-

Count Timothy von Icarus

4.3kThis is the meme rallying cry against bears and crypto bulls. Stock prices only go up (given a long enough time horizon). This is something that is taught almost as a fact of economics. For example, The Great Courses' micro/macro 101 level course explains how the stock market has averaged a 10% return per annum, and how a slow and steady flow of savings into a diversified stock portfolio yields a large amount of savings over time. This is the famous "Warren Buffet," advice: "stick your money in S&P500 ETFs and forget about it."

Count Timothy von Icarus

4.3kThis is the meme rallying cry against bears and crypto bulls. Stock prices only go up (given a long enough time horizon). This is something that is taught almost as a fact of economics. For example, The Great Courses' micro/macro 101 level course explains how the stock market has averaged a 10% return per annum, and how a slow and steady flow of savings into a diversified stock portfolio yields a large amount of savings over time. This is the famous "Warren Buffet," advice: "stick your money in S&P500 ETFs and forget about it."

There is a rather large problem with this ubiquitous outlook on the price of equities.

First, it is falsified by history.

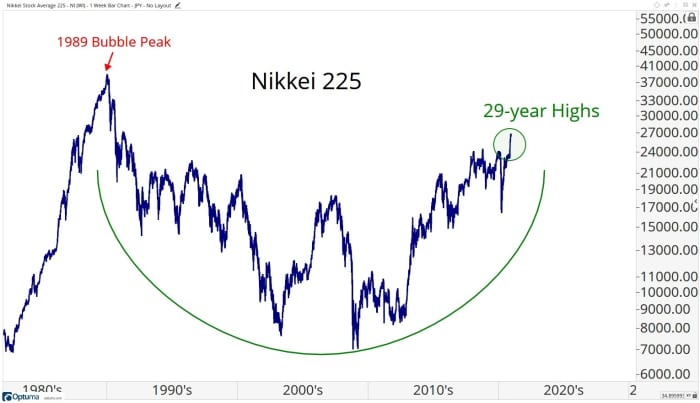

Imagine pouring your savings into an S&P500 ETF in 1965 as it approached 800, only to see it not surpass that level until the early 1990s, at which point decades of high inflation had already greatly eroded the real value of nominal share prices. Investing at age 35 does not guarantee solid returns by age 65.

A look at other markets is even less friendly to this view:

The second problem is that, in all my time studying and now teaching economics, I have never seen an argument for why stock prices for large caps should necessarily outpace both inflation and % GDP growth. Yet the argument that parking your money in an index fund should be a rather fool proof strategy endures, and this argument presupposes that this is true. In reality, it seems odd that the value of shares of the largest 100-500 companies should continually grow significantly faster than overall GDP, wages, or inflation.

From an information theoretic perspective this also makes little sense. If stocks outperform fixed assets consistently in this way, this should be priced in already, and so we shouldn't have continuous growth. Continuous growth of this sort presupposes an informational deficit that, by my reckoning, should not exist.

What's up here?

It's an open question. My thought is that the long-term boom in stock prices is tied directly to central bank efforts to stimulate full employment by keeping interest rates very low. This has made fixed asset investments (e.g. bonds), produce a very low return on investment. This in turn has driven people to invest in equities. Helping this trend is the advice that "throwing money into equities is a sure thing." But, at some point, people will remember that it isn't. You can plow your money into a diversified large cap index in a developed country at age 35, come back at 65, and find your assets' real value are lower than it was when you bought it. This has indeed happened historically.

The reason "stonks only go up," then is central bank actions depressing the value of fixed asset investments, while at the same time cheap debt allows companies to do things like issue debt for stock buybacks and "debt funded dividends." My opinion is that both of these should be illegal. Corporations, like government entities, should only be allowed to borrow to fund investments or operating deficits.

Corporate debt to GDP hit record levels in the US even before the Pandemic borrowing binge. This debt service represents a considerable anchor on companies' future ability to generate profits. Yet stocks have soared. This seems mysterious until you realize that interest rates have been held so low, even as inflation rises, that stocks have represented one of the only places for yield chasing investors to plow their money into. Who wants to hold 30 year debt at 2.8% when inflation is 8%?

(The other place they've looked for yields? Single family homes .This also has had bad effects, on the one hand increasing housing scarcity, and on the other looking like a new bubble, as rents and home prices rise with no connection to wage growth.)

The problem I foresee is twofold. First, the policy of keeping rates low has now been identified as far from benign. It is a major driver of wealth inequality. To see why, simply look at the percentage of all equities held by the top 0.1%, 1%, and 10% wealthiest individuals in developed economies. Rising stock values inflate the value of assets largely held by the wealthy.

This wasn't politically untenable before because the middle class had still plowed most of their savings into the market. The fate of stock prices became very politically relevant as the ability of citizens to retire was increasingly tied to stock prices. Thus, there was considerable pressure to make sure "stonks only go up," which you see in the fact that so much debt was allowed to be issued for stock buybacks.

Now the interests of the wealthy and everyone else are diverging because inflation is back. It's more important for the median citizen to see inflation subside than it is to see stock values stay up.

How do we beat inflation? We dramatically increase interest rates. What happens if rates go up dramatically and eclipse the projected return for stocks (which are already probably unrealistic)? You get a massive vacuum pulling money out of stocks and into fixed assets. You get this not only because returns are higher in fixed assets, but because heavily indebted large corporations now are forced to roll over debt at much higher rates, which is going to tank profitability.

Which isn't to say I think stocks will plunge in value and stay low for 30+ years, but to say that it is totally possible and I find it hard to see why this is ignored. And while raising rates and keeping them high will be painful, it might be the right thing to do. Middle class people should not necessarily have most of their non-home related assets tied up in equities. Wouldn't it be nice if people who can't afford to gamble could make actual meaningful yields on savings bonds like they used to be able to? Isn't fixed asset income a better foundation for middle class savings? Aren't bonds, which are issued for real investments (stock buybacks aside), a better place to focus than stock prices, whose shift up or down does absolutely nothing for how much a company can invest?

ETFs are a great innovation. They allow you to quickly diversify your portfolio. They're also awful for amateur investors as far as fixed income is concerned. Instead of thinking about buying a coupon rate, you're buying shares of a bond ETF. The price of that share now moves around based on bond market behavior.

On a practical note, the US government does offer anyone with a Social Security number up to $10,000 in savings bonds that are tied to the rate of inflation. That, far more than equities, is where luminaries should be telling people to put their money first. There is a 9.6% coupon sitting out there and "experts" are saying "go buy stock" now?

Lot to unpack there. Figured it would be a fun topic of discussion. -

Cuthbert

1.1kStock market players create no value. They build no houses, sail no ships, entertain no crowds, sew no garments, dig up no precious stones, make no medicine, fight no wars, paint no fences, install no boilers, deliver no babies and create nothing of either use or beauty. They encourage one lot of people to lay bets on other people's success at doing these things. They take some of the value that other people have created. They generally keep out of trouble and include some of the sweetest people you could ever hope to meet. They toil hard and spin like crazy. They are not the only drones in the hive politic. They look after our pensions so that we can be drones in our turn. But they are not really doing anything of value.

Cuthbert

1.1kStock market players create no value. They build no houses, sail no ships, entertain no crowds, sew no garments, dig up no precious stones, make no medicine, fight no wars, paint no fences, install no boilers, deliver no babies and create nothing of either use or beauty. They encourage one lot of people to lay bets on other people's success at doing these things. They take some of the value that other people have created. They generally keep out of trouble and include some of the sweetest people you could ever hope to meet. They toil hard and spin like crazy. They are not the only drones in the hive politic. They look after our pensions so that we can be drones in our turn. But they are not really doing anything of value. -

Gnomon

4.3k

Gnomon

4.3k

Most of the economic math and speculative predictions are way over my head. But "information-theoretic" is right down my philosophical alley. What does your IT perspective say about the near future? In view of the current inflationary bubble, is a serious Recession inevitable? I have no upwardly mobile "stonks", and I don't have any money to invest in EFTs. So, maybe I'll just hunker-down in my non-fungible cave, where I have nothing to lose, and try to ride it out. :cool:From an information theoretic perspective this also makes little sense. — Count Timothy von Icarus -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

I think any attempt to predict the particulars of a recession is a fool's errand. I'm talking more about how "what has been the case," is erroneously seen as "what must be the case in the future."

So, my point would be merely that there is no reason that a broad investment in large firms is going to necessarily result in robust returns. This is the experience of the Baby Boomers during their peak earning years, but this phenomena seems more driven by government intervention than is commonly admitted.

I think people shouldn't be led to think of their retirement savings as being something that is going to "grow" over time. Equities are by no means guaranteed to grow at a rate greater than inflation. A glance at the historical yields on investment grade bonds vs inflation suggests that savings will have a hard time keeping the value they held when you put the money away, let alone gaining value.

The easiest way to think about this is just to ignore inflation entirely. If you want to be able to pull $40,000 a year out of a retirement account from age 65-85, you might want to expect that you have to put $20,000 in a year from age 25-65 (holding all $ amounts constant).

But that's definitely not what you're told in the US. You're told to expect that money put into stocks will result in real growth, significantly above inflation, over the course of your life.

I'd say the interesting questions here are:

1. Why have such huge blinders developed, such that professionals don't look back beyond around 1990, or to other developed markets and see that "stonks" in fact, do not always see their prices go up?

2. Why would otherwise well informed people even expect the value of large corporations' stock to routinely grow faster than GDP for decades on end?

3. To what degree has the surge in stock prices been due to government/central bank interventions (targeting stock prices or not; in general they are targeting unemployment rates)? I get the sense that the large population of "long term unemployed" people created by globalization was used as an excuse to keep interest rates low under the guise of helping boost employment, when really a key benefit was inflating asset values. After all, labor force participation rates never came close to returning to pre-2008 levels even as we saw "historically low unemployment," circa 2019, but interest rates were kept low because small hikes caused the stock market to tank.

4. Ethically, should we have a better way of helping people fund their retirement? The current system seems like a perfect storm of perverse incentives where politicians are now motivated to make sure stock prices keep going up because people have been talked into betting their ability to retire on the fact that they WILL go up.

This is incidentally not that different from another mantra for developed economies: "housing values always go up." Apparently they can keep increasing at a rate higher than wages, and in the face of declining birth rates and eventually declining populations... -

Tate

1.4k

Tate

1.4k

How about real estate? Doesn't that always go up? Just thinking of inflation hedges these days.

Oh, just saw that you addressed that. -

jgill

4kI think any attempt to predict the particulars of a recession is a fool's errand. I'm talking more about how "what has been the case," is erroneously seen as "what must be the case in the future." — Count Timothy von Icarus

jgill

4kI think any attempt to predict the particulars of a recession is a fool's errand. I'm talking more about how "what has been the case," is erroneously seen as "what must be the case in the future." — Count Timothy von Icarus

The dismal science. :cool: -

BC

14.2k"In the long run, money invested in stocks will do better than money invested in savings" -- or some such formulation. Perhaps, but as John Maynard Keynes said, "In the long run, we're all dead."

BC

14.2k"In the long run, money invested in stocks will do better than money invested in savings" -- or some such formulation. Perhaps, but as John Maynard Keynes said, "In the long run, we're all dead."

No investment return (real estate, gold, platinum, pork belly futures, mutual funds, stocks and bonds, etc.) can claim to be guaranteed. If someone claims their fund is guaranteed to turn a profit, they are running some sort of scam.

it makes sense to save money, to buy (and pay for) a reasonably priced appropriately sized house; to put money into conservative investments which are unlikely to yield either unreliable big gains or very big losses. It makes sense to invest in yourself -- education (skills acquisition), a reasonable level of fitness (you'll be less likely to fall apart too early), and relationships (marry, find a long-term partner, get a nice dog, and the like.

What can go wrong if you follow my advice above? Pretty much everything. You could end up flat broke after decades of sensible thrift and prudent investment and totally wretched. It just that you are less likely to end up flat broke and miserable if you save, invest conservatively, limit debt as much as possible, and live within your means. Friendship is always good to have on hand. -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

To be fair, no one asks a biologist to predict the next mammal that will evolve, or a neuroscientist to guess what they're thinking of using neuroimaging alone. People's expectations for economists are strangely high. -

Cuthbert

1.1kTo be fair, no one asks a biologist to predict the next mammal that will evolve, or a neuroscientist to guess what they're thinking of using neuroimaging alone. People's expectations for economists are strangely high. — Count Timothy von Icarus

Cuthbert

1.1kTo be fair, no one asks a biologist to predict the next mammal that will evolve, or a neuroscientist to guess what they're thinking of using neuroimaging alone. People's expectations for economists are strangely high. — Count Timothy von Icarus

That's because the last economist who said, truthfully, "I have no more idea what is going to happen than a biologist knows what mammals will evolve" stopped getting invited to economists' parties and conferences and eventually ended up swigging cider under the railway arches. It is an expectation that economists have brought upon themselves. G B Shaw noticed this. He likened the economy to a runaway horse doing whatever it wants while we hold the reins and pretend to be in control and have some idea what might happen next. -

Count Timothy von Icarus

4.3k

Count Timothy von Icarus

4.3k

I think it owes to the field being necessarily more closely tied to politics than other fields.

I also think a huge black mark against economics comes from the mystification of Smith's "invisible hand," and the "power of markets."

We now know that these patterns of phenomena are what we call emergence and complexity. Economies are complex, dynamical systems. We have a lexicon and formalisms for defining and describing this complexity. Nevertheless, there is still a deep trend in economics to mistify markets, to see this complexity as something unique to markets, and thus intervention in markets as somehow "spoiling the market magic," instead of seeing that the economy will remain a dynamical system no matter how you set things up. Its dynamical nature just means policy interventions may have unintended consequences. -

abstract-project

2Hey this is my first post around here. I don’t know a ton about formal economic theory but I’ve been trying to learn more. This is less me trying to prove anything and more me trying to think through what’s in the OP.

abstract-project

2Hey this is my first post around here. I don’t know a ton about formal economic theory but I’ve been trying to learn more. This is less me trying to prove anything and more me trying to think through what’s in the OP.

The middle class putting its savings into the stock market does lead to some odd dynamics. The basic idea is that wage-earners should be able to turn their wages into capital. Their money doesn’t sit around doing nothing. It can fund new productive ventures. This should be good for society and middle class investors.

Like you’ve said, this isn’t how it actually works. Would it be right to say that buying a stock is simply buying an older investment? If you buy a stock when it is issued you are buying something with a theoretically unlimited return. You then sell the stock when you think it will give you its highest realistic return or when you want liquidity. Whoever buys it still gets the potential for endless returns.

Theoretically there could be a benefit to this. The needs of early investors and later investors might not align. Whoever buys the stock when it’s issued might want a higher return. Once the investment creates something that can generate proven (but not astronomical) returns it might be more attractive to a middle class person.

The key variable that would determine if this is a positive for society has to do with the “information deficit.” It’s possible that early investors are better at knowing which unproven assets to invest in. In this case the middle class provides those early investors with liquidity to take on productive risks. A virtuous circle results if the initial stock has room to grow and the initial investors know what they are doing. Some of the goods those risky investments produce can be bought by aspiring retirees, since their growing wealth in stock allows them to spend their wages more freely.

However, the whole thing also has the potential to be a disaster. It could be that investors mostly sell stock when they believe it has reached its highest realistic value or when they think the value of the stock will fall. In that case the savings of middle class retirees are pushed into a market for investments that aren’t expected to generate more revenue. Why wouldn’t Warren Buffet want a market like that to grow?

I’ll wrap this up but I have a question about increasing interest rates. If rates lead to demand destruction (indirectly through unemployment and directly through devaluing retirement plans) doesn’t that hurt the potential return for fixed assets? Someone needs to buy the goods those assets produce. Is it worth it to make fixed assets relatively more appealing to stocks even if they have less absolute potential?

Sorry if none of this made sense lol. -

unenlightened

10kTo be fair, no one asks a biologist to predict the next mammal that will evolve, or a neuroscientist to guess what they're thinking of using neuroimaging alone. People's expectations for economists are strangely high. — Count Timothy von Icarus

unenlightened

10kTo be fair, no one asks a biologist to predict the next mammal that will evolve, or a neuroscientist to guess what they're thinking of using neuroimaging alone. People's expectations for economists are strangely high. — Count Timothy von Icarus

Chaps do manage to forecast the weather to an approximation, and that's a complex system. I think economics suffers from the same problem as psychology, (and politics, as you mentioned) that the theories change behaviour and so confound themselves. For example, the effect of this thread, if widely read and believed, might be to send stocks into a long term decline as long term investors diversify. Until folks get as far as this post and realise that the long term decline has been caused by a self-fulfilling prophesy rather than real events ... and so on.

I suspect every theory in the humanities is inclined to become either self-fulfilling or self-refuting as soon as it becomes public, but I wouldn't care to say which kind this one is. -

Agent Smith

9.5kChaps do manage to forecast the weather to an approximation, and that's a complex system. I think economics suffers from the same problem as psychology, (and politics, as you mentioned) that the theories change behaviour and so confound themselves. For example, the effect of this thread, if widely read and believed, might be to send stocks into a long term decline as long term investors diversify. Until folks get as far as this post and realise that the long term decline has been caused by a self-fulfilling prophesy rather than real events ... and so on.

Agent Smith

9.5kChaps do manage to forecast the weather to an approximation, and that's a complex system. I think economics suffers from the same problem as psychology, (and politics, as you mentioned) that the theories change behaviour and so confound themselves. For example, the effect of this thread, if widely read and believed, might be to send stocks into a long term decline as long term investors diversify. Until folks get as far as this post and realise that the long term decline has been caused by a self-fulfilling prophesy rather than real events ... and so on.

I suspect every theory in the humanities is inclined to become either self-fulfilling or self-refuting as soon as it becomes public, but I wouldn't care to say which kind this one is. — unenlightened

Most interesting. — Ms. Marple

Evidence then that panpsychism is false (no discernible change in behavior of matter/energy despite patterns/laws in their conduct being public knowledge since Galileo-Newton).

This is the issue with psychology, oui mon ami? Any theory in psychology that explains (human behavior) will also have to predict (human behavior). Yet, once we're in the know about such a theory, we can alter our conduct, thus falsifying the theory. :chin: -

Isaac

10.3kI suspect every theory in the humanities is inclined to become either self-fulfilling or self-refuting as soon as it becomes public, but I wouldn't care to say which kind this one is. — unenlightened

Isaac

10.3kI suspect every theory in the humanities is inclined to become either self-fulfilling or self-refuting as soon as it becomes public, but I wouldn't care to say which kind this one is. — unenlightened

Any theory in psychology that explains (human behavior) will also have to predict (human behavior). Yet, once we're in the know about such a theory, we can alter our conduct, thus falsifying the theory. — Agent Smith

You two have a very distorted view of the degree to which the general public read psychology papers! I'd venture the general public are aware of less than one percent of psychological theories and less than one percent of those are actually capable of changing their behaviour despite being aware of the theory describing it. The pool of people you're concerned about is vanishingly small. -

Agent Smith

9.5k

Agent Smith

9.5k

Yet, once we're in the know — Agent Smith

You underestimate us, mon ami! You also fail, quite paradoxically, to understand human nature - wealth, fame, and power drive us and you, of course, know the implications of that.

In addition, I'm not expecting the transformation and thus the falsification of a psychological theory overnight - it'll be gradual, depending on what you alluded to which is how fast the information is disseminated to the people, but falsification is inevitable. So, my advice to psychologists is don't even try and if you do, take the secret to your grave! -

Isaac

10.3kI'm not expecting the transformation and thus the falsification of a psychological theory overnight - it'll be gradual, depending on what you alluded to which is how fast the information is disseminated to the people, but falsification is inevitable. — Agent Smith

Isaac

10.3kI'm not expecting the transformation and thus the falsification of a psychological theory overnight - it'll be gradual, depending on what you alluded to which is how fast the information is disseminated to the people, but falsification is inevitable. — Agent Smith

So presumably has happened with a great many theories already? Providing an example shouldn't be too much trouble then. -

Agent Smith

9.5kSo presumably has happened with a great many theories already? Providing an example shouldn't be too much trouble then. — Isaac

Agent Smith

9.5kSo presumably has happened with a great many theories already? Providing an example shouldn't be too much trouble then. — Isaac

Read up on cognitive biases, the modern version of fallacies, and get back to me. Philosophy, with its emphasis on objectivity, is anti-psychology to that extent, oui monsieur? -

Isaac

10.3kRead up on cognitive biases, the modern version of fallacies, and get back to me. — Agent Smith

Isaac

10.3kRead up on cognitive biases, the modern version of fallacies, and get back to me. — Agent Smith

Are you suggesting that people no longer suffer from cognitive biases? -

unenlightened

10kYou two have a very distorted view of the degree to which the general public read psychology papers! — Isaac

unenlightened

10kYou two have a very distorted view of the degree to which the general public read psychology papers! — Isaac

The general public read trashy women's magazines and watch tv, which are full of thelatestfreshly out of date psychology theory concerning losing weight, self improvement of all kinds,, and whatever the latest therapy of the stars is. It's psychology, Issac, but not as we know it. they are also moulded by clickbait which is designed by psychologists - one doesn't have to understand to be influenced.

They don't read astronomy papers either, but they know space is big and think they have been abducted by aliens in space ships. That's a new phenomenon of human behaviour. -

Agent Smith

9.5kAre you suggesting that people no longer suffer from cognitive biases? — Isaac

Agent Smith

9.5kAre you suggesting that people no longer suffer from cognitive biases? — Isaac

Getting there...as we gain knowledge of our how our brains work, we will also be able to avoid the pitfalls we discover along the way. -

unenlightened

10kProviding an example shouldn't be too much trouble then. — Isaac

unenlightened

10kProviding an example shouldn't be too much trouble then. — Isaac

The theories of Freud have totally transformed public attitudes and behaviour regarding sex, from regarding a glimpse of stocking as something shocking, to anything goes. Freudian imagery has become a cliche of cinema, and what was repressed and unconscious is now trendy to the point that S&M bondage dungeons are now one the extra rooms looked for on house moving programs, along with the home office and gym. -

Isaac

10.3kThe general public read trashy women's magazines and watch tv, which are full of the latest freshly out of date psychology theory concerning losing weight, self improvement of all kinds,, and whatever the latest therapy of the stars is. — unenlightened

Isaac

10.3kThe general public read trashy women's magazines and watch tv, which are full of the latest freshly out of date psychology theory concerning losing weight, self improvement of all kinds,, and whatever the latest therapy of the stars is. — unenlightened

Absolutely. But do they actually change mental practices in any way which then falsifies the theory. Are these people actually thinking in a meaningfully different way from the way they thought prior to reading the trash?

they are also moulded by clickbait which is designed by psychologists - one doesn't have to understand to be influenced. — unenlightened

Indeed, but that's making use of a psychological theory, not falsifying one. Psychologists can use theories of human thinking strategies to manipulate human behaviour, but that doesn't' then falsify those theories, if anything it provides good evidence that they're right.

They don't read astronomy papers either, but they know space is big and think they have been abducted by aliens in space ships. That's a new phenomenon of human behaviour. — unenlightened

Yep, new knowledge definitely changes narratives, but this is a far cry from knowledge about psychological theories rendering those theories false. I'm not denying a mechanism exists whereby it could happen, I'm denying that it actually has (to any significant degree). If people read a lot of actual psychology and if they were plastic enough in their thinking to have those theories alter their behaviour, then those theories would be rendered false by their very publication. The mechanism is sound. I just don't see any evidence it actually takes place.

as we gain knowledge of our how our brains work, we will also be able to avoid the pitfalls we discover along the way. — Agent Smith

You've misunderstood my request (which is odd because it was quite simple) I was asking for evidence that this has actually happened, not a mechanism whereby it could. -

Agent Smith

9.5kYou've misunderstood my request (which is odd because it was quite simple) I was asking for evidence that this has actually happened, not a mechanism whereby it could. — Isaac

Agent Smith

9.5kYou've misunderstood my request (which is odd because it was quite simple) I was asking for evidence that this has actually happened, not a mechanism whereby it could. — Isaac

Replication crisis in psychology? -

Isaac

10.3kThe theories of Freud have totally transformed public attitudes and behaviour regarding sex — unenlightened

Isaac

10.3kThe theories of Freud have totally transformed public attitudes and behaviour regarding sex — unenlightened

Have they? Or was it the counterculture in the 60s very few of whom had even picked up Freud?

Besides which, has that rendered Freud's theories false? (I can't stand Freud by the way, and think he was a fraud of the highest order, so this is all theoretical). Very few psychological theories contain the conclusion "and no one can ever do anything about this, it will never change". Psychological theories are (or should be) about modes or habits of thought. I can't think of a single one which claimed anything more than a generality.

Replication crisis in psychology? — Agent Smith

What about it? -

Agent Smith

9.5kWhat about it? — Isaac

Agent Smith

9.5kWhat about it? — Isaac

Pre-publication: Bad science.

Post-publication: People altering their behavior (now they know).

Either way, disastrous for psychology, oui? -

Agent Smith

9.5kThe theories of Freud have totally transformed public attitudes and behaviour regarding sex, from regarding a glimpse of stocking as something shocking, to anything goes. — unenlightened

Agent Smith

9.5kThe theories of Freud have totally transformed public attitudes and behaviour regarding sex, from regarding a glimpse of stocking as something shocking, to anything goes. — unenlightened

:up: -

unenlightened

10kbut that doesn't' then falsify those theories, if anything it provides good evidence that they're right. — Isaac

unenlightened

10kbut that doesn't' then falsify those theories, if anything it provides good evidence that they're right. — Isaac

Everybody knows about clickbait. So they become somewhat immune and it has to change. In order for psychology to be a science, it needs to keep subject and object apart. That is why every experiment involves deception - as soon as the subject knows what aspect of behaviour is being investigated, their behaviour is influenced by that knowledge. But a huge part of all social behaviour in humans is dependent on what one thinks of humans - one's folk psychology, and folk psychology is influence by so-called scientific psychology. Physicists do not have this problem as atoms do not have a folk atomic theory, that influences their interactions. But I'll stop there because we are way off topic. -

Isaac

10.3kPre-publication: Bad methodology.

Isaac

10.3kPre-publication: Bad methodology.

Post-publication: People altering their behavior (now they know).

Either way, disastrous for psychology, oui? — Agent Smith

Well, no.

In the first instance, psychology's replication rate is similar (marginally better, in fact) to medicine. Do you refuse medical treatment?

Bad methodology is bad. We learn better, we fix the problem. It's hardly a disaster.

In the second place, you've yet to provide me with any evidence of this actually happening, so I can't see it being anything more than your idle speculation. Again, hardly a disaster. -

Isaac

10.3kEverybody knows about clickbait. So they become somewhat immune and it has to change. — unenlightened

Isaac

10.3kEverybody knows about clickbait. So they become somewhat immune and it has to change. — unenlightened

Indeed. But the theory behind clickbait never said anything like "and even knowing about this won't change the model" so the actual psychological theory is not falsified by the behaviour. In fact, the vast majority of theories on which ideas like clickbait are built, actually include the prediction the knowledge of the process will lead to a change in habit, so the subsequent change in habit has added weight to the model, not falsified it.

every experiment involves deception - as soon as the subject knows what aspect of behaviour is being investigated, their behaviour is influenced by that knowledge. — unenlightened

...which itself is s psychological theory, supported by the evidence, and included in almost all psychological theory behind these experiments. Even Milgram was aware of the effect and worded his theory carefully to accommodate it.

a huge part of all social behaviour in humans is dependent on what one thinks of humans - one's folk psychology, and folk psychology is influence by so-called scientific psychology. — unenlightened

It's this latter claim we're discussing. I haven't seen much evidence yet.

Physicists do not have this problem as atoms do not have a folk atomic theory, that influences their interactions. — unenlightened

Well...tell that to the Copenhagenists. -

Agent Smith

9.5k

Agent Smith

9.5k

Well, you could google that, but here's a little experiment you can do yourself. Take two people A & B. Inform A on comfirmation bias aka cherry-picking and keep the other, B, in the dark about this bias. Ask both to analyze their beliefs. There should be a noticeable difference betwixt the two in my humble opinion, oui? Philosophy, as I mentioned earlier, is an antidote for our psychological shortcomings. -

Isaac

10.3kTake two people A & B. Inform A on comfirmation bias aka cherry-picking and keep the other, B, in the dark about this bias. Ask both to analyze their beliefs. There should be a noticeable difference betwixt the two in my humble opinion — Agent Smith

Isaac

10.3kTake two people A & B. Inform A on comfirmation bias aka cherry-picking and keep the other, B, in the dark about this bias. Ask both to analyze their beliefs. There should be a noticeable difference betwixt the two in my humble opinion — Agent Smith

Uh huh. And which part of the published theory on cherry-picking predicted that would not happen?

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum