-

ssu

9.8k

ssu

9.8k

More like professional wrestling. The media frenzy around it.Just another myth. — fishfry

Or likely how rules don't matter (naked short selling) and what odd things gets the attention of the media and the people. In other times things like this would be an interest of a small group of market players, not something that politicians would be commenting about.The GME incident is a beautiful example of the free market in action. — fishfry -

Metaphysician Undercover

14.8kNow without a large segment of traders, as a US person you will only access the CME because brokers don't offer any alternative and certainly not at prices that would make sense for a retail investor. Good for you because price happens to be lowest at the CMEbut that's a matter of luck. But if you're a Singaporean, you're being screwed. And for the Singaporean to set up an investment account in the US is also prohibitively complex and expensive. — Benkei

Metaphysician Undercover

14.8kNow without a large segment of traders, as a US person you will only access the CME because brokers don't offer any alternative and certainly not at prices that would make sense for a retail investor. Good for you because price happens to be lowest at the CMEbut that's a matter of luck. But if you're a Singaporean, you're being screwed. And for the Singaporean to set up an investment account in the US is also prohibitively complex and expensive. — Benkei

I don't see how this difference in price between the CME and the SME is significantly different from my analogy of paying more for milk at the corner store compared to buying it at the big box store. Remember, I don't see anything inherently wrong with such price differences. I wouldn't say that the person buying milk at the corner store is getting screwed. Nor would I say that the person in Singapore who has to pay more for gold than the person in the USA is getting screwed.

There's a wide variety of different reasons for such differences in price which don't constitute getting screwed, such as being closer to the source of a resource makes that resource cheaper for you. There is nothing inherently wrong with the same commodity being different prices in different parts of the world. And, as I said already, I think that all the traders do, in creating price equality, is screw anybody they can.

There are no losers here... — Benkei

Yes there are losers here, the traders. The traders don't make any money in your scenario. But in reality the traders do make money, and it's at the expense of the others. So unless the traders aren't making any money, and are losers themselves, there are others who are losers, those who get screwed by the traders' desire to make money.

it all just tells how rotten the whole system is. — ssu

I'll agree to that. -

Benkei

8.1kIt looks like you're wilfully not wanting to understand what I wrote. It's not that unclear. Replace "screwed" with unlucky, for starters.

Benkei

8.1kIt looks like you're wilfully not wanting to understand what I wrote. It's not that unclear. Replace "screwed" with unlucky, for starters.

There's a wide variety of different reasons for such differences in price which don't constitute getting screwed, such as being closer to the source of a resource makes that resource cheaper for you. — Metaphysician Undercover

Yes, they're inefficiencies and traders would be people investing in infrastructure and distribution bringing local prices down. But it's not a good analogy because they cause other people to do this simply by adding their money to the market.

Yes there are losers here, the traders. The traders don't make any money in your scenario. — Metaphysician Undercover

What? The traders make money in the arbitration of prices. It's literally in my post. -

Metaphysician Undercover

14.8kBut it's not a good analogy because they cause other people to do this simply by adding their money to the market. — Benkei

Metaphysician Undercover

14.8kBut it's not a good analogy because they cause other people to do this simply by adding their money to the market. — Benkei

What? The traders don't make any money from the market, they actually add money to the market?

What? The traders make money in the arbitration of prices. It's literally in my post. — Benkei

I still don't see any reference to traders making any money. All I see is this.

Here come the traders, driving broker and transaction prices down because they add transaction volume...

...

The inefficiencies are gone so if the price of SME gold is higher, traders will buy CME gold driving prices up and selling gold at the SME driving prices down. — Benkei

See, you portray the traders as interfering with natural market trends, to heroically create equality in prices to ensure that no one get's unlucky in the market. But you give no indication as to how the traders get paid for these gallant efforts, so we have no means of judging whether or not the traders are actually screwing people, driving up the prices all around, to be able to extract some money for themselves. If the traders were doing this, they would really be screwing everyone on the demand side. And then, when they've driven the prices so high that there's a breaking point, they'll turn around and drive the prices down, screwing everyone on the supply side. In the end, everybody's been screwed by the traders. And that's not a matter of luck.

So what I see, is that your equality between different places, Chicago and Singapore, is produced at the cost of inequality at different times. The traders make the world into one equal market in its spatial extensions, at the price of having that global market swing up and down violently in its temporal extension, in order for the traders to extract some money. Is there any means for a compromise between these two, or do you simply believe that spatial equality at the cost of temporal instability is the best situation? -

Benkei

8.1kWhat? The traders don't make any money from the market, they actually add money to the market? — Metaphysician Undercover

Benkei

8.1kWhat? The traders don't make any money from the market, they actually add money to the market? — Metaphysician Undercover

They add transaction volume (eg. more money is exchanged then before because they enter the market with their own money. That doesn't mean they're giving it away. It's like poker, the initial pot gets bigger), which means exchanges, brokers, custodians, clearing houses etc. all make extra money. They can pay for those costs from the profits they make from their trading activities.

I still don't see any reference to traders making any money. All I see is this. — Metaphysician Undercover

Buy low, sell high. That's implicit in arbitrage.

See, you portray the traders as interfering with natural market trends, to heroically create equality in prices to ensure that no one get's unlucky in the market. — Metaphysician Undercover

The idea markets become less natural because more buyers and sellers (eg. Traders) enter it is something I don't even understand how you got there to begin with so I don't know how to reply to it.

But let's go back. What exactly is your problem with some finding out he can buy low in one market and sell higher in another? There's a willing seller in the first and a willing buyer in the second. Who's being hurt here exactly? This is all a trader does. -

ssu

9.8k

ssu

9.8k

This trade is called arbitrage and the traders arbitrageurs. And those traders aren't typically appreciated.What exactly is your problem with some finding out he can buy low in one market and sell higher in another? There's a willing seller in the first and a willing buyer in the second. Who's being hurt here exactly? This is all a trader does. — Benkei

That there's mispricing is the plain theoretical reason. However usually the reason for having different prices in separate markets isn't because the sellers would be ignorant or indifferent of there being higher prices somewhere else.

If we rule out logistical reasons for different prices, typically the price difference is done by government decree to "help" the ordinary people by rationing or fixing prices. That naturally leads to a black market, where the arbitrageur is one of the most hated persons in the society.

Brent crude and WTI do have traded with separate prices, because an arbitrage in the oil market does have it's limitations.

-

Metaphysician Undercover

14.8kBuy low, sell high. That's implicit in arbitrage. — Benkei

Metaphysician Undercover

14.8kBuy low, sell high. That's implicit in arbitrage. — Benkei

OK, so the trader buys on the CME low, and sells high on the SME, and makes some money. The person buying higher, could have bought lower, directly from the CME, so how is the trader not screwing that person?

The idea markets become less natural because more buyers and sellers (eg. Traders) enter it is something I don't even understand how you got there to begin with so I don't know how to reply to it. — Benkei

I don't care if you want to represent trading as a "natural" part of the market, we can represent greed and its associated activities of hoarding, stockpiling, monopolizing, and all sorts of other things which are morally wrong as "natural" too. The question is whether we ought to put modern day "trading" into this category of morally wrong.

But let's go back. What exactly is your problem with some finding out he can buy low in one market and sell higher in another? There's a willing seller in the first and a willing buyer in the second. Who's being hurt here exactly? This is all a trader does. — Benkei

If this were really "all a trader does", we could easily class the trader as providing a service which one ought to get paid for. The trader would purchase goods here, and deliver them over there, selling them at a mark up, to get paid for that service, like a common middleman. The problem is that with today's connectivity in the global market there is no such separation between here and there, every place has access to buy in any other place, so there is no need for the trader to purchase here and deliver over there. Effectively, the need for the trader has been eliminated, there is no longer any purpose for the trader in the market. One can hire a broker if required, and the trader's services have become obsolete.

However, the fact that there is no longer anything useful for the trader to do does not incline the trader to leave the market, because the trader still has all the knowledge of the system, and the skill required for making money in the market. So the trader has quickly found a new role, and that is to manipulate the market. This is done as you described, through transaction volumes. it's easy to see how an increased or decreased flow rate has an immediate effect in market prices, allowing some money to be extracted.

But investors, and the market in general, quickly become accustomed to such changes in volume, the market climatizes itself, and it becomes more and more difficult for the trader to extract money through volume manipulations. The magnitude of change in volume required for a trader to extract money becomes higher and higher, beyond the individual trader's resources, as the market has climatized itself to these individual actions, so the individual trader's capacity to manipulate the market has quickly been eliminated. Again, this does not incline the trader to leave the market, it inclines them to collude, to conspire, pool their resources in order to obtain the magnitude required to manipulate the market. . -

Benkei

8.1kThe person buying higher, could have bought lower, directly from the CME, so how is the trader not screwing that person? — Metaphysician Undercover

Benkei

8.1kThe person buying higher, could have bought lower, directly from the CME, so how is the trader not screwing that person? — Metaphysician Undercover

Uh... In your milk example you were perfectly fine paying more and not having to travel further. Now someone offers it to you locally cheaper and you're complaining it's not as cheap as it is somewhere else despite it being cheaper than it was? It seems to me you have a judgment ready and are hell bent on ensuring that you reach that preconceived conclusion.

I don't care if you want to represent trading as a "natural" part of the market, we can represent greed and its associated activities of hoarding, stockpiling, monopolizing, and all sorts of other things which are morally wrong as "natural" too. The question is whether we ought to put modern day "trading" into this category of morally wrong. — Metaphysician Undercover

I think if you postpone your moral indignation for a moment you'll realise your analysis goes only skin deep, which is why you're stuck at blaming traders. There are structural problems how our markets operate. You complain about the players and miss what's actually going on.

The rest of your post just reflects how your preconceived judgment colours everything you say, leading to statements that are just plain false. Traders are not en masse engaged in market manipulation. This is just silly talk.

Personally, I'm out of patience trying to explain basic aspects of how stock markets work to you. I'm open for direct questions if you want to learn something from someone who's worked for governments and private firms in both stocks and bonds. -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

If Metaphysician Undercover is also against "hoarding", "stockpiling" and gambling then I can't imagine it's worth it to try to convince him to accept trading. Some of his responses to me also lead me to believe that he's never actually traded or used leverage so this discussion would appear to be entirely theoretical for him. For someone who's never really participated in this type of activity to then come down and basically say "the need for the trader has been eliminated" is just drivel to me. As an actual trader who follows other traders no one really cares whether the market "needs" us or whether others morally approve, but you've made some good macro points about how traders do provide value even if when we're doing it we're mostly just out for ourselves. -

Metaphysician Undercover

14.8kIt seems to me you have a judgment ready and are hell bent on ensuring that you reach that preconceived conclusion. — Benkei

Metaphysician Undercover

14.8kIt seems to me you have a judgment ready and are hell bent on ensuring that you reach that preconceived conclusion. — Benkei

I wouldn't say "hell bent", but I do need some sort of an argument from you, to change my preconceived conclusion. I really haven't seen much from you as an argument. And I'm not even trying to change your preconceived idea, just laying out some opinions.

There are structural problems how our markets operate. You complain about the players and miss what's actually going on. — Benkei

OK, so my preconceived conclusion is based in a misunderstanding of what's actually going on. Do you claim to know what's actually going on?

Some of his responses to me also lead me to believe that he's never actually traded or used leverage so this discussion would appear to be entirely theoretical for him. — BitconnectCarlos

Wouldn't it be sort of hypocritical for me to actually be engaged in trading and at the same time expressing the opinion that it's inherently wrong?

For someone who's never really participated in this type of activity to then come down and basically say "the need for the trader has been eliminated" is just drivel to me. — BitconnectCarlos

So an observer's opinion is not worth anything? One must actually participate in the activity to make a judgement about it? Do you think that one must participate in murder, or theft, before judging that there is no place for these activities in our society? -

Benkei

8.1kI wouldn't say "hell bent", but I do need some sort of an argument from you, to change my preconceived conclusion. I really haven't seen much from you as an argument. And I'm not even trying to change your preconceived idea, just laying out some opinions. — Metaphysician Undercover

Benkei

8.1kI wouldn't say "hell bent", but I do need some sort of an argument from you, to change my preconceived conclusion. I really haven't seen much from you as an argument. And I'm not even trying to change your preconceived idea, just laying out some opinions. — Metaphysician Undercover

There's no argument to be had where I'm still trying to explain the basics and you aren't interested to even listen. -

Pfhorrest

4.6kThere may not have been any 'popular uprising' factor to these events at all.

Pfhorrest

4.6kThere may not have been any 'popular uprising' factor to these events at all.

Unless most of the Reddit bunch have assets in the top one-tenth of one percent of Americans, they were mere bystanders to last week's trading of 682 million shares at an average price of $218.20 — purchases totaling nearly $150 billion in a wildly volatile market. Only institutional investors have such resources to trade stocks, not self-styled populists with Robinhood on their iPhones. Since most big players are regulated public corporations with fiduciary responsibilities to avoid the enormous risks involved in this high-stakes game of chicken, the GameStop players almost certainly are all lightly regulated hedge funds. -

ssu

9.8kYet the portrayal of "David" defeating "Goliath", the "little people" shoving it to the hedge funds was excellent PR: it got people interested in the trade and worked wonders for those doing the pump and dump trade. The Wall Street bashing alt-media was ecstatic. And longer time owners of the stock can be happy while it's still at prices where the share was at it's earlier peak back in 2008 before the financial crisis. Would be rather ugly if the stock would go back to single digits immediately. In a few weeks it will be forgotten as another squirrel catches our attention.

ssu

9.8kYet the portrayal of "David" defeating "Goliath", the "little people" shoving it to the hedge funds was excellent PR: it got people interested in the trade and worked wonders for those doing the pump and dump trade. The Wall Street bashing alt-media was ecstatic. And longer time owners of the stock can be happy while it's still at prices where the share was at it's earlier peak back in 2008 before the financial crisis. Would be rather ugly if the stock would go back to single digits immediately. In a few weeks it will be forgotten as another squirrel catches our attention.

(Besides, those 150+ million shares or so bought over 300 dollars likely were just recreation.) -

Metaphysician Undercover

14.8kThere's no argument to be had where I'm still trying to explain the basics and you aren't interested to even listen. — Benkei

Metaphysician Undercover

14.8kThere's no argument to be had where I'm still trying to explain the basics and you aren't interested to even listen. — Benkei

I'm listening but you haven't gotten anywhere. I asked how the traders make any money. You said "buy low sell high" and then you just get distracted, sidetracked into going on about all the good which they are doing for the market, bringing in their own money to create a big pot, increasing volumes. Of course this is easily debunked as attempts at market manipulation, but you seemed upset by that suggestion..

So, back to the question, how do the traders ensure that they can buy low and sell high, to make sure that they get paid. If it was only a 50/50 chance they wouldn't be hanging around there, and it can't be like a gambling casino where the table is slightly slanted toward the house, because regular brokers would all share the same slant. And if it were a matter of knowledge, the brokers would share that as well. So what produces the slant for the traders, to keep them hanging around, if it's not market manipulation through pools of money and volume control? -

BitconnectCarlos

2.8kSo an observer's opinion is not worth anything? One must actually participate in the activity to make a judgement about it? Do you think that one must participate in murder, or theft, before judging that there is no place for these activities in our society? — Metaphysician Undercover

BitconnectCarlos

2.8kSo an observer's opinion is not worth anything? One must actually participate in the activity to make a judgement about it? Do you think that one must participate in murder, or theft, before judging that there is no place for these activities in our society? — Metaphysician Undercover

Sure you're an observer - and I don't mean to be offensive or rude here - but you don't really seem to be an observer who really knows quite exactly what's going on in financial markets. I'm certainly not claiming to be an expert either and there are plenty of discussions where I'll be lost, but the difference between us is that I'm less inclined to make these kinds of overarching judgments. Before trading I was a semi-professional poker player so I'm just not that interested in hearing someone's take on why poker is wrong. According to who?

I'll ask you the question I asked earlier in this thread: What is the difference between buying a stock at $200 and selling it at $300 and buying a piece of artwork at $200 and selling it for $300? Why is one okay but not the other? -

Baden

16.7k

Baden

16.7k

Before trading I was a semi-professional poker player so I'm just not that interested in hearing someone's take on why poker is wrong. According to who? — BitconnectCarlos

Poker is a good analogy to use. What's the slant on poker players who consistently make money? They must be cheating, right? No, it's a skill and they're good at it. Same with trading. Institutional advantage doesn't negate that. -

Metaphysician Undercover

14.8kbut you don't really seem to be an observer who really knows quite exactly what's going on in financial markets. — BitconnectCarlos

Metaphysician Undercover

14.8kbut you don't really seem to be an observer who really knows quite exactly what's going on in financial markets. — BitconnectCarlos

If you know better, inform me then, I'm good to listen.

but the difference between us is that I'm less inclined to make these kinds of overarching judgments. — BitconnectCarlos

I've heard some opinions, so I'm throwing them out there to see if anyone can show me whether, they're true or not. Of course I would not say that every trader is like this, or every trader is like that, but I'm wondering if, over all, they bring more bad or more good to the market.

I'll ask you the question I asked earlier in this thread: What is the difference between buying a stock at $200 and selling it at $300 and buying a piece of artwork at $200 and selling it for $300? Why is one okay but not the other? — BitconnectCarlos

i wouldn't think that trading in artwork is any less immoral than trading in stock, or any commodity. Huge markups seem to be unacceptable no matter how you look at it. And that the buyer is willing to pay it doesn't justify the markup. Would it be acceptable to you if traders took control of all the produce from the farms releasing it to the people only if they would pay a huge mark up? The people would be really hungry, and willing to surrender large amounts of money for some food, after the supply was squeezed for just a few days.

There is however, a sense that if a person is wasting money on art, which is a luxury item, there's nothing wrong with trying to get as much money out of that person as possible. But just because the person has a whole lot of money, and may even have got it through immoral means, doesn't make it morally acceptable to use immoral means to get money from the person. It's kind of like stealing from a thief, it's not really acceptable. And there's still a victim, the person the first thief stole from, or in your example, the artist who didn't get paid the appropriate value for the work.

What about investments? Why should it be morally acceptable for people to take advantage of huge price swings, and even worse, manipulate the stock market attempting to force prices in one way or another to be able to take advantage of huge price swings?

Poker is a good analogy to use. What's the slant on poker players who consistently make money? They must be cheating, right? No, it's a skill and they're good at it. Same with trading. Institutional advantage doesn't negate that. — Baden

The reason why gambling is considered to be a vice, is not that some may cheat. It's more like some will take advantage of others. Do you think it's morally acceptable for a highly educated person who's engaged in the same trade as a lesser educated person, to take advantage of the lesser educated person? The apprentice gets paid a fair and reasonable amount, not taken advantage of for everything that the more highly educated person can get from the apprentice. To me, that seems to be the issue with trading, some will take advantage of others, and there's nothing to prevent this, just like in poker. You might think that so long as it's done within the boundaries of the law, it's ok. But why do they have laws to try and prevent people from taking advantage of each other, if it were ok to take advantage of others so long as you do it within the law. -

Baden

16.7k

Baden

16.7k

I haven't made any argument concerning the law yet. I simply don't equate winning with taking advantage of. Do you not see any distinction? Theoretically, if consenting adults pit themselves against each other in a game of poker and/or a session of trading, is there necessarily something immoral going on there in your view? Or is your argument more nuanced than that? -

Metaphysician Undercover

14.8kI haven't made any argument concerning the law yet. I simply don't equate winning with taking advantage of. Do you not see any distinction? — Baden

Metaphysician Undercover

14.8kI haven't made any argument concerning the law yet. I simply don't equate winning with taking advantage of. Do you not see any distinction? — Baden

Without the money in the game, winning might not be taking advantage. But if you're playing for money, and one has a skill level which clearly exceeds the other, then winning is a matter of the one taking advantage of the other. And if the skilled player creates the illusion of a fair playing field, like they used to do in the pool halls, or when the skilled poker player allows the less skilled to get a little ahead at the beginning, to get a taste of winning, only to turn things around when it counts, it's surely immoral, regardless of the consent. There's no end to the little tricks which winners can do to increase what they take from the losers. Betting is half the game in poker. So the game becomes a game of trying to take as much as possible from the losers.

I think that's why activities like this are generally considered to be immoral. Wen you have a contest of skill, and you're playing for money, there's no way to avoid the reality that people will take advantage of others. Isn't that the goal of the game, to win as much as you can? How can win as much money as you can, be consistent with, don't take advantage of the others? So that goal of winning money always turns into a matter of taking advantage of, as the means to the end. -

Benkei

8.1kIt's not even comparable with a poker game. With a trade there's a willing buyer and a willing seller who trade precisely because they are getting out of the trade what they want. It's win-win. It's no different from me buying dinner and a restaurant selling it to me,except this time I'm buying a share.

Benkei

8.1kIt's not even comparable with a poker game. With a trade there's a willing buyer and a willing seller who trade precisely because they are getting out of the trade what they want. It's win-win. It's no different from me buying dinner and a restaurant selling it to me,except this time I'm buying a share. -

ssu

9.8k

ssu

9.8k

Generally yes, people are happy with the voluntary transactions they make.With a trade there's a willing buyer and a willing seller who trade precisely because they are getting out of the trade what they want. It's win-win. — Benkei

Yet tell that to someone that has to sell when they have gotten a margin call. -

ssu

9.8kTell that to them.

ssu

9.8kTell that to them.

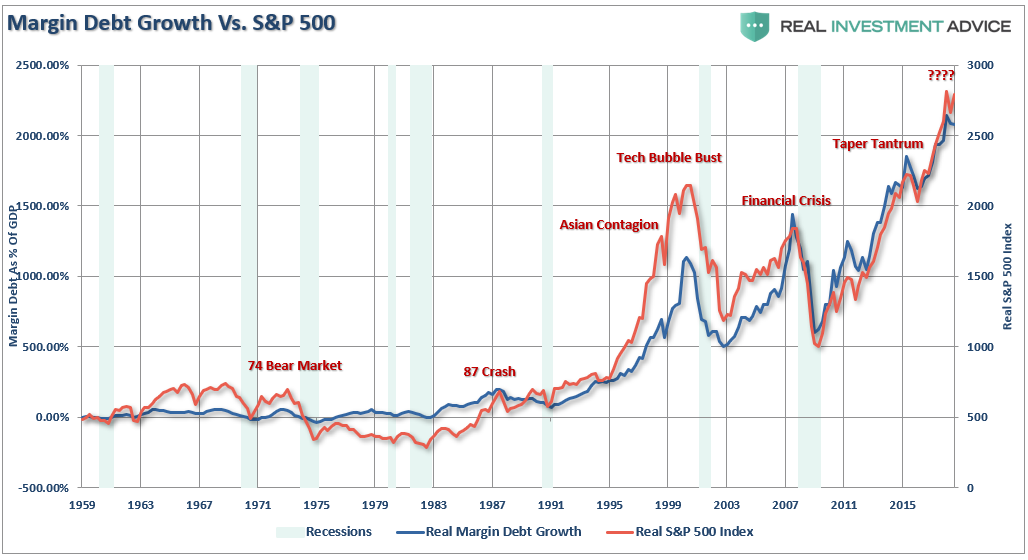

The fact is that never has been so much leverage been used in the stock market.

(Margin debt is debt a brokerage customer takes on by trading on margin.)

(DEC 28th 2020) Margin balances have reached a new record high as a widening class of affluent Americans borrowed against their portfolio investments to buy more stock. Margin debt has reached the highest point in two years as investors borrowed a record $722.1 billion against their investment portfolios through November, topping the previous high of $668.9 billion from May 2018, according to the Financial Industry Regulatory Authority (FINRA).2

This amount is a 28% increase since the same time last year and is up nearly 10% from $659.3 billion in Oct. 2020. The surge in risk-taking indicates that investors were euphoric as COVID-19 vaccines neared. These investors are chasing bigger gains and exposing themselves to potentially devastating losses through riskier plays, including concentrated positions, trading options, and leveraged exchange-traded funds (ETFs). The milestone is not a good sign for the stock market since margin debt records often precede market volatility, as seen in 2000 and 2008.

Just remember Benkei that in this World we live in profits are privatized, yet the losses are socialized. -

BitconnectCarlos

2.8kDon't trade on margin then, which is basically borrowing money. People who complain about margin calls or close outs shouldn't be trading at margin anyways. Comes with the territory. — Benkei

BitconnectCarlos

2.8kDon't trade on margin then, which is basically borrowing money. People who complain about margin calls or close outs shouldn't be trading at margin anyways. Comes with the territory. — Benkei

No! I stand with your average mom and pop investor who comes home from their 9-5 on payday, paycheck in hand, and decides to 10x leverage long AMC at $15. They don't use a stop loss because liquidation is their stop loss. But then evil traders come and manipulate the market and these poor Americans are forced to sell. The whole thing seems very immoral to me. -

Metaphysician Undercover

14.8kIt's not even comparable with a poker game. With a trade there's a willing buyer and a willing seller who trade precisely because they are getting out of the trade what they want. It's win-win. — Benkei

Metaphysician Undercover

14.8kIt's not even comparable with a poker game. With a trade there's a willing buyer and a willing seller who trade precisely because they are getting out of the trade what they want. It's win-win. — Benkei

When poker players are betting on what they are holding, they are all willing, and getting what they want, at that time. They all think it's win-win, until "later" when it's decided who really wins. That "later" is when some don't get what they want. How is this different from trading?

Don't trade on margin then, which is basically borrowing money. People who complain about margin calls or close outs shouldn't be trading at margin anyways. Comes with the territory. — Benkei

Yes, and tell that to the gambler too, you shouldn't gamble, the table's slanted to the house, you "probably" will not win, this comes with the territory. You can't even stop people from buying lottery tickets when the odds are millions against them, by trying to reason with them in this way. The fact that a reasonable person would not do that, does not stop people from doing it nevertheless.

That's the problem with this type of vise. The "evil" consequences appear minimal, or completely nonexistent. So what if I lose a little bit of money, I've got some to spare, and if I lose it, no one gets hurt but me. But when some of us get a taste of winning our emotions overwhelm our capacity to reason and we throw caution to the wind. Then "a little bit of money" has no bounds.

It may be easy for someone like you to say, "those people should not be playing that game". However, those people are the suckers, and if they weren't playing the game, the rest of you wouldn't be making the easy money. This just requires that you adhere to some fundamental principles while letting the emotional ones make the mistakes. So it's clearly a matter of the reasonable people taking advantage of the unreasonable, where "unreasonable" is defined by an emotional weakness. -

Benkei

8.1kWhen poker players are betting on what they are holding, they are all willing, and getting what they want, at that time. They all think it's win-win, until "later" when it's decided who really wins. That "later" is when some don't get what they want. How is this different from trading? — Metaphysician Undercover

Benkei

8.1kWhen poker players are betting on what they are holding, they are all willing, and getting what they want, at that time. They all think it's win-win, until "later" when it's decided who really wins. That "later" is when some don't get what they want. How is this different from trading? — Metaphysician Undercover

A poker player takes willing risks but they don't want to lose. A trade consists of a buyer and seller who want to trade and for a price they both want - otherwise no trade. Nobody is losing here. -

BitconnectCarlos

2.8k

BitconnectCarlos

2.8k

It may be easy for someone like you to say, "those people should not be playing that game". However, those people are the suckers, and if they weren't playing the game, the rest of you wouldn't be making the easy money. This just requires that you adhere to some fundamental principles while letting the emotional ones make the mistakes. So it's clearly a matter of the reasonable people taking advantage of the unreasonable, where "unreasonable" is defined by an emotional weakness. — Metaphysician Undercover

This can certainly be the case, but it's not always the case. Two emotionally-balanced players could be playing and one could just be using better strategy than the other. The player that is using better strategy could (and often does) still lose though. Edges can be quite small and only expose themselves over thousands of hands.

But by and large, yeah, poker is often about exploitation and if you're 100% opposed to exploitation and want to maintain moral purity at all costs you probably shouldn't be at a poker table. You probably shouldn't be in business either. You might make a good philosopher though who can provide sweeping moral judgments over areas that they have zero personal experience with. -

ssu

9.8kThat looks.... worryingly unsustainable. — Benkei

ssu

9.8kThat looks.... worryingly unsustainable. — Benkei

Many things look worryingly unsustainable. Not just the stock market and it's stellar performance during an economic crisis.

However that doesn't mean that we can get the same thing, go along the same road singing merrily while we go on without a worry in our minds. And nothing really bad happens.

For a month or two. For a year or two. Perhaps for even a decade....or not.

Afterwards the easy wisdom of hindsight. How could people do what they did? How could they not use their brains? How could they not see what was happening?

What were they thinking? -

Baden

16.7k

Baden

16.7k

Fair point. Also, @Metaphysician Undercover, where do you draw the line between trading and investing? Seems you could apply the same logic you've used to condemn anyone who puts money into a market with the intention of later taking it out at a profit (and note that markets aren't zero sum games when they are expanding).

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum