-

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

Different sources will say different things about index funds vs. mutual funds. For the sake of clarity and simplicity, index funds just basically track an index (like the S&P 500) while mutual funds are often actively managed by fund managers attempting to beat market returns. Typically mutual funds have much higher expense ratios than index funds.

Hedge funds are less regulated than mutual funds and much, much more exclusive. Much higher barrier to entry.

Here's an article that expands on the differences between mutual funds and index funds.

https://www.nerdwallet.com/article/investing/index-funds-vs-mutual-funds -

Pfhorrest

4.6kI know all about index funds and active vs passive management thanks. I’ve got tens of thousands of dollars in a variety of different kinds. An index fund is still a particular kind of passively managed mutual fund. You were right about hedge funds being something narrower than I thought though.

Pfhorrest

4.6kI know all about index funds and active vs passive management thanks. I’ve got tens of thousands of dollars in a variety of different kinds. An index fund is still a particular kind of passively managed mutual fund. You were right about hedge funds being something narrower than I thought though. -

ssu

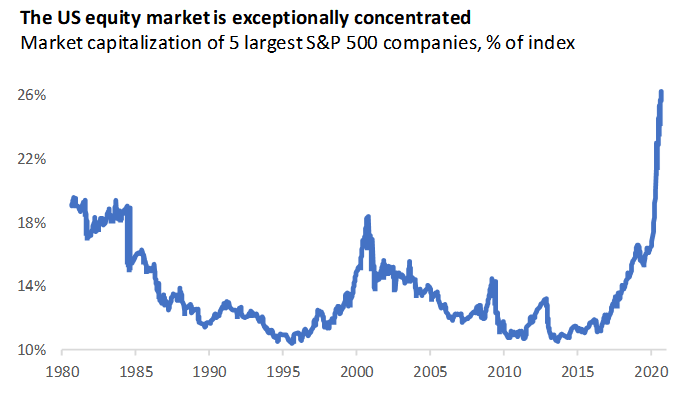

9.8kIndex funds likely inadvertently make the stock market even more volatile and pushing some stocks to very high prices, when you take into account that few stocks actually make a huge proportion of the index.

ssu

9.8kIndex funds likely inadvertently make the stock market even more volatile and pushing some stocks to very high prices, when you take into account that few stocks actually make a huge proportion of the index.

Never before has the S&P 500 been as top-heavy as it is now.

The five largest companies by market capitalization (Apple, Microsoft, Amazon, Facebook and Alphabet) comprise more than 22% of the index. Those five companies have as much influence on benchmark performance as the bottom 363 companies combined.

It's not totally out of the question that those five stocks could/would go down and what now has been the engine for the stellar performance of index fund reverses and then it's a slaughter with index stocks while old time mutual fund managers would beat the index. That kind of transition could possibly happen. When if ever, who knows that.

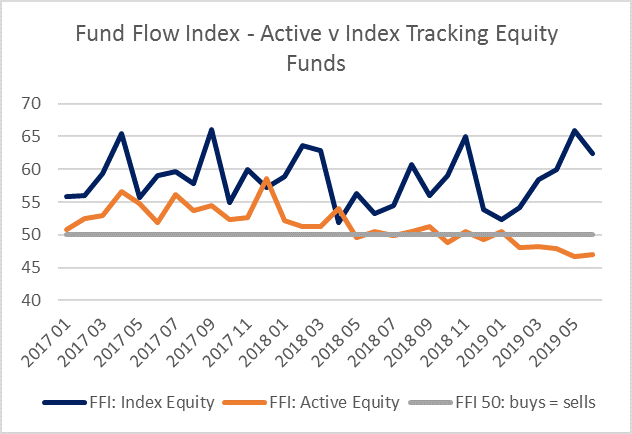

Just notice how the flows into funds have changed:

In recent years, index funds have been steadily catching up with their actively managed competitors. In 2015, for example, active equity funds enjoyed £15.3bn of inflows, compared to £1.8bn for index trackers, a ratio of almost 9:1. In 2018, index trackers already saw larger inflows than active funds, but so far in 2019, active funds have shed £2.6bn, while trackers have absorbed over £2.9bn of inflows.

And this has just continued:

-

Streetlight

9.1kWhat do you mean with covering a short position? And what is an overshorted stock? — Benkei

Streetlight

9.1kWhat do you mean with covering a short position? And what is an overshorted stock? — Benkei

To cover a short simply means to close out your position by buying the stock you initially sold (after borrowing it). It's what all these hedge funds who shorted GME are obligated to do, at some point. As for an overshorted stock - that's just what set off this whole fiasco in the first place. As @fdrake already described, GME had been shorted to the tune of about 120% of its available stock - there was more stock that had to be covered (bought) than actually exists. One of the reasons this happened was because, again, people were hedging on the company to go bust, so that no stock would ever have to be bought back. -

Benkei

8.1kGME had been shorted to the tune of about 120% of its available stock - there was more stock that had to be covered (bought) than actually exists. — StreetlightX

Benkei

8.1kGME had been shorted to the tune of about 120% of its available stock - there was more stock that had to be covered (bought) than actually exists. — StreetlightX

That's no problem though. If only one share is issued and it's sold twice in one day, the transaction volume was 200% of the outstanding stock. In this example we understand these are consecutive sales.

One of the reasons this happened was because, again, people were hedging on the company to go bust, so that no stock would ever have to be bought back, — StreetlightX

This isn't the case though. If a company goes bankrupt its stock continues to exist and would still have to be delivered back to the lender. The stock no longer represents an equity ownership after bankruptcy but a subordinated claim. -

Streetlight

9.1kThat's no problem though. If only one share is issued and it's sold twice in one day, the transaction volume was 200% of the outstanding stock — Benkei

Streetlight

9.1kThat's no problem though. If only one share is issued and it's sold twice in one day, the transaction volume was 200% of the outstanding stock — Benkei

But we're not talking about transaction volume. And I didn't say it was a 'problem' - only that it was this situation that created an opportunity for the attempt at a squeeze that's happening/happened. Take a read:

https://www.fool.com/investing/2021/01/28/yes-a-stock-can-have-short-interest-over-100-heres/

If a company goes bankrupt its stock continues to exist and would still have to be delivered back to the lender. The stock no longer represents an equity ownership after bankruptcy but a subordinated claim. — Benkei

Sure, but again, the point is still that the expected profit banks on the company going out of business. -

Streetlight

9.1kVia Zizek:

Streetlight

9.1kVia Zizek:

"Yes, what the wallstreetbets members are doing is nihilistic, but it is nihilism immanent to the stock exchange itself, a nihilism already at work in Wall Street. To overcome this nihilism, we will have to move out of the game of the stock exchange. The moment of socialism is lurking in the background, waiting to be seized, since the very center of global capitalism is beginning to fall apart.

Will this happen? Almost certainly not, but what should worry us is that this latest crisis is another unexpected threat to the system already under attack from multiple sides (by the pandemic, global warming, social protests…). Moreover, this threat comes from the very heart of the system not from outside. An explosive mixture is in the making, and the longer the explosion is postponed, the more devastating it could be."

https://spectator.us/topic/corruption-for-everybody-slavoj-zizek-wallstreetbets/ -

Benkei

8.1kBut we're not talking about transaction volume. And I didn't say it was a 'problem' - only that it was this situation that created an opportunity for the attempt at a squeeze that's happening/happened. Take a read:

Benkei

8.1kBut we're not talking about transaction volume. And I didn't say it was a 'problem' - only that it was this situation that created an opportunity for the attempt at a squeeze that's happening/happened. Take a read:

https://www.fool.com/investing/2021/01/28/yes-a-stock-can-have-short-interest-over-100-heres/ — StreetlightX

Errr... this is still about transaction volume because shares that were borrowed were sold to another investor who then lends it to another. The locate requirements are met because the underlying stock is available because of multiple sales of the same stock. That the borrower is doing the selling really doesn't change anything.

Sure, but again, the point is still that the expected profit banks on the company going out of business. — StreetlightX

I don't see the problem. Why is expecting a company to go bankrupt fundamentally wrong, or indeed, worse than expecting it to do just worse than other people think it will do? Once again, going back to the beginning, market capitalisation is expectation of future performance. All these trades have exactly no bearing on the likelihood of GME surviving except for possibly the fact that GME might hold a lot of its own stock as @BitconnectCarlos mentioned and even then just having a ton of money with a shitty business is still not really improving things for any employees.

I see fundamental problems with the stock markets how they operate and how financial institutions dominate the economy and society nowadays but this isn't the issue here. Speculators add liquidity and lower risks for every investor active in that market. That they make money off of that is only fair as the lower risk for others is basically the result of that risk being transferred to speculators. And that's still true even when speculators expect a company to go bust. -

Kenosha Kid

3.2kThat the borrower is doing the selling really doesn't change anything. — Benkei

Kenosha Kid

3.2kThat the borrower is doing the selling really doesn't change anything. — Benkei

Well, it does when they find themselves paying for inflated stock they don't want not just once but 1.4 times, and find they can only sell it again once. Shorting is a risk, and therefore a potential problem, sometimes a real one. -

BitconnectCarlos

2.8kAnd if traders make money, that money must come from someone. So it's a matter of traders being engaged in a completely different activity from that of investors. And "taking advantage of", means that the traders treat the investors unfairly, because they know that the rules of the market place will allow them to do so. — Metaphysician Undercover

BitconnectCarlos

2.8kAnd if traders make money, that money must come from someone. So it's a matter of traders being engaged in a completely different activity from that of investors. And "taking advantage of", means that the traders treat the investors unfairly, because they know that the rules of the market place will allow them to do so. — Metaphysician Undercover

That money is going to come from other traders. So for instance I trade eth and btc derivatives on Phemex (I know we're talking about stocks here but it's the same theme), and when I make a trade I use the Phemex orderbooks so that liquidity is coming from other Phemex traders or maybe whatever liquidity reserves Phemex itself has, but I'd assume mostly from other traders.

When you're an investor that gain or loss doesn't become realized until you sell it. A trader could go short or long, but he's competing against other traders here and his profits are from other traders, not long-term holders who aren't offering their liquidity to the orderbooks.

EDIT: It's also worth noting that in my experience the vast majority of traders are investors themselves. It would be jarring to me to hear from a serious trader who just doesn't invest in anything. -

Metaphysician Undercover

14.8kThat money is going to come from other traders. — BitconnectCarlos

Metaphysician Undercover

14.8kThat money is going to come from other traders. — BitconnectCarlos

I think that this is demonstrably false. If the money came from other traders, there would be an equality between traders making money and traders losing money. A trader losing money could not make a living, and would be gone from the market. But on top of this, all the losing traders, would have to be bringing into the market place all the money required for the winning traders to be making their living. So there'd be an endless supply of losing traders coming in with money for the winning traders.

In reality, a lot of the money comes from investors who are forced (for one reason or another) into selling at a loss. As you say, when the market drops, you don't lose anything unless you sell. So when the market dips, an investor doesn't lose money, until the company goes out of business, or is bought out or something like that, or else is forced to sell for some other reason.

However, there is the issue of margins, which was mentioned earlier in the thread. An investor might think that taking a margin is a smart and profitable way to invest. But if we consider the reasons why an investor would sell when the market is down, the call to cover the margin when the market does drop from an unforeseen event, is reason number one.

You might argue that once a person is into this category of investing using margin, that person is not an investor anymore, but a trader, and that may be true. Still, you cannot avoid the fact that huge market drops are perpetuated by traders then, and there is still a significant number of investors who are forced to sell low, due to prior commitments or whatever other reason, and companies are forced out of business, and the loses from these investors are supplying a lot of money to the traders. -

Kenosha Kid

3.2kWhile true, not related to what we were discussing — Benkei

Kenosha Kid

3.2kWhile true, not related to what we were discussing — Benkei

To be clear, I was responding to the point that overshorting is not a problem since it is equivalent to the same stocks being bought and sold in succession (volume-based). But if it were just that, there would be no situation in which someone pays for 1.4 stocks and ends up with 1 stock.

If someone bought a share at $10 dollars, sold it for $5 dollars, then bought another at $10, we'd say that person was a bit dim for paying $15 dollars for a share worth $5. The problem that person would be creating for themselves is the problem inherent in shorting that the trader risks meeting. -

frank

19kI think any investor guide gives you the basics for normal investing, which is very good to understand. — ssu

frank

19kI think any investor guide gives you the basics for normal investing, which is very good to understand. — ssu

I guess I just can't get interested in it. My employer invests benefit money in a company called Vanguard, but I don't really think of it as mine. I think if the global economy crashes and can't be bailed out as previously, then I won't be missing anything. -

Benkei

8.1kTo be clear, I was responding to the point that overshorting is not a problem since it is equivalent to the same stocks being bought and sold in succession (volume-based). But if it were just that, there would be no situation in which someone pays for 1.4 stocks and ends up with 1 stock.

Benkei

8.1kTo be clear, I was responding to the point that overshorting is not a problem since it is equivalent to the same stocks being bought and sold in succession (volume-based). But if it were just that, there would be no situation in which someone pays for 1.4 stocks and ends up with 1 stock.

If someone bought a share at $10 dollars, sold it for $5 dollars, then bought another at $10, we'd say that person was a bit dim for paying $15 dollars for a share worth $5. The problem that person would be creating for themselves is the problem inherent in shorting that the trader risks meeting. — Kenosha Kid

I'm not sure I follow what you're saying. First of all, let me say that we were discussing shorting as actually affecting the livelihood of the people employed by the shorted company. I don't think that view is correct.

But let me try to follow what you're trying to say. Nobody has paid a price of 1.4 to then end up with 1 merely as a result of "shorting". "Overshorting" just isn't a thing. Taking the example of a company with a single share again. I borrow the share, I sell it, the person I sold it too, lends it out too, and that borrower sells it again. We now have two short sales with only one issued share and no regular transactions. Is it "overshorted" because I know have a 200% short interest? I can make a chain of 100 short sellers if I want and I still don't see an issue with the activity of short selling itself. -

frank

19kI'm not sure I follow what you're saying. First of all, let me say that we were discussing shorting as actually affecting the livelihood of the people employed by the shorted company. I don't think that view is correct. — Benkei

frank

19kI'm not sure I follow what you're saying. First of all, let me say that we were discussing shorting as actually affecting the livelihood of the people employed by the shorted company. I don't think that view is correct. — Benkei

Shorting by a large company would send a signal to the market that the target stock is expected to decline. The market runs on moods, right? So the stock declines because it's expected to, and the target company now has a diminished ability to pay for marketing, securing talent, planning for the future.

That said, I didn't know GameStop was still in business. After the pandemic, how? Who are these people shopping at malls? -

Michael

16.8kWe now have two short sales with only one issued share and no regular transactions. Is it "overshorted" because I know have a 200% short interest? I can make a chain of 100 short sellers if I want and I still don't see an issue with the activity of short selling itself. — Benkei

Michael

16.8kWe now have two short sales with only one issued share and no regular transactions. Is it "overshorted" because I know have a 200% short interest? I can make a chain of 100 short sellers if I want and I still don't see an issue with the activity of short selling itself. — Benkei

I think the issue is that two people are contractually obliged to buy a share but there's only 1 share available. -

BitconnectCarlos

2.8kA trader losing money could not make a living, and would be gone from the market. But on top of this, all the losing traders, would have to be bringing into the market place all the money required for the winning traders to be making their living. So there'd be an endless supply of losing traders coming in with money for the winning traders. — Metaphysician Undercover

BitconnectCarlos

2.8kA trader losing money could not make a living, and would be gone from the market. But on top of this, all the losing traders, would have to be bringing into the market place all the money required for the winning traders to be making their living. So there'd be an endless supply of losing traders coming in with money for the winning traders. — Metaphysician Undercover

I've heard the statistics that 90% of traders are losing money. But some portion of that figure will probably become winning traders and some portion of the winners will become losers. It's not a static thing where the winners just always stay winners.

I wouldn't be surprised if some portion of those "losing traders" are really just using trading platforms to hedge and are thus happy with their losses (I've been guilty of this.)

In reality, a lot of the money comes from investors who are forced (for one reason or another) into selling at a loss. — Metaphysician Undercover

Why are investors "forced" to sell? Have they hit their stop loss? Do investors face liquidation if the price goes too low? Tell me what is forcing the investors to sell.

But yeah, the investor only really loses if the stock or asset goes to zero. Then you're screwed. If the asset goes to zero then traders can no longer trade it either so they're out of work too for that market.

An investor might think that taking a margin is a smart and profitable way to invest. But if we consider the reasons why an investor would sell when the market is down, the call to cover the margin when the market does drop from an unforeseen event, is reason number one. — Metaphysician Undercover

Yeah, if you take on margin you're taking on a lot of extra risk. Obviously if you go long and the market tanks you will be facing margin calls or be forced to sell at liquidation or your stop loss, but this doesn't apply to people who just buy and hold. Margin holders add that extra feature themselves. Newer traders or investors should stay away from margin.

Still, you cannot avoid the fact that huge market drops are perpetuated by traders then, and there is still a significant number of investors who are forced to sell low, due to prior commitments or whatever other reason, and companies are forced out of business, and the loses from these investors are supplying a lot of money to the traders. — Metaphysician Undercover

Well, sure it could be traders or whales or any big price mover who's looking to either buy or sell is going to move that market and the swings can be pretty wild. That's why you need to extremely careful when using margin and it's not something for newer traders to use. If you just buy and hold you can wait out these price swings and you'll never be forced to sell unless you're investing money that you need for personal use, but that's a whole different thing and we can ask ourselves whether that person should even be investing in something this risky in the first place.

TLDR: If you're using margin you're speculating so if you get stopped out or liquidated don't come crying that "speculators take money from investors" because by using margin you're speculating. -

Benkei

8.1kShorting by a large company would send a signal to the market that the target stock is expected to decline. The market runs on moods, right? So the stock declines because it's expected to, and the target company now has a diminished ability to pay for marketing, securing talent, planning for the future. — frank

Benkei

8.1kShorting by a large company would send a signal to the market that the target stock is expected to decline. The market runs on moods, right? So the stock declines because it's expected to, and the target company now has a diminished ability to pay for marketing, securing talent, planning for the future. — frank

Come now Frank, as if everybody is really taking account of who has which short position all the time. Normally, nobody gives a shit. This whole GME debacle is just hyped. It's actually really not that interesting and it's not interesting what Robin Hood did. I find the reactions of people interesting though. A lot of the comments remind me of 2008.

I think the issue is that two people are contractually obliged to buy a share but there's only 1 share available. And assume that you buy back this share from the person at the bottom of the chain and return it to the original owner. Now the person who borrowed the share from you owes you a share, but there's no share left to buy. — Michael

Oh there's definitely a settlement risk. But that's always there. One reason the naked short is prohibited. At least the short seller has a locate for his initial sale. He might get squeezed when buying it back. But that's why it's an issue of transaction volume and not how big the interest in short sale is compared to the outstanding number of stock. If that one share is normally traded 500 times during a day, buying it back twice on the same day (assuming the stock lending agreements end on the same day) isn't an issue. -

Michael

16.8kWhat about in this situation:

Michael

16.8kWhat about in this situation:

There are 100 shares and you own them all. I borrow 60 from you and sell them to Jane. Jane sells them back to you. You have all 100 shares. I borrow another 60 from you and sell them to Jane. Jane sells them back to you. You have all 100 shares. I owe you 120 shares. -

Benkei

8.1kYes, so since we know I have all the shares, we could dispense with transactions and you simply pay the fee related to the SBL transactions if I wanted to be nice. Or if you want, I can sell 60 shares to you and you deliver them back and then you ask 60 again and you give them back. Or 100 and 20, if you prefer, in both cases it will be costly for you.

Benkei

8.1kYes, so since we know I have all the shares, we could dispense with transactions and you simply pay the fee related to the SBL transactions if I wanted to be nice. Or if you want, I can sell 60 shares to you and you deliver them back and then you ask 60 again and you give them back. Or 100 and 20, if you prefer, in both cases it will be costly for you.

But this once again illustrates the importance of total transaction volume and the shares of short sales part of that transaction volume. If what you describe is a typical day in the market, shorting is an extremely bad idea. If there are lots of players and transaction volumes are a multitude of issued shares, 240% short interest doesn't raise any concerns. -

Metaphysician Undercover

14.8kTLDR: If you're using margin you're speculating so if you get stopped out or liquidated don't come crying that "speculators take money from investors" because by using margin you're speculating. — BitconnectCarlos

Metaphysician Undercover

14.8kTLDR: If you're using margin you're speculating so if you get stopped out or liquidated don't come crying that "speculators take money from investors" because by using margin you're speculating. — BitconnectCarlos

All investing is speculating, so this is not a real distinction. There is however a real distinction to be made between investing and trading. While both are speculating, what is speculated on, differs. -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

Ok just replace "speculating" with "trading" then. My point is you basically step into the realm of trader when you start using margin trading/leverage. -

Metaphysician Undercover

14.8k

Metaphysician Undercover

14.8k

Perhaps, but I think I implied that this is debatable. Would you say that someone who takes out a mortgage to buy a house does this only because they plan to flip the house? -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

No of course not. Buying a house is a different issue. It would actually be really dumb to buy a house in cash. Regardless of whether we consider using margin/leverage "trading" or just "investing" by choosing it the user has consciously taken on more risk than just holding the asset normally. When you use leverage you must know there's always a chance of being forced to sell. -

Metaphysician Undercover

14.8kNo of course not. Buying a house is a different issue. I — BitconnectCarlos

Metaphysician Undercover

14.8kNo of course not. Buying a house is a different issue. I — BitconnectCarlos

It's really not a different issue, look at the crash of the housing market in the USA, 15 or so years ago. It's well documented that this crash was caused by traders. More and more money was needed to support the traders until the mortgages were worth more than the real estate itself. What happens when you owe more for your house than your house is worth? Bankruptcy.

When you use leverage you must know there's always a chance of being forced to sell. — BitconnectCarlos

Sure, but an investor never expects to be forced to sell at a loss. And when this appears to be forced by the activity of traders there's likely more hard feelings, because now there's someone other than oneself, to blame. That's where the problem lies, in the fact that there's someone to blame. Blame implies wrongdoing. To admit to myself, I made a bad investment, I lost money, is not a big deal. To think that some traders cheated me out of my investment is a big deal. Notice it's "to think that some traders cheated me...". When people start to point fingers at wrongdoing, then the truth or falsity of this or that particular instance doesn't even matter anymore, just like for the Trump supporters who thought that they got cheated out of the election. -

Deleteduserrc

2.8kI think there's like

Deleteduserrc

2.8kI think there's like

(1) the early guys, at wallstreet bets, who knew the whole structure of the thing

(2) the hedgefunds

(3) the late adopters.

I think the people who point to this as a sort of popping, neon symptom of the immanent crisis in the heart of capitalism etc etc are right, but also it's going to fuck up a shit load of regular people.

& that's not a value-judgment, in any way, on the traders. I'm on board with Wall Street Bets.

But I think an interesting question is to what degree people understand their role in the living-out-of-the-immanent-crisis-at-the-heart-of-capitalism.

There's no way around the fact that the structure of this thing is:

short squeeze -> profit -> bagholders.

Regular people are going to get fucked. If they knew that going in, & if they bought it as a show of solidarity, then right on. If they didn't, it quickly becomes more complicated. I think most didn't buy in for that reason.

The bagholders are going to be people who signed up on the wsb fuck-the-hedgefund-energy. They will be confused at the stock's value goes down. They already are.

i think the real leftist question is how to continue this energy, when most people are bagholders. I haven't seen many people talking about that.

I think the worst thing the left could do would be cheerlead this, then drift away when the fallout happens. I don't want to be cynical, but... let's see where this thread is in a few months. -

Pfhorrest

4.6kIt would actually be really dumb to buy a house in cash — BitconnectCarlos

Pfhorrest

4.6kIt would actually be really dumb to buy a house in cash — BitconnectCarlos

Oh yeah, avoiding paying all that mortgage interest is super dumb. -

Deleteduserrc

2.8kI think the worst thing the left could do would be cheerlead this, then drift away when the fallout happens. — csalisbury

Deleteduserrc

2.8kI think the worst thing the left could do would be cheerlead this, then drift away when the fallout happens. — csalisbury

What is the next step, rather than dropping this when it stops trending?

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum