-

Mikie

7.3kIf you argue that inflation doesn't export itself in a globalized world, you are simply going against the facts. — ssu

Mikie

7.3kIf you argue that inflation doesn't export itself in a globalized world, you are simply going against the facts. — ssu

Of course it does. Which is why we see it all around the world. When you have an unprecedented global event, like COVID, there's no reason not to think in a globalized world that inflation wouldn't spread. Ditto with Russian oil sanctions and supply disruptions.

The global economy has had low inflation and low interest rates for many years. Before the financial sector and the central banks caused asset inflation. — ssu

Since the housing bubble and QE, there has been extremely low rates and no inflation. The Fed would have continued this trend had it not been for inflation. They kept rates ultra low for too long. I was talking about this last summer before inflation was even an issue. But raising rates will do next to nothing except lower what they are able to raise: stocks, bonds, housing. They can do nothing about Ukraine or supply chain shocks or COVID lockdowns or China's Zero Covid policies. If we're waiting around for the Fed to cause a recession to lower inflation, we just aren't paying attention to reality.

The Fed’s policies move asset prices. That’s it. Fiscal policy— the government giving it checks, etc. — has some effect, sure. But it does not account for the higher prices of oil and gas.

— Xtrix

Umm, I think you have not studied economics. — ssu

And I don't think you've studied reality. Again, my advice is to put down the theories and look around. It's tempting to want to attribute everything to a single cause -- like, say, the money supply -- but again, REALITY has a way of throwing such things off course.

We had QE, low rates, and fiscal stimulus in 2009 as well. People were screaming about inflation -- and there was none -- except in the asset classes I mentioned above. The Fed now does the same thing, assets hit a super bubble, and there's also inflation -- and people say "See, it's because there's too much money -- it's monetary policy!" No, it isn't. It's COVID and war. The unprecedented FISCAL stimulus (giving real people checks) had a small effect, too. To scream that inflation is due mostly to fiscal policy is wrong; to argue it's monetary policy is even more wrong.

Yes, regardless of what Milton Friedman says.

I do like to debate issues with you and don't want to be irritating or condescending. — ssu

What's irritating is that you're not listening.

So I'll give you an example of just why monetary policy and fiscal handouts do effect things like price of oil. — ssu

Without even reading further, I didn't say they don't effect the price of oil. I said the Fed can do nothing about the war in Ukraine or supply shocks -- which is obvious. The fiscal money has an effect on demand -- and there was indeed pent-up demand after the lockdowns. To argue this is the main driver of inflation is wrong.

Second question: If we agree that at least some would spend a lot more than before, do you think that their increased spending would create "supply chain issues" or not? — ssu

The argument being what, exactly? That giving people some extra money is what caused the oil prices to go up? You know very well that's not true.

Fiscal policy has an effect on demand -- but a much bigger effect were the lockdowns. Look at the change in behavior from 2020 to 2022. Even if people had the same amount of money as before, there would be high demand for services over goods in 2021/22. There were SOME supply problems in 2020 (toilet paper, paper towels, masks, etc) for a little while -- which had nothing to do with monetary or fiscal policy -- and they quickly caught up with demand. Prices of lumbar rose, etc. Basic supply/demand. What does this have to do with monetary policy? -

ssu

9.8k

ssu

9.8k

Since the money went to create asset inflation. (And with this we seem to agree on)Since the housing bubble and QE, there has been extremely low rates and no inflation. — Xtrix

Ok, think about this for a moment. Why do you forget that this has also an effect on the consumer? If his/her interest on the mortrage or on other loans go up, it will have an effect on his/her other spending.But raising rates will do next to nothing except lower what they are able to raise: stocks, bonds, housing. — Xtrix

But the Fed can cause a recession, if it would raise interest rates to be higher than the current inflation, right?They can do nothing about Ukraine or supply chain shocks or COVID lockdowns or China's Zero Covid policies. If we're waiting around for the Fed to cause a recession to lower inflation, we just aren't paying attention to reality. — Xtrix

I'm not doing that. Actually you are... with saying things like:It's tempting to want to attribute everything to a single cause — Xtrix

The reason you see inflation everywhere is due to factors that have nothing — zero — to do with monetary policy. — Xtrix

Which is really bizarre. If you'd follow what Roubini or CNBC documentary or me actually say, it's about both monetary policy and events like Russo-Ukrainian war. And monetary policy here is actually linked to the COVID response.

Then I'll stop. Hope you have the time to clarify the above.Without even reading further — Xtrix -

Mikie

7.3kit's about both monetary policy and events like Russo-Ukrainian war. And monetary policy here is actually linked to the COVID response. — ssu

Mikie

7.3kit's about both monetary policy and events like Russo-Ukrainian war. And monetary policy here is actually linked to the COVID response. — ssu

We’ve established there are multiple factors. Monetary policy is a minor one— especially around the globe. You want to emphasize it over the others — and that’s nutty, in my view. Besides, you seem to be talking more about fiscal policy, which is different. -

ssu

9.8k

ssu

9.8k

If you want to minimize the role of the central banks, be my guest. But that's nutty in this World, in my view.You want to emphasize it over the others — and that’s nutty, in my view. — Xtrix

You should understand the link that monetary and fiscal policy have, which is simple and obvious.Besides, you seem to be talking more about fiscal policy, which is different. — Xtrix

If the government cannot cover it's expenses by tax revenues, it can turn to the central bank, which either buys government bonds to finance this or simply prints more money to cover the expenses. And no government usually admits doing this.

Hopefully you understand this link between monetary and fiscal policy. -

Mikie

7.3kIf you want to minimize the role of the central banks, be my guest. But that's nutty in this World, in my view. — ssu

Mikie

7.3kIf you want to minimize the role of the central banks, be my guest. But that's nutty in this World, in my view. — ssu

Even in the face of an unprecedented global pandemic, supply disruptions, and war? Then it’s dogma.

If the government cannot cover it's expenses by tax revenues, it can turn to the central bank, which either buys government bonds to finance this or simply prints more money to cover the expenses. — ssu

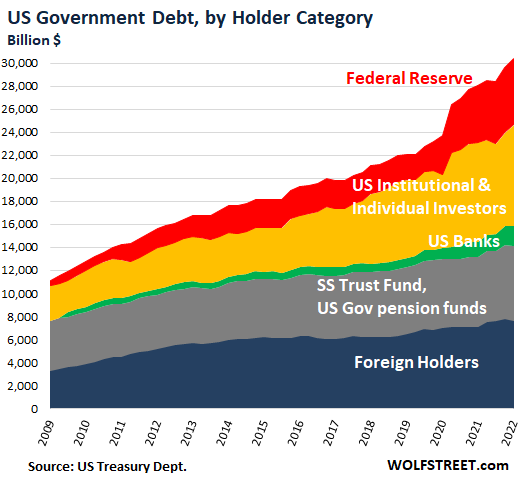

That’s only partly true. The government does issue bonds, yes. The Fed owns a fraction of that debt — a fraction. We’ve been through that before. So there’s a thin connection between the central bank and congress— but that’s it. The rest are bought by foreign countries or by other government departments, like social security.

But regardless, fiscal policy is NOT monetary policy. The checks sent out to real people — which was much more than in 2009 — was not the decision of the Fed. It was a decision by congress, and sent through the treasury. The Fed doesn’t send stimulus checks. The Fed handles MONETARY POLICY, which is entirely different from FISCAL POLICY. Being clear on this is helpful. Blurring the lines like you’re doing, and then justifying it by stating that the Fed buys treasuries, is pure confusion.

The bottom line here is that inflation isn’t simple. It’s due to multiple factors. You choose to harp almost exclusively on monetary policy. Ask yourself why that might be. -

ssu

9.8k

ssu

9.8k

Fraction means also a bit, little. Yes, there are others holding the debt.The Fed owns a fraction of that debt — a fraction. — Xtrix

However:

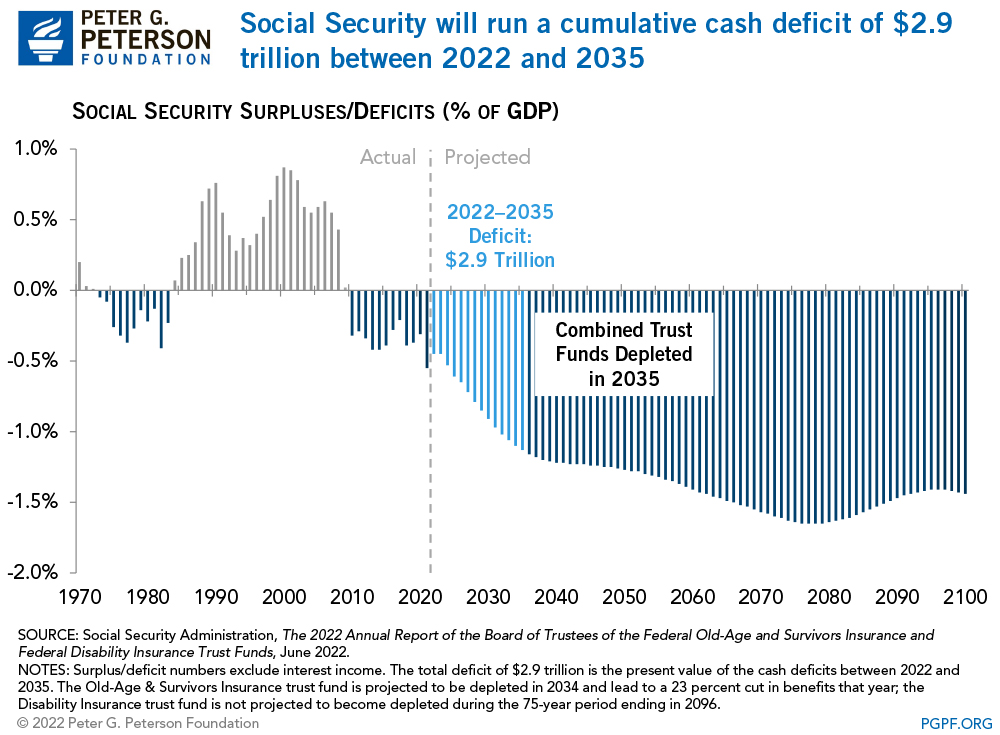

The Federal Reserve is the largest single owner of US treasuries. Japan owns "just" 1,2 trillion $ of US treasuries and China has smaller holdings of the debt. And notice what has happened:

Since the coronavirus (COVID-19) pandemic began, the U.S. Federal Reserve has significantly ramped up its holdings of Treasury securities as part of a broader effort to counteract the economic impact of the public health emergency. Currently, the Federal Reserve holds more Treasury notes and bonds than ever before.

As of June 8, 2022, the Federal Reserve has a portfolio totaling $8.97 trillion in assets, an increase of $4.25 trillion since March 18, 2020 (around the time that many businesses shut down). Longer-term Treasury notes and bonds (excluding inflation-indexed securities) comprise two-thirds of that expansion, with holdings of those two types of securities more than doubling from $2.15 trillion on March 18, 2020 to $4.97 trillion on June 8, 2022.

A "thin connection" counted in trillions. :snicker:So there’s a thin connection between the central bank and congress— but that’s it. — Xtrix

And what is so hard for you in understanding a sentence like above: " the U.S. Federal Reserve has significantly ramped up its holdings of Treasury securities as part of a broader effort to counteract the economic impact of the public health emergency."The Fed handles MONETARY POLICY, which is entirely different from FISCAL POLICY. Being clear on this is helpful. — Xtrix

Sorry, but in this case, monetary policy and fiscal policy have gone hand in hand, even if you don't believe it. -

ssu

9.8k

ssu

9.8k

Reconciliation Bill would have been a better name, but if Americans worry about inflation, the name has to be Inflation Reduction Act.President Biden on Tuesday signed into law the Inflation Reduction Act, an ambitious measure that aims to tamp down on inflation, lower prescription drug prices, tackle climate change, reduce the deficit and impose a minimum tax on profits of the largest corporations. -

Mikie

7.3kThe Federal Reserve is the largest single owner of US treasuries. — ssu

Mikie

7.3kThe Federal Reserve is the largest single owner of US treasuries. — ssu

No, it isn’t.

A "thin connection" counted in trillions. :snicker: — ssu

Yes, so by your standard theres a connection between fiscal policy and China, mutual funds, and social security. Because they all buy bonds. For that matter, I’M connected to fiscal policy, since I own bonds. Fine. So what? Is this serious?

And what is so hard for you in understanding a sentence like above: " the U.S. Federal Reserve has significantly ramped up its holdings of Treasury securities as part of a broader effort to counteract the economic impact of the public health emergency." — ssu

What about it? When have I once denied that the Fed purchases treasuries? That’s a tool of the Fed.

You seem to think the Fed prints money and that’s what the Congress uses to send checks. Well, for the fraction of the debt that’s bought by the Fed in the open market, that’s true. And? -

ssu

9.8k

ssu

9.8k

Really? Tell me just what single owner is bigger?No, it isn’t. — Xtrix

Actually, yes. Technicalities aside (actual paper money wasn't printed).You seem to think the Fed prints money and that’s what the Congress uses to send checks. — Xtrix

Last year (2021) the US federal government collected $4.05 trillion in revenue. It spent $6.82 trillion. Hence the federal government spent $2.77 trillion more than it collected, resulting in a deficit and new debt.

Who do you think bought that new debt? Who suddenly had a lot more US treasury securities? Think. -

Mikie

7.3kReally? Tell me just what single owner is bigger? — ssu

Mikie

7.3kReally? Tell me just what single owner is bigger? — ssu

Social security. By a great deal, I believe.

You seem to think the Fed prints money and that’s what the Congress uses to send checks.

— Xtrix

Actually, yes. — ssu

But like I said, this is pretty misleading. In fact the Fed has only a fraction of the debt, and mostly buys bonds from financial institutions — like banks — and not directly from the treasury.

Last year (2021) the US federal government collected $4.05 trillion in revenue. It spent the government spent $6.82 trillion. Hence the federal government spent $2.77 trillion more than it collected, resulting in a deficit and new debt.

Who do you think bought that new debt? Who suddenly had a lot more US treasury securities? Think. — ssu

Lots of people and institutions buy the debt, in fact. Banks buy trillions in bonds. They also issue their own bonds (corporate bonds). The Fed can buy both from the banks (and individuals) on the open market, like everyone else. The only difference is that the Fed can create (“print”) money. That’s what they’ve done.

It’s more accurate to say that the Fed owns the debt of banks and corporations. They’re given money in exchange for those bonds— money that’s created out of thin air.

But the Fed doesn’t directly buy the deficit. That’s nonsense. Nor do they indirectly buy most of it. Rather, they indirectly buy SOME of it, along with corporate debt. They do this as part of monetary policy.

I’m sorry that it’s more complicated than you want to believe. You might as well accuse the SSA of being “hand in hand” with Congress. Kind of absurd, in my view, but not completely false. -

ssu

9.8k

ssu

9.8k

Not in the quantity now they would have had to. The simple fact is that the Federal Reserve was the largest buyer of this huge increase in debt until the start of this year. You simply cannot deny that.Lots of people and institutions buy the debt, in fact. Banks buy trillions in bonds. — Xtrix

But of course, the largest buyer just buys SOME of the debt as there indeed are others buying the debt too. :smirk: -

Mikie

7.3kWrong. Please know the reality. — ssu

Mikie

7.3kWrong. Please know the reality. — ssu

Ah, I see where the problem was. Looking at the chart, “US investors” are by far the biggest owners of debt— but they’re not a single entity. Social security is also counted as a single entity; I had assumed all governmental purchases (mutual and retirement funds, etc.)

Fair enough— so the Fed, as a single entity, owns more debt than any individual governmental institution or individual country. Still, doesn’t change the point.

Not in the quantity now they would have had to. The simple fact is that the Federal Reserve was the largest buyer of this huge increase in debt until the start of this year. — ssu

Well, individually yes. But look at your chart — individual investors and foreign holders bought more.

Anyway — I’d let go of monetarism. It simply doesn’t explain inflation, except at the margins. At least in this case. It’s not without some truth, but I don’t see how one can look at war and COVID and conclude that the main driver is monetary policy — other than attachment to the theory, dogmatism, or a desire for neat and simple answers. Ultimately it’s a cover for neoliberalism and austerity, as we’re seeing right now. And the working class will be the ones you pay, as usual. All under the name of liberty. -

ssu

9.8k

ssu

9.8k

There's one thing to know about schools of economic thought: they all have a point. Taken as an ideology is wrong. Yet they have, be it Keynesianism, monetarism, the Austrian school or anything else, have a point and make a reasonable argument about some aspects of the economy. A huge naive error is made when someone thinks that one school is "wrong" and the other one is "right". Yes, they are indeed political, hence the old name for economics, political economy, is far more accurate. But one shouldn't put on political blinders, even MMT can be reasonable and it's supporters did admit that inflation can happen. So "letting go" of some economic school of thought isn't the way, one should look at what the different schools all say together.Anyway — I’d let go of monetarism. It simply doesn’t explain inflation, except at the margins. At least in this case. — Xtrix

The main driver is the response to COVID, which 2020-2021 prevented the "man-made" recession when people were forced to stay home.It’s not without some truth, but I don’t see how one can look at war and COVID and conclude that the main driver is monetary policy — Xtrix

The issue basically is when monetary policy is used to as fiscal policy, be it in Argentina, Belarus or Zimbabwe. Hyperinflation happens when people lose trust in their currency (and their government and central bank). That isn't happening in the US. Yet the dramatic response to COVID had huge undeniable effects: the persistently loose monetary policies with excessively stimulative fiscal policies and a rapid accumulation of household savings during the pandemic led to pent-up demand once economies reopened.

We have to remember that giving such if small sounding amount to people (By Trump administration) had huge effects, because many Americans live hand to mouth.

On the one hand, COVID-19 stimulus undoubtedly helped Americans in some very big, tangible ways. Namely, it reduced poverty — beyond merely keeping people afloat during the early days of the pandemic.

According to the U.S. Census Bureau’s supplemental poverty measure, the stimulus payments moved 11.7 million people out of poverty in 2020 — a drop in the poverty rate from 11.8 to 9.1 percent. And the 2021 poverty rate was estimated to fall even further to 7.7 percent, per a July 2021 report from the Urban Institute.

But there were the consequences for this:

However, there is also evidence that the stimulus, especially the last round, likely stoked higher and higher prices for the very people it was intended to help. Though global supply chain issues (and, more recently, the war in Ukraine) have been significant drivers of inflation, the divergence between U.S. and European inflation suggests there’s more to it than that. In fact, a recent analysis from researchers at the Federal Reserve Bank of San Francisco found that the stimulus may have raised U.S. inflation by about 3 percentage points by the end of 2021.

Americans are struggling financially as a result — particularly low-income people who don’t have a cushion to absorb higher prices. Moreover, inflation is outpacing wage growth. Despite a 5.6 percent jump in wages year-over-year, 8.5 percent inflation in March 2022 meant that Americans saw a nearly 3 percent decrease in inflation-adjusted wages.

This wasn’t a completely unforeseen problem, either. Back in early 2021, some economists raised the alarm about the size of the final round of stimulus — the American Rescue Plan, which was headlined by $1,400 direct payments to individual Americans — for its potential to overheat the economy and create an inflationary environment.

I guess your argument is that this won't matter, that it was an one time thing. Perhaps we don't see COVID lockdowns, but do notice that basically every third dollar the Government spent last year. That's a huge gap. Think that they can tighten it now?

You can have wealth distribution and transfer payments from the rich to the poor, when that is done by tax revenue. But when basically all expenditure is done in such large way by new debt, it will have consequences.

In my view they will continue on the famous lines of Dick Cheney that "Deficits don't matter" until the system brakes. Because a crisis is the only case when something is done. Something on the lines of Naomi Klein's Shock Doctrine. Of course, this is likely a thing that will take years.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum