat on the money like Scrooge McDuck. Banks sitting on money doesn't create inflation. Or basically just creates asset inflation, which isn't so bad as people don't have to buy assets (but they do have to buy food).The Fed has been printing money galore since 2009. — Xtrix

Now the money is going directly to consumers, which does put the money into circulation. Yes, incredible isn't it! Sure, those who have debt and have invested it in something that holds value are going to be the winners. Part of those are ordinary people, but it's the rich who profit most from this. Worse are those who have fixed income like pensioners. -

ssu

9.8k

ssu

9.8k

That is actually true. Perhaps better to say that things could get even worse.There is no 'brewing' economic and monetary crisis. The world economy has been in crisis for more than a decade now. — StreetlightX

Nah. Those who have it the worse now will be the ones hit the hardest in the future too, if we have another crisis (on top of the current long one).It's only 'brewing' for those who are comfortable and benefiting from the misery of those who have been in unending crisis for years. — StreetlightX

:smile:For sure it's the valley of death I open up my wallet and it's full of blood because of inflation. — Maw

Well, there was this argument of MMT going around that especially the US government can spend more than they think without spurring runaway inflation. (I'd call it the Cheney-rule: "deficits don't matter".) That deflation is our main problem. But I guess if things stay as now, it's great for the wealthy class with those negative real interest rates.

Yes, it isn't the only problem and surely isn't the biggest problem facing us (when you have things like a pandemic and climate change...) -

Streetlight

9.1kMonetary policy (injecting or withdrawing credit money or hiking or lowering policy rates) is really ineffective in managing inflation or economic activity. Study after study has shown that ‘quantitative easing’ had little or no effect on boosting the ‘real’ economy or production and investment; and study after study has shown that huge injections of money credit by central banks over the last 20 years have not led to an acceleration of inflation – on the contrary. So whether the Fed, BoE or ECB speed up the tightening of monetary policy will not work to ‘curb inflation’. Monetary policy does not work – at least at the levels of interest rates that central banks are envisaging.

Streetlight

9.1kMonetary policy (injecting or withdrawing credit money or hiking or lowering policy rates) is really ineffective in managing inflation or economic activity. Study after study has shown that ‘quantitative easing’ had little or no effect on boosting the ‘real’ economy or production and investment; and study after study has shown that huge injections of money credit by central banks over the last 20 years have not led to an acceleration of inflation – on the contrary. So whether the Fed, BoE or ECB speed up the tightening of monetary policy will not work to ‘curb inflation’. Monetary policy does not work – at least at the levels of interest rates that central banks are envisaging.

...If there is going to be any ‘cost-push’ this year, it’s going to come from companies hiking prices as the cost of raw materials, commodities and other inputs rise, partly due to ‘supply-chain’ disruption from COVID... Inflation rates reached post-war lows in the 2010s despite ‘quantitative easing because real GDP growth slowed along with investment and productivity growth. All monetary policy did was weakly counteract that downward pressure on price inflation.

Inflation now is ‘transitory’ in the sense that after the ‘sugar rush’ of consumer and investment spending ends during 2022, growth in GDP, investment and productivity will drop back to ‘long depression’ rates. That will mean that inflation will subside. The Fed is forecasting just 2% real GDP growth by 2024 and 1.8% a year after that – a rate lower than the average for the last ten years. In Q3 2021, US productivity growth slumped on the quarter by the most in 60 years, while the year on year rate dropped 0.6%, the largest decline since 1993, as employment rose faster than output.

https://thenextrecession.wordpress.com/2021/05/09/inflation-and-financial-risk/

Inflation is a yawn that is being used by neolib wreckers to further institute cuts and hurt the poor. -

ssu

9.8k

ssu

9.8k

We'll see.Inflation is a yawn that is being used by neolib wreckers to further institute cuts and hurt the poor. — StreetlightX

Especially about this line:

I guess the question is how long is something 'transitory'.Inflation now is ‘transitory’ in the sense that after the ‘sugar rush’ of consumer and investment spending ends during 2022, growth in GDP, investment and productivity will drop back to ‘long depression’ rates. That will mean that inflation will subside.

Especially the idea that the spending will end during 2022 is hilarious. :snicker:

But it's nice to see that you believe in what the Federal Reserve is forecasting!

Oh, they have such great history of accuracy in predicting what will happen. :blush: -

Streetlight

9.1kAs opposed to being empirically wrong about something for two decades and still thinking that it holds. Mmhm.

Streetlight

9.1kAs opposed to being empirically wrong about something for two decades and still thinking that it holds. Mmhm. -

Mikie

7.3kSo how long are you going to believe the official "supply chain" argument? — ssu

Mikie

7.3kSo how long are you going to believe the official "supply chain" argument? — ssu

How long are you going to believe in monetarism?

First, no, not in this way. The alphabet soup of programs they went through wasn't at this level and intensity — ssu

It most certainly was. They went through several rounds of QE, which at that point hadn't been done before. No one even knew what it was. Whatever "alphabet soup" of programs you're talking about, there is a difference: last March the Fed started buying corporate debt as well. That too is unprecedented, but hardly any more shocking than what was done in '09.

AND the money basically went to uphold the banks, which sat on the money like Scrooge McDuck. Banks sitting on money doesn't create inflation. — ssu

Interesting that you're willing to get into the weeds on the 2009 actions, but fail to do so now.

The Fed is still propping up banks and corporations to this day. They're hostage to the banks, and are a backstop for them. And contrary to your implication, inflation was predicted back in 2009 -- and never came. So why now? It's obvious why -- and it's not because of monetary policy. Like you said, that money didn't raise the economy -- it raised markets. If you want to argue that the current housing market boom (which is likely another bubble) is largely because of the Fed, or the stock market, or the bond market -- that's probably right.

The rest is because of the coronavirus and fiscal policy. Spending habits changed for a year, away from services (like travel, haircuts, gyms, restaurants, massages, etc) and towards goods (Pelotins, toilet paper, furniture, kitchenware). The vaccines rolled out a year ago, Biden came into office, the numbers started to come down, vaccination rates were at a good pace, states started opening up again, and there was optimism about the future. That was winter and spring. Consumer habits then changed once again, especially with traveling -- we saw this around June and July. Combine this with the supply chain problems, and companies having to raise pay and incentives for angry, worn out workers (which only means they raise their prices, because God forbid it cuts into their already enormous profits), and there's no surprise some items are increasing in price. Families were also sitting on more money than a couple years ago.

It's gasoline that people mainly care about. When prices for gas go up, as they have, people think that's inflation. So there's widespread panic about it, especially when the media talks up the CPI numbers (which most people have no clue about) and half the country are eager to jump on any news that seems negative because they want Biden to fail (odd that these same people don't talk about how GREAT the economy is, since the stock market is still setting records...). In any case, gasoline prices have nothing to do with monetary policy. That's a supply and demand issue -- there's far more demand, and less supply (which is why Biden was begging OPEC to pump more).

You look at the backup at the ports, particularly in LA, and take the rest into account, and it's fairly obvious: this is a COVID related issue. We went through a major shock with lockdowns in March of 2020. Yes, Wall Street panicked, stocks plunged, and the Fed was there to rescue them yet again. That certainly caused inflation -- it inflated stocks, corporate profits, and CEO compensation. Good for them. But to confuse this with the prices of chicken, bread, and gas is just nonsense.

Now the money is going directly to consumers, which does put the money into circulation. — ssu

The Fed has nothing to do with the fiscal policy of last year or this year. Nothing. I have no idea what you're talking about, and I suspect you don't either. See above. -

ssu

9.8k

ssu

9.8k

Uhh... I do believe in economic history. Been a believer for a long time.How long are you going to believe in monetarism? — Xtrix

And btw it's not just monetarism, it's classical economics going back to Adam Smith. And basically what also Keynes says:

Keynes had noted in ‘A Tract’ that in all the Western countries from 1914 to 1920 the money supply had increased considerably leading to inflation. The case in Germany was the worst because the price level in 1923 was higher by 7,650 times of the price level in 1913. He called this an inflation a tax imposed by governments on society to avoid being declared bankrupt, the notion proposed by Adam Smith earlier. It also redistributes wealth in a manner injurious to savers, but beneficial to borrowers.

So these ideas just to be "monetarist" is wrong.

Oh like nobody knew who the "little green men" were that occupied Crimea. QE is just a fancy way to avoid terms like money printing or debt monetization.It most certainly was. They went through several rounds of QE, which at that point hadn't been done before. No one even knew what it was. — Xtrix

Alphabet soup refers to TAF, CPFF, TSLF, PDCF, etc. which you can read from The Alphabet Soup Explained: An Analysis of the Special Lending Facilities at the Federal Reserve . It's basically how QE rounds were implemented. And I think they have for a long time bought corporate debt and were directly involved in helping other entities than banks.Whatever "alphabet soup" of programs you're talking about, there is a difference: last March the Fed started buying corporate debt as well. — Xtrix

About the financial crisis of 2008-2009:

So when you have a banking crisis, give money to McDonalds.As expected, the data showed that the Fed loaned trillions of dollars to banks and other financial companies during the crisis. (The Fed says it hasn't lost any money on the loans, and the emergency lending programs are winding down.)

But the data also showed smaller loans to some companies that aren't usually associated with the workings of the Fed; companies like McDonald's, Harley Davidson, Verizon and Toyota.

These companies used an emergency program the Fed set up to keep a key financial market going in the teeth of the crisis -- commercial paper.

The commercial paper market is basically like a credit card for giant companies in every major industry; it's something they use every day to borrow money that they plan to pay back very soon.

During the crisis, when people were afraid that Wall Street would collapse, the commercial paper market basically shut down.

I'm not at all contradicting this!!! The financial crisis of 2008-2009 never went away. This is extremely important to understand just why the situation could be a bit sinister.The Fed is still propping up banks and corporations to this day. They're hostage to the banks, and are a backstop for them. — Xtrix

I think we agree on this, so I'm not contradicting you. The whole thing basically propped up the speculative bubble from not bursting...which actually would be the way free markets would correct the situation, if there would be free markets. The banks didn't lend, people saved, stock market went down, that is what people saw as the deflation era.And contrary to your implication, inflation was predicted back in 2009 -- and never came. — Xtrix

Yeah, do you remember that not long ago we had negative oil futures prices in the US? Tells how great theIt's gasoline that people mainly care about. — Xtrixmarketscasino is in predicting the future.

I do admit that thanks to the covid pandemic lockdowns have created supply chain problems, but those really, just as with toilet paper or masks, do get solved. They do get fixed and do go away. As we agree, the financial crisis never went away and the stock market was boosted by monetary policy. And this is why this is far more serious than just supply chain problems or a temporary bout of inflation.

First of all, let's look at the forecasts and then the reality:

Here's a forecast done in 2014 how the next six years will be. Notice the idea of the financial crisis being a one off event and then it's back to "smooth sailing with moderate deficits".

In 2020 and this year the deficits to GDP were well over 10% last year over 3 trillion, I think somewhere 13% or so, hence they don't fit in the above graph. Now comes the crucial question:

Do you think this spending is totally abnormal and can be lowered? Or the economy will hugely improve? On the contrary. If the pandemic worsened the situation, the overall situation was already bleek.

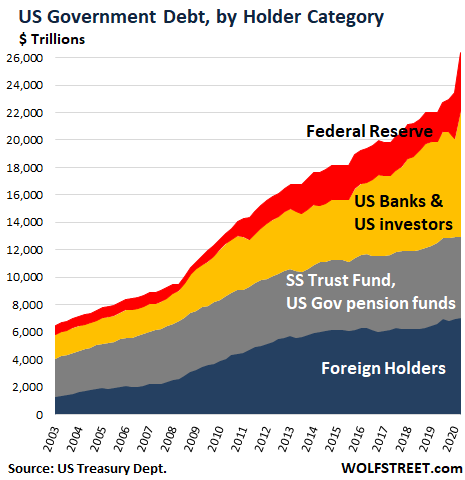

Isn't the actor who is the biggest buyer of US government debt a major player here? I think so. The Federal Reserve is already the biggest owner of Treasury debt. Not China.The Fed has nothing to do with the fiscal policy of last year or this year. Nothing. — Xtrix

The U.S. Federal Reserve has significantly ramped up its holdings of Treasury securities as part of a broader effort to counteract the economic impact of the coronavirus (COVID-19) pandemic. Currently, the Federal Reserve holds more Treasury notes and bonds than ever before.

As of July 14, 2021, the Federal Reserve has a portfolio totaling $8.3 trillion in assets, an increase of about $3.6 trillion since March 18, 2020. Longer-term Treasury notes and bonds (excluding inflation-indexed securities) comprise nearly two-thirds of that expansion, with holdings of those two types of securities doubling from $2.2 trillion on March 18, 2020, to $4.5 trillion on July 14, 2021.

China owns about 1,0 trillion dollars of US treasury debt. The Fed, now a quadruple amount from that.

Yes, the Federal Reserve is the biggest player buying the debt. And is monetizing the debt, which can be said to be an important part of fiscal policy. -

Mikie

7.3kAnd I think they have for a long time bought corporate debt and were directly involved in helping other entities than banks. — ssu

Mikie

7.3kAnd I think they have for a long time bought corporate debt and were directly involved in helping other entities than banks. — ssu

They did not buy corporate debt prior to March 23rd 2020, so far as I know. This was done via the PMCCF and the SMCCF, both created at that time.

What you're talking about are loan programs. It sounds like I'm splitting hairs, but there's a real difference -- and we can get into it further if you'd like. But my point was that this was one major difference between 2008/9 and 2020. The financial sector was heavily leveraged and corporate debt had skyrocketed prior to the shutdowns, which is why another round of QE didn't work and these newer programs were created.

Here's the Fed statement:

https://www.federalreserve.gov/newsevents/pressreleases/monetary20200323a.htm

And from Brookings:

https://www.brookings.edu/research/fed-response-to-covid19/

All of this has very little to do with inflation, which was the initial subject.

I do admit that thanks to the covid pandemic lockdowns have created supply chain problems, but those really, just as with toilet paper or masks, do get solved. They do get fixed and do go away. As we agree, the financial crisis never went away and the stock market was boosted by monetary policy. And this is why this is far more serious than just supply chain problems or a temporary bout of inflation. — ssu

Well yes, of course. If what you're really arguing is that the Fed has a major impact on the economy, who could disagree? What I'm arguing against is your statement that the Fed's monetary policy (printing more money) is what has caused inflation, when a much simpler explanation exists: the COVID pandemic -- which in turn triggered disruption in consumer spending, supply chain problems, and fiscal policy. The Fed purchasing trillions in treasuries and corporate bonds have little to do with the prices of gas and chicken.

The Fed has nothing to do with the fiscal policy of last year or this year. Nothing.

— Xtrix

Isn't the actor who is the biggest buyer of US government debt a major player here? I think so. The Federal Reserve is already the biggest owner of Treasury debt. Not China. — ssu

That's not true. The biggest owner of treasuries is social security. The Fed owns a great deal.

But again, I don't see the relevance. The Fed does buy treasury bonds, yes. But they always have. Buying corporate debt is different -- but none of this has much to do with inflation we're seeing this year. -

ssu

9.8k

ssu

9.8k

OK, let's concentrate first at the most important issue. The obvious question is the following: when is a central bank doing the basic thing which it has been created for and when is a central bank issuing money to pay for government expenses, printing money like in Zimbabwe?But again, I don't see the relevance. The Fed does buy treasury bonds, yes. But they always have. — Xtrix

This is an important thing to get clear...as obviously NO central bank will admit that they are financing government debt with money printing. Just as no central bank will ever admit that if there's an economic problem, they will pump up the competitiveness of the export sector by devaluating the currency. These two things are never admitted, but I hope you do understand that these things do happen. When looking at central bank statements, they will never admit this. But central banks providing money for governments for wars and stuff is a historical fact, which one cannot disagree with (and I think you agree with me on this).

So, the federal reserve owning US treasuries isn't itself a problem the US dollar plays a dominant role in the currency system, the US economy as being so big isn't export oriented hence there simply isn't a reason for the Federal Reserve to have it's assets in large foreign currency holdings. The old Finnish central bank (now part of the ECB) didn't have it assets just in Finnish government treasuries for obvious reasons.

Yet here is the obvious difference: if the central bank would just focus on monetary issues, there would be no need to expand the balance sheet of the bank rapidly. Now if there is a financial crisis and the threat of run on the banks, then naturally the central bank can take of the bad loans from the bank and reorganize the banking system to be more healthy. The bad loans are in option given to a "bad bank" that will look to minimize the losses (this option wasn't done in the US, but for example in the Nordic countries it was done so as not back then to tarnish the balance sheet of the various small central banks).

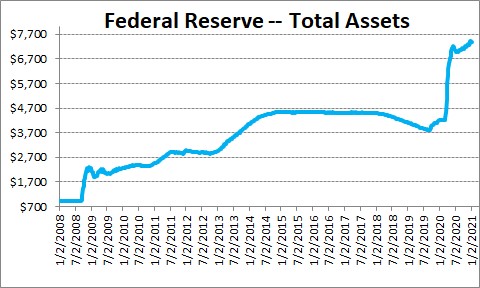

So let's look at that balance sheet of the Federal Reserve:

The 2008 financial crisis and it's aftermath can be seen here clearly. Before the balance sheet was small, because why not? There was trust in the system. Few years ago the Fed was on the path to decrease it's balance sheet afterwards, but then COVID-19 happened. The stock market tanked, but the came again the Fed to say the rich people. And then with COVID-19 it wasn't only the rich.

What effects this has for the stockmarket can be seen smartly from these to graphs shown together:

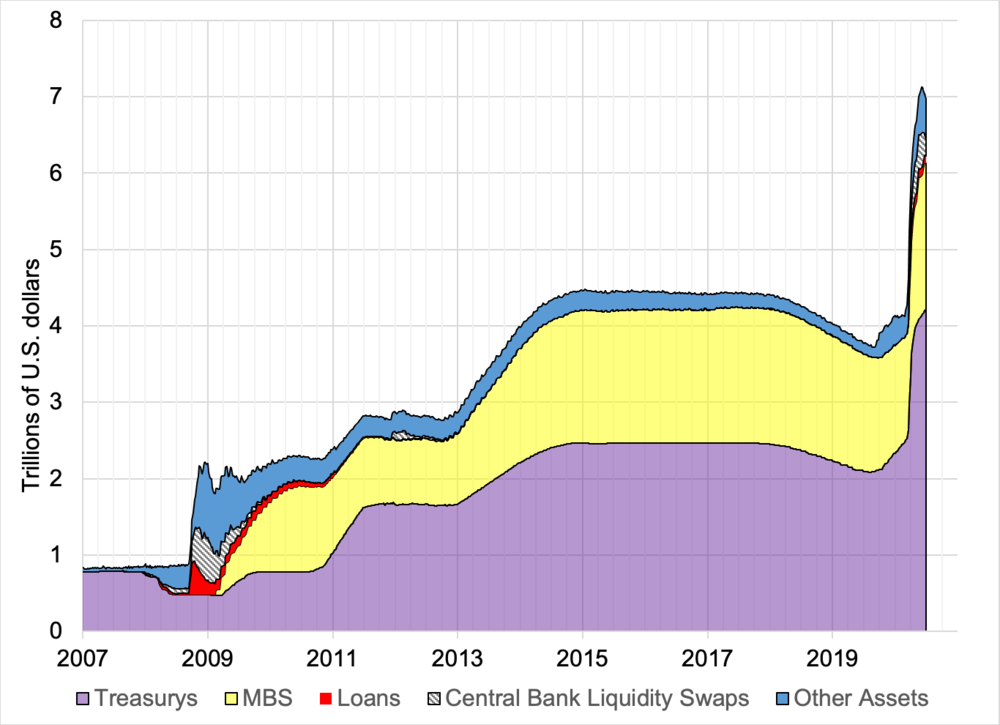

And then let's look in side to see what has made the Fed balance sheet to explode. We find it's the buying of US treasuries.

Now you might argue that the Fed just happened to come and swoop up US treasuries from the open market from participants holding treasuries. Not so. If so, there would be a decrease in the holdings of other holders as you can see here:

From above, you can see the Fed is a the largest buyer of the new debt.

Yes, biggest buyer but not (yet) biggest owner, so I stand corrected here. Thanks for the correction.That's not true. The biggest owner of treasuries is social security. The Fed owns a great deal. — Xtrix

Ok, we should then look what it means when social security owns US treasuries. First a question: If I write check to myself for a 1 million dollars (saying the SSU will pay me 1 million dollars), am I more wealthy? No. If I put earn somehow 1 million and then write a check saying SSU will pay me 1 million dollars, that's just a reminder for myself I have the money. With the Social Security Trust fund one has to remember that it is basically an accounting thing, but that doesn't mean it's fiction. But the role is different.

I think the following explains article explains this well:

Social Security was designed primarily as a “pay-as-you-go” system. Instead of prefunded accounts for individuals, such as individual retirement accounts (IRAs), contributions from current workers have always paid for most of the benefits. For the most part, money going into the system each year almost immediately goes out to pay for benefits.

When Social Security’s receipts from payroll taxes and other sources exceed program costs, as when the baby boom generation dominated the workforce and had not yet started retiring on Social Security, excess funds purchased interest-bearing special-issue US Treasury bonds. In effect, the Social Security trust fund lent money to the general fund.

Where does the money go? When the non–Social Security part of government is running deficits, any Social Security surplus funds other government activities, reducing the size of the unified fund deficit. When the trust funds themselves run deficits, however, they add to these other non–Social Security deficits to produce an even larger unified fund deficit. Because these special-issue bonds are essentially both sold and held by the government, aren’t publicly traded like other financial assets, and represent IOUs from the government, some people believe that the trust funds are nothing more than an accounting fiction.

Another factor confuses the issue. Because the trust funds represent an asset to one side of government (the Social Security Administration) and a liability to another side of government (the general fund), some accounting presentations based essentially on cash flows make the effect of the trust funds on the budget look “neutral.” In fact, future obligations are also liabilities to be paid but are not counted in that trust fund ledger.

So, are the trust funds real? Yes. They have legal consequences for the Treasury and are backed by the full faith and credit of the federal government, just like other Treasury bonds. When the Social Security Administration redeems the bonds, the government has a legal obligation to pay the money back with interest, with no additional appropriation by Congress required.

The trust funds are not a free lunch for taxpayers. Money from the general fund used to repay debts to the trust funds cannot be used for other purposes, like building roads or providing for national defense. And as an additional outlay for the government, those general fund payments increase the Treasury’s need to borrow from the public, increasing federal deficits and adding burdens on future taxpayers.

For all the heat about whether the trust funds are “real,” the debate misses a larger issue: the long-term fiscal challenges posed by Social Security and Medicare are not caused by inadequate trust funds, which will be depleted after only a few years of drawdown, but to decades-long imbalances between promised benefits and the revenues required to fund those benefits.

Which takes us back to the fundamental question: the US is uncapable of doing anything else than deficit spending and now it's own central bank has had to buy a huge share of that new debt. Furthermore: nothing, absolutely nothing will happen before there is a huge crisis. The Republicans spent as there's no tomorrow (let's remember that it was Dick Cheney who said "deficits don't matter") and so do the Democrats. The Republicans just bitch about the issue when they are in opposition, and hence leftist people think I'm a Republican if even talk about the same issue.

The whole fucking system is built on these cards. It can blow up some day. And then we all have some expedient narrative fed to our tribe that it was the fault of the people in the other side of the political spectrum.

-

Mikie

7.3kBut central banks providing money for governments for wars and stuff is a historical fact, which one cannot disagree with (and I think you agree with me on this). — ssu

Mikie

7.3kBut central banks providing money for governments for wars and stuff is a historical fact, which one cannot disagree with (and I think you agree with me on this). — ssu

Of course. I still don't see the relevance.

The US central bank, the Fed, lowers and raises the federal funds rate through mostly through bond purchasing -- treasury notes, bills, and bonds. Treasuries are issued by the treasury to make up the difference between revenue (mostly taxes) and spending. So the Fed buying treasuries is, in a sense, funding all kinds of government spending. That's buying government debt. They themselves are a part of the government, of course, but they're given this special privilege. They pay for this by "printing money," which is now done by creating numbers on a computer.

All of this I assume you know very well. But the original issue was about inflation. The Fed is in charge of monetary policy, which plays a role in inflation -- no doubt about it. But Friedman's thesis, that inflation is "everywhere and always a monetary phenomenon" just doesn't seem to apply everywhere and always. I gave the example of gas prices. I suppose that can in some way be connected to the money supply, but a much more simple explanation exists. That was the point.

Which takes us back to the fundamental question: the US is uncapable of doing anything else than deficit spending and now it's own central bank has had to buy a huge share of that new debt. Furthermore: nothing, absolutely nothing will happen before there is a huge crisis. The Republicans spent as there's no tomorrow (let's remember that it was Dick Cheney who said "deficits don't matter") and so do the Democrats. The Republicans just bitch about the issue when they are in opposition, and hence leftist people think I'm a Republican if even talk about the same issue.

The whole fucking system is built on these cards. It can blow up some day. And then we all have some expedient narrative fed to our tribe that it was the fault of the people in the other side of the political spectrum. — ssu

I don't think I'm disagreeing. But remember not long ago there was a surplus, not a deficit. It's not impossible. The debt isn't even that big a problem, for many reasons. But even if it were, there's two things you can do: cut spending or raise taxes, or both. But then the issue becomes: where? Where do we raise taxes and where do we cut spending? The Republicans are itching to cut social security and medicare and turn them over to private hands -- no surprise there. The Democrats want to "tax the rich," which is on the right track, but then have no problem shelling out a grotesque $778 billion in defense spending. Meanwhile their "proposals" never come to fruition on taxes. Bernie and Warren had wealth tax proposals which were decent and modest, but there's no chance of that. Yellen has been pushing for a 15% minimum global corporate tax -- but that'll most likely go nowhere too.

So if neither party will allow more taxes on the ultra rich and the corporations, and neither are willing to cut what needs to be cut (defense spending), of course there will be a deficit every year and the national debt will continue to climb.

They're all capitalists, through and through. And it's capitalism that is crushing us and will, in all probability, be terminal for us. The Fed plays a large role in all of that, no doubt -- but it's not completely their fault. -

ssu

9.8k

ssu

9.8k

There you said it yourself.Treasuries are issued by the treasury to make up the difference between revenue (mostly taxes) and spending. So the Fed buying treasuries is, in a sense, funding all kinds of government spending. — Xtrix

Technically they aren't. (That's the norm with central banks, actually) Remember it was the Wall Street banks who created the Fed, even if then the law was passed by Congress. Meeting at Jekyll Island in 1910 and all that.They themselves are a part of the government, of course, but they're given this special privilege. — Xtrix

When there a speculative bubble that has burst, the deflationary effects can easily overwhelm any actions central bank makes for the moment.But the original issue was about inflation. The Fed is in charge of monetary policy, which plays a role in inflation -- no doubt about it. But Friedman's thesis, that inflation is "everywhere and always a monetary phenomenon" just doesn't seem to apply everywhere and always. — Xtrix

And I'll reiterate, this idea isn't something just from Friedman as the monetarist go to specific directions with their theories, but basically what already Adam Smith and Maynard Keynes noted. So this isn't a purely monetarist view here.

When? During the Clinton era? More of a technical one as with changes to Social Security (and it's famous Trust Fund) you can get a surplus:But remember not long ago there was a surplus, not a deficit. — Xtrix

Actually the above is a good example how the system works. But of course, the problem is that aging of the population doesn't mean good for the Social Security Trust Fund, even if the demographic situation of the US isn't as bleak as it is here.When it is claimed that Clinton paid down the national debt, that is patently false--as can be seen, the national debt went up every single year. What Clinton did do was pay down the public debt--notice that the claimed surplus is relatively close to the decrease in the public debt for those years. But he paid down the public debt by borrowing far more money in the form of intragovernmental holdings (mostly Social Security).

Interestingly, this most likely was not even a conscious decision by Clinton. The Social Security Administration is legally required to take all its surpluses and buy U.S. Government securities, and the U.S. Government readily sells those securities--which automatically and immediately becomes intragovernmental holdings. The economy was doing well due to the dot-com bubble and people were earning a lot of money and paying a lot into Social Security. Since Social Security had more money coming in than it had to pay in benefits to retired persons, all that extra money was immediately used to buy U.S. Government securities. The government was still running deficits, but since there was so much money coming from excess Social Security contributions there was no need to borrow more money directly from the public. As such, the public debt went down while intragovernmental holdings continued to skyrocket.

The net effect was that the national debt most definitely did not get paid down because we did not have a surplus. The government just covered its deficit by borrowing money from Social Security rather than the public.

Before the crisis, it isn't. Just like a "nobody" can see a speculative bubble until is bursts and all the excesses of the "strong new economy" are exposed. It's all based on faith and hence there isn't any real indicator when the faith bubble will burst.The debt isn't even that big a problem, for many reasons. — Xtrix

I agree. Let's forget the political rhetoric here. Basically the two parties just want to spend on different issues (or easy the tax burden of the super rich) and the Republicans have their sanctimonious lies about taking seriously the deficit issue. We should put the rhetoric aside and look how the two parties operate.The Republicans are itching to cut social security and medicare and turn them over to private hands -- no surprise there. The Democrats want to "tax the rich," which is on the right track, but then have no problem shelling out a grotesque $778 billion in defense spending. Meanwhile their "proposals" never come to fruition on taxes. — Xtrix

How they operate is that they simply will continue with the same old ways until we have a crisis. That's how things happen. I think Naomi Klein in her book "the Shock Doctrine" pictures this falsely thinking that government deliberately create crises to then push through their liberal agenda. They might resort to some ideological agendas too, but the clear fact is that they don't want the crisis to happen intentionally. I'm sure if there is a dollar crisis or whatever they call it, some will argue that it was done on purpose by "insert here the people who you think are bad".

Likely it isn't so terminal. Just look at us now in the midst of global pandemic where millions have died an the World has been locked down in spectacular ways. Things go on.. And it's capitalism that is crushing us and will, in all probability, be terminal for us. The Fed plays a large role in all of that, no doubt -- but it's not completely their fault. — Xtrix

Same will be if (or when) this crisis really blows up. People will just loose a lot of money. There will be many more unemployed. Political turmoil. And some people will profit especially in the long run. But life, and also capitalism, will go on. (So no need to worry that people won't have that to bitch about in the future). -

Mikie

7.3kThey themselves are a part of the government, of course, but they're given this special privilege.

Mikie

7.3kThey themselves are a part of the government, of course, but they're given this special privilege.

— Xtrix

Technically they aren't. — ssu

"Technically" they're both public and private, but that's really just silliness. They're a government agency. Here I agree with Friedman.

but basically what already Adam Smith and Maynard Keynes noted. So this isn't a purely monetarist view here. — ssu

Smith and Keynes never stated that inflation is always a result of changes in the money supply, which is what the claim was initially. The Fed controls the money supply.

But remember not long ago there was a surplus, not a deficit.

— Xtrix

When? During the Clinton era? — ssu

Yes. I believe it was 1998 or around there.

How they operate is that they simply will continue with the same old ways until we have a crisis. — ssu

Yes indeed.

. And it's capitalism that is crushing us and will, in all probability, be terminal for us. The Fed plays a large role in all of that, no doubt -- but it's not completely their fault.

— Xtrix

Likely it isn't so terminal. Just look at us now in the midst of global pandemic where millions have died an the World has been locked down in spectacular ways. Things go on. — ssu

I was talking there about climate change. But it applies equally well to nuclear weapons and pandemics as well. How we respond when a virus comes around that's both highly transmissible and highly deadly, which is inevitably going to happen, is the real story. If COVID is a trial run, it's not looking good on that front either.

Again, it's hard to see the connection, but one important thing behind it all is essentially greed, the desire for more and more money and power, and the adherence to the "vile maxim of the masters of mankind" (Adam Smith) of "all for ourselves and nothing for other people" -- or "gain wealth, forgetting all but self."

As long as we keep behaving as if this is what we believe (whether we profess it or not), it will indeed be terminal. -

ssu

9.8k

ssu

9.8k

Indeed they weren't monetarists, but they did understand that just printing more money to cover expenses of the government will create inflation. Keynes of course did naturally see uses for things like debt financing, but the how not to run a central bank was obvious for a person that acted as a director of the Bank of England. Of course his theories for inflation ran into problems with stagflation, which only shows that there isn't one simple phenomenon or process for rising prices. After all, if prices rise because of larger demand or smaller production, that isn't inflation but ordinary way how markets should work.Smith and Keynes never stated that inflation is always a result of changes in the money supply, which is what the claim was initially. — Xtrix

Greed and ignorance of one's own role. Like having the attitude that problems are for others to solve... like the government. The basic problem is that actors that don't understand that there actions have large consequences.Again, it's hard to see the connection, but one important thing behind it all is essentially greed, the desire for more and more money and power, and the adherence to the "vile maxim of the masters of mankind" (Adam Smith) of "all for ourselves and nothing for other people" -- or "gain wealth, forgetting all but self." — Xtrix

I think the worst case scenario is where you have a clueless elite that simply doesn't understand it's role in a society, that it's them, the ruling class, that ought to take the initiative to correct the problems. Or at least, give way for others to solve them. At worst this elite is just fearful of it's own commoners, hiding behind walls and sending all the money to outside safe havens without investing anything in their own society. -

Mikie

7.3kApologies for resurrecting this thread, but this is big and surprising news:

Mikie

7.3kApologies for resurrecting this thread, but this is big and surprising news:

https://www.huffpost.com/entry/manchin-schumer-climate-deal_n_62e1a677e4b07f83766bafbb

Fingers crossed that this reconciliation bill finally, at long last, passes. We desperately need some legislation on climate. -

Mikie

7.3kActually it's more of a reversal of a reversal (since Manchin blocked his very own bill two weeks ago), but whatever, I'll take it. — Mr Bee

Mikie

7.3kActually it's more of a reversal of a reversal (since Manchin blocked his very own bill two weeks ago), but whatever, I'll take it. — Mr Bee

Yes. It's funny -- the thread was created a year ago and its title is incredibly obsolete, but it goes to show how far this has come.

To recap for those who aren't following this story: the reconciliation bill (reconciliation being the budgetary process that avoids a senate filibuster -- meaning the Democrats can pass it without any Republican support) was initially $3.5 trillion; it was whittled down to $1.1 trillion or so, then CEPP provision was removed to please Manchin, then Manchin sunk the entire bill right before Christmas of '21. There was talk about rescuing parts of it throughout 2022, and they appeared to be going well -- and then he sunk that too two weeks ago. Shouldn't have been a huge shock, given that he's a coal magnate.

But this reversal really is a shock. I was not expecting this at all. Will it pass? Depends on (a) whether it meets the requirements of reconciliation, which is determined by the senate parliamentarian, (b) if all other Democrats, especially Sinema, agree to vote for it, and (c) if the House has the votes to pass it (there could be some Democratic holdouts over state tax deduction rules).

If I were a betting man, I'd give it a 70% chance of passing. Whether in its current form, I'm not so sure. -

Mr Bee

735

Mr Bee

735

No it was way more complicated than that. Manchin killed the last bill because he had concerns about the fact that it didn't tax the rich enough and that he didn't like the temporary programs (in particular the Child Tax Credit, which was only extended for 1 year because of a compromise deal with him because he didn't like it). At least that what he told a WV radio show host back in December.

Then after months of saying he's willing to continue talking and ignoring people's requests to restart negotiations to instead tell people that those negotiations aren't happening, he laid out a climate, drug price, and deficit reduction bill that he said he wanted to pass. This would be funded by tax increases, and according to him the deficit reduction was the "best way" to fight inflation. This was what he urged the Democrats to do in response to inflation.

Then two more months pass and when it looked like talks were restarting in May on that very bill Manchin wanted everyone to pass, Manchin out of the blue sidelined those talks for bipartisan climate talks with people who don't believe in climate change. The only thing bipartisan agreement he managed to get was for both sides, Democrats and Republicans, to come into the same room and agree that this was all pointless. That shaved off an entire month off the clock when Democrats were urging Manchin that there wasn't much time left, and set the stage for the time crunch we saw in July.

And just when it looked like things were finally about to come to an agreement, Manchin suddenly had a realization that because of concerns about inflation he cannot do the tax increases in the bill which would've hindered the deficit reduction funding in the bill which would've, according to Manchin's own metrics, hindered fighting inflation. In exchange he was willing to do a temporary health care bill instead, because if the BBB bill negotiations taught us anything, he was perfectly fine with that.

And now he's kind of reversed that last position. I suppose somebody came up to him and told him that it was his own inflation fighting bill and he came to his senses. Either that or because the Democrats played the Republicans (a rare instance) because they threatened to block the CHIPs bill from passing if they realized that the Democrats were trying to cut the deficit. I mean, they just blocked veteran's aid because of it so yeah.

All in all, Manchin is a fucking nightmare to negotiate with. But he was the reason why the bill was kept up for so long and given the state of most of the congressional Democrats, then I imagine they're willing to just take what he's offering them. The only wildcard is Sinema who seems to love holding corrupt shitty positions and not telling anyone about it. Then again the bill was designed around her strict tax demands, she's stated she won't change her position in this new round of negotiations months ago, and she apparently seems to genuinely care about the climate stuff in BBB. Then again she's also a diva so who knows. -

Mikie

7.3k

Mikie

7.3k

A much better synopsis, yes.

The more I look at it, the less great this bill looks for climate. I'd like to think it's still a win, but if it is it's a small one. The provisions about oil and gas leasing on public lands are just absolutely horrific and morally repugnant. -

Mr Bee

735

Mr Bee

735

I kind of knew that already going in since Manchin was calling for it for months. Progressives have largely accepted the poison pill in favor of the long term goal. Plus they may be more okay with the oil and gas leasing given the current situation with global gas supplies. Everyone knew that they were dealing with a coal baron from West Virginia, which was why they killed the CEPP. If there's anyone who you should thank for the clean energy tax provisions it's Ron Wyden who's been so on top of this whole thing that he approached Manchin about this very deal 8 years ago when Obama was still president. He's even keeping regular conversations with Sinema on taxes since he's probably aware of the current situation regarding getting her support.

Alot of experts still think that this will significantly cut down climate emissions so I'll take it. -

ssu

9.8kThat’s not why we have inflation. We have inflation because of the supply chain. — Xtrix

ssu

9.8kThat’s not why we have inflation. We have inflation because of the supply chain. — Xtrix

So how long are you going to believe the official "supply chain" argument? — ssu

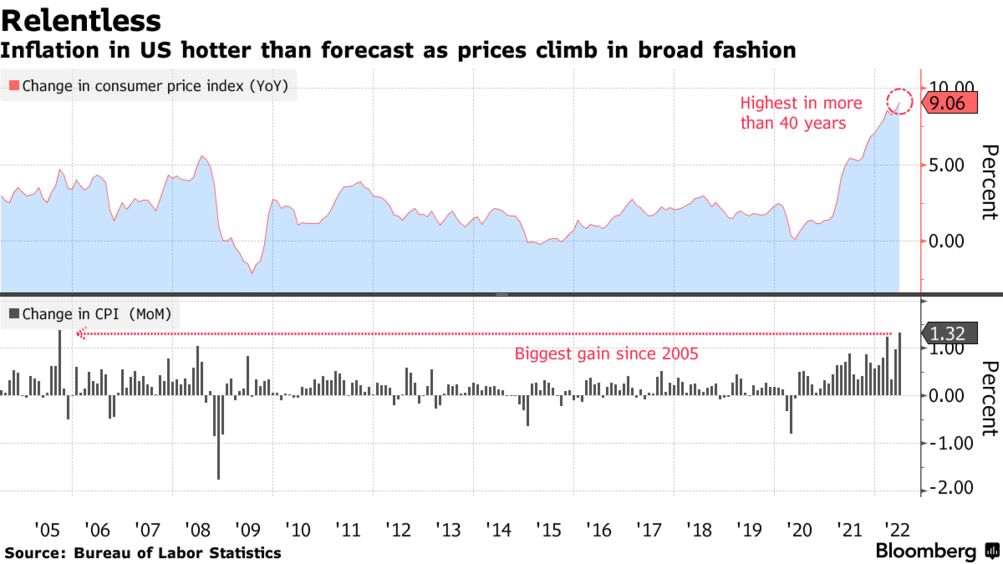

Well, it has been seven months from this exchange. All only a supply chain problem, still?

Of course there are many reasons for the inflation, the effects of the pandemic, the war and both previous fiscal and monetary policy. But as the US is now in recession, it's interesting to see what the Fed will actually do from here onwards.

Let's see how much inflation reduction that bill is going to create. -

Mikie

7.3kWell, it has been seven months from this exchange. All only a supply chain problem, still? — ssu

Mikie

7.3kWell, it has been seven months from this exchange. All only a supply chain problem, still? — ssu

I didn’t say “only,” but it’s the main driver in my view. Yes, that still holds— fairly obvious, in fact. You raise this now as if you’ve been vindicated when the money supply has decreased as the Fed has tightened policy. You’d think that would bring inflation down — but hasn’t. It will probably send us into recession— but that’s about it.

The Fed can do nothing about oil and gas supplies. Nothing. And it’s this that’s driving inflation so high.

It also does nothing about monopoly power and price gouging, which is also happening. Hence why big oil just posted record profits. Billions of dollars that go from customers being gouged to shareholders’ pockets. There’s absolutely no good reason for that whatsoever. It’s stupidity and greed.

Of course there are many reasons for the inflation, the effects of the pandemic, the war and both previous fiscal and monetary policy. But as the US is now in recession, it's interesting to see what the Fed will actually do from here onwards. — ssu

The Fed will continue lowering rates until we hit recession. They have only limited options. I imagine inflation will come down a little in the next few months, but overall what happens will largely be contingent on what Russia, China, and the corporate monopolies do.

Someone showed me a segment the comedian John Oliver did on inflation. A surprisingly good analysis, actually.

-

ssu

9.8kYou’d think that would bring inflation down — but hasn’t. — Xtrix

ssu

9.8kYou’d think that would bring inflation down — but hasn’t. — Xtrix

Well, just look at how high the Fed had to raise the interest rates in the 80's for the inflation to ease off. Real interest rates were back then positive. Now positive real interest rates would be a disaster and that's the basic problem.

You are right. And that's why actually the Russian linking their ruble to commodities (that you have to use rubles to buy their resources) made the ruble so strong.The Fed can do nothing about oil and gas supplies. Nothing. And it’s this that’s driving inflation so high. — Xtrix

Yet high oil prices are like an applied handbrake to the economy. The recession is the cure for it... assuming a recession is tolerated in an election year. Copper prices are a classic indicator for future economic activity and copper prices took a dip.

The Fed will continue lowering rates until we hit recession. — Xtrix

Uh, I think you meant raising. Technically we are in a recession. Two quarters of negative growth just happened.

The U.S. economy shrank in the last three months by 0.9%.

This is the second consecutive quarter where the economy has contracted. In the first quarter, GDP, or gross domestic product, decreased at an annual rate of 1.6%. While two consecutive quarters of negative growth is often considered a recession, it's not an official definition.

The last bit is typically added now to near every story about this. :smirk:

So let's see how solid inflation-fighter the Fed will be. -

Mikie

7.3kSinema has just signed on to this bill. Crucial step.

Mikie

7.3kSinema has just signed on to this bill. Crucial step.

Looks like she’s nixing the carrier interest credit in favor of a buyback excise tax of 1%. Not bad.

https://www.nytimes.com/2022/08/04/us/politics/sinema-inflation-reduction-act.html -

Mikie

7.3khttps://www.nytimes.com/interactive/2022/08/02/climate/manchin-deal-emissions-cuts.html

Mikie

7.3khttps://www.nytimes.com/interactive/2022/08/02/climate/manchin-deal-emissions-cuts.html

Currently they’re in “vote-o-rama” — more ridiculousness. But it should pass soon.

Regarding climate:

This bill will apparently get us close— but still isn’t enough. Question is: does this over or under estimate the impact of the Inflation Reduction Act?

With the additions of fossil fuel leasing, it’s hard to say.

We need to spend about 3% of GDP to really fight global warming. That’s about $700 billion a year. (US GDP is about 23 trillion).

That’s about what we spend on the pentagon every year (viz., corporate America— Boeing, Lockheed Martin, Raytheon, etc., which mostly goes to shareholders and CEOs) — in other words, straight to the pockets of the 0.01%. Nice taxpayer gifts to the rich, who in turn give the bloated military more planes they don’t need.

This bill spends $38.5 billion a year instead. Which is an absolute joke. It’s about 6% of what we should be spending. The gimmick is that they stretch it out over ten years and say it’s “385 billion” that they’re spending. Funny how they don’t do this with the military. If they did, we spend 7.5 trillion on the military.

Military: $7,500,000,000,000.

Climate: $385,000,000,000.

The suggestion that this bill gets us to 40% from 2005 level emissions is interesting. If true, it goes only to show how much we’re failing to do so much more. Stupid, stupid, stupid.

[also posted on climate thread as it’s relevant there as well.]

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum