-

Eric Weinstein

I'm not sure which of the two brothers caught fame first, but at least Bret Weinstein was dragged unwittingly into the public eye with the incredible events in an unknown university, who otherwise would have stayed as an total unknown.I agree with your analysis in general, but I don't think that analysis applies to Weinstein. He isn't someone in academia who's been unwittingly dragged into the public eye, and so unfairly dunked-on. Rather he's someone who quite intentionally courts public attention, in the mode of provocateur, and tends to do so rather than engage in academia - for instance, his infamous dismissal of peer-review and so forth. — csalisbury

I think the main reason is that the American public debate is and has been void of "common sense" academicians who once pushed into the media limelight appear different from the usual bunch, the celebrities, movies stars or politicians. Somewhere the intellect from your Hollywood-actors has to show and now with Youtube and other podcasts there can be these "long form" chats and there is an audience for them.

Again, I don't know the math or science, so I can't appraise him on anything but the indirect - but this feels an awful lot to me like symptoms of something like a personality disorder - intense grandiosity + a kind of disavowed shadow self that almost perversely projects stuff onto the outside (fitting the grandiosity, he doesn't project onto others, but onto the world.) Again: He has the key to restoring phsyics and America; without the key, we have EGOS that made people fake growth and become pathological. It's so on the nose, that it's surreal. It's like he's got some kind of perverse subconscious imp. — csalisbury

I think that there is the type of academic person like Eric Weinstein that isn't humble, bit confrontational and a provocateur as you said. They can come off as a bit hostile, but the solution is to disregard the manners and focus on what they say. Yet the actual message has to be treated separately of this, and to really judge the mathematics you truly have to know mathematics yourself. Usually people might have some point about the issue there are talking about. Very rarely is it totally false. The real issue is how relevant their point of interest is for the whole field and that's the hundred dollar question. Yet that something is wrong in the academic world isn't an outrageous or revolutionary thing.

Some famous hoaxes, like the Sokal hoax, have shown that peer review has it's failures, but I think the issue is more widespread. I remember my father (a professor of virology) saying that when publishing an article lets say in Lancet (he got I think one article published in the publication), from where you publish does matter. American top notch Ivy League university will easily open doors, something from the local University of Helsinki here might even pass, but good luck trying to get something published if you are from an university from Kano state, Nigeria. -

CryptocurrencyI'm too considering getting getting a new computer and ordered a new one. They said they don't have any clue when the new computer will arrive from Asia. Hopefully this year, I guess.

Yet I think the chip shortage is more because of the pandemic problems on our wonderful globalized supply system than the "everything bubble". -

Inflation? Something? (Hyper?)

Those groceries are what is counted in the indexes. And there are ways to make the costs appear smaller. For example, if you buy any tech gadget, they can say that now the gadget is far more better than last year and hence it's cheaper even if the price has stayed the same or have gone up. Then there's housing: usually what is used are rents, which don't go up (or down) as real estate prices do. Making inflation appear smaller than it is, is an objective for any government now days.Whoops! My wife, who is almost a professional shopper, informs me many grocery items remain at pre-pandemic levels. :yikes: — jgill

Thanks Shawn, you pick up an excellent point: the velocity of money has gone down (thanks to the lockdowns).People are just saving or banks hoarding, pick one... — Shawn

What has happened is that people are really saving. And why not? The economy has gone off a cliff, so why not to save now as things won't get to normal in an instant. Hence with the large (in aggregate) wealth transfer from the government the statistics have really gone quite bonkers. The real issue here is if that velocity starts picking up once the COVID-19 scare starts to be history. Raising interest rates starts to be a non-option: the market can easily crash if interest rates go up. The last thing Joe and Kamala want is a stock market crash and again a 30's style economic depression. If the interest rates would return to the historical normal, the government and the economy would be in real difficulties. For example Japan is already a captive of low to zero interest rates.

Hence inflation seems to be the real way to "tax the people" and to get out of this. If people wouldn't just notice it... -

Eric WeinsteinSo the question is: do you trust eric weinstein enough that you're willing to dig down and fullly learn physics to learn his alternative physics? If so, god bless you, but I think most Weinsteinians want a quick 'in' to a outsider-intellectual status. And that usually comes from being an outsider and wanting something to show for it. — csalisbury

The basic problem is that any academic debate or the people of an academic or scientific field once drawn into the public media discourse (as Weinstein has been) in highly popular forums (such as the Joe Rogan experience etc.) are dealt with the typical toxicity prevalent to our times. I've seen this for example in economics: economists are put into categories of either being "credible real economists" or "bogus charlatans". Will the bogus charlatans be Keynesians or Austrians totally depends on the person's own tastes and political views. With politicized fields as climate science or now perhaps virology with COVID-19, this may be even worse. Simply put it, ordinary people cannot fathom that different schools of thought may all have quite reasonable points they make. They are far too eager to put some scientists or academicians to a similar category where we put those "researchers" sponsored by the Tobacco industry claiming there are no health hazards to smoking (or that the results are disputed). And others are then put to a pedestal for promoting real science.

Those people that comment issues outside of their field will naturally commit themselves to the polarized public discussion and face the wrath of that. Eric Weinstein, who comments nearly anything and has even coined the term Intellectual Dark Web, will naturally immediately put off people (as one can see even here). -

Economic Ideology

Sure.If considering paradise in the grander scheme of life, can it exist without money? — ghostlycutter

The economy will be just different. Barter isn't the only option, if you have other things that replace the role of money and give the information and feedback, then I guess it would be OK. And those roles are medium of exchange, unit of account, store of value and perhaps standard of payment.

I think that there might be a few leftist leaning forum members here who have thought about the idea (or read about it) more. Yet to think that the problems like wealth inequality wouldn't go away if you are thinking about that. -

Eric WeinsteinEric Weinstein is full of theories.

You might be more specific just what your referring to and perhaps open it a bit to those who haven't read or heard it. -

Is Totalitarianism or Economic Collapse Coming?

Well, a historical collapse of globalization is when antiquity and the Roman globalization collapses into the Dark Ages. A trillion tears for that one.I should have stated, "this foray into serious globalization," which will end just like other attempts...in a trillion tears. — synthesis

This is what I've felt for a long time. However, until at least now, even if we have a huge asset bubble everywhere, the whole system has been very persistent. The doomsayers have had their same line for decades now. Hence I'm really puzzled about MMT and have wanted to have a serious debate about it, yet it seems to be too difficult. Even the believers of MMT do state that too much debt will cause a inflationary crisis, yet they argue that for the US this doesn't matter. At least now. How much is too much?It was the creation of full FIAT reserve currency, of course, which allowed this to happen on the scale it did (so what should that tell you?). Globalization is a fraud, plain and simple, as it is exploitation at some of its worst, and MMT is simply a polite term for counterfeiting, nothing more. — synthesis

It actually an interesting question why has it become so failed. I think that the simple reason is that every part of the system has to make a profit, the corporations themselves have made the policies to favor themselves and in the end people without any long term health care have to be then in ER. Why Americans accept this is beyond me.The U.S. health care system is another example of massive fraud, believe me, as I have been part of it for many decades. — synthesis

(Yes, it's extremely expensive...)

(Has been so since the 1980's...)

(And takes a huge share of the costs...)

(...with mediocre or dismal results, when measured by life expectancy or by any other health indicator.)

So you are right, it is a huge scam. And why people opt for it? Think that anything else would be even worse?

Japan is a homogeneous society while Germany is quite multicultural now days. I think the real problem is that in the US the class divide (which you can find in every country) has gone through racial lines and this has created a toxic environment. And of course that many Americans deny the existence of class and think of a class system as a caste system (which it isn't). Also that the labor unions have been corrupt and been infiltrated by organized crime at some stage has had very negative consequences.Japan and Germany are both homogeneous societies and lack the social, educational, and cultural differences found in the U.S. The labor unions that still do exist (such as unions for federal employees) are about as corrupt as it gets, and, as well, have pretty much bankrupted many cities and municipalities. — synthesis

That cities or municipalities have been bankrupted by labor unions is one way to put it. Another way to look at it is that cities, municipalities (and companies too) have opted for the easiest solution of promising beneficial retirement plans (that will be paid later) instead of salary increases as a way to push the problems forward.

Sorry, this what you refer to and answer later isn't my quote (or the other's), but I think replies of and/or others.You have to approach any government situation ASSUMING that bad things are going to happen (because they almost always do). — synthesis

Perhaps correct the references so that people can follow the correct interesting debate, Synth? :wink: -

Is Totalitarianism or Economic Collapse Coming?

Globalization didn't start in 1980, it might be called an era of de-regulation.Let's look at three periods, post WWII (say, 1950), the beginning of globalization and financialization (1980), and forty years later (2021). And let's just take the U.S. as an example. — synthesis

Also here it's important to see also the reasons of American dominance before, because the US isn't an island when it comes to the global situation:

1950: All other major industrialized countries in ruins after WW2, China has communism, India and the Far-Eastern "Tigers" very poor, some still colonies. Hence US dominance in every field.

1980: China just starting to change it's economic system, West Europe and Japan back on track and can compete well with the US.

2021: China has enjoyed historical growth, India has too shed it's socialist system, many Far-Eastern Tigers like South Korea and Taiwan are wealthy countries.

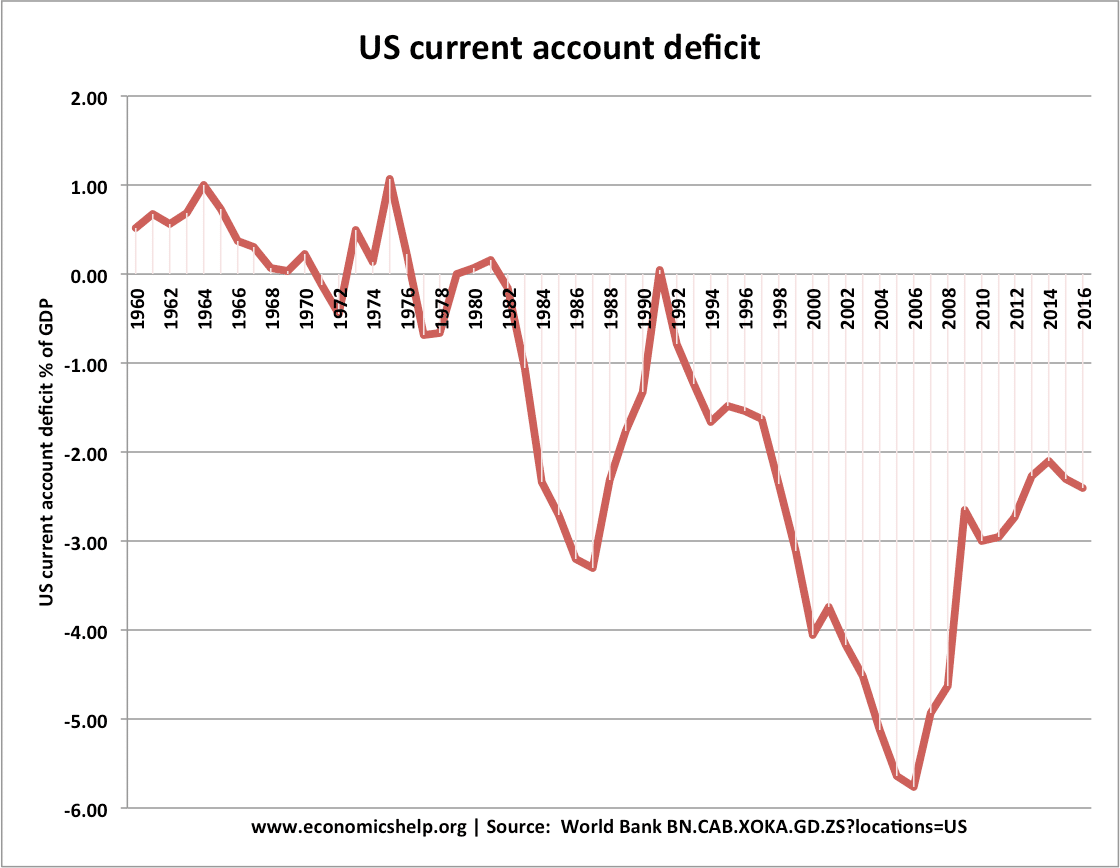

Indeed, I think this more because of monetary policy than because of globalization. Going off the gold standard and having a fiat system was the crucial thing. Other countries, like mine, would quite quickly face a current account crisis and a run on their foreign reserves, but not the US. When the Saudis were OK with just getting dollars for their oil, why not? (And then are things like that Americans simply want to pay the most for a mediocre health care system, I guess.)The lasting legacy of globalization has been monetary inflation which has gutted the American middle class. This is a product of monetary policy and (by far) the winners are those who profited by the corporate bonanza in cheap manufacturing in Asia, the ramp-up in stock prices, ,and the political class (and it's employees who in 1950 made 50% of what the average private-sector worker made, and now makes double what the average makes in this country!). — synthesis

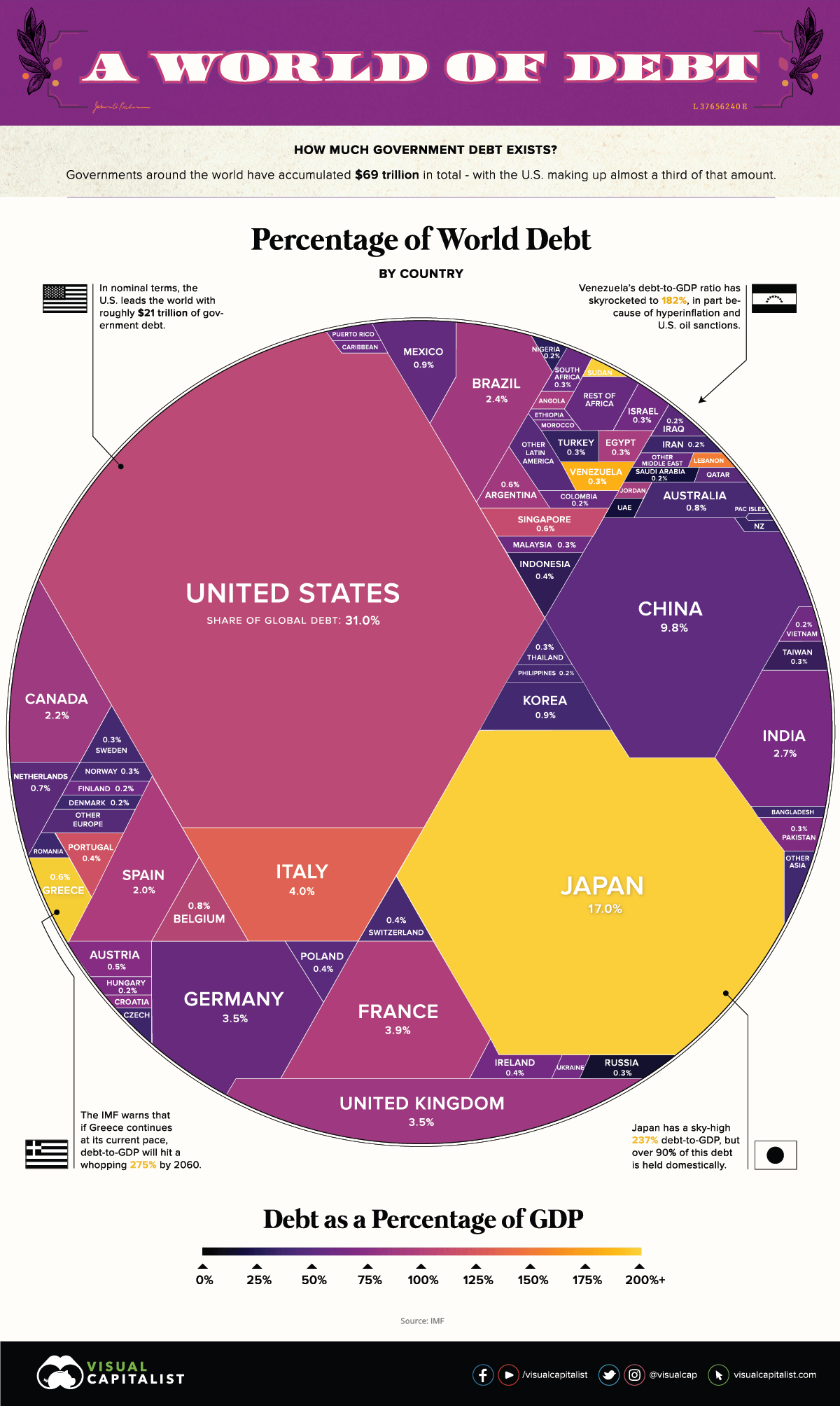

The US has enjoyed the situation where it can print the global currency everybody uses, hence debt doesn't matter and the current account can be negative for over 40 years. And why not? Since the World is OK with an US Dollar system, then US politicians can print as much as they want. We all seem to believe now in modern monetary theory.

Who cares about things that more debt actually creates more problems...

Well, some export oriented countries like Germany have done quite well and don't have such wealth inequality. Even if I'm not a leftist, I think one important issue is that Americans aren't in labor unions, hence the employers can do nearly whatever they want. I think this also more of a domestic issue than just globalization.Despite access to your yellow tropical fruit, this past 50 years has been a disaster the average American worker and a bonanza for the average corporate exex. and all federal employees. It's the exact opposite of what you want in a healthy economy and another example of how socialism destroys everything it touches. — synthesis

-

How The Insurrection Attempt of January 6 Might Have SucceededThe left is naïve if they think those *few* people you refer to on the right don't pose a substantial, credible threat. — James Riley

A tiny cabal of people or even single persons that adhere to violence can have huge in consequences if they are successful. The most successful terrorists are those who by their actions create a response that they actually want. Best example that comes to mind is Al Qaeda, an organization that hoped that the US would respond by invading Muslim countries. An organization that had less than 200 people has become quite popular franchise. Luckily sometimes the intensions of terrorists backfire.

I am fully aware of how the right can look at the left in the same light that the left can look at the right. That is a false equivalence, akin to the media giving time to both sides and then patting themselves on the back for being neutral. — James Riley

"Both sideism" can indeed lead to propaganda and mis- or disinformation being successful. However it's always better to read what actually the people say, judge their views yourself and not just follow the people who criticize the other side. The current polarization is based upon of us being in our own echo chambers.

Those in leadership positions that disregard what our democracies stand for and can and will resort to violence can never turn back on the path they have chosen. They will change the system and if violence and breaking the rules is tolerated, the politicians that succeed in that environment will be far more uglier than the one's we have now.Leadership starts at the top. Leadership sets the tone that springs from our Constitution and Bill of Rights. Enforce. Find men and women of leadership and character and spine who, with due process of law, can vet and weed out the traitor. And back their hand when they do it. For, ultimately, the institution is subordinate to the tone. — James Riley -

How The Insurrection Attempt of January 6 Might Have SucceededInteresting option to view this like Platoon.

Just replace the word "the right" with "the left": "If the left wants to bury the hatchet, they need to confess the error of their ways first. They brought this shit on themselves, etc. etc." How does that sound?If the right wants to bury the hatchet, they need to confess the error of their ways first. They brought this shit on themselves. They are back under the fridge for now. But we have to assume they are planning. And they may be hiding in an among our intelligence, law enforcement and military communities. If all they do is drag their feet we'll be lucky. — James Riley

I'm just trying to point out how hollow this is. "The Right" just as "The Left" depicted as a single actor isn't credible here. Q-anon followers, the Proud Boys, Oath Takers, the Bugaloo-movement and other aren't those 74 million voters. There are up to 6 000 Proud Boys at best, perhaps several thousand Oath Takers and so on. Less than four hundred people were charged on the assault on the Capitol. In a country of well over 300 million that is not much, but naturally these fringe people can have a big impact. Yet one should call them out with their own name. I wouldn't say they portray all the people in "the right" in a republic. Yet this is very common on both sides. On the right the left, the liberals and especially the progressives are depicted as staunch enthusiastic supporters of the leftist rioters. That simply isn't true, even if there are those who give the thumbs up for rioting.

Radicalization of the extremes can turn ugly and there are historical examples of this. Italy had a big problem from the end of the 1960's to the start of the 1980's with a crisis now called the Years of Lead. The history from Italy is a good example of what happened when radical elements start fighting their "war" on the streets and this goes on, even if the economy of the country is doing rather OK. I hope it doesn't get to something like that in the US, but that tempers calm down.

-

Is Totalitarianism or Economic Collapse Coming?The winners were the (corporate) elite and the politicians, the losers, regular folks. — synthesis

If I can get in the winter a fresh banana here in Finland, that basically makes us here "winners" thanks to globalization. I even have the option to buy a fair trade banana, actually. Without globalization, that wouldn't simply be a possibility. Sure, I could eat canned food as my grandparents when they were young in the winter, it's not such a big difference, yet it still is a difference.

Hence I object to the populism that the only winners are the (corporate) elite and the politicians and the (only?) losers are the regular folks. Sorry, but anybody talking about the benign "regular folks", the "common people" as these people who are the suffering losers uses populist rhetoric. You and I know that in the West the majority of the people have it OK. They are not starving. They have it reasonably well. It is a minority, the underclass, who really are poor. In the US or in Western Europe, they don't make up a majority.

The real problem is that far too many things that globalization has given us we take for granted, while we are too eager to focus on the downsides. Perhaps it's just a matter of rhetoric: we simply don't want make an argument like this and that is good, but here we have problem. Far better to say only that here we have a problem.

They have been far more better export oriented countries than many. And here we get onto thin ice, if we really want to look at why some countries have been more successful than others. Some can argue about a worse starting point, poverty or war or having been colonies, but sometimes, as in the case of Argentina, the real reason why they have been failures is quite puzzling, when they have had all the cards stacked for them.Seems pretty interesting that Germany and Japan still kept robust high quality manufacturing in their countries. — synthesis -

How The Insurrection Attempt of January 6 Might Have Succeeded

The Trump crowd hadn't been violent before. And of course, Trump didn't respond to the riot, obviously, but just looked at how events unfolded. Simple as that, actually.And yet it happened. I suspect it happened, not because the apparatus wasn't looking, but because so many within it "stood back and stood by" while it happened. — James Riley

And most of those 81 million weren't rioting in the streets last summer either. They stayed home too.Most of those 74m were smarter and stayed home. It doesn't take a whole lot to be smarter than Trump, or to have more courage. — James Riley

Well, you go with the polarization of your country then, if you want. I've lost hope that Americans could be capable of consensus or calming down and doing away with the polarization. If a pandemic cannot get Americans together, what could do that? Think of your fellow citizens as the enemy then, if you like it. Some seen to do so.I refuse to cede that ground to them. I think they pick and choose which mob and which cop will get their interest or alienation. — James Riley -

Is Totalitarianism or Economic Collapse Coming?

I think many did care. This isn't a thing that is new as globalization, which outsourcing is part of, and technological advancement are phenomena that are quite old. Have started in earnest in the 19th Century.Tens of millions of people had their jobs outsourced over the past decades and nobody cared...until Trump came along. — synthesis

Globalization creates winners and also losers. The majority of people have been winners and that's why globalization has endured. Trump or populism in general is a logical outcome when far too little emphasis is given to those who have not prospered from globalization.

The unfortunate truth is that putting up trade barriers doesn't make us better, it makes things worse in the long run. Post-colonial Africa is an example of that. -

How The Insurrection Attempt of January 6 Might Have Succeeded

More courage and less brains? Hmm.We just need to make sure law enforcement is keeping tabs on his followers, just in case someone with more courage and less brains than Trump decides to attack the Union. — James Riley

If you look at the reality, the American security apparatus has kept tabs on every kind of domestic group there is that can possible adhere to violence, from right-wing militias to animal rights activists and everything in between. I'm sure both the events of last year and of last January have increased emphasis on domestic terrorism in many departments.

And of course, let's not forget that it was a vote of 81 million to 74 million, so the smartest thing isn't to call those 74 million followers that have to be kept tabs on.

Yet the real issue is that Trump truly performed a huge train wreck during the last days of his Presidency, and this really has likely had a lot of consequences. Nothing alienates conservatives and authoritarian right-wingers more than mob attacking and killing policemen. -

Is Totalitarianism or Economic Collapse Coming?Yes, I believe totalitarianism is coming, but not total totalitarianism. — god must be atheist

What I think we have is more self censorship and people believing that the society is far more totalitarian than it is. And of course, few know what actual totalitarianism feels like as they are few totalitarian societies out there now. What they fear they will get messages like this or something similar:

-

How The Insurrection Attempt of January 6 Might Have Succeeded

And what actually comes of the Trump brand? You see, the era of social media has made us even more short sighted than ever. We lose focus even more quicker than before. People might remember the Tea Party or the Occupy Wall Street movement, but do the follow these movements now? Are they making the waves here? The next Presidential election is years ahead.Who could be the heir apparent? Who has Trump's faith in the brand? He is the brand, and he rose to that position because of a narcissism that has been refined down to a level so pure that it has rarely (if ever) been seen in the annals of man. — James Riley

Trump's comeback on social media might take a bit time:

(CNN, March 31st, 2021)The former president will return to social media in two to three months on his own platform, according to Jason Miller, a long-time Trump adviser and spokesperson for the president's 2020 campaign. The new platform will attract "tens of millions" of new users and "completely redefine the game," Miller added.

Let's see how completely it "redefines the game"... -

Should we follow "Miller's Law" on this Forum?Failure to to apply it is pretty rampant here, as with most everywhere. — Pfhorrest

Be it called Miller's Law or principle of charity isn't so important. And also for those of us who have been here for years, every thread, especially started by someone new, ought to be approached as if you yourself were talking about it for the first time and explain your reasoning clearly. -

How The Insurrection Attempt of January 6 Might Have Succeeded

Donald Jr or anybody of Trump's family has his or her chance if daddy isn't around anymore. You see, it is still Trump himself that has the delusional ideas that he can win again the GOP nomination and win again the Presidency. However the thing is that the media isn't anymore fixated in him. When has Trump been news lately? When is the last time he has said something that has gotten everybody commenting it?It needs to be one of the blood-line. The blood of the prince has power over the ppl like nothing else. If his dad wasn’t bold enough, Donald Jr might be. What is he doing right now? Do you think he isn’t salivating over wet-dreams of 2024? — Todd Martin

I think it might be a totally different kind of person that overthrows the Constitution, if that happens. An American version of Vladimir Putin, the no-nonsense leader who doesn't take bullshit and the masses love him and the liberals just whine about something bogus like "overthrowing the Constitution".

It really still is hypothetical. But then again, remember how delusional and afraid people were after 9/11? And let's think about it if every major city in the US started to look and feel like Portland? Have enough polarization, ineffiecient governance, violence and riots and then people might in the end be too tired just about everything. In that kind of situation to say that emergency powers are there to protect the Constitution might sound totally logical and correct to enough people.Another consideration is, the "top brass" aren't as on top as they might like to think. And the troops aren't inclined to follow all orders. There is a limit. That limit would be found had the top brass followed Tump. But again, it's all academic, because the top brass wouldn't do that. — James Riley

Luckily the US isn't there yet. And so isn't the armed forces either:

-

How The Insurrection Attempt of January 6 Might Have Succeeded

Let's remember that Trump was in charge of the executive branch and the commander of the military, hence this would have been a self-coup.For, to his own detriment, he was not a martially-minded man, not willing to put himself into the fray, too protective of his life and person to risk putting his neck out there. Only witness his opinion of the “suckers” that died at Normandy. — Todd Martin

Donald Trump lives is to be at heart a media personality, who absolutely enjoys the idol worship by his supporters. And that's what this extremely narcissistic person wants, not much else (and of course more money). He doesn't have a zeal and a mission like dictators usually do. He simply isn't a man that would make a coup, or in this case a self-coup.

The scary thing is that there were people who indeed were totally capable of going through this and would have committed. Forget the MyPillow-guy, general Flynn, ex-national security advisor and ex-leader of an intelligence service pardoned by Trump advised Trump to use the military and would be a person that would have gone through with a self-coup. He (Flynn) likely totally understood that there was no turning back once committed, either you get all the power or you go to jail for the rest of your life. That incentive, either everything or prison (or death) is a mighty incentive for people once committed to not turn back at anything. People can in this kind of situation start to believe in their own lies.

(The pardoned Flynn would have been a loyal Trump man, who could have pulled a coup off.)

(How about Giuliani as the Attorney General or leading the election fraud investigation, that might go on for years.)

The obvious obstacle was the military. It repeatedly, and this Americans want to forget, repeatedly had to officially announce that it would do nothing and that the US military protected the constitution. Hence the Trump administration would had have to fire a lot of generals until they would have gotten military servicemen that thought that "protecting the constitution" would mean to halt the election process.

(These guys would have been an obstacle for Trump, but perhaps others...)

But Trump is no Hitler, no Stalin, nobody that can truly lead people to go through with a self-coup. He surely would have had the support at least to make it seem popular. Just think about the reaction of the crowd at January 6th if military or secret service personnel would have detained Democrat politicians and brought them out in handcuffs charged with election fraud to the crowd. The Trump mob would have been ecstatic. The hallucination that this was all done to protect the Constitution would have spread like wildfire. And, unfortunately as the vast majority of people are fearful and just want to mind their own business, it could have easily gone through. The counter protest would have naturally sprang up everywhere and naturally the police would do what the police does when demonstration without permit happen. And with an instant, I believe that a huge number of people, many also here at PF, would have assumed that the police, military and the establishment are all behind the Trump self-coup and would hurl their vitriol at any government official they see. Their inability to see that the vast majority of the government would not be on the side of the Trump putsch would be beneficial for the coup plotters. Then the counter protests would be the reason for curfews, lock downs etc. which people already are used to thanks to the coronavirus. Knowing the polarization in the US, any kind of large passive resistance and an widespread consensus that this is a coup would not have been reached. In fact, Americans would have been at each others throat even more viciously than now: the anti-Trumpists would be full of hatred against anyone that had voted for Trump, which would simply pushed a lot of Americans being in favor of Trump's actions.

The ugliest thing is that the World would have adapted to the new situation. A lot of Americans would have just minded their own business. The coup plotters would think that they would truly be on a mission to protect the Constitution. Other countries would just express their concern about the situation, but do nothing. We'd hope that the US would find it's way again back from these troubled times. That's it. Life goes on.

But Trump was not that man, in reality, so this is very hypothetical.

His popularity gets people to attach to him like flies to push their own agenda. Trump simply isn't a man that would have the ability and the balls to go through with something like overthrowing the Constitution. The real issue is that there does exist those, who could go through, if they would get into power. -

The Poverty Of Expertise

I think nearly all, if not all, of those car manufacturers above listed manufactured cars prior to WW2 with Skoda being the most famous...a rare car in that it was exported to the West during the Cold War. But anyway.. They made another car, forgot the name, even before the second world war. — god must be atheist

Many times people do bring up Czechoslovakia or East-Germany as "the better" examples, yet it is quite obvious how much better things would have been if it hadn't been for the Soviet system of marxism-leninism. The fact that we had West- and East-Germany and today still have North- and South Korea and China and Taiwan make the obvious comparison that shows what works and what doesn't.

The fact is that now we have a young generation for whom the Soviet era and it's authoritarian system is forgotten history, hence the same rhetoric used during the Cold War can be recycled from the past. With ignorance of the reality a romantic picture can be painted, which doesn't make it look so bad, but rather interesting. As of course, not all socialist regimes were like the Red Khmer in Cambodia. And history in the West doesn't bother to look critically at the system during the Soviet era. It's not a trendy subject. -

The Poverty Of Expertise

?But the oppression by governments in Eastern Europe was still a system that provided a heavenly existence to the largest segment of the population IN COMPARISON with the pre-war and turn-of the century conditions. — god must be atheist

The Czechs didn't have it so bad. And the Austro-Hungarian Empire wasn't so backward as let's say Russia. What I remember is that the country (Czechoslovakia) was a democracy and a prosperous industrialized country after it's independence. And they did have cars, they even made them back then. Tanks too! And my country's southern neighbor Estonia would likely be far more wealthier than my country today if they wouldn't have "joined" the Workers Paradise. It's catching up very quickly.

-

Does Labor Really Create All Wealth?The obvious example of technology increasing population growth is of course the emergence modern medicine. When fewer infants and children die, it's obvious that you have a growth in population. And when technology creates the ability to feed more people through the agricultural revolution, things like famines don't happen. Yet the decision how much children to have is a different social issue.

Otherwise, technological advancement and increased prosperity means usually that population growth decreases: well off people have less children. Children aren't there to take care of you at old age and not there to work on the field.

I think this is a bit backward. The industrial revolution meant more jobs in new industries, which had higher wages for those working on the fields in the countryside. If factories are built and operate means that there have been enough people with the needed skills in the job market already. Population growth and demographic transitions take a long time.The industrial revolution required many new workers drawn from somewhere--hence an increase in the population. — Bitter Crank

Mali can have a large growing young population, but no semiconductor plants will spring up there as simply there aren't enough skilled people in the workforce to operate a semiconductor plant. If there would be with such a workforce with low African salary levels there, manufacturers would be in a frenzy to shift their production to Mali. Yet something like making clothes might something that the population could do (yet unfortunately the country is landlocked with minimal infrastructure). This is why textile industry is typically the first industry to start the industrial revolution from an agrarian country to an industrial country.

(Scotsman James Finlayson built a textile factory in Tampere, Finland in 1820. It became at one time the largest textile manufacturing plant in the Nordic countries, if I remember correctly. Reason: very cheap labour, cheapest in the Nordic countries, even if part of Russia back then.)

-

Economic slow down due to Covid-19 good?

True. At least Trump didn't go to war.Certainly, the last far-right winger to hold office (Trump) being truly derelict in his duty of public safety, by downplaying the pandemic and covering-up the medical science associated with same, ( recommending/suggesting the ingesting of bleach, not wearing masks, downplaying its impacts/being over as soon as it gets warm, ad nauseum), was there any sense of "communal resolve" and "political unity" in lying to the American tax payer about this? — 3017amen

What he did was to send some cruise missiles to Syria and killed an Iranian general, to which Iran responded by firing missiles at US bases... and Trump didn't retaliate about that. And was keen to withdraw troops. Which btw. Biden has rejected to withdraw now. -

Does Labor Really Create All Wealth?Well, if labor creates all wealth, the guy who taps the computer at the central bank and creates a few billion dollars with a few keystrokes must be the most laborious.

-

Does Labor Really Create All Wealth?

?All wealth? Goldman Sachs doesn't create wealth? — frank

This is about Marxist theory.

Not about reali... hm, better leave it to that. -

CoronavirusIt seems that even if the WHO made the investigation jointly with China about the Covid outbreak and was very diplomatic, some things that the UN agency has stated does raise an eyebrow:

The head of the World Health Organization, the U.S. government and 13 other countries on Tuesday voiced frustration with the level of access China granted an international mission to Wuhan — a striking and unusually public rebuke.

WHO Director General Tedros Adhanom Ghebreyesus said in a briefing to member states on Tuesday that he expected “future collaborative studies to include more timely and comprehensive data sharing” — the most pointed comments to date from an agency that has been solicitous to China through most of the pandemic.

He said there is a particular need for a “full analysis” of the role of animal markets in Wuhan and that the report did not conduct an “extensive enough” assessment of the possibility the virus was introduced to humans through a laboratory incident.

Even if the WHO report does state what China wants to hear, that a leak from the Wuhan lab does not warrant further investigation, this possibility hasn't gone away, even if at first was aggressively shouted down. Quite credible people thinking about the possibility, lastly a former head of the CDC Director Robert Redfield:

don't believe this somehow came from a bat to a human," he said. Usually, it takes awhile to become more efficient in human-to-human transmission.

"I just don't think this makes biological sense," said Redfield, a virologist.

The most likely etiology is the virus escaped from a lab, he said. It's not unusual for respiratory pathogens to infect laboratory workers. Redfield said he was not implying any intentionality to the escape of the virus.

Of course this possibility, the lab-leak hypothesis, from a highest level of biosafety BSL-4 laboratory at Wuhan, which had bats and had studied SARS corona viruses and was the first of it's kind in China, doesn't seem so far fetched. Yet it's politically, both domestically and internationally, the worst kind of scandal that nearly any government would want to hide. Hence I think the Chinese will deny it as it tried to downplay first the whole outbreak from the start, even if the hypothesis would be true.

-

Logicizing randomnessThere seems to me something infinite about randomness. — Gregory

Think about it the other way around. What is the opposite of randomness? Something that repeats itself somehow, that has a pattern. How can you know that something doesn't have a pattern? One hypothetical way looking at it would be to go to infinity and see that there is no pattern and the mathematical object is truly unique, which one obviously cannot do. Hence I think the Algorithmic Information Theory is a very good way to understand the complexity of the issue. -

Pornification: how bad is it?

Generalization of it being good or bad isn't the best way to think of this. Far better is to make more specific questions about it. There are negative aspects to it and porn is a sad industry, yet how the society deals with pornography differs. Banning it isn't a good idea, just as the idea of prohibition of the use alcohol or drugs is bad, even if their use has far more obvious negative impacts and there is far more justification for the prohibition of the recreational use of them.but do you think the good outweighs the bad? Because I honestly don't know — TaySan

Is it good or bad depends quite a lot on the society and how the society deals with sexuality in general. I've noticed that the most conservative and non-permissive societies where porn is totally banned can have also the most serious sexual harassment and there women and girls are treated as sexual objects even more. It's not a simple question, just like violence in movies, games etc. don't simply make us or our society more violent: kids that have just played first person shooter games for all of their childhood and not exercised outside make lousy soldiers. -

Joe Biden (+General Biden/Harris Administration)Ok,

Seeing that the excitement of having the new administration has worn off.

That took, uh... two months. I'll think the anti-Trump crowd will be on the streets demonstrating against this administration in two months or so. For some reason that is bound to happen. (Of course the protests in places like Portland never stopped, but who in the media cares about that.)

In spring it's warmer and nicer to protest. -

Pornification: how bad is it?As with so many issues, such things are complex in a society and have both good and bad sides to it.

-

Something that I have noticed about these mass shootings in the U.S.I think one positive thing is that it seems the media finally has understood not to focus on the shooter itself and especially not to publish any "declarations" a mass murderer would make. Similar thing ought to be done with terrorists, as especially with classical terrorism the primary goal is to get publicity. I think this is partly true with these suicides with mass shooting.

-

Abstractions of Gödel IncompletenessThanks for correcting me, and . Learn bit more every day. Yet of course, in math something important can be said in many ways.

-

Abstractions of Gödel IncompletenessI think that what you say is the diagonal argument. A REAL NUMBER that is NOT on that list. That's the negative part. And how do we get that real number? From the list itself.

That's the reference part. -

Abstractions of Gödel Incompleteness

What?Cantor's proof is not a reductio ad absurdum. — TonesInDeepFreeze

Cantor's diagonal argument is a reductio ad absurdum proof. The link to incompleteness results should be obvious.

The diagonal argument was not Cantor's first proof of the uncountability of the real numbers, which appeared in 1874. However, it demonstrates a general technique that has since been used in a wide range of proofs, including the first of Gödel's incompleteness theorems and Turing's answer to the Entscheidungsproblem. -

Abstractions of Gödel Incompleteness

Yes, you got the point exactly. I would say that the issue has more than just a superficial relation, but that is just my personal view about the subject.As Nash demonstrated fixed-point theory is useful in game theory. Brouwer's fixed-point theorem was proven indirectly, with no simple path to its value, and this distressed Brouwer, who later turned to intuitionism. Proving a math object exists indirectly, but without a process for its construction, is still proving a theorem. This sort of thing has a superficial relation to Godel's works, but I don't think it's what he had in mind. Others here, with more knowledge of the matter can correct me if I'm in error. — jgill

Perhaps it is a far more simple issue and has less to do with Gödel, but this is exactly where Oskar Morgenstern saw a problem in economic forecasting in the American Journal of Economics in the 1930's. And I have forgotten which Nobel-laureate responded to him back then 1930's that Morgenstern is wrong while there is obviously is a correct solution: because fixed point theorem proves that there exists a correct solution. Yet the whole problem is that an indirect proof, a reductio ad absurdum proof leaves things unanswered.

The most simple example (well, how simple it is remains questionable) is with Cantor's proof that there are more reals than natural numbers. The issue here is that the reductio ad absurdum proof uses negative self reference. And then we are left with the Continuum Hypothesis being unanswered. In my view, with real numbers our finite mathematical system that starts from counting natural numbers gets into some foundational problems.

I wrote some time ago in PF that our understanding of mathematics has started from a necessity, from counting and thus we lay the foundations of math to natural numbers and counting. Hence it is a bit hard to add into the picture the uncomputable / uncountable afterwards. Counting and the number system should rather be seen as part of mathematics, a very natural and obvious part, which is possible to use in nearly every part of mathematics, but not with everything and especially not being a foundation. Logic in my view should be the foundation for math. It might be that it is the historical foundation of math, but not perhaps the logical foundation of mathematics. -

Abstractions of Gödel IncompletenessBut the fact remains that math people not in those areas are usually not very concerned, even if they are stumped in proving something. However, I haven't been around mathematicians for a long time and I could be mistaken. — jgill

I think that the incompleteness results have an effect on a wide range of things not just in the set theoretic realm and with the foundations of mathematics. We just don't want to make or are ignorant about the link to the incompleteness results.

I think the classic example of something being true but unprovable is a game theoretic situation where it's easy to show that a correct solution exists, yet there seems to be no way to get there. The existence of a correct solution can be shown...based on mathematics. Yet then how to get there seems impossible, actually illogical. Hence for example in economics these problem are dealt with taking the approach of there being a "black box" where "something happens" and the correct result is reached. Great! The economist has his function (with the black box) and can say that the issue has been modelled. But then opening up the black box cannot be done. Which basically is sophistry, but it goes with the remark "this is hopefully resolved later".

Why I say that these problems are similar to the incompleteness results is because in many of these cases there is the negative self-reference that similarly is in use in Gödel theorem and in the Halting Problem of Turing.

Mathematicians are far more rigorous. They cannot just assume something will work. Or, as the joke goes, they can have everything work and get every kind of result they want when 0=1. But that is hardly useful. -

Does Anybody In The West Still Want To Be Free?

Uh actually.... I think you don't know Finnish history. The story during WW2 and later being non-aligned, not in NATO, never getting the Marshal aid. And no Liberation-Day / VE-Day for us in WW2, thankfully!Fortunately for many of the smaller countries around the world, me and my closest 340M neighbors have been paying to keep you guys free so you can fully enjoy your associations, etc.. I would suppose that Finland would be part of Russia at this point had the U.S. not been prodding that bear with nuclear pokers. — synthesis

Yep, you've never heard of the Winter War between Finland and Soviet Union, I presume.If Finland had to defend itself (which it could never do), then you would see more clearly the negative aspect of these groups. I will always maintain that groups are designed by the few in their own interests. Otherwise, why would they exist? — synthesis

But we surely know that we are expendable and nobody would give a rats ass about us, if it wasn't for ourselves. -

Abstractions of Gödel Incompleteness

In my view Gödel's incompleteness theorems, as the other incompleteness results, aren't roadblocks.It has the respect of most in the math community, but most of those think they will never come up against that roadblock. — jgill

The problem is that many view them as like that: hoping that they wouldn't find them in front of them. I think that they, the results I mean, just show that a crucial logical part in our understanding of the foundations of mathematics isn't understood yet. Obviously from our system of natural numbers doesn't come everything in mathematics, that is plain obvious.

I think the problem is that Gödel's theorem is far too complicated and specific to show just where the real problem lies on. People simply fall into the complexities of Gödel numbering etc. I'd prefer something as simple as the diagonalization in Cantor's diagonal argument: the negative self reference. I think there lies the key problem: with negative self reference we get either paradoxes or true but unprovable mathematical objects. -

Does Anybody In The West Still Want To Be Free?

Smaller makes it's far more easier to have that feeling of togetherness, social cohesion and to have that "direct democracy". This can be seen from the fact that many tiny countries are ruled de facto by monarchs still. For example Monaco has the executive branch of the state directly under control of the Monarch. Yet as there are less than 40 000 people in Monaco of whom only a fifth are native Monégasque, it is easy for people to directly talk to the ruler. Yet when you have countries with millions of people, that isn't a possibility and hence the link to politicians is quite far. Think about it this way: if you are an American, do you personally know some politicians, Congress members or higher ranking people in the Democratic or Republican party? In a country of 340 million people those 535 voting members of Congress are quite rare.Not to reinforce the notion that Americans know little about what happens outside of the U.S., but Finland is one country of which I am not so familiar. It would seem that smaller countries would have many advantages. — synthesis

On the other hand, staunch individualism can result in the resentment of groups altogether and people believing that any form of collectivism or collective idea is bad. Yet it isn't so. Social cohesion is extremely important in a society and the feeling that one ought to do one's share.I am a staunch individualist because I believe it is the nature of groups is to self-corrupt, the larger the group, the more potential for corruption (much larger payoffs). — synthesis

I think that Americans just locker these issues in a different way: if they are distrustful of collective issues and emphasize the role of the individual, yet they do actively go to church and are active in charity. On the other hand here in Finland the Finns just love associations of all types. A joke is that if Finns go anywhere in the World, the first thing they will do is build a sauna. The second thing they will do is form an association. I think it's crucial for any republic that it's citizens are active and do participate in collective matters in some form or another and not only voting in the rare election once in a while. -

Abstractions of Gödel Incompleteness

Incompleteness theorems.There are lots of people who think Godel's undecidable theorems are applicable to practically anything they can think of - and they're not. — tim wood

Even if there are the obvious nonsense (just think how much nonsense there is about quantum physics etc), I think there are vast more of those mathematicians who push the theorem to the sidelines close to the border of logic and logical inquiry and insist that it has nothing to do with anything else in the field of math than what the theorems state. It's just an oddity and no reason to think just what those Gödel numbers would be. I think many of these don't even see any link to Turing's Halting problem or with other incompleteness results.

ssu

Start FollowingSend a Message

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum