-

Mikie

7.3k

Mikie

7.3k

After following this all day, your post was the first I heard it passed. :lol:

I’m guessing it passes the house now. I’m shocked this happened at all. Shows the impact of people pushing for it.

Or — this was Manchin’s plan all along: keep whittling it down over time, keep saying no, get everyone thinking it’s dead — then, when you let that linger, come back and give scraps and have everyone forget that they’re being fucked: that it’s nowhere close to the original $6 trillion, which was already too little. In the end we get 400 billion. A drop in the bucket.

A nice psychological trick. Similar to the “low-balling” technique of haggling.

I don’t know if this was all deliberate, but I’m suspicious. This isn’t a great bill. Still, I can’t help being glad they got something. -

Mikie

7.3kYou're glad for nothing. Way too little too late. — Benkei

Mikie

7.3kYou're glad for nothing. Way too little too late. — Benkei

Cutting emissions by 40% is better than 27%. That’s reason to be glad. Not nearly enough, but it’s a start.

By no means am I advocating complacency because of this bill. But even this small step wouldn’t have happened without real work. Real work that really isn’t possible if one resigns oneself to defeatism. -

Mikie

7.3k

Mikie

7.3k

I really can’t see how anyone whose read anything I’ve written on here for three years can claim I have trust in the political system— or, for that matter, am an “optimist.”

I believe in the power of real people doing real work, especially in solidarity. Which is why I’ve said, repeatedly, that the organizing should continue. I also don’t relegate possible actions exclusively to pressuring governments. I embrace a diversity of tactics.

So I’m not sure what you’re driving at, but it’s at least misplaced. -

ssu

9.8kI just wonder how more spending will reduce inflation.

ssu

9.8kI just wonder how more spending will reduce inflation.

Oh well, must be like the new definition for a recession: when the old definition was two quarters of negative growth back-to-back and when it happened, you just define the term in a new way. Voters won't notice anything, I guess.

Wikipedia has changed the definition of ‘recession’ and locked the page from further edits. These changes were made during the week that the White House proposed a re-definition of recession to mean something other than two consecutive quarters of negative GDP growth.

Until July 11, the world’s largest online encyclopedia included in its definition of a recession ‘two negative consecutive quarters of growth’ with users free to make alterations. But as of July 25 any mention of ‘two negative consecutive quarters of GDP growth’ was removed from this section. A Wikipedia administrator then froze the edit feature, blaming a ‘persistent addition of unsourced or poorly sourced content,’ with a warning that the page may have been ‘affected by a current event’.

They still do say that the old definition is a "common practical" definition though.

Next I guess is to change the definition of inflation. -

Mr Bee

735

Mr Bee

735

According to Manchin, reducing the deficit is the "best way" to fight inflation. Why else do you think the bill has $300 billion in net deficit reduction instead of literally anything else?

I mean, there are some aspects of the bill like the drug price negotiation stuff that would help reduce costs. Also the bill is tied to more oil and gas drilling so if you're one of those people who think a pipeline will slash gas prices then that may do something for you. There are some people who say that this will reduce pressure on the Fed in raising rates, but I'm not an economist. -

Mikie

7.3k

Mikie

7.3k

Yes, I guess it's a giant conspiracy. My advice: stop wasting time on stupidity.

The bill probably won't do anything about inflation. It's a silly label created so that Joe Manchin can save face.

Inflation isn't important and isn't a problem. What's important is doing something about climate change. This bill takes a few baby steps in that direction. -

ssu

9.8k

ssu

9.8k

Well, lets see how much the net deficit will be reduced.According to Manchin, reducing the deficit is the "best way" to fight inflation. Why else do you think the bill has $300 billion in net deficit reduction instead of literally anything else?

I mean, there are some aspects of the bill like the drug price negotiation stuff that would help reduce costs. Also the bill is tied to more oil and gas drilling so if you're one of those people who think a pipeline will slash gas prices then that may do something for you. There are some people who say that this will reduce pressure on the Fed in raising rates, but I'm not an economist. — Mr Bee

Usually in recessions the deficits don't come down. -

ssu

9.8k

ssu

9.8k

Well, if inflation would be calculated as it was in 1980, the US would be now experiencing 15% inflation. But that's not dangerous...only several years of this high inflation will be.Inflation isn't important and isn't a problem. What's important is doing something about climate change. This bill takes a few baby steps in that direction. — Xtrix

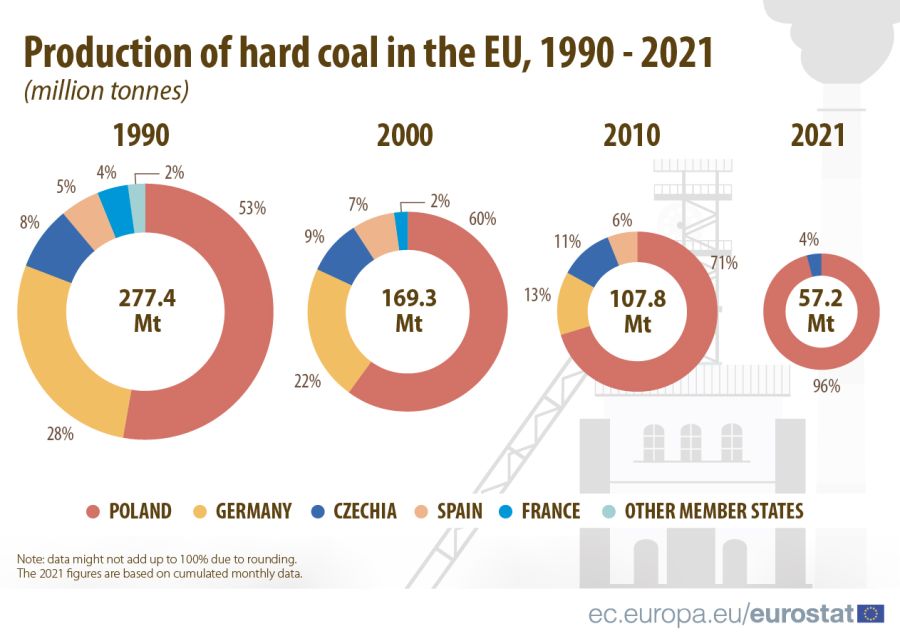

And climate change? At least we are burning coal in record numbers, going off from nuclear power, so that obviously is the path we have decided to be on.

(IEA, March 8th, 2022) Global energy-related carbon dioxide emissions rose by 6% in 2021 to 36.3 billion tonnes, their highest ever level, as the world economy rebounded strongly from the Covid-19 crisis and relied heavily on coal to power that growth, according to new IEA analysis released today.

The increase in global CO2 emissions of over 2 billion tonnes was the largest in history in absolute terms, more than offsetting the previous year’s pandemic-induced decline, the IEA analysis shows. The recovery of energy demand in 2021 was compounded by adverse weather and energy market conditions – notably the spikes in natural gas prices – which led to more coal being burned despite renewable power generation registering its largest ever growth.

So if you want to tackle climate change, then I guess hope for a severe economic depression. Especially in China as they are totally on a league of their own when it comes to the use of coal. China's share of coal use is half. The other half is the rest of the world. If I sound to gloomy, there is at least this nice statistic from the EU:

(Now the stats may be different as Germany has opted to use more coal and not nuclear energy.) -

Mikie

7.3k

Mikie

7.3k

Not too gloomy. It's going to be a very difficult path indeed.

I didn't know Poland accounted for that much coal use. Guess that should be the focus.

The EU is turning to coal temporarily, and that's bad in the short run. But it'll be better in the longer run, in my view. The war will likely push them to develop renewables even faster, if only to avoid dependence on Russia. But that's in the longer run. This regression is unfortunate in the meantime. But I cut them some slack for it given the circumstances. -

Agent Smith

9.5kI'm interested in bank interest rates and how they relate to inflation. What is the point of depositing x dollars in a bank with y% interest if the rate of inflation is such that the amount at the end of say 5 years the amount I deposited at the beginning of those 5 years. We're being fleeced, robbed in broad daylight, oui? :snicker:

Agent Smith

9.5kI'm interested in bank interest rates and how they relate to inflation. What is the point of depositing x dollars in a bank with y% interest if the rate of inflation is such that the amount at the end of say 5 years the amount I deposited at the beginning of those 5 years. We're being fleeced, robbed in broad daylight, oui? :snicker:

P.S. I'm poor! :grin: -

Mikie

7.3kTell that to my fellow senior citizens on fixed incomes. :roll: — jgill

Mikie

7.3kTell that to my fellow senior citizens on fixed incomes. :roll: — jgill

There should be assistance to senior citizens. My advice is for them to stop voting Republican. In any case, inflation is temporary. Climate change is existential.

I suppose it's better that they're literally under water or burned in a wildfire? -

ssu

9.8k

ssu

9.8k

It doesn't need to be hyperinflation. Just look what couple years of (actual) double digit inflation will do. I think we will have stagflation, just as during the 1970's. The war in Ukraine has quite similar effects as did the Yom Kippur war and the Oil Embargo after that. And as the workforce is shrinking, there is a reason for wage inflation to continue. After all, now in the US there is low unemployment. It's all a central bank play: either it's a recession or double digit inflation. Likely they deny everything, hope that people don't notice the inflation and with their actions will just prolong the stagflation.The whole "price stability" has been bullshit from the start. "We'll never have another crisis": my ass. Only hyperinflation is an issue. Both moderate deflation and inflation should just run its course. — Benkei

Even if from last May 2022, Nouriel Roubini makes the case for stagflation quite well in my view and his message is quite current:

-

Mikie

7.3kYou do understand that assisting ordinary people (by printing a lot of money) was partly the cause of the inflation now? — ssu

Mikie

7.3kYou do understand that assisting ordinary people (by printing a lot of money) was partly the cause of the inflation now? — ssu

Emphasis on “partly.” In my view it accounts for very little, but it’s telling that you want to highlight this “part” over and over again — rather than COVID or the war. Why exactly I’m not sure, but it’s a right-wing talking point and cover for desired austerity. -

ssu

9.8k

ssu

9.8k

If you don't personally lose your job (or your wealth). Otherwise recession and even economic depressions can be great!we had double digit inflation in the 70s here. Golden years. It's not very interesting if wages can keep up. — Benkei

What they surely aren't are these kind of "end of the World" events. Recessions or the oddity of stagflation and other economic "disasters" are quite normal.

To make economics part of the "culture war" is what I think will happen. People will come to learn economic words to be dog whistles and just to mention them, you are put in one political camp. And totally forget (if not even understand) that when it comes to the US, both Republicans and Democrats have had, when in power, the same economic policies. Even if the parties desperately try to mask it otherwise (which people, unfortunately, believe).In my view it accounts for very little, but it’s telling that you want to highlight this “part” over and over again — rather than COVID or the war. Why exactly I’m not sure, but it’s a right-wing talking point and cover for desired austerity. — Xtrix

It was Trump who started the massive wealth transfers to people that finally started the inflation way before Putin attacked Ukraine. With an unprecedented two trillion. But of course, now the Republicans don't remember it.

Let's remember what Trump gave:

Couples earning up to $150,000 received $2,400, plus an additional $500 for each child.

Individuals earning up to $75,000 received $1,200, plus an additional $500 for each child.

These payments will phase out for those earning over $75,000, $112,500 for head of household filers, and $150,000 for married couples filing joint tax returns.

That wasn't "very little", when you remember that there are over 330 million Americans.

But if you genuinely think the problem of inflation can be dealt with giving more assistance (which is basically printed money) to the people who will use it, then I assume Joe Biden will be happy with you. -

Mikie

7.3kBut if you genuinely think the problem of inflation can be dealt with giving more assistance (which is basically printed money) to the people who will use it, then I assume Joe Biden will be happy with you. — ssu

Mikie

7.3kBut if you genuinely think the problem of inflation can be dealt with giving more assistance (which is basically printed money) to the people who will use it, then I assume Joe Biden will be happy with you. — ssu

If you genuinely think that inflation is caused, in this case, by giving working people more money, then the neoliberals will be very happy with you indeed.

Inflation is global, and we know why. It’s not because the US gave people more money. Nor the ECB. But if that’s the story you want to latch onto, that’s your choice. Again, having people believe this is wonderful for the ruling class. What a shame you perpetuate it. -

ssu

9.8k

ssu

9.8k

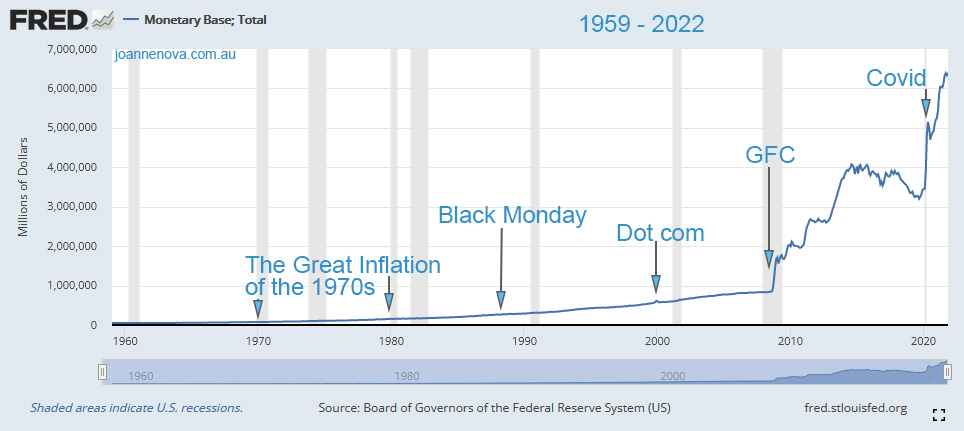

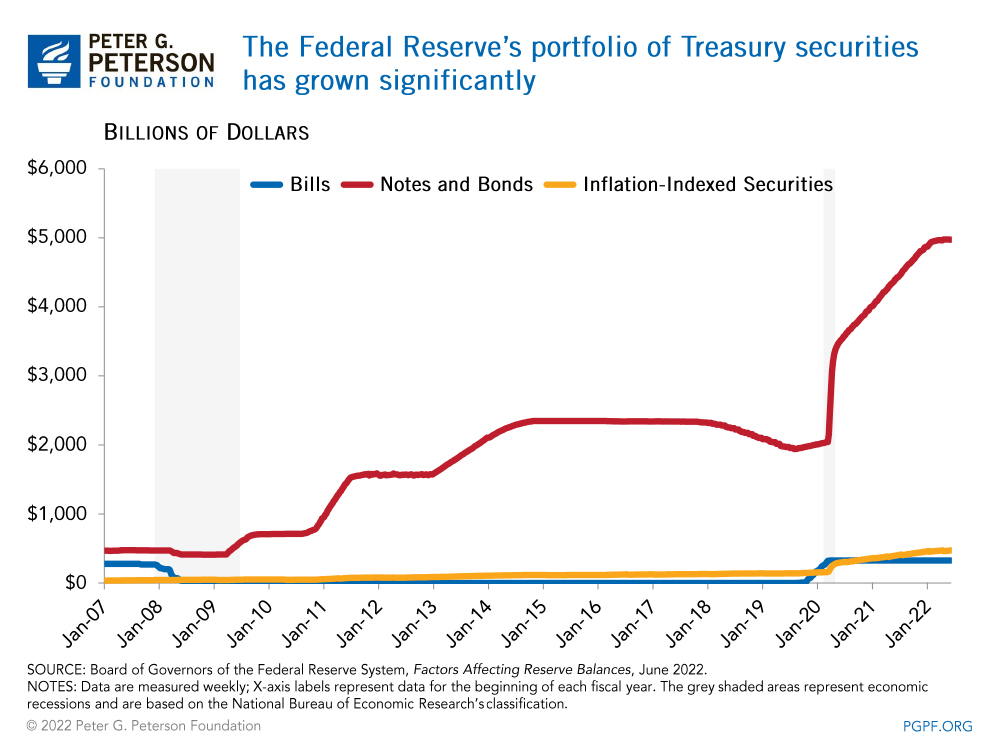

Really?Inflation is global, and we know why. It’s not because the US gave people more money. Nor the ECB. But if that’s the story you want to latch onto, that’s your choice. Again, having people believe this is wonderful for the ruling class. What a shame you perpetuate it. — Xtrix

You really think that the ECB multiplying the monetary base many times over won't in the end create inflation?

(Euro area (changing composition), Eurosystem reporting sector - Base money)

(see ECB stats)

Or you genuinely think that enlarging the monetary base by the Federal Reserve and giving those trillions to people who did spend the money wouldn't also matter?

Especially when this was started by the Trump administration, you think it's just a right-wing talking point? (Yeah, it might be, because just as the right-wing talking point is that Biden lost Afghanistan (which totally disregards the surrender that Trump made), I guess they can talk that this inflation was just caused by the Biden administration. (Which it obviously wasn't)

Sorry, but nobody is talking about the Modern Monetary Theory now in economic circles. For obvious reasons. -

Mikie

7.3kYou really think that the ECB multiplying the monetary base many times over won't in the end create inflation? — ssu

Mikie

7.3kYou really think that the ECB multiplying the monetary base many times over won't in the end create inflation? — ssu

And this accounts for inflation in Mexico, Brazil, Russia, Argentina, Canada, South Africa, and India?

No. The reason you see inflation everywhere is due to factors that have nothing — zero — to do with monetary policy.

But by all means keep emphasizing US fiscal policy. This way we can punish the true culprits: working people.

On par with Reagan’s welfare queen myth.

Especially when this was started by the Trump administration, you think it's just a right-wing talking point? — ssu

Yes. Beyond that, it’s also narrow. It accounts for some inflation, sure. No one has denied that. How much? Some have put the estimate as accounting for less than 10%. But even if it’s higher, it’s not the main driver. What’s leading the charge are energy prices, which has a ripple effect. We know why energy prices are up— around the world. It’s not because of the central banks, nor fiscal policy — and certainly not of the Fed or Congress.

Sorry, but nobody is talking about the Modern Monetary Theory now in economic circles. For obvious reasons. — ssu

Neither am I. -

ssu

9.8k

ssu

9.8k

Partly yes, because the dollar is used globally. Inflation is exported to other countries:And this accounts for inflation in Mexico, Brazil, Russia, Argentina, Canada, South Africa, and India? — Xtrix

See How does the United States export inflation?1. The US Federal Reserve lowers interest rates or creates dollars through quantitative easing – both of which are aimed at increasing the total supply of dollars in the world.

2. The Fed’s actions allow cheaper dollar credit to be accessed by the US Federal Government, US companies, and those with connections to American banks. When this credit is used by taking out loans, new dollars are created.

3. Those who receive new dollars spend them – often on imports to the US – and the extra dollars end up circulating in foreign countries.

4. Now, foreign countries are flooded with new dollars and their governments face a choice:

Let their own currency appreciate in value against the dollar, which would reduce the country’s competitiveness in the world market and decrease their exports. Or then...

5. Create more of their own currency to stabilize its value against the dollar and retain competitiveness on the world market. However, this causes price inflation for their citizens and makes imports more expensive.

Many developing countries are dependent on cheap exports in order to keep their economy growing, so they cannot let their own currency appreciate. However, if they create too much of their own currency they risk setting off rampant inflation and increased import prices. Individuals choosing to hold US dollars instead of local currency in times of crisis also push down the value of the local currency, causing price inflation.

Naturally other governments have their own monetary and fiscal policies too. Hence they are totally capable of messing their economy all by themselves too. But it's a global economy, still.

This is simply wrong.No. The reason you see inflation everywhere is due to factors that have nothing — zero — to do with monetary policy. — Xtrix

Please just watch the following, just to give one example. It describes clearly what I'm trying to say and just what happened, what were the consequences of both monetary and fiscal policy. And yes, there have been other reasons for supply shocks too. And it's not from Fox News, it's from CNBC.

What then do you think the reason is? Partly it is that we haven't invested in the industry as we have anticipated we would be using alternative energy resources. Yet oil prices started to climb from 2020, far earlier than February 24th this year.We know why energy prices are up— around the world. It’s not because of the central banks, nor fiscal policy — and certainly not of the Fed or Congress. — Xtrix

Let's just remember what the definition for inflation is: a general increase in prices and fall in the purchasing value of money.

What we are going to see (and are seeing) is stagflation.

Those will already be punished by stagflation. It's the workers arguing for higher salaries (because of higher expenses) that are the last in the line, yet that is political rhetoric to make them the culprits for inflation.But by all means keep emphasizing US fiscal policy. This way we can punish the true culprits: working people. — Xtrix

You see, if that assistance given to people would come from taxes, that wouldn't be so inflationary. What makes it truly inflationary is when that assistance is paid off by de facto money printing.

-

Mikie

7.3kAnd this accounts for inflation in Mexico, Brazil, Russia, Argentina, Canada, South Africa, and India?

Mikie

7.3kAnd this accounts for inflation in Mexico, Brazil, Russia, Argentina, Canada, South Africa, and India?

— Xtrix

Partly yes, — ssu

No. The ECB has essentially nothing to do with it.

No. The reason you see inflation everywhere is due to factors that have nothing — zero — to do with monetary policy.

— Xtrix

This is simply wrong. — ssu

No, it isn’t. Monetary policy of the US does not lead to inflation in all the countries mentioned. They’ve had low rates for years — no inflation. The reason for global inflation has many factors— but the biggest is COVID and the war, and their impacts on supply/demand and especially energy.

The Fed’s policies move asset prices. That’s it. Fiscal policy— the government giving it checks, etc. — has some effect, sure. But it does not account for the higher prices of oil and gas.

What then do you think the reason is? — ssu

See above. -

ssu

9.8k

ssu

9.8k

If you argue that inflation doesn't export itself in a globalized world, you are simply going against the facts. The global economy has had low inflation and low interest rates for many years. Before the financial sector and the central banks caused asset inflation. The COVID response was different: the money went actually to the real economy.No, it isn’t. Monetary policy of the US does not lead to inflation in all the countries mentioned. They’ve had low rates for years — no inflation. The reason for global inflation has many factors— but the biggest is COVID and the war, and their impacts on supply/demand and especially energy. — Xtrix

Umm, I think you have not studied economics.The Fed’s policies move asset prices. That’s it. Fiscal policy— the government giving it checks, etc. — has some effect, sure. But it does not account for the higher prices of oil and gas. — Xtrix

I guess it would be far better to talk with you about the labour movement or climate change. I do like to debate issues with you and don't want to be irritating or condescending. So I'll give you an example of just why monetary policy and fiscal handouts do effect things like price of oil.

So imagine a President decides to give every American (that's 330 million of them) a million bucks. To go spend and get the economy moving. 330 million times a million is 330,000,000,000,000, which is simply 330 trillion. As the monetary base has been grown by trillions, so it's totally possible to increase some hundreds of times.

First question: Do you think that some Americans would go and buy something with this 1 million they just got? Or would they all put it into a bank account or store it somewhere for a rainy day and go on just as they had before?

Second question: If we agree that at least some would spend a lot more than before, do you think that their increased spending would create "supply chain issues" or not?

Third question: As the million dollars is given to all Americans, I would assume there are some reckless 18-year old American males that would want to buy a Ferrari with their money. Ferrari makes about 8 400 cars annually and now an "ordinary" new Ferrari costs from 250 000 to 600 000 dollars (some have an even bigger price tag). Now, do you think that the price of new Ferrari's would stay at a quarter of a million? Or would the dealerships increase their prices due to the demand and the fact they cannot increase their production?

If you agree that actually Ferrari prices would be higher than what they are now (because every American got a million bucks), then the fourth question:

Why wouldn't this show also in fuel prices? Is oil price somehow immune here?

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum