-

Mongrel

3k

Mongrel

3k

Yea.. money is confidence. A drop in stock prices reflects worries... known as the Bear.

A crash means the bottom has dropped out of confidence in the economy. There's usually something gravely wrong that precipitates a crash. These days, a sign that a crash is trying to happen is that markets halt trading. If they're doing that.. that's a bad sign.

You say that stock markets don't have anything to do with the liquidity of industries. That's true when the stock market is characterizes by what's called a "speculative bubble." That means the market has become a casino.

There has never been a speculative bubble that didn't eventually pop.

My advice: broaden your view of the situation. But you've never taken my advice before so...

Carry on. :) -

ssu

9.8k

ssu

9.8k

Zizek???Zizek is probably planning a book right now, entitled "I Told You So" — Landru Guide Us

Of all the people that are or have been saying that this bull market is over, you refer to Zizek???

This is quite naive even from you, Landru.In short, if the market disappeared tomorrow it would have almost zero impact on 90% of Americans. The stock market is owned by the superwealthy and the wealthy. Nobody else has a stake in it. — Landru Guide Us

If the market dissappeared tomorrow, we would have a recession. The prices of stock actually have a meaning to the corporations and companies. If you don't understand that, here's an article that explains that in simple term: "Why Do Companies Care About Their Stock Prices?". So what happens in the Stock Market, especially if the trend is longer than the occasional panic or frenzy, it does have consequences. It will affect employment. A recession or an economic depression would affect even the ordinary guy that has never ever owned any stock.

One stock analyst said to me in the fall of last year, If China goes under, sell all of your European stock. -

Landru Guide Us

245A crash means the bottom has dropped out of confidence in the economy. There's usually something gravely wrong that precipitates a crash. These days, a sign that a crash is trying to happen is that markets halt trading. If they're doing that.. that's a bad sign. — Mongrel

Landru Guide Us

245A crash means the bottom has dropped out of confidence in the economy. There's usually something gravely wrong that precipitates a crash. These days, a sign that a crash is trying to happen is that markets halt trading. If they're doing that.. that's a bad sign. — Mongrel

Well, no - it means that the rich have put their money somewhere else. It's not like they care about the US economy or the glories of the stock market.

It just so happens that the US stock market, like T-Bills, has for the past 90 years been a safe and predictable place to put your money if you're rich. But of course, it wasn't always that way and maybe that's all changed, as Zizek has suggested. -

Landru Guide Us

245Of all the people that are or have been saying that this bull market is over, you refer to Zizek??? — ssu

Landru Guide Us

245Of all the people that are or have been saying that this bull market is over, you refer to Zizek??? — ssu

Zizek said it a long time ago. -

Landru Guide Us

245You say that stock markets don't have anything to do with the liquidity of industries. That's true when the stock market is characterizes by what's called a "speculative bubble." That means the market has become a casino. — Mongrel

Landru Guide Us

245You say that stock markets don't have anything to do with the liquidity of industries. That's true when the stock market is characterizes by what's called a "speculative bubble." That means the market has become a casino. — Mongrel

The market has always been a side bet. Like the guy who bets on whether the dice player will crap out or not.

You must be aware that when you "invest" in the market, not a dime of the purchase price goes to the company? I hope you are -

Landru Guide Us

245If the market dissappeared tomorrow, we would have a recession. The prices of stock actually have a meaning to the corporations and companies. If you don't understand that, here's an article that explains that in simple term: "Why Do Companies Care About Their Stock Prices?". So what happens in the Stock Market, especially if the trend is longer than the occasional panic or frenzy, it does have consequences. It will affect employment. A recession or an economic depression would affect even the ordinary guy that has never ever owned any stock. — ssu

Landru Guide Us

245If the market dissappeared tomorrow, we would have a recession. The prices of stock actually have a meaning to the corporations and companies. If you don't understand that, here's an article that explains that in simple term: "Why Do Companies Care About Their Stock Prices?". So what happens in the Stock Market, especially if the trend is longer than the occasional panic or frenzy, it does have consequences. It will affect employment. A recession or an economic depression would affect even the ordinary guy that has never ever owned any stock. — ssu

Investopedia -- a perfect source for your understanding of advanced capitalism!

Of course you have it backwards. Recessions cause stock prices to fall, not the other way round. But I suspect you're going to persist in your cliches.

Investopedia! -

BC

14.2kWell, no - it means that the rich have put their money somewhere else. It's not like they care about the US economy or the glories of the stock market. — Landru Guide Us

BC

14.2kWell, no - it means that the rich have put their money somewhere else. It's not like they care about the US economy or the glories of the stock market. — Landru Guide Us

The United States isn't a 'fake economy'. Economic activity is as real here as it is anywhere else. We produce, manufacture, buy, sell, consume. Real goods. Real services. The GDP represents real activity. The Uber Wealthy in the United States have a real stake in the prosperity and stability of the United States: Not all of their wealth, but a good share of it, is anchored in US properties. Secondly, there are not many other places in the world that provide all the stuff that the USA provides, and which they control. France is a nice place, but the American Rich don't own France the way they own the USA. China may be a dynamo of profits, but most rich Americans do not seem to want to actually live in China.

It is true -- usually when the stock market goes down, the rich will be the first ones out. Why? Because they can afford the best advice, and can arrange a fast exit if need be. Of course, they can get caught too. If the collapse happens very rapidly, they will be stuck with losses (which of course will not reduce them to eating discounted canned baked beans). Secondly, the rich can afford to have vastly diversified holdings, even within the continental USA. Land, rental properties, railroads, mines, warehouses, shipping firms, and so on and so forth, in addition to stock. The oldest, and richest of New York families , for instance, own land under skyscrapers and have long term (like, 99 year) leases. Unless the Empire State Building or Met Life Building (the old Pan Am Building) were to mysteriously disappear some afternoon, their rent on that land is about as secure as anything can be. Most cities are owned in the same way. The first families bought a lot of land, the city was built on it, but the original owners retained title to the ground.

Another factor about the rich: Their activity sways the market. Several rich families could start a very bad day on the market by suddenly dumping a lot of stock. Other investors would notice, and decide that they should get rid of their stock too. Before long, the market would be a lot cheaper. Later that day or the next day, the rich folk could buy up the now-much-cheaper-stock with just the profits they made from the sell off the day before.

The market being a casino reminds me of a WC Fields joke. Fields is dealing the cards. A sucker asks, "Is this a game of chance?" Field answers, "No, not the way I play it." The market is, to some extent, like W. C. Field's card game. -

ssu

9.8k

ssu

9.8k

Landru logic again as you seem not to understand how it goes. Stock market crashes accelerate the recession and are the catalyst. As I said earlier, not all rapid moves in the stock market come in tandem with recessions, but there is a logic why the two are related.Of course you have it backwards. Recessions cause stock prices to fall, not the other way round. But I suspect you're going to persist in your cliches. — Landru Guide Us

First you have the excesses of banks lending gone haywire with banks competing of market share and basically pushing money to everyone that wants it and creating a stock market bubble (and likely a real estate bubble) in the first place. Once this pops it means that there will be a banking crisis. That banking crisis will have a direct consequence of banks closing their lending taps even to totally healthy companies too. And how does a lending bubble then pop? Well, once the stock market or real estate market starts to collapse.

Your idea of first their being a recession and only then afterwards somehow the stock market noticing it creates a crash is persistent with your illogical Landru-kool aid views. -

Mayor of Simpleton

661Perhaps, but one thing I noticed is that the economic crash has a much more noticeable effect/affect in the USA than it has in Austria. (just came back to Austria after a 4 week visit in the USA)

Mayor of Simpleton

661Perhaps, but one thing I noticed is that the economic crash has a much more noticeable effect/affect in the USA than it has in Austria. (just came back to Austria after a 4 week visit in the USA)

Personally I find that one cannot really compare the two countries, as they have very different in governmental and economic models, but there is certainly a more obvious effect/affect of the crisis in the USA. Something tells me that it makes a bit more sense to address this issue of economic crisis in much tighter and specific context than any general worldwide notions.

Tiff mentioned that she hasn't felt the first one leave and I sort of haven't noticed the first one at all. Indeed I'm not wealthy or 'well-off', but I cannot say that this crisis has been more than a small bump for my life. My friends and neighbors (in Austria) have very much the same experience as I do. Indeed a country that is geographically small and a very small population is easier to govern, but maybe size matters? The bigger you are the harder you fall? Difficult to say...

Meow!

GREG -

BC

14.2kI cannot say that this crisis has been more than a small bump for my life. — Mayor of Simpleton

BC

14.2kI cannot say that this crisis has been more than a small bump for my life. — Mayor of Simpleton

If one is employed, recessions--even depressions--are not catastrophic. 75% of the workforce was employed during the great depression of the 1930s, and for them the depression wasn't horrible. "A recession is when your next door neighbor is unemployed. A depression is when you are unemployed."

Another factor: Most European Community countries have intact safety-nets. The USA has been busy getting rid of generous protections. The "social contract" in Europe is more protective. In the United States it is more oriented toward keeping labor relatively poor. -

ArguingWAristotleTiff

5kI knew back in 2004, when a group of friends NicK and I, were standing around a campfire talking about where we were in our lives at 32-34 yrs old in comparison to where our parents were at the height of their working careers. While I realize in many circles it is taboo to talk about salaries, we had always shared ours without hesitation and still do. All of the men present were earning at least what their parents top salary was but most were making multiples of their annual salaries. Were we financially wealthy? Yes, in comparison to those around us. Was I embarrassed to tell my parents what we were making annually? Yes and I still am.

ArguingWAristotleTiff

5kI knew back in 2004, when a group of friends NicK and I, were standing around a campfire talking about where we were in our lives at 32-34 yrs old in comparison to where our parents were at the height of their working careers. While I realize in many circles it is taboo to talk about salaries, we had always shared ours without hesitation and still do. All of the men present were earning at least what their parents top salary was but most were making multiples of their annual salaries. Were we financially wealthy? Yes, in comparison to those around us. Was I embarrassed to tell my parents what we were making annually? Yes and I still am.

In 2008 we cashed out our 401k's to make payments for the deed on the ranch, while two of our friends were advised and decided to take the route of a 'strategic foreclosure'. My feeling has always been that if you give your word, you do everything in your power to uphold that word, including keeping our word to continue to invest in our ranch. In 2004 we were approved for a $999k loan for a home which NEVER in a million years, would we ever be able to afford if we took any kind of a financial hit. We purchased our ranch for $400k and at it lowest value in 2010 it's value was $159k. Now in 2016 it is projected to be worthy $375k. Has it been worth it to uphold our commitment on the deed? For me? Yes. Everyone around me says that I made an emotional decision about a financial decision which we are still paying for and I admit they were right. However after losing everything that was not living in a house fire in 2003, making a home that we could raise our family safely in was my first priority. Stability.

Having said all that, I know that there are other's around me, some here in TPF that needed more than the trunks of food and toiletries that were delivered to our ranch to keep us from going hungry. I am reminded that there are others who lost so much more, so, so, much more.

There will come a time when we will be able to afford health insurance, a second car and maybe be able to put both are Indians thru a University after they give me 2 years at the community college. I was raised thinking that college was as mandatory as primary school, I didn't realize that it was a privilege until I neared my Junior year.

I have learned a lot along the way, who my parents are and who I wish my children to be. Rich in health, love and happiness is all I wish to create. Utopian views I know but they get me thru the tougher times. -

Landru Guide Us

245Your idea of first their being a recession and only then afterwards somehow the stock market noticing it creates a crash is persistent with your illogical Landru-kool aid views. — ssu

Landru Guide Us

245Your idea of first their being a recession and only then afterwards somehow the stock market noticing it creates a crash is persistent with your illogical Landru-kool aid views. — ssu

More whacky economics from somebody who doesn't understand what the stock market does. SSU probably thinks that when he buys IBM stock the money goes to IBM. Invincible ignorance.

This is what happens why you look to Investopedia for your understanding of advanced capitalism -

discoii

196Landru, are you seriously suggesting that a stock market crash has no effect on poor people? Even when banking systems are so interlocked with the stock market itself?

discoii

196Landru, are you seriously suggesting that a stock market crash has no effect on poor people? Even when banking systems are so interlocked with the stock market itself? -

BC

14.2kGood link. Thanks.

BC

14.2kGood link. Thanks.

Fairly extreme views are presented by media at times, and sometimes these poorly represent reality. For instance, declines in the DJIA is just about always described as a bad thing. It is perfectly normal and healthy for markets to bounce up and down (like a hookers drawers). What is relevant is long term trends -- not a week or a month long, but year and years long.

Employment and unemployment figures, GDP, trade figures, etc. are important too -- probably more important than the DJIA or the averages of other exchanges. Some of these figures conceal worrisome conditions that are not featured much: unemployment is down, but there are large numbers of people who are not working, not looking for work, and they are not idle rich. They are people who have dropped out of the labor force because they don't fit anywhere.

China needs economic growth. No growth is not an option. It has a huge population, it's population is growing, and large numbers of people expect opportunity and rewards. If 200 million people are grossly disappointed, watch out. So, slowdowns in China are more significant than slowdowns in Canada. (Nothing against Canada, of course...)

A lot of economic reporting is, to use the technical term, bullshit. American Public Media's "Marketplace" sometimes has decent content, but much of it is slop and fluff. Their 1/2 hour show sometimes is devoid of significance. Sometimes it's OK, but mostly it's easy listening happy chatter. -

Landru Guide Us

245↪Landru Guide Us Landru, are you seriously suggesting that a stock market crash has no effect on poor people? Even when banking systems are so interlocked with the stock market itself? — discoii

Landru Guide Us

245↪Landru Guide Us Landru, are you seriously suggesting that a stock market crash has no effect on poor people? Even when banking systems are so interlocked with the stock market itself? — discoii

I'm amazed you'd think otherwise.

Working people have almost no significant ownership in the market. Working people have very little credit issued to them, at least not the kind that has anything to do with the market, like corporate bonds.

The issue for working people is not where the market is at (are you really claiming that working folk have profited by the huge increase in the value of equities since the 2008 meltdown?). But rather where the economy is at. If the economy is in recession, and people get laid off, then that affects working people. Recessions have lots of causes. One of them is not a stock market decline.

The current market sell off - the topic of the OP - has nothing to do with a recession and will have no impact on jobs. Neither China nor the US are in a recession and nobody is predicting that there is any risk of one, except the usual rightwing kooks. You've got the cart before the horse. -

ssu

9.8k

ssu

9.8k

Typical. Start with your incredible and condescending strawman arguments of what you assume people to think.More whacky economics from somebody who doesn't understand what the stock market does. SSU probably thinks that when he buys IBM stock the money goes to IBM. Invincible ignorance. — Landru Guide Us

This is the biggest piece baloney for a long time to come of out you and tells about utter ignorance of basic facts.Working people have very little credit issued to them, at least not the kind that has anything to do with the market, like corporate bonds. — Landru Guide Us

Working people have little credit? Are you really implying that working people don't have debt in order to buy their homes? That home mortrages are not the biggest share of loans that banks basically give loans to?

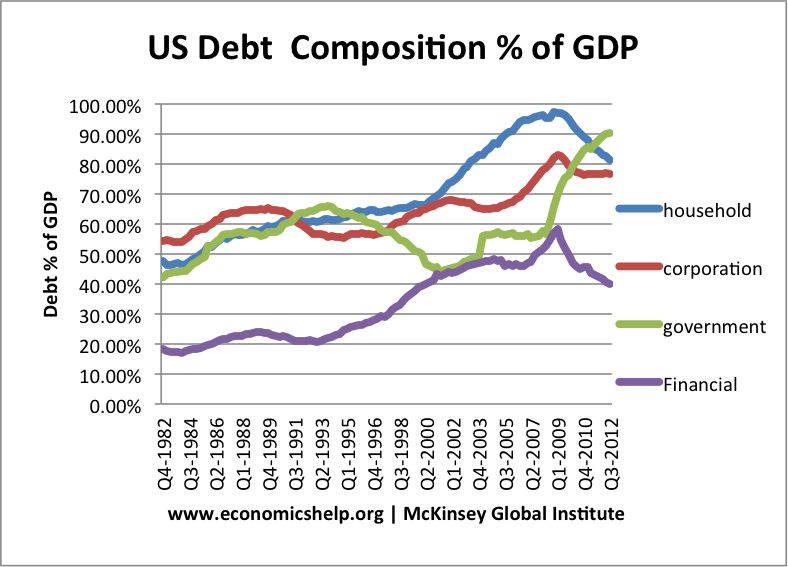

Here's a graph about the US debt composition:

According to Landru, the biggest piece after public debt of the composition doesn't matter. Because working people have little credit.

According to Landru, the biggest piece after public debt of the composition doesn't matter. Because working people have little credit.

I think you are alone with your ideas, as disoii's question showed. It's obvious that you fail to understand how the financial sector does have an effect on ordinary people.

If you don't understand the stock market, then at least you should understand how financial institutions with the real estate market creates these boom and bust cycles every now and then. It's an easier way to understand how markets have an effect. For example, the construction business gives jobs to people as obviously homes and offices cannot be built by robots in China. When banks (or financial institutions) compete in market share and push loans to the market, housing and real estate prices go up. With rising real estate prices real estate projects look good. Then when the real estate bubble bursts, the financial sector has a problem. Projects are shelved. Then come the layoffs for people.

Here's a graph that shows just what banks do when there is a banking crisis:

Now, compare the above graph to the following graph:

I would assume that a drop of over 3 million jobs does have an effect on the economy. (Do notice the effect of the real estate boom also) -

discoii

196Landru, you do know that when people play the market, they are basing their buy and sell decisions off of the most current information about the economy, right?

discoii

196Landru, you do know that when people play the market, they are basing their buy and sell decisions off of the most current information about the economy, right? -

Michael

16.8kI read that article. It seems to agree with @Landru; stock prices are only really of interest to the investors and the management. It also explicitly says "the stock market is to act as a barometer for financial health", which again seems to agree with @Landru; a failing marketing is an effect of a bad economy (or at least a perceived bad economy) rather than its cause.

Michael

16.8kI read that article. It seems to agree with @Landru; stock prices are only really of interest to the investors and the management. It also explicitly says "the stock market is to act as a barometer for financial health", which again seems to agree with @Landru; a failing marketing is an effect of a bad economy (or at least a perceived bad economy) rather than its cause.

So based purely on that article (and I have nothing else to go on as I don't know much about the economy) it seems that Landru is correct; remove the stock (i.e. secondary) market and the only people who'll lose out are the investors. Only the IPO, the favour of creditors, and public demand matter to the company's success itself. -

ssu

9.8k

ssu

9.8k

Companies get money through their IPOs. Yet the value of the stock isn't unimportant. Yeah, those with stock options or investors are one thing, yet that the value of the company itself. Assume you have a company that is in the stock exchange. If the total company share values value is 1 million or 1 billion, the difference affects a wide variety of things the company can do... and not only for the management to give itself lucrative options (assuming they can control the owners).I read that article. It seems to agree with Landru; stock prices are only really of interest to the investors and the management. — Michael

When stock markets plunge, it makes more difficult for companies to make successfull IPO's or to issue new stock. That means that fewer companies can get the money for investments, especially if the market crash results in a banking crisis. Then there is the wealth effect for those that own shares. And a lot of people actually do in the form of pension funds (you in the US have your 401k's).

Well, you could similarly say that real estate prices going down is an effect / a barometer also. Here's a bit longer answer than dicoii.It also explicitly says "the stock market is to act as a barometer for financial health", which again seems to agree with Landru; a failing marketing is an effect of a bad economy (or at least a perceived bad economy) rather than its cause. — Michael

The basic reason, I would argue, is what the banking sector and the financial sector does. If it pumps too much money into the economy and this results in a speculative bubble in the markets, watch out below when the bubble bursts. I would be careful with the term malinvestments, because there are allways good and bad investments, yet what usually happens when the lending taps are opened, first the money goes into the most sound investments, then more riskier investments and finally into pure speculation about asset prices. Now Landru would say that who cares, it's the rich and some stupid taxi drivers playing in "the casino", and it hasn't any effect on the real market. And most times the volatility doesn't matter. As the saying goes: Stock markets have predicted 10 out of the last 3 recessions.

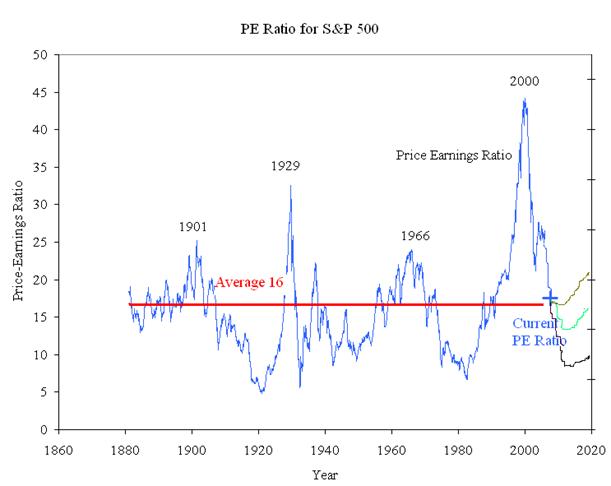

Yet sometimes it matters. Especially when there has been a speculative bubble. And they don't emerge just because people are irrational, they emerge because of the financial sector. The changes in the Price to earnings ratio, the P/E, show this. You would think that the P/E would stay somewhat close to some long term average, but it isn't so:

In Japan when their bubble burst, the P/E ratio was something like 100. Hence it took a Century in annual earnings to get back the price of the stock. -

Michael

16.8kWhen stock markets plunge, it makes more difficult for companies to make successfull IPO's or to issue new stock. — ssu

Michael

16.8kWhen stock markets plunge, it makes more difficult for companies to make successfull IPO's or to issue new stock. — ssu

True, it would be a problem when issuing new stock.

That means that fewer companies can get the money for investments, especially if the market crash results in a banking crisis.

So in this sense a failing marketing is like panic-inducing media?

Then there is the wealth effect for those that own shares. And a lot of people actually do in the form of pension funds (you in the US have your 401k's).

Well, not me as I'm not in the US. ;) -

Landru Guide Us

245When stock markets plunge, it makes more difficult for companies to make successfull IPO's or to issue new stock. — ssu

Landru Guide Us

245When stock markets plunge, it makes more difficult for companies to make successfull IPO's or to issue new stock. — ssu

Ironically, the companies that can issue IPOs are the very ones that don't need capital. If they are so successful that they can go public, they can get all the private capital they want or need. A marginal company wouldn't even try to go public.

The purpose of an IPO is not to obtain investment capital, but for the owners to cash out. Usually a large portion of the IPO capital goes to the founders as part of the deal.

So the notion that a falling market starves out struggling IPOs is simply a fantasy. If you're in a position to go public, capital is not a problem.

In any case, this is absurd. IPOs are a vanishingly de minimus part of stock market transactions even in the boom times. They have no impact on a $17T economy. -

Landru Guide Us

245Landru, you do know that when people play the market, they are basing their buy and sell decisions off of the most current information about the economy, right? — discoii

Landru Guide Us

245Landru, you do know that when people play the market, they are basing their buy and sell decisions off of the most current information about the economy, right? — discoii

Actually, no, they usually aren't. Since most of the market is owned by the rich, they are basing their decision on their particular economic situation - it usually involves tax planning to maximize after tax cash. Thus when Reagan lowered capital gains, the market fell precipitously. Can you guess why? It has nothing to do with the economy.

In any case, the market and its relationship to the economy, particular bonds, is highly complex. Anybody who sees a one-to-one relationship with equities and anything is not to be taken seriously. -

Landru Guide Us

245If you don't understand the stock market, then at least you should understand how financial institutions with the real estate market creates these boom and bust cycles every now and then. — ssu

Landru Guide Us

245If you don't understand the stock market, then at least you should understand how financial institutions with the real estate market creates these boom and bust cycles every now and then. — ssu

We already know how the Bush Meltdown happened: deregulation of mortgage lenders (the gutting of Glass-Steagall) plus deregulation of credit default swaps plus falling income due to the income gap resulting in middle class people using their only major asset (their homes) to pay for health care and their kids' college.

Almost all the rise in loans in the 2000s were refinances, not purchase money.

In short the rich had so much money they put it into lending institutions, usually in the form of high risk REITS. When the bubble burst (and the bubbles created by income inequality always do), the risk was everywhere due to CDSs. The result, a credit bottleneck that caused job losses, causes more mortgage defaults, causing more job josses. We always get mortgage defaults. The FDIC can handle it because with Glass-Steagall there were always lenders with good portfolios. But the deregulation of CDSs (thanks Bush) made all the portfolios toxic.

You're not going to get into some rightwing meme about how poor people were "living beyond their means" are you. God, I hope not. You really have no idea what you're talking about on this issue, do you? It's all from googling. -

BC

14.2k...plus deregulation of credit default swaps... — Landru Guide Us

BC

14.2k...plus deregulation of credit default swaps... — Landru Guide Us

When and by whom were credit default swaps ever regulated? My understanding was that CDS were outside regulation jurisdictions (in practice, if not by rules). They hadn't been in use that long (13 years) at the time of the 1007 crash. Credit default swaps have existed since 1994, and increased in use after 2003. By the end of 2007, the outstanding CDS amount was $62.2 trillion, (Information obtained by Googling "credit default swap history".)

There is something facile about your dismissal of everyone else's interpretation of the way the economy works. It isn't as if the operations of the economy are so obvious that even high school drop outs can readily make sense out of it. Economists don't all agree on these things. -

Cavacava

2.4kI just reread a fascinating article by Michael Klare a professor of peace and world security studies at Hampshire College and the author, most recently, of The Race for What’s Left. A documentary movie version of his book Blood and Oil.

He reviews a little of the history of oil, the nations and policies involved. He thinks that oil may stay depressed at least through 2020 and maybe longer, which will change the whole balance of power around in the world. Think of how many national economies have been built and sustained by oil.

Interesting idea, it certain might affect stock picks...many industries had to raise their pricing because oil was over $100 a barrel, now at $33 a barrel, these companies profit margins must be going through the roof....if much of food cost is its transportation cost..then look at grocery chains and other fuel sensitive industries.

Article here: http://www.tomdispatch.com/post/176089/tomgram%3A_michael_klare%2C_the_look_of_a_badly_oiled_planet/ -

Landru Guide Us

245When and by whom were credit default swaps ever regulated? My understanding was that CDS were outside regulation jurisdictions (in practice, if not by rules — Bitter Crank

Landru Guide Us

245When and by whom were credit default swaps ever regulated? My understanding was that CDS were outside regulation jurisdictions (in practice, if not by rules — Bitter Crank

It's just shorthand, Bitter, for the rather serpentine process whereby Republicans, particularly the odious conservative Phil Gramm, made sure they weren't regulated, as they obviously should have been. He snuck an exemption into a budget bill. Typical rightwing bad faith. I didn't want to get into the weeds.

If you want to call it facile be my guest. You don't seem to be aware of the above facts.

The point is SSU's analysis of the Bush Meltdown is rubbish. If conservatives hadn't prevented regulation of tabletop mortgage lenders and CDSs, if they hadn't gutted Glass-Steagall, if they hadn't given the rich the biggest transfer of wealth in US history with the Bush tax cut, the Meltdown wouldn't have happened. There would have simply been a normal recession with a level of mortgage defaults that the system could easily handle as it always had by having the good banks buy up the bad inventory. But due to CDSs, there were no good banks - they all held the toxic assets in the form of CDSs.

Conservative economic policy is always a horrible failure (except to transfer wealth to the rich). Democrats should never agree to any part of it. Not one inch. -

Landru Guide Us

245. Economists don't all agree on these things. — Bitter Crank

Landru Guide Us

245. Economists don't all agree on these things. — Bitter Crank

The reputable ones do. Every recession is preceded by a growing income gap. Every single one. The larger the gap, the larger the recession. The facts are indisputable. Feel free to google them yourself.

The Bush Meltdown was preceded by the largest income gap since the Depression due to the triumph of conservative economic policies of deregulation and wealth transfers to the rich.

Sorry, it's just the way it is. And I do dismiss the rightwing memes that say otherwise.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum