-

ssu

9.8kIt's been one traditional narrative for a long time, which hasn't gone anywhere, but now I think many have started to talk more about inflation coming to be a somewhat serious problem in the future.

ssu

9.8kIt's been one traditional narrative for a long time, which hasn't gone anywhere, but now I think many have started to talk more about inflation coming to be a somewhat serious problem in the future.

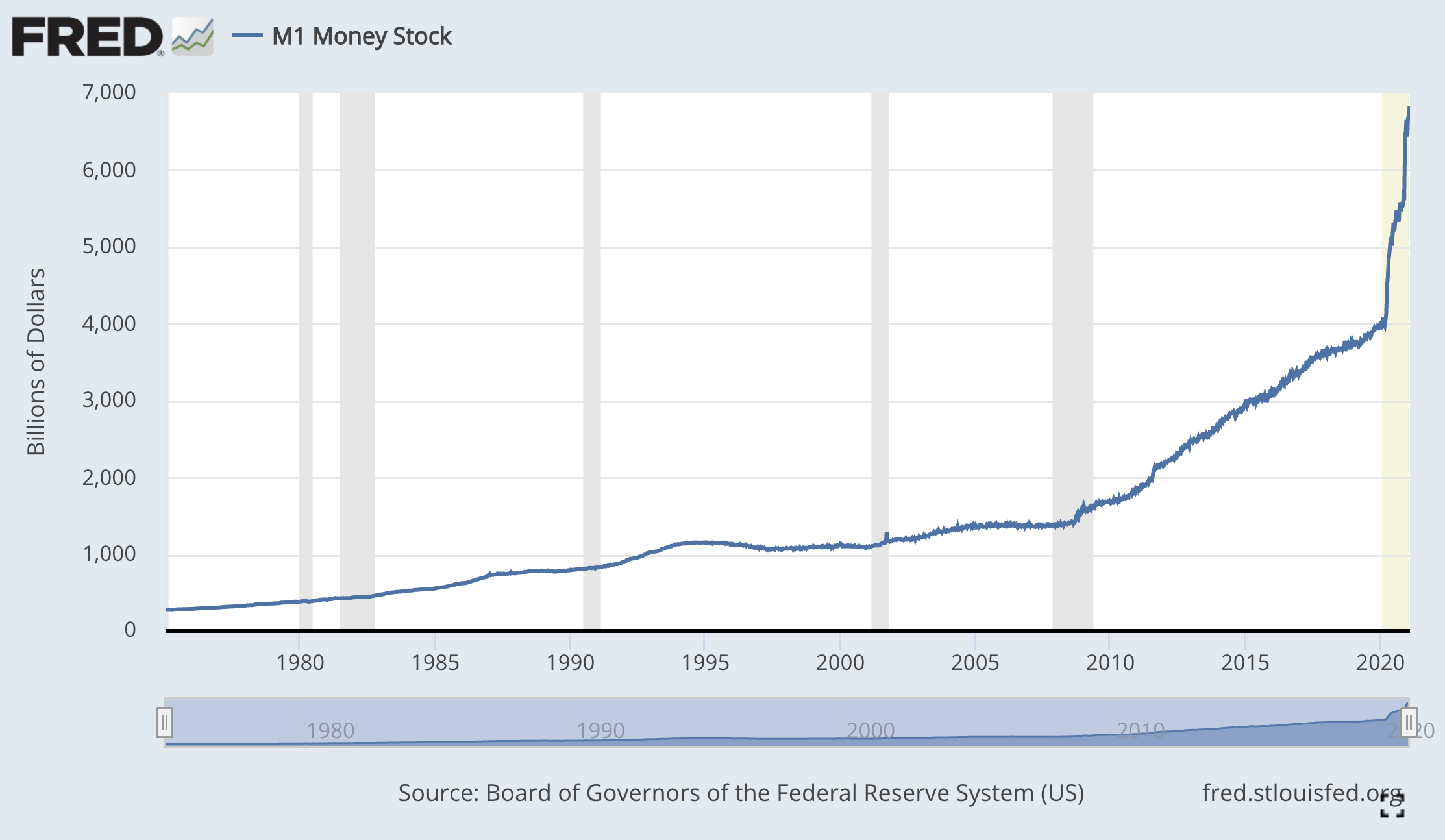

Not a promising development that the Federal Reserve decided to discontinue to report the weekly money supply M1 (and M2 also, I think) and now gives the statistics more seldom. And of course, the stats started to be the traditional hockey stick...

See Federal Reserve internet page M1 (discontinued)

Inflation being irrelevant of money supply is the new MMT (modern monetary theory) that is difficult for at least older people to understand.The Federal Reserve recently discontinued updating the M1 and M2 weekly money supply series and is instead updating the series monthly.

Steve Hanke, professor of Applied Economics of Johns Hopkins University, said that this change reflects a change in attitude from the world's largest central bank on the importance of looking at money supply.

"Chairman Powell has very explicitly claimed that money doesn't matter in recent testimony. He's basically said that money and the measurement of money doesn't really matter because it's unrelated to inflation," Hanke said.

These money supply series have been published since the 1970s, and the fact that the Fed has changed the publishing frequency on M1 and M2 money supply from weekly to monthly demonstrates a change in worldviews, Hanke said.

"In principle, they don't think [this data] is important. They want to deep-six the monetarists, basically and push them off to the sidelines. They want to bury Milton Friedman once and for all and be done with it, and their preference would probably to not report any monetary statistics," he said.

Of course this isn't something that is only happening in the US. Other countries, especially the ECB is following suit and for example the Swiss Central Bank has been printing money and buying with it US stocks and other financial investments in order for the Swiss franc not to revalue against other currencies (see here). And what happens now depends on how people will respond to the new situation. Once Covid-19 lockdowns are history, what happens?

The succession of government stimulus packages to combat the covid-19 pandemic has increased the broad supply of money in the United States from $15.5 trillion in February 2020 to a whopping $19.4 trillion in January. That is a record one-year increase, according to statistics from the Federal Reserve Bank of St. Louis. Biden’s billions will come on top of that.

This has not caused inflation so far because people have largely saved the money rather than spent it. The personal savings rate — the percentage of income that people save rather than spend — has skyrocketed during the pandemic, up from a pre-pandemic average of around 7 percent to as high as 34 percent last April. The savings rates for almost every month over the past year have exceeded that of virtually every month in the past 60 years, as people socked away their wages and the government’s previous stimulus checks. That means most Americans will already be sitting on oodles of cash when Biden’s new $1,400-per-adult checks hit their bank accounts.

What Americans decide to do with this money will determine whether we experience a burst of inflation in the coming months.

Do you think inflation will be a real problem to the ordinary person in the future?

-

jgill

4kI suspect the official inflation rate will not gibe with my personal expenditures. Virtually everything I have bought recently has cost 15-30% more than a year or so ago. Could be it's just me. What has been your experience? :chin:

jgill

4kI suspect the official inflation rate will not gibe with my personal expenditures. Virtually everything I have bought recently has cost 15-30% more than a year or so ago. Could be it's just me. What has been your experience? :chin:

Edit: Whoops! My wife, who is almost a professional shopper, informs me many grocery items remain at pre-pandemic levels. :yikes: -

javi2541997

7.2kI have bought recently has cost 15-30% more than a year or so ago. Could be it's just me. What has been your experience? — jgill

javi2541997

7.2kI have bought recently has cost 15-30% more than a year or so ago. Could be it's just me. What has been your experience? — jgill

Exactly the same feeling. Even in terms of prices in shipping or transporting is clearly how increased since the last year. I would say like a 15-30 % as you said. -

ssu

9.8k

ssu

9.8k

Those groceries are what is counted in the indexes. And there are ways to make the costs appear smaller. For example, if you buy any tech gadget, they can say that now the gadget is far more better than last year and hence it's cheaper even if the price has stayed the same or have gone up. Then there's housing: usually what is used are rents, which don't go up (or down) as real estate prices do. Making inflation appear smaller than it is, is an objective for any government now days.Whoops! My wife, who is almost a professional shopper, informs me many grocery items remain at pre-pandemic levels. :yikes: — jgill

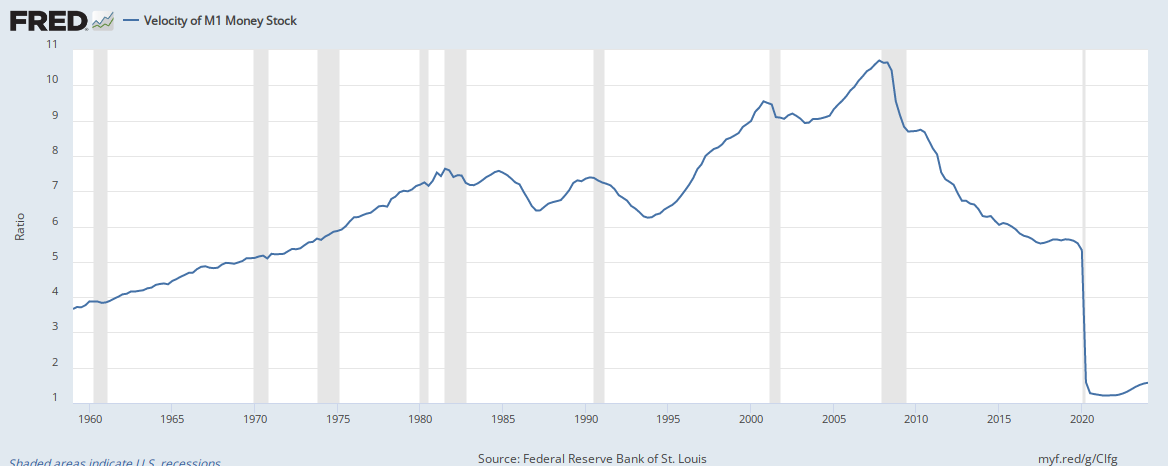

Thanks Shawn, you pick up an excellent point: the velocity of money has gone down (thanks to the lockdowns).People are just saving or banks hoarding, pick one... — Shawn

What has happened is that people are really saving. And why not? The economy has gone off a cliff, so why not to save now as things won't get to normal in an instant. Hence with the large (in aggregate) wealth transfer from the government the statistics have really gone quite bonkers. The real issue here is if that velocity starts picking up once the COVID-19 scare starts to be history. Raising interest rates starts to be a non-option: the market can easily crash if interest rates go up. The last thing Joe and Kamala want is a stock market crash and again a 30's style economic depression. If the interest rates would return to the historical normal, the government and the economy would be in real difficulties. For example Japan is already a captive of low to zero interest rates.

Hence inflation seems to be the real way to "tax the people" and to get out of this. If people wouldn't just notice it...

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum