-

Ukraine CrisisHow is NATO going to be secure by essentially degrading European-Russian relations and remilitarizing Russia while DEmilitarizing Europe?

But hey, folks like Kasja get to play pretend with the big boys in Washington, so all is well. — Tzeentch

Exactly. :up:

You explained pretty well what I defended with arguments in my latest posts, but some users just do not see or call you 'pro-Russian' if you have a more eclectic idea or opinion on this conflict.

It is obvious that the conflict will be perpetual if the Western world is obsessed with disapproving Russia in literally everything. I even posted my full opposition to all of those universities which are ready to block Russian culture, - I was called 'Pro-Putin' for just defending Dostoevsky... *sigh*

I only see a reliable ending, with good faith if both sides have mutual respect. I expect a similar effort from European states, and I even feel very ashamed of this situation, to be honest.

For me, it is clear that Washington is so interested in degrading Russia and pushing EU members against them. A terrible situation for both Europeans and Russians, but not for Americans. Yikes! -

Who owns the land?Good points, ssu.

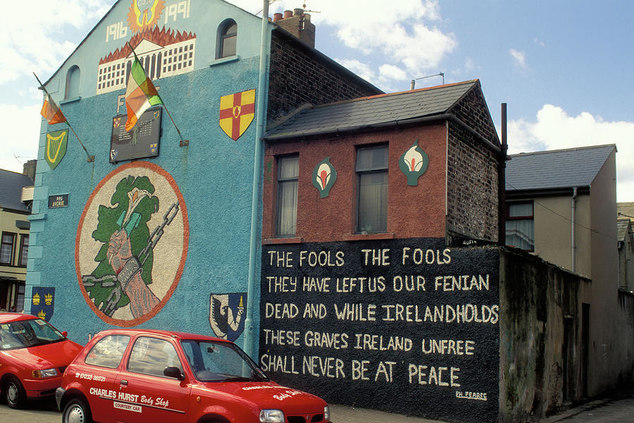

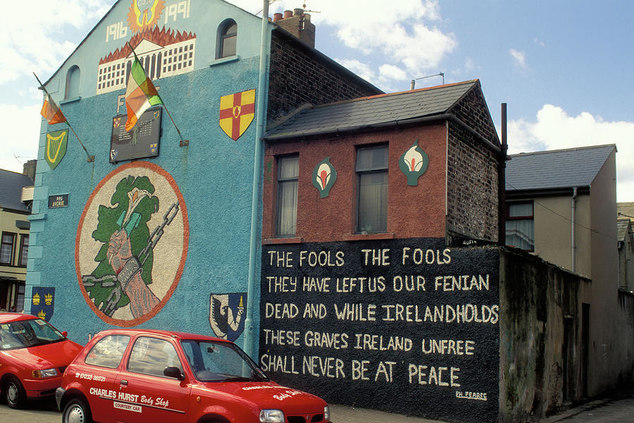

I agree that the Irish government doesn't seem to be interested in dealing with Unionists. But, if the separation of Ulster was a possible way, I think both governments would have had their conversations and treaties, as well as they did in the 1990s with the aim of stopping the conflict. It is important to consider that both sides have mutual respect, so I guess that a solution should be found sooner or later. I am not seeing it 'impossible', not like the difficult between Armenia and Azerbaijan, for example.

On the other hand, since when police officers - or public workers in overall - have been covered by the government? It will be a difficult situation, but with some differences, because the new generations of N. Ireland haven't been raised at the core of the conflict. They are the sons and daughters of the 1998 Belfast agreement. I don't think they would be as violent as their parents or grandparents.

Secondly, Northern Ireland is the poorest part of the UK. And the Irish enjoy a higher GDP per capita than the UK. Hence Northern Ireland will be a huge drain of welfare payments from Ireland. — ssu

I didn't know this. I understand your point, and yes, maybe Ireland is not really interested in the utopian union with N. Ireland due to financial matters, - apart from the rest of the social problems we both mentioned previously - -

Who owns the land?But is there anything about the N. Ireland situation that could be generalized and used to resolve the Ukraine situation? — EricH

It is a good, intelligent question. I wish I had precise arguments to answer your question, but I will give a try using the data and knowledge that I have.

It is very complex to juxtapose the N. Ireland conflict with the Ukraine-Russia war. The first conflict had religious implications - Protestants vs Catholics - while Ukrainians and Russians share the same religion, orthodox. On the other hand, this was just an isle conflict, where the international arena was not interested enough because the conflict didn't have implications in other regions.

But, above all those characteristics, it is important to highlight the fact that the parties ended with the conclusion that both sides had to win, sooner or later. Despite the conflict, the representatives of each side understood the interests of the other.

The Good Friday Agreement says: The Agreement created a new power-sharing arrangement, including an Executive and Assembly, and was based on a series of fundamental principles including: the parity of esteem of both communities the principle of consent underpinning Northern Ireland’s constitutional status the birthright of the people of Northern Ireland to identify and be accepted as British or Irish, or both, and to hold both British and Irish citizenship The Belfast Agreement

As you can see, there was mutual respect. The only way to achieve peace, honestly. But, regarding the Ukrainian-Russian war, I do not see an ending if one of the sides ends up devastated. This is a war on destroying others. Nobody seems really interested in reaching peace like the representatives of Sein Feinn and the Unionists back in the 1990's. -

Who owns the land?Well, morally speaking, the UK betrayed Northern Ireland because of Brexit. They knew it was a sensitive problem to face if the referendum succeeded, but London didn't care. Afterwards, the divisional line between Belfast and Dublin was clearer and the problem arose again because of fees and financial matters. Yes, I am aware that some agreements have been reached. Yet, I think it will be interesting to make an enquiry into Northern Irish people and see what they think or feel. Most of the seats of the North Irish chamber are pro-European basically. So, this could only mean that they feel pro-Ireland.

It seems to me that, in terms of culture and values, they feel more attached to Ireland than ever... -

Ukraine CrisisWell then, fuck you! — tim wood

:up:

And the real question is, who are you, that you offer up such nonsense? Either very confused, or a sorry excuse for a man, or just a troll. I infer you're smart enough to be just a troll. But that, in the final analysis, is not very smart at all. — tim wood

My name is Javier Miranda Jiménez. I am a 26-year-old Spanish citizen in Madrid. My aim is to defend free of speech and European borders and identity. I am 'pro': Habsburg Kingdom; Russian Tsars; Prussia; Otto von Bismarck; Dutch monarchy; Swedish monarchy; Danish monarchy; Norwegian monarchy; Austro-Hungarian Empire; Greek monarchy the Kingdom of Romania and the Kingdom of Bulgaria.

I do not recognise: 'Catalunya', 'Ukranian Crimea', 'Kosovo', 'Moldova', 'Macedonia' and the rest of artificial entities which were born recently.

If that's to be a 'troll' for you, OK. What can I do? I will not change my inner values and ideas.

I will leave this thread for a while, it is becoming boring to me. See you sooner or later, with the international recognition of Russian sovereignty in Crimea, mate! :smile:

-

Who owns the land?Interesting thread. Thanks for bringing it back. :up:

But seriously, would Ireland really want North Ireland? All those loyalist paramilitaries that would be a pain in the ass if Northern Ireland became part of Ireland. And if the UK would brush aside North Ireland, then no worries about "The time of Troubles" coming ever back. The UK would be a far happier place. — ssu

ssu, of course, Ireland wants Ulster back to theirs. The unification of all the island has been one of the 'undone' tasks since 1922 when the Irish got independence from the UK. As well as I have provided arguments about Russia, I would say the same in favour of the Irish people. It is obvious that Ulster is both culturally and politically 'Gaelic'.

@EricH said that at least they are not chucking missiles at each other. They are both members of NATO, and civilised countries which prefer to resolve the conflicts diplomatically.

On the other hand, the Unionist are a small number if we compare them with the Sinn Féin. The number of seats in the Northern Ireland Assembly is 90. 27 of them are covered by the Sinn Féin, plus 'Social Democratic and Labour Party', which are republicans (8 seats). And, 'Alliance Party of Northern Ireland' which are pro-european and leftists (17 seats).

The 1998 Belfast agreement said: that the majority of the people of Northern Ireland wished to remain a part of the United Kingdom;

that a substantial section of the people of Northern Ireland, and the majority of the people of the island of Ireland, wished to bring about a united Ireland.

What is the situation 25 years later? On current trends, Northern Ireland will leave the Union 'The figures instead indicate that the liberals from Protestant backgrounds who helped deliver the region’s 56% vote for Remain had already identified as Irish or Northern Irish rather than British.'

It is a question of identity!

-

Ukraine CrisisI agree, but I personally wonder what would happen if Catalunya gets the independence of us finally. I guess there will be a lot of hypocrisy: If the world considers it reliable for an autonomous region to make its own nation without the back-up of Spaniards, but at the same time denying Russia's sovereignty in Crimea... I will give up politics and diplomacy forever.

-

Ukraine CrisisI see no further conversation if you don't see how those treaties were written to diminish the influence of Russia. Points taken, and thanks for debating with me, but I will not waste more time on someone who is not more neutral and only sees a reliable way: the destruction of Russia. Mate, this will not happen. You guys also tried the same plan in China, and the efforts ended up in nothing. You are obsessed with countries which do not act as they are supposed to do.

-

Ukraine CrisisAnd so? And how, exactly is he selfish? In what does his selfishness inhere? — tim wood

He is selfish because we all have to waste our resources and time on an impossible project. Many people - including you - claims that they could be more developed if they were not part of the Russian presence. Well, this is a lie. Ukraine is far from being a socially responsible country. Come on, dude... They do not even respect gay marriage. Is Russia responsible for this too?

is Ukraine independent of Russia, yes or no, what say you? Yes? Or no? — tim wood

I do not know. What does the White House say?

Yours is the language of disingenuity, deflection, denial, misdirection, disinformation, misinformation - hardly a good look for a philosophy forum! — tim wood

You can flag my posts if you want to, and let the moderators decide. Nonetheless, I am aware that I am speaking the truth when you guys accuse me of being denial and spreading disinformation. What a classic, I already received this kind of commentaries in 'Donald Trump' thread...

We are under no obligation to respect that which is not entitled to respect. And as the thing in question be disrespectable, we may be under even other obligations. — tim wood

Oh really? According to you, we should not respect the Russian constitution because its damn 65th article says that the Russian Federation extends to Sevastopol. Yet, at the same time, our governments promote businesses in countries whose constitutions allow them to hit women, such as Morocco or Qatar. Aren't you tired of this Western hypocrisy? -

Ukraine CrisisCan you provide the exact quote where I state that? — Jabberwock

I said: I think you do not understand how the Soviet Union used to work. Between 1917 and 1991, Ukraine and Russia didn't exist at all. They were the Soviet Union altogether, a single and unique nation.

You said: I understand perfectly well how the Soviet Union worked - mostly Russians forced other nations under its boot, militarily, like with the Baltics, or by other means, like Holodomor in Ukraine. And no, being in one state does not make them one nation, which even the legislation of the USSR confirmed. https://thephilosophyforum.com/discussion/comment/842651

On the other hand, I personally think that if you want to understand my position, you have to stay away from the Western media more often. I know that there were hundreds of treaties where countries or states lost part of their territory because of losing a war or other issues. Nonetheless, most of those treaties always abused the position of the loser. This was one of the main causes of the ascence of Hitler. Does Alsace-Lorraine ring a bell to you?

When the Soviet Union split apart in different nations, the Western world saw it as a good opportunity to make the Russian position weaker. Divide and you will win, you know. And having Yeltsein as President was a terrible mistake because he didn't have respect for others, making Russia's position like a circus.

The Alma-Ata protocol means nothing to me and to Putin either - as much as the USA regarding international criminal court ha! - If Russia hadn't signed the treaty or protocol, the Western media would say: Oh wow look at them, they are not a democracy and bla, bla. It is obvious that sooner or later this conflict will arise because the Western world never respected the soul of Russia. It is a clear threat to put NATO headquarters closer to Ukraine or even allow this country to join the group. Would you feel safe if Russia put their navy next to your coast?

If Empire Russia never recognised the independence of Latin American countries, why do we have to recognise Ukraine's sovereignty in Crimea? Because the USA goes mad and blocks us financially? By the way, why cannot the Europeans act as neutral countries instead of being enemies of Russia? These are the questions you should wonder about, and stop wondering about Crimea, because it is clear that - at least for those who are not influenced by CNN or BBC - it will be part of Russia. I bet they will remain as part of theirs! -

Ukraine CrisisWhy do my arguments make nonsense? For me, the only senseless side of this conflict is Zelensky's selfishness. He is asking for a lot of things, more than the average Ukrainian citizen has ever dreamed of. You claim they deserve to be considered independent of Russia, but paradoxically, they are ready to join another establishment full of rules: NATO. Frankly, we are not talking about Japan or South Korea, Ukraine is very poor, and their system is broken, so they would need the support of the rest of the world endlessly.

On the other hand, we have to respect another nation's constitution, with the aim of getting reciprocal respect. I cannot gain your trust in me if I do not respect your system firstly. -

Ukraine CrisisAs to the Russian Constitution, the way I'm understanding what you're claiming is that because the Russian Constitution says something, we're all obliged to respect it. Is that it? — tim wood

Of course, we have to respect the Constitution of each nation. Some are well done and written, and others don't. I am not claiming that the Russian constitution is perfect, but admitting that I am not anyone to say their law and jurisdiction is rubbish. It is easy to blame them for everything related to injustice and corrupt judges. But can you name one country whose judges and laws work perfectly?

Is Ukraine a separate independent country? — tim wood

There are no separate nor independent countries, mate. You are part of the block of the Western world, the European Union and NATO or you are part of the Russia/China spectrum. It seems that Ukraine decided to be part of the first group, but I wonder what kind of freedom they are looking for. -

Ukraine CrisisSo it was not something that 'Ukraine said in bad faith', that is what Russia internationally and legally confirmed and which the international community, the UN included, recognizes. — Jabberwock

Boris Yeltsein's Russia and not the modern Russia as we know nowadays. This is the point I want to defend at all costs. I doubt that Russia signed those treaties freely and Ukraine is a poor beautiful bunny surrounded by evil. I must admit that I am wrong when I said 'for centuries', but 174 years is a long duration for me. It is true that they transferred the administration to the 'Supreme Soviet of the Ukrainian Soviet Socialist Republic'

Nonetheless, Ukraine didn't exist as a nation yet. The Russians shared the management of Crimea with good faith and when the Soviet Union split apart, the Ukrainians thought that there was a unique opportunity to take Crimea. It is not my problem if you can't see it, but I would use an example: imagine you giving me your house as a lease, but recognising that you are the owner, while I just manage your house. The years pass by, and then I decide to take your home because one day 'you transferred me the possession'

But that is exactly what I am writing about: it was never 'one nation', as you claim, it was a federation of republics ruled by Russians, often more like colonies. — Jabberwock

Don't be dishonest. You never claimed that it was a federation of republics. You stated that Ukraine already existed, which not.

Status: Satellite state of the Russian SFSR (1919–1922); Union Republic of the Soviet Union (1922–1991). Also, the 1977 Soviet Constitution says: Article 75. The territory of the Union of Soviet Socialist Republics is a single entity and comprises the territories of the Union Republics. -

Ukraine CrisisAnd no, being in one state does not make them one nation, which even the legislation of the USSR confirmed. — Jabberwock

The hell, no! You claim that I am not looking into reliable sources, I would say the same regarding you and your arguments...

The Soviet Union was nominally a federal union of fifteen national republics; in practice, both its government and its economy were highly centralized until its final years. It was a one-party state governed by the Communist Party of the Soviet Union, with the city of Moscow serving as its capital as well as that of its largest and most populous republic: the Russian SFSR.

Historian Matthew White wrote that it was an open secret that the country's federal structure was 'window dressing' for Russian dominance. For that reason, the people of the USSR were usually called 'Russians', not 'Soviets', since 'everyone knew who really ran the show.

We should consider only treaties that suit you and ignore all the others, is that correct? — Jabberwock

Mate, the point here is not whether the treaties fit me or not. I am showing you evidence of why Crimea belongs to Russia. I was not part of those treaties, but I think it is obvious that Crimea had belonged to Russia for centuries, and it was confirmed both internationally and legally. These facts are not undermined just because, in the Soviet Union, Crimea was managed by Ukranians. When the USSR fell, the Ukrainians proceeded with bad faith and said: 'Hey, if we managed Crimea for only 34 years - in comparison to Russia, which managed it for centuries - then it belongs to our artificial new nation.

No, the point is I do not agree with you, just like Russians would not agree with you that Germans have the right to Kaliningrad. — Jabberwock

Are you referring to Prussia, right? Another vast empire which took some territories as theirs as well. Does The Dollart ring a bell to you? The Netherlands and Germany do not agree on the exact course of the border through the bay.

Let's go and fund The Netherlands because of evil Germany... oh, this is childish. -

Ukraine CrisisYou should be aware that repeating the assertion does not prove it. Can you provide evidence that the treaties were forced? — Jabberwock

The evidence: https://books.google.es/books?id=i1C2MHgujb4C&pg=PA194&redir_esc=y#v=onepage&q&f=false

And whether you like it or not, Khrushchev gave it to Ukraine 1957, so formally it has been with Ukraine since that time. — Jabberwock

I think you do not understand how the Soviet Union used to work. Between 1917 and 1991, Ukraine and Russia didn't exist at all. They were the Soviet Union altogether, a single and unique nation. So, Khrushchev didn't give Crimea to Ukraine. I think he shared the management of the Oblast with other authorities far from Moscow. If Ukraine didn't exist until 1991 - or what we understand as Ukraine nowadays... - how was it possible to give a territory to a non-existing nation? It seems illogical to me.

Again, you seem to believe that only Russian conquests count. — Jabberwock

It does count because it is written and signed in the treaties, my mate.

Later that year, the Ottoman Empire signed an agreement with Russia that recognised the loss of Crimea and other territories that had been held by the Khanate. The agreement, signed on 28 December 1783, was negotiated by Russian diplomat Yakov Bulgakov. https://en.m.wikipedia.org/wiki/Annexation_of_the_Crimean_Khanate_by_the_Russian_Empire

But if they do get interested, they have every right to seize it, is that correct? — Jabberwock

You agree with me, then. Or... you just follow up the basic argument that 'Western countries can claim territories, but Russia doesn't.' -

Ukraine CrisisMost of the 1990s treaties signed by Russia were forced, or they didn't have a good back-up to Russia's interests or borders. Boris Yeltsein was obsessed with showing to the world that the Soviet Union had ended and Russia started to become a democratic/Liberal country. As I stated to ssu and Tim wood previously, Crimea has always been part of Russia, but the Ukrainians took it forcibly in 1997. So, the Russians got catfished in the new map of their borders.

You state that we should not give credit to Russian constitution, but why we have to do so regarding Ukrainian? It is funny how the Ukrainians expropiate Crimea from the Russians between 1992 and 1997, when that peninsula was part of Russian Empire for centuries. Frankly, the Ukranians acted with bad faith and Putin is taking back all that belong to Russia.

And what about Kaliningrad? Historically it was not part of Russia, can Germans just take it, provided they add it to their constitution after annexation? — Jabberwock

That's a different story. Don't mix up things. We are debating about Crimea. But, if you want to dive in, fine. Provide some data, at least...

[Kaliningrad]

In the context of the Seven Year War, all of East Prussia was conquered and partly occupied by the Russian Empire (1758–1762).Immanuel Kant is famous for having sworn allegiance to Empress Elizabeth of Russia.

The annexed territory was populated with Soviet citizens, mostly ethnic Russians but to a lesser extent also Ukrainians and Belarusians. What a paradise it seems!

In 2010, the German magazine Der Spiegel published a report claiming that Kaliningrad had been offered to Germany in 1990 (against payment). The offer was not seriously considered by the West German government which, at the time, saw reunification with East Germany as a higher priority.

Hmmm... It doesn't seem that the German authorities are as interested in Kaliningrad as Russians are as much in Crimea... -

Ukraine Crisis

1. A forced 'Memorandum' is not above a country's constitution.

2. Yeah, the 'existing borders', but these borders - specifically - have always been part of Russia, whether you like it or not, that's the truth. Maybe Luhansk and Donetsk are another different story. -

Ukraine CrisisI was expecting that you would have disrespected the Russian constitution because it does not 'fit' in your world. But, dude, it is a bloody constitution approved by the Duma back in 1993 - Putin was not even in cabinet yet - by the representatives of Russia. We cannot do this: an act of arrogance or debunk other people's constitution. You find not reliable how Russians include Crimea in article 65, while I see it as crazy how the American Constitution allows people to possess firearms. If we ever want to criticise others, we have to look at ourselves first. Another example: Spain allows the king to be 'sacrosanct' and he is above the law. Just another abnormality from the perfect Western world...

-

How do we know that communism if not socialism doesn't work?Thank you for your substantial reply, Hailey :up:

-

Ukraine CrisisWe have repeatedly said before that, according to our forecasts, there will be fatigue in this conflict, growing fatigue in various countries from this completely absurd sponsorship of the Kiev regime, including in the United States. This fatigue will lead to a fragmentation of the political leadership and growth of contradictions.

— Dmitry Peskov · Reuters · Oct 2, 2023

I'm noticing some familiar rhetoric coming from Aleksandar Vučić — jorndoe

It is comprehensible. We are feeling that fatigue too, but the main difference is that our government is reckless and will keep wasting money and resources on Ukraine. I saw it coming - Slovakia's coming PM -, our nations are committing a big job and effort to supply them. But Zelensky doesn't seem to be satisfied entirely. So, the new positions of Poland and Hungary are understandable. If the U.S. is now doubting on keeping the fund, imagine us with fewer resources and poorer economies.

Robert Fico won the most votes in the 2023 parliamentary election with 22.95% of the vote and winning 42 seats fairly. And because he will not be a reckless dude, the Western media is already treating him poorly: He Is ProO RusSiAN!!!1!!1!1!1! https://edition.cnn.com/2023/10/01/world/slovakia-election-pro-russia-robert-fico-win-intl-hnk/index.html

These journalists piss me off... -

Ukraine CrisisYou don't think the Netherlands is essential of your country. Or Mexico or Cuba. Spanish imperialism is quite well in the past. Last time I think it was the Rif war... — ssu

I would agree that we do not feel that The Netherlands belongs to us, or it is part of our culture/identity. But Cuba is another different story. I don't consider them very different to the Canary Islands or the rest of the peninsula, and I disagree that sooner or later they will be independent of us. They never got real independence, by the way. Cuba has always been under the pressure of the USA and dictatorships (Batista's, Castro's family, etc.)

We feel that the US robbed us our Caribbean pearl - As well as the Russian perceive that Crimea could be robbed by the Westerns, ha! -. The American State declared war against Spain just to help Cuba to be free, supposedly. This is a big lie, they just wanted to keep promoting their presence on the American continent. Cuba has never been free since it became independent of us.

Mexico and the other nations are irrelevant to us. We know we share the same language, and just it. But, losing Cuba hurt back then, and the feeling remains even though it happened nearly 130 years ago. We even have a saying that goes: Más se perdió en Cuba..., which means that there will not be a greater sense of loss than losing Cuba. -

Ukraine CrisisThe problem starts from geography. This is the first problem anybody neighboring Russia has. — ssu

I agree.

The next thing is that Russia's identity is imperial, there is actually nothing else. — ssu

As well as the British, Spanish, American, French, or even German identity. That's how the world and countries - as we know nowadays - were built in the past. The territories were under the shadow of those vast kingdoms. Some states still have that 'pride' in their DNA, others don't. While Spain gave up on everything in 1898 with the lost of Cuba and Puerto Rico, Russia has always tried to keep their borders safe and controlled. Maybe they are proud of themselves, and we have low self-esteem as a failed Empire.

The fact is it wasn't simply a mistake. Once countries get idependence that's it, to assume the independence is a "mistake". — ssu

I had in mind the same idea, ssu. Not only they believe that the fall of Soviet Union was a mistake, but I truly believe that it was literally, sort of. Because that vast territory splitting apart in different republics was a chaos. It is true that some countries managed the independence correctly, for example: Estonia, Latvia and Lithuania, but others don't, such as the bloody collapse of Yugoslavia.

On the other hand, most of those 'new' republics never really got independence from Moscow or the Kremlin. They became satellite countries, such as Kazakhstan, Belarus, Turkmenistan, etc. And I also consider Ukraine part of this list too.

The third issue that Russia hasn't understood that it has lost the empire. Yet for Russia it might only be this war with Ukraine. Or something else in the future. — ssu

I agree that they should accept that the Russian Empire ended with the collapse of the Soviet Union and the enter of capitalism in their culture. Nonetheless, I think the Western world should not disrespect Russia as we - not all countries, for sure - since 1991. I say that the fall of the USSR was a failure, but Boris Yeltsein as a President is even worse. He made great reforms in modern Russia, but he also undermined respect for Russia. Frankly, Putin was necessary for Russia's defence from the Western world. They did not - and will not wither - accept being a more 'satellite' state of the USA. They consider themselves as superpowers, and honestly I think they are. Despite the economic block, they remain in the 9th position of the world's largest economies and their geographical position is excellent. They even have some 'democratic' allies which support them silently: Poland, Slovakia, Hungary, Republican party, etc. -

Ukraine CrisisIn a sense you are correct, Ukraine is the Ukrainian's house, and that's an end of it! — tim wood

Exactly. But respecting the Russian sovereignty on Donetsk, Luhansk and Crimea. It is written in the Russian constitution:

Chapter 3. The Federal Structure

Article 65

1. The Russian Federation includes the following subjects of the Russian Federation:

Republic of Adygeya, Republic of Altai, Republic of Bashkortostan, Republic of Buryatia, Republic of Daghestan, Republic of Ingushetia, Kabardino-Balkarian Republic, Republic of Kalmykia, Karachayevo-Circassian Republic, Republic of Karelia, Komi Republic, Republic of Crimea, Republic of Mari El, Republic of Mordovia, Republic of Sakha (Yakutia), Republic of North Ossetia - Alania, Republic of Tatarstan, Republic of Tuva, Udmurtian Republic, Republic of Khakassia, Chechen Republic, Chuvash Republic;

Altai Territory, Trans-Baikal Territory, Kamchatka Territory, Krasnodar Territory, Krasnoyarsk Territory, Perm Territory, Primorye Territory, Stavropol Territory, Khabarovsk Territory;

Amur Region, Arkhangelsk Region, Astrakhan Region, Belgorod Region, Bryansk Region, Chelyabinsk Region, Ivanovo Region, Irkutsk Region, Kaliningrad Region, Kaluga Region, Kemerovo Region, Kirov Region, Kostroma Region, Kurgan Region, Kursk Region, Leningrad Region, Lipetsk Region, Magadan Region, Moscow Region, Murmansk Region, Nizhny Novgorod Region, Novgorod Region, Novosibirsk Region, Omsk Region, Orenburg Region, Orel Region, Penza Region, Pskov Region, Rostov Region, Ryazan Region, Samara Region, Saratov Region, Sakhalin Region, Sverdlovsk Region, Smolensk Region, Tambov Region, Tomsk Region, Tver Region, Tula Region, Tyumen Region, Ulyanovsk Region, Vladimir Region, Volgograd Region, Vologda Region, Voronezh Region, Yaroslavl Region;

Moscow, St. Petersburg, Sevastopol - cities of federal importance. -

Ukraine CrisisAs did my country also belong to Russia. Until it didn't, when we gained independence. Just like Ukraine got it's independence and Russia did recognize the independence of Ukraine and it's borders. Until it didn't anymore. And that's the whole issue here with Russia. The nah... these countries around me are "artificial"! — ssu

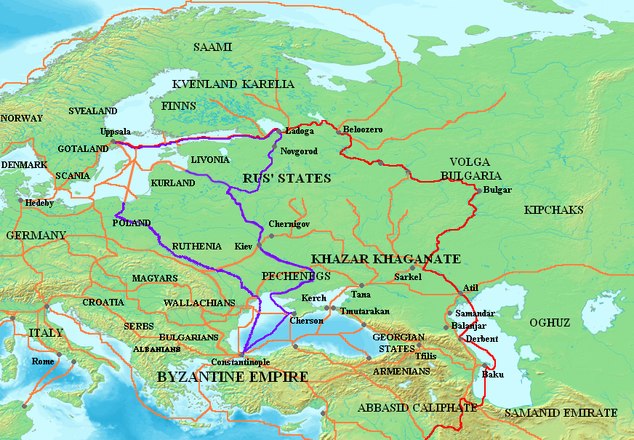

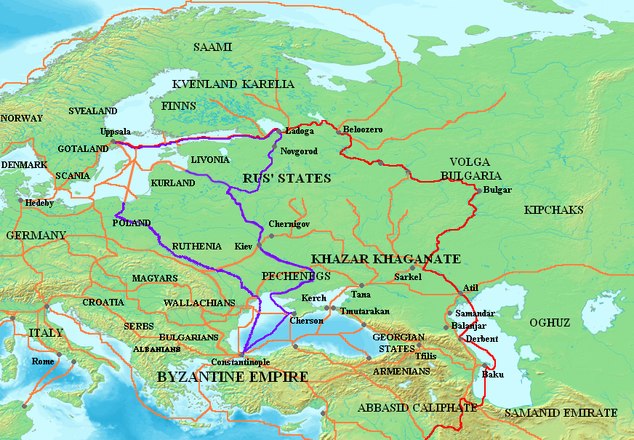

I expected you would have used Finland as an example. But it is obvious that the example of the Finnish are very far away from the Ukrainian, or speaking frankly, 'Kyi' or the 'Kievan Rus'. Oleg set himself up as prince in Kyiv, and declared that it should be the "mother of Rus' cities."

I did some quick research on the history of your beautiful country - I wish one day I can visit it - and the tribes were always ruling on different territories, until the unstoppable expansion of the Russian Empire. Nonetheless, if the following information is not biassed or mistaken, the Russian Empire considered the Duchy of Finland as 'autonomous': In 1809, as a result of the Finnish War, Finland became part of the Russian Empire as the autonomous Grand Duchy of Finland. Alexander I did not want the Grand Duchy to be a constitutional monarchy but the governmental institutions born during the Swedish rule offered him a more efficient form of government than the absolute monarchy in Russia. This evolved into a high level of autonomy by the end of the 19th century. https://archive.wikiwix.com/cache/index2.php?rev_t=20151206184816&url=http%3A%2Fweb.eduskunta.fi%2FResource.phx%2Fparliament%2Faboutparliament%2Fpresentation%2Fhistory.htx#federation=archive.wikiwix.com&tab=url

We can say that Finland was a province of the vast Russian Empire and both sides were aware of the differences amongst the other. Yet, Ukraine is fully similar to Russia, and they were 'born' with the same characteristics: language, religion and culture. Thus, the ethnicity. While the Finnish people have always been a Baltic ethnic group, Ukrainians and Russians come from the same group: Slavs.

The following map is very well drawn, and we can see how Finland has always been different from Russia. While Ukraine - or at least the modern Crimea and Donetsk - was part of Russian origins, clearly.

-

Ukraine CrisisI agree with you, except for the following statement:

It seems to me we might say that imperialists, like the Russians at the moment, want to go into someone else's house, take it over, and tell them what to do and how to do it. The West, on the other hand, mostly just says, if you want to play with us, there are rules.... — tim wood

Ukraine is not some one's else house. They don't even claim all their vast territory but three important provinces: Crimea, Donetsk and Lugansk. These three 'municipal dumas' have always belonged to Russia, and they have been managed by Russian authorities since the Russian empire.

[...] Saint Petersburg, Moscow, Kyiv, Odesa, Riga, and the Polish cities of Warsaw and Łódź. These elected their delegates to the Duma directly, and though their votes were divided (on the basis of taxable property) in such a way as to give the advantage to wealth, each returned the same number of delegates. State Duma (Russian Empire) Look at the following map of the Russian Empire when they fought against the Ottomans. It is obvious that those territories belonged to Russia, and they were recognised internationally as part of their vast nation. It is written in the treaties:

One of the main errors committed in the dissolution of the Soviet Union was the lack of precision in 'drawing' the new maps for the new republics. Ukraine considered those territories as a subdivision of them, while the Russian Federation stated that they were 'Federal subjects'. More precisely the Russian Constitution says: "1. The Russian Federation includes the following subjects of the Russian Federation: [...] Republic of Crimea http://www.constitution.ru/en/10003000-04.htm

In 1774, the Ottoman Empire was defeated by Catherine the Great with the Treaty of Küçük Kaynarca making the Tatars of the Crimea politically independent. Catherine the Great's incorporation of the Crimea in 1783 into the Russian Empire increased Russia's power in the Black Sea area.

With the dissolution of the Soviet Union and Ukrainian independence in 1991 most of the peninsula was reorganized as the Republic of Crimea, although in 1995 the Republic was forcibly abolished by Ukraine with the Autonomous Republic of Crimea established firmly under Ukrainian authority. A 1997 treaty partitioned the Soviet Black Sea Fleet, allowing Russia to continue basing its fleet in Sevastopol, with the lease extended in 2010. https://books.google.es/books?id=i1C2MHgujb4C&pg=PA194&redir_esc=y#v=onepage&q&f=false -

How do we know that communism if not socialism doesn't work?Yes, 'it was meant to be put into action', but everything remained in theory, and as you said, each country had their own 'version' of Marxism. I don't deny that they are based or influenced by Marxism, but it is clear that those countries hardly put it in practice.

-

How do we know that communism if not socialism doesn't work?and (Good points ssu, I was thinking the same, sort of).

Firstly, none Communist country has really applied Marxism into practice. They were countries influenced by or based by Karl Marx, but they hardly understood what he meant. Some nations, like Cuba or North Korea, followed up the path of their respective dictators, creating and establishing a self-basis of Communism.

Nonetheless, it is true that China is a good example of a successful nation. Thanks to Deng Xiaoping revolution in the 1990's, China has been becoming one of the main countries of the world. I think they were very clever, because, as ssu pointed out, they are always adapting their system to new challenges. Yet, I do not know if we should consider them as Marxists, because their main role and leader is Maoism. We can conclude that while Western or Eastern European Communism has failed dramatically, Chinese Maoism remains.

I wish @Hailey and @guanyun could log in and express their opinion on this. -

Ukraine CrisisComment? — tim wood

I am not accusing you of 'cancelling' Russian culture. I just wrote those paragraphs because I thought it was unfair to mix up things. 'Karamazov Brothers' and a normal/regular Russian citizen is not guilty of Russian oligarchy. The latter doesn't represent the real Russia and it is unfair. To be honest, I think I have sympathy with them because I understand what it feels like living in a country with a dictatorial background. My point is that there is an abyss between the Russian Kremlin and the citizenship of Moscow or the rest of the Oblasts. Most of the statistics - which come from the Western media - showing that most of the Russians support this war are twisted and these are not reliable to me.

On the other hand, I agree with you in the point that the Russian natural resources have always been poorly managed. Since 1991, the oligarchy members are the only ones who make profits on it. Then, this causes a dysfunctional social structure. The Russian middle-class is not perceiving everything that they deserve. But it is important to highlight that the middle-class of every Western country has experienced a decrease in their purchase power because of Zelensky's childish behaviour of not allowing us to buy Russian natural resources. I wonder whether they will pay us back one day (as well as Japan and Germany did after WWII), or if our budget went to unclaimed funds...

Nonetheless, what about the unfair financial block from the Western world? This attitude only harms the Russian citizens we are debating about, and has zero effects on the Russian oligarchy. So, I can't see the point in not having financial relationships with them. Even with all the blocks from the Western world, they are still the 9th economy of the world and we - the European hypocrites - still buy them oil and gas. Amazing! I am jealous of the resistance of the Russian state. -

On “correct” usage of language: Family custom or grammatical logic?I'm interested in posting the following words here, in this thread, because it was the first time I have read them. I do not want to forget those.

Trifle: slightly, (used as an adverb. 'She seemed a trifle anxious').

Whimsically: in an unusual or slightly silly way that people find either funny or annoying.

Haughtily: in an unfriendly way that shows other people that you think that you are better than them.

Commandingly: in a position of authority that allows you to give formal orders.

Tormentedly: to make somebody suffer very much.

Maybe I will post more interesting adverbs or words which I would find in the books I read. I understand that maybe you all see them as normal and not so amazing, but for me, they are spectacular because those are taught in school. :sparkle: -

Ukraine CrisisBut as you seem to be an apologist for things Russia, — tim wood

Reading and having an admiration for Russian writers, is an apology to Russia. Wow! We are living in the era of stupidity and 'cancel culture'. Yet, I would like to highlight my words again: 'Karamazov brothers' or 'The Don' will remain in the passage of the years, because these are pieces of culture and not your brainwashed propaganda. According to your own basis, I bet you never read Don Quixote because it comes from a bloody imperialist country as well, right? Pathetic.

On the other hand, I will try to answer to your following fallacious assessment: 'Arguably Russia should be the richest country on the planet and its citizens enjoying the highest standard of living. Why isn't it; why aren't they?'

I do not know where you get the premise that Russia should be the richest country and its citizens the happiest. But I will not hesitate in using data to contradict your position. I will use a comparison between my country and Russia. I act with good faith and humbly, at least. You will be amazed.

GDP: $2.36 trillion (Spain) / $4.77 trillion (Russia)

GDP per capita: $31,223 (Spain) / $33,263 (Russia)

Unemployment ratio: 11.6% (Spain) / 5.2% (Russia)

Suicide ratio: 6.1 per 100,000 people. (Spain) / 10.7 per 100,000 people.

Well, showing those facts, it is proven that Russia is a better country than some - at least than mine -. The suicide ratio is high but is even higher in Spain if we compare the proportion of numbers of citizens. -

The meaning of meaning?When you use the word 'pretend' do you mean 'attempt'?

I thought it might be a 'false friend', so checked it out: — Amity

I didn't know it was a false friend! Wow, this is so interesting to me. I am learning a lot ,thanks to this thread and interacting with you, Amity. Yes, I was referring to "attempt" not "pretend", which are two different concepts.

Pretend: 'to behave in a particular way, in order to make other people believe something that is not true'

Attempt: an act of trying to do something, especially something difficult, often with no success.

I was referring to the latter, but I used the wrong word. I beg your pardon. I feel ashamed of myself when I don't use grammar properly.

And there are many more examples. I bet you've met a few! — Amity

Yes, I know one that is a classic: Anuncio/publicidad means 'advertisement', and not 'announcement' (anunciar), to announce. :smile: -

Ukraine CrisisIf I am not wrong, you were off from this forum for months. I recommend you stay away again, because wasting the space and time of others is one of the worst things ever. Are you capable of reading three paragraphs, or do you just stay on the surface of everything? Answer to yourself, because I will not waste my time on you.

-

The meaning of meaning?I didn't pretend to find the 'perfect' answer, but I just admit that I do not see myself as capable as of answering those complex questions.

On the other hand, regarding your quote from Japanese literature, Yes, I feel more comfortable with this topic and I can provide answers with knowledge.

Japanese literature is well known for being ambiguous, and I fully agree with the author of the paper in Britannica. There was a big debate amongst modern Japanese authors whether they should be writing in this technique because they were receiving a lot of influence from Western authors, who are very different from them, obviously. To be honest, if a haiku is not ambiguous, you kill the haiku. The ambiguity is the main essence of these poems, and fortunately modern Japanese haijin have not given up on this. Yet, I understand that it is a big and complex task for translators, because how do you translate this ambiguity into Western languages? It reminds me of Sofia Coppola's film: Lost in translation. -

The meaning of meaning?I think you are well-placed to answer at least one of the questions in the OP: — Amity

I think not. I am not capable to do so and @hypericin just answered you. I alude to what he states.

On the other hand, I wonder what you refer to as 'old meaning'. I am lost here. I do not understand what you mean by such a concept or idea. -

The meaning of meaning?But would that still be 'enough' for you? — Amity

Well, this is a good question, because there is not always enough for the seek for knowledge. I think I was referring to a technical context/idea. Trying to answer this interesting topic, but not having 'enough' background to explore its nature. I must assume that I need to read more books related to philosophy, because most of the time I only read Japanese literature. This is not something I regret, but it is obvious that I have lost some information on other topics. Maybe I should be more paradigmatic.

How does a mess of philosophical theories help? When there are other more practical disciplines? — Amity

You are right! -

The meaning of meaning?What would be 'enough knowledge'? — Amity

There are more users who would have better and more precise answers than me, because they have a background in Linguistics and Philosophy, something that I don't.

It seems that it is more than 'just a personal opinion'. You have used your knowledge about Philosophy and its Concepts logically to make 'correct' premises. Do the scare quotes around 'correct' mean they are 'provisional' assumptions? Are there only 2 views/theories of 'meaning'? Perhaps, yes, if the spotlight zooms in on — Amity

I think more than premises, they are 'tools' for me. I personally believe that this OP is understood using Philosophy of Language and some authors, as Steven Pinker explains this very well, or at least, I liked it a lot. Nonetheless, I am aware that some members would disagree about the way I see and understand 'meaning', because it is something that maybe goes beyond than just boxing in categories. -

Ukraine CrisisOne of the main things which pisses me off the most, is the way the Western world is cancelling Russia on literally everything: from economics to the arts.

The following week starts the Nobel laureates ceremony. I think it is a beautiful and vivid place to appreciate interesting and intelligent people. Well, as a reminder, the Nobel Foundation cancelled the Russian ambassador, and this means that there will not be Russian laureates, although it is a country full of intelligent and cultural people...

Nobel Foundation reverses decision to invite Russia to prize ceremony.

On the other hand, can you imagine a world without Dostoyevski or Shólojov? It is a disgrace the efforts to cancel Russian culture. There are some universities - like Milan - or symposiums which avoid Russian participants. It is pathetic. For example, there was a symposium about Dostoevsky in Nagoya (Japan) and the Russian specialists were cancelled. :roll: https://elpais.com/opinion/2023-09-04/dostoievski-y-ucrania-en-japon.html

Although sooner or later Ukraine will be irrelevant to most people, the 'Karamazov brothers' will remain. Culture is above economics and politics! -

The meaning of meaning?Your approach is to decide which category a philosophical concept should be boxed.

You seem to suggest that this discussion (see underlined) should rest in a subcategory:

Philosophy of Language. — Amity

Exactly, Amity. But boxing this OP in the 'Philosophy of Language' category is just a personal opinion, which helps me to understand it. I do not pretend to say if the OP is in the right or wrong direction of debating. I don't even have enough knowledge on the matter! :smile: -

noneThe Australian marsupial can pass up to 100 deposits of poop a night and they use the piles to mark territory. This also explains how the universe was created in the first place. The original poop is called the "big bang".

The shape helps to stop the poop rolling away (there is nothing worse than having your fundamental unit of the universe roll away). — Agree-to-Disagree

:up:

javi2541997

Start FollowingSend a Message

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum