-

Tzeentch

4.4kI realize I should have specified, but fiscal policy and monetary policy are connected, and intimately so, and both have been disastrous.

Tzeentch

4.4kI realize I should have specified, but fiscal policy and monetary policy are connected, and intimately so, and both have been disastrous.

How did the United States finance decades of endless war and military projects such as the $800 billion you referred to?

Why, by printing money, of course.

Now, some governments are able to practice restraint, and despite wanting to spend more, they realise that printing money whenever they want will ruin a country in the long-term. The United States government was no such government. -

Mikie

7.3kfiscal policy and monetary policy are connected, and intimately so — Tzeentch

Mikie

7.3kfiscal policy and monetary policy are connected, and intimately so — Tzeentch

Everything is “connected” in one way or another.

Fiscal and monetary policy are very different animals. You can have one without the other, as was the case after the 2010 midterms.

How did the United States finance decades of endless war and military projects such as the $800 billion you referred to?

Why, by printing money, of course. — Tzeentch

It finances expenditures through revenue. To spend beyond revenue, the government borrows money by issuing treasuries. Treasuries can be bought by anyone, including corporations and foreign countries — and the central bank. The Fed currently holds around 15% of the US debt, which it purchases by printing money.

So again, it’s just not so simple.

We could balance the budget by cutting spending on wars and the military, yes. But the debt isn’t that important.

I’ll tell you where Friedman’s theory holds up fairly well: with major asset classes, like stocks. Since this is where the money flows, you see “inflation” within these classes. Another word for it is “bubbles.” But even here it’s not so cut and dry, because the outcome is largely a matter of corporate choices — buyback choices, CEO remuneration choices, dividend choices, general resource allocation, etc.

Also, even if your generalization were true, it doesn’t explain inflation.

I notice too that you have avoided substantiating anything:

What "fiscal policy" are you referring to, exactly?

And who is "everyone"? Everyone predicted this for "decades"? Since when, the 80s? — Xtrix

Care to elaborate? -

Mikie

7.3kCare to elaborate?

Mikie

7.3kCare to elaborate?

— Xtrix

I'm not going to play this game where you ask for details while ignoring the elephant in the room. — Tzeentch

You said inflation was due to monetary policy. Then you said it’s fiscal policy. Now I ask: what specific fiscal policies are you talking about?

I don’t see how this is ignoring anything.

If you can’t (or don’t want to) support your argument, that’s fine. No need to make things up though. -

Tzeentch

4.4kIt's monetary policy of printing billions of dollars causes inflation.

Tzeentch

4.4kIt's monetary policy of printing billions of dollars causes inflation.

It adopts this monetary policy to accomodate a general fiscal policy of spending too much.

I don't know why you would be asking me for the specifics of that fiscal policy, since it's completely besides the point and you've yet to acknowledge the elephant I just described. -

Tzeentch

4.4kNot all money printing is undesirable, since it can be used to accomodate a growing economy which relates to your comment.

Tzeentch

4.4kNot all money printing is undesirable, since it can be used to accomodate a growing economy which relates to your comment.

But instead it has been used to accomodate government spending.

Yes, inflation can be a delicate issue, but this isn't a delicate situation anymore. It's a complete disaster and the cause is obvious. -

Janus

17.9kNothing you say there tells against the MMT principle that inflation will only result if supply of goods is not adequate to demand, even if extra money has been injected into the economy.

Janus

17.9kNothing you say there tells against the MMT principle that inflation will only result if supply of goods is not adequate to demand, even if extra money has been injected into the economy.

So, if this principle is right, then supply chain issues would be the proximate cause of inflation, and it seems likely that if supply cannot meet demand, inflation (perhaps not as significant) would still have resulted even if extra money had not been injected, -

Mikie

7.3kIt's monetary policy of printing billions of dollars causes inflation.

Mikie

7.3kIt's monetary policy of printing billions of dollars causes inflation.

It adopts this monetary policy to accomodate a general fiscal policy of spending too much.

I don't know why you would be asking me for the specifics of that fiscal policy, since it's completely besides the point and you've yet to acknowledge the elephant I just described. — Tzeentch

I have done nothing but discuss that “elephant.” I went over monetary and fiscal policy.

Again, this idea is mostly Friedman’s — and it’s obsolete. Why? One reason is that the Fed increased the money supply in 2009 as well— injecting huge sums into the financial sector, and even buying mortgage backed securities. Did inflation follow? No.

A second reason is because, when you look at inflation in detail — whether the CPI or PCI — a major factor is the ripple effect of supply disruptions from COVID and Ukraine, particularly in energy. That has little to do with the money supply. Inflation is 6% outside of food and energy, and even that is mostly inflated because of the prices of used and new cars — itself a result of lack of supply.

So here we have a few industries, and a handful of companies within these industries, raising prices due to the supposed rising costs of production and labor and/or shortages of commodities like oil/gas and semiconductor components (for computer chips in cars). That’s a choice, as I mentioned before— not an inevitability.

It’s not only profiteering, though. With cars and housing, there’s a supply issue — but also the fact that people are willing to pay up the nose for a house or car. Where did they get this money? From higher wages, stimulus programs, and borrowing (incentived by low interest rates). The government COVID stimulus has now stopped, and the Fed is raising interest rates and decreasing the money supply.

But while it will effect borrowing and spending, it won’t effect profiteering nor supply chain disruptions to commodities, nor the next pandemic, nor the war in Ukraine, nor climate change. And all of these things effect inflation— not just expansionary monetary policy. It will effect what it helped create — stock, bond, and housing bubbles. We already see all three crashing. That’s no surprise. So why has inflation persisted? It’s claimed that they have to go farther, and it takes some time because of lag. I don’t buy this completely.

So, again, this isn’t ignoring the money supply— but as a theory that explains inflation, “everywhere and always,” it’s just no longer true. It assumes things which aren’t true now — but which may have been true in the 70s. It’s at best an incomplete, narrow view. No where near as obvious and simple as you seem to believe.

Lastly, your sense of how the government finances spending is simply wrong. It’s not that they’re financing things by “printing money.” Again, the Fed owns about 15% of debt. That fact should give you pause. -

NOS4A2

10.2k

NOS4A2

10.2k

State intervention in the service of plutocrats.

Your solution: abolish or minimize state intervention; keep the plutocrats.

My solution: abolish or minimize plutocracy. Keep and strengthen democracy.

I don’t have solutions, mostly because I don’t claim a right to tell others how to live their lives. Though I would abolish those who claim such rights. -

Tzeentch

4.4k

Tzeentch

4.4k

Interesting theories, no doubt with a great deal of truth to them.

But I'm not willing to absolve governments just because an alternative theory exists, while they continue to break economy 101. You double the amount of currency in a system, you halve its value.

Is it more complicated than that? Undoubtedly.

Government also failed elsewhere, including in how it mismanaged the covid epidemic, and how it provoked Russia into its illegitimate attack on Ukraine.

Again, the Fed owns about 15% of debt. That fact should give you pause. — Xtrix

I'm sure you have an idea of what kind of money that amounts to, same for the amounts of money that are printed every year. Maybe those number should give you pause? -

Mikie

7.3kBut I'm not willing to absolve governments just because an alternative theory exists, while they continue to break economy 101. — Tzeentch

Mikie

7.3kBut I'm not willing to absolve governments just because an alternative theory exists, while they continue to break economy 101. — Tzeentch

What I’m suggesting is looking at the available data and trying your best to think through what’s going on, temporarily suspending certain beliefs and assumptions and perhaps leaving them behind altogether if there are alternatives that give a better explanation.

It’s not really a theory I’m offering— it’s just looking at the facts. What facts? Well, the topic is inflation. How is inflation measured? Through the consumer price index and personal consumption index (which is what the Fed uses). These are baskets of goods and services, as you know. And when you look at this in detail, the highest rates of inflation are in commodities and products effected by these conditions. Oil is an obvious example. Wheat is another. Disruptions to supply and steady or greater demand will usually lead to higher prices. Add in to this fact the price gouging factor, and it’s not a shocker that we have inflation right now. But just misleading to attribute it all to monetary policy or fiscal policy in terms of an increased monetary base.

The fact that there’s more money in the economy is true. This will have effects. Milton Friedman wasn’t an idiot. Is his claim that “inflation is always and everywhere a monetary phenomenon” true, however? I suppose in the sense that it involves money. But otherwise it’s a matter of changes in supply and demand, belief and confidence, price gouging, and — in my view — the socioeconomic system of capitalism.

Worth remembering too that inflation is widespread right now. As you would expect from shocks to oil and wheat supply. Even if printing money was the only (or main) culprit here — what about everywhere else?

Is it more complicated than that? Undoubtedly. — Tzeentch

Agreed.

the cause is obvious. — Tzeentch

Disagreed. -

Mikie

7.3kSo, if this principle is right, then supply chain issues would be the proximate cause of inflation, and it seems likely that if supply cannot meet demand, inflation (perhaps not as significant) would still have resulted even if extra money had not been injected, — Janus

Mikie

7.3kSo, if this principle is right, then supply chain issues would be the proximate cause of inflation, and it seems likely that if supply cannot meet demand, inflation (perhaps not as significant) would still have resulted even if extra money had not been injected, — Janus

I think this is true. Which is why we see inflation internationally.

At the heart of it all, I think, is capitalism. We could easily control inflation by controlling profits, and taking investments out of the hands of the private sector. We’re not supposed to talk about it, but this is partly why China isn’t seeing the same levels of inflation — even though they too are basically a state-capitalist economy, it’s far more regimented than in the Western world.

What we’ll do instead is increase unemployment and stagnate wages and price people out of buying homes, cripple them with greater credit card/mortgage/loan interest rates, etc., to curb spending/demand. This will do nothing about supply chains and nothing about a privatized, profit-driven economy. But what else is new? -

ssu

9.8k

ssu

9.8k

Simply to put it, stopping the easing is already tightening. If you have increased the money supply and then decrease it or stop it altogether, isn't that tightening?I don't know what this means either. Quantitative tightening is the opposite of easing. That means the Fed is beginning to lower mortgage-backed securities and debt on their balance sheet. That was indeed increasing the money supply. The opposite (QT) will decrease the money supply. — Xtrix

How the markets react to the monetary policy of the Fed is a result of monetary policy. Markets going down is a consequence, not the other way around.I don't think so. What this will do is burst the bubbles created by the Fed -- stocks, bonds, and real estate. We're seeing that already. — Xtrix

Basically one should understand the interest rate as the price of money. Higher interest rates mean higher price of money, which is like putting on the brakes on the stock market.

Paul Volcker killed the inflation (and inflation expectations) by raising the Fed's fund rate to 20% in June 1981. From that year interest rates have basically gone down (or stayed at level). I think now we are seeing or have seen the bottom and now the cycle is in the upward going phase.

Of course the real issue is political. And I fear that the politicians can and will choose inflation than higher interest rates. And blame everybody else: the war in Ukraine, the pandemic, climate change, foreigners, hoarders... you name it!!! -

Mikie

7.3kI don't think so. What this will do is burst the bubbles created by the Fed -- stocks, bonds, and real estate. We're seeing that already.

Mikie

7.3kI don't think so. What this will do is burst the bubbles created by the Fed -- stocks, bonds, and real estate. We're seeing that already.

— Xtrix

How the markets react to the monetary policy of the Fed is a result of monetary policy. Markets going down is a consequence, not the other way around. — ssu

Since the asset bubbles I mentioned were created by the Fed’s monetary policy, it’s no surprise they are bursting now. Stocks have even farther to go to trend, in fact.

So I’m not exactly sure why you’re stating this.

Of course the real issue is political. And I fear that the politicians can and will choose inflation than higher interest rates. And blame everybody else: the war in Ukraine, the pandemic, climate change, foreigners, hoarders... you name it!!! — ssu

Politicians aren’t choosing anything. Monetary policy is in the hands of the Fed — which has become more and more hawkish in terms of money. Interest rates have already been raised 1.5% this year alone and will likely continue.

Inflation is largely due to supply chain disruptions. There’s nothing the Fed can do about that. What the Fed can do — and we see happening — is reverse what it caused: the inflation of three key markets: stocks, bonds, and housing. All are bubbles; some were superbubbles (stocks).

These bubbles bursting will have some effect on overall inflation— but, again, will do nothing whatsoever for semiconductor shortages, wheat supply stocks due to war, or oil/gas supply chains. -

ssu

9.8k

ssu

9.8k

Uhhh....yeah. They have.Politicians aren’t choosing anything. Monetary policy is in the hands of the Fed — which has become more and more hawkish in terms of money. Interest rates have already been raised 1.5% this year alone and will likely continue. — Xtrix

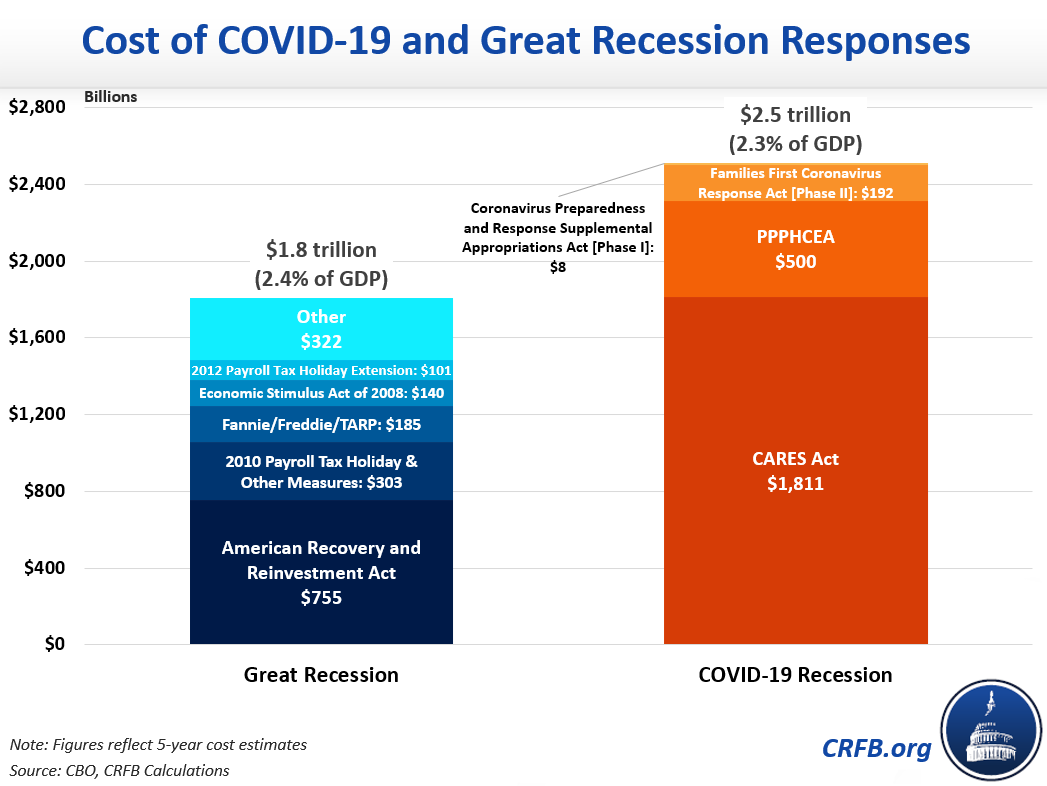

They've chosen the various stimulus packages etc. which got the inflation finally going.

Now when you give that stimulus to people, the money does go into the economy and does create higher demand, which then creates higher prices.

And hence we finally have high inflation. And hence the need for higher interest rates. -

180 Proof

16.4k

180 Proof

16.4k

:100:Inflation is largely due to supply chain disruptions. There’s nothing the Fed can do about that. What the Fed can do — and we see happening — is reverse what it caused: the inflation of three key markets: stocks, bonds, and housing. All are bubbles; some were superbubbles (stocks).

These bubbles bursting will have some effect on overall inflation— but, again, will do nothing whatsoever for semiconductor shortages, wheat supply stocks due to war, or oil/gas supply chains. — Xtrix -

Mikie

7.3kUhhh....yeah. They have. — ssu

Mikie

7.3kUhhh....yeah. They have. — ssu

No, they haven’t. What I was responding to:

And I fear that the politicians can and will choose inflation than higher interest rates. — ssu

Politicians don’t “choose” anything about interest rates.

As far as fiscal policy: yea, they passed stimulus bills. Arguing that

stimulus packages etc. […] got the inflation finally going. — ssu

is simply an assertion. If it were so cut and dry, then Europe shouldn’t be experiencing inflation — according to your own chart. But they are as well.

The effects of stimulus is real, but I agree with economists who say it accounts for about 1% of inflation or so.

does create higher demand, which then creates higher prices. — ssu

Low interest rates create demand too. Cheap borrowed money lead to higher prices.

But this almost completely overlooks supply shocks and corporate choices. This is far more a supply side issue.

True, we can use inflation as an excuse for austerity, for punishing workers and families, etc., which is the most likely outcome. But that’s a political choice. -

Mikie

7.3k

Mikie

7.3k

We could be here all day, but solutions are plentiful. Just off the top of my head — and restricted only to the low-hanging fruit:

Ban stock buybacks (specifically SEC rule 10b-18)

Decouple CEO pay and stocks

Wealth tax

Excess profit tax

Maximum wage

Increase corporate tax rate

Increase capital gains taxes

Close tax havens (Bahamas, Caymans, Ireland)

Close tax loopholes (stepped-up basis, etc)

Fund the IRS

Strengthen labor laws and the NLRB

Require worker representation in boardrooms

Pass the PRO act

And on and on. But I have no illusions that any of this will happen any time soon. -

Mikie

7.3kBut I have no illusions that any of this will happen any time soon. — Xtrix

Mikie

7.3kBut I have no illusions that any of this will happen any time soon. — Xtrix

Sorry, but your "solutions" sound like pipe dreams. — baker

I’m glad you read carefully.

What’s funny is that I was going to put in “Is this a real question or just an excuse to shit on anything offered?” Figured I’d give the benefit of the doubt. I regret that. Should have known better, given your history.

I guess I’ll just repeat myself: there are plenty of solutions. These are some of the ones off the top of my head. My own personal activity has been directed at the local and state level, and towards unionizing. Not at the federal level, where I have no impact whatsoever.

But since you aren’t really interested in any solutions (all “pipe dreams”) and apparently just want an opportunity to display your very-superior-cynicism, I’ll leave it there. My mistake for engaging. -

baker

6kBut since you aren’t really interested in any solutions (all “pipe dreams”) and apparently just want an opportunity to display your very-superior-cynicism, I’ll leave it there. My mistake for engaging. — Xtrix

baker

6kBut since you aren’t really interested in any solutions (all “pipe dreams”) and apparently just want an opportunity to display your very-superior-cynicism, I’ll leave it there. My mistake for engaging. — Xtrix

*sigh*

And this is how you're actually helping those at the top stay there.

I'm saying you're idealistic to a fault, to the point of ineffectiveness. And nobody's there to stop you ...

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum