-

RogueAI

3.5kYet you aren't on the barricades, are you? Is anybody else? — ssu

RogueAI

3.5kYet you aren't on the barricades, are you? Is anybody else? — ssu

I'm getting 5% on my money.

And with a 5% inflation, just look how quickly your money will lose value. Let's say that for the next five years you would have 5% inflation (which could be masqueraded by statistical gimmicks to look like 3% or 2%). Afterwards it won't take so much time to get where the money is half of it used to be. But who cares what things were priced a decade ago.

Only if it would be 5% per month people would panic and it would be an uproar. The idea is just to boil the frog so low that it doesn't jump out, you know.

Eventually, if inflation gets bad enough and the fed is seen as protecting bankers more than Main Street, a political party will run on a platform of revoking the fed's independence. -

creativesoul

12.2k -

frank

18.9kProbably a direct result of growing up so poor... much easier to satisfy! — creativesoul

frank

18.9kProbably a direct result of growing up so poor... much easier to satisfy! — creativesoul

I think you're just not greedy, so your vision isn't clouded by that. -

Mikie

7.3kThat big retailers exploit their financial control over suppliers to hobble smaller competitors is a different phenomenon. — ssu

Mikie

7.3kThat big retailers exploit their financial control over suppliers to hobble smaller competitors is a different phenomenon. — ssu

Right, a phenomenon which explains the inflation that matters for most people. Not stocks and bonds.

As I've said, prices can go up and down for many reasons that aren't related to inflation. And you can allways find new reasons to argue just why prices are up. — ssu

Prices going up over time is inflation.

And you're right, you can always find new reasons -- which is only right, considering the world is complicated. Which is why clinging to obsolete generalizations from yore is silly. -

ssu

9.8k

ssu

9.8k

I'm actually not so sure about that, unfortunately.Eventually, if inflation gets bad enough and the fed is seen as protecting bankers more than Main Street, a political party will run on a platform of revoking the fed's independence. — RogueAI

Americans can easily be divided by party lines and made to hate each other. I think that's the basic way to control the disappointed voters and keep them supporting the system by voting the two parties. It doesn't matter that they voters do actually share common things. Americans didn't like the way the financial institutions were handled with silk gloves in the last financial crisis (socialism for the rich), but the animosity between the right and the left prevailed. Doesn't matter that actually the "Occupy Wall Street" and the Tea-party people shared common issues, they hate each other enough not to notice them.

And secondly, there's a time lap when inflation rears it's head and when the money was printed. If it was Trump sending cash to Americans, it's only during Biden's administration that the effects can be seen. Inflation also goes up and down and isn't a fixed continuous issue.

Hence you can always say once the inflation decreases that the "inflation" has been now contained, or that it was temporary, or transitory, as we were lead to believe.

And then you have to remember that there are those for whom high inflation works: those that have invested debt into something that keeps its value. They are just happy about inflation taking care of their debt. -

Mikie

7.3kFrom the front page of the Times:

Mikie

7.3kFrom the front page of the Times:

Companies Push Prices Higher, Protecting Profits but Adding to Inflation

Glad to see some attention to this glaring contributor to inflation. -

ssu

9.8kCompanies that have the ability to put the highers costs into prices and protect their margins are actually quite good investments in this environment. But are they really the sources, the main culprit, for inflation?

ssu

9.8kCompanies that have the ability to put the highers costs into prices and protect their margins are actually quite good investments in this environment. But are they really the sources, the main culprit, for inflation?

For example real estate doesn't have this ability... it can tackle inflation only in the long run: a flat in the perfect location has historically usually been very expensive no matter of the market. Yet when real estate is "historically looking very low priced", especial when real prices are looked at, there simply are few if none of these in the market on sale. -

Mikie

7.3kCompanies that have the ability to put the highers costs into prices and protect their margins are actually quite good investments in this environment. — ssu

Mikie

7.3kCompanies that have the ability to put the highers costs into prices and protect their margins are actually quite good investments in this environment. — ssu

No they aren’t. They protect the profits, yes, which goes to shareholders. The consumers and workers get screwed, as always. It’s a terrible investment.

But are they really the sources, the main culprit, for inflation? — ssu

It’s a major contributor and, often, the main culprit, yes. In the case of food, it’s the main culprit. In the case of cars…It’s partly that but partly supply disruptions. Etc.

For example real estate doesn't have this ability — ssu

As I’ve said elsewhere, housing, stocks and bonds are all a different animal. The Fed is great at creating asset bubbles. Especially when moral hazard is factored in, which they’re exceptional at creating. -

frank

18.9k

frank

18.9k

This is an interesting video. It touches on how the west can import deflation from China to offset policies that would normally cause inflation. Supposedly that happened in the last decade. Ignore the flashy title. It seems like all YouTube videos have hyperbolic titles these days.

-

ssu

9.8kNo they aren’t. They protect the profits, yes, which goes to shareholders. The consumers and workers get screwed, as always. It’s a terrible investment. — Mikie

ssu

9.8kNo they aren’t. They protect the profits, yes, which goes to shareholders. The consumers and workers get screwed, as always. It’s a terrible investment. — Mikie

Again, If they protect their profits, which go to the shareholders, wouldn't they be actually quite good investments in this environment? Why would they be a terrible investment?

Let me get this straight:It’s a major contributor and, often, the main culprit, yes. In the case of food, it’s the main culprit. In the case of cars…It’s partly that but partly supply disruptions. Etc. — Mikie

If they government simply prints more money to bay it's bills, and this creates a situation where there's far more money sloshing around, you seem to then accuse those who see this happening. In fact it's quite similar to those that accuse inflation of happening because of the trade unions wanting have higher wages. Not that trade unions react to the higher prices.

It's really about just who can put this inflation into motion.... -

creativesoul

12.2k

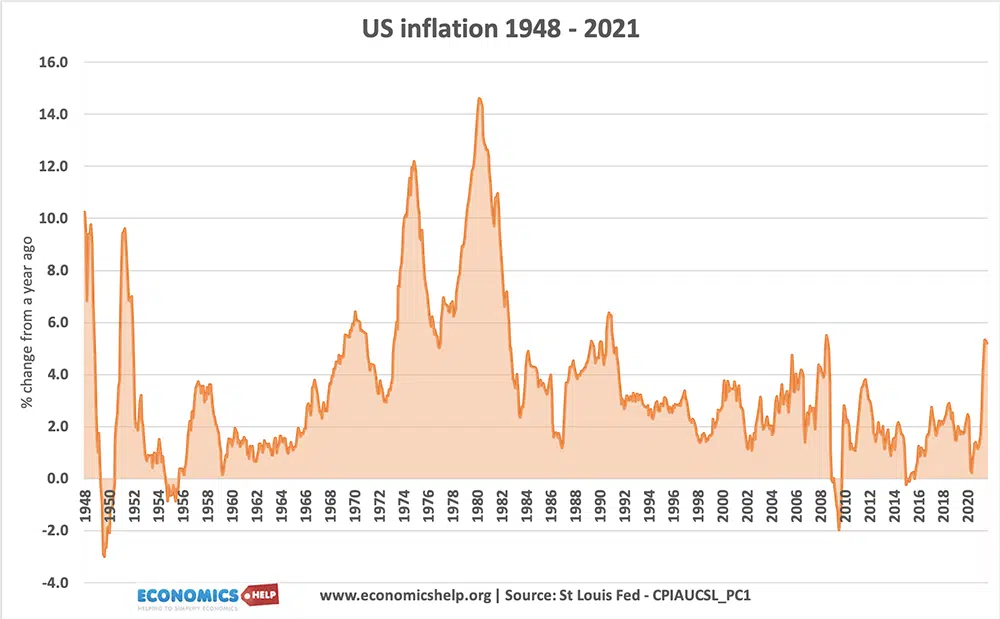

I find it odd that you keep blaming inflation on the government printing more money, while offering a graph that clearly disputes that...

Look at 2009... -

creativesoul

12.2kIt's really about just who can put this inflation into motion.... — ssu

Whomever wants to increase profit margin and can get away with raising prices. -

creativesoul

12.2kWhy would they be a terrible investment? — ssu

Because of the clearly demonstrable quantifiable harm done to the consumer and less fortunate members of society.

The market is supposed to be a vehicle to provide goods and services to the members of society. Increasing cost is a disservice. It's a complex way for the poorest and less fortunate to transfer what little they have into the pockets of those who already have the most... -

Mikie

7.3kWhy would they be a terrible investment? — ssu

Mikie

7.3kWhy would they be a terrible investment? — ssu

Because raising prices, which customers pay for, just to maintain profits, and then giving away 90% of those profits to shareholders is a terrible investment. It’s terrible for workers, customers, society, and, as has been studied, for businesses themselves.

To even call it an investment is misleading. It’s not investing anything, really. It’s trying to keep the profits and stock prices high.

It's really about just who can put this inflation into motion.... — ssu

Yes. Companies can. Wal Mart chose to absorb extra cost, for example. Others don’t.

The Fed printing money does inflate certain assets, yes. That’s only one part of overall inflation. -

ssu

9.8k

ssu

9.8k

So your refutation is that once there was peak of deflation during the financial crisis? Weak.I find it odd that you keep blaming inflation on the government printing more money, while offering a graph that clearly disputes that...

Look at 2009... — creativesoul

No, the primary reason is that the US government is spending far more than it earns. And the US government will continue this until a crisis erupts. Then they will blame something else and people will obediently believe them.

Stock companies try to make a profit for their owners. It's not a terrible investment, if they achieve doing that.Because raising prices, which customers pay for, just to maintain profits, and then giving away 90% of those profits to shareholders is a terrible investment. It’s terrible for workers, customers, society, and, as has been studied, for businesses themselves. — Mikie

Stock buybacks etc. are another thing. Basically if the company makes a profit, then it's a healthy company.To even call it an investment is misleading. It’s not investing anything, really. It’s trying to keep the profits and stock prices high. — Mikie

So trade unions too when they achieve a pay raise?Whomever wants to increase profit margin and can get away with raising prices. — creativesoul

Again, just who gets to use the money before the prices start to go up is the real winner in this game.

Most important asset being the US dollar. Yet I'd add that it's not just the Fed, it's all the central banks and financial institutions that have to be considered too.The Fed printing money does inflate certain assets, yes. That’s only one part of overall inflation. — Mikie -

Mikie

7.3kStock companies try to make a profit for their owners. It's not a terrible investment, if they achieve doing that. — ssu

Mikie

7.3kStock companies try to make a profit for their owners. It's not a terrible investment, if they achieve doing that. — ssu

It’s not an investment in anything. And it’s a terrible practice. Terrible for businesses, in fact. To say nothing of the moral bankruptcy of the shareholder primacy view, which you seem to assume as a law of nature.

Basically if the company makes a profit, then it's a healthy company. — ssu

Just more nonsense.

Quarterly earnings tells you little about a company’s “health.” It only tells you it’s profitable this quarter. -

creativesoul

12.2kSo your refutation is that once there was peak of deflation during the financial crisis? Weak. — ssu

It's never a good sign when one supplants valid objection with attacking a strawman. It's not the only time that the government provided stimulus(printed money) and no inflation followed.

However...

...even if it were, which it's not...

...that single example would serve as more than adequate prima facie empirical evidence(proof even) that inflation is not caused by the government printing money. -

creativesoul

12.2kSigh...

The intellectual poverty in comparing government finances to private business...

It's a shame that many, if not most, Americans have been brainwashed into believing that that's a good analogy. -

ssu

9.8k

ssu

9.8k

Terrible practice to make a profit? Terrible for business?. And it’s a terrible practice. Terrible for businesses, in fact. To say nothing of the moral bankruptcy of the shareholder primacy view, which you seem to assume as a law of nature. — Mikie

Just what in your mind is a business profit?

Evil banality of greedy people that abuse people or what? -

ssu

9.8k

ssu

9.8k

What is the strawman where you do have inflation every year except one?It's never a good sign when one supplants valid objection with attacking a strawman. — creativesoul -

Mikie

7.3kTerrible practice to make a profit? Terrible for business? — ssu

Mikie

7.3kTerrible practice to make a profit? Terrible for business? — ssu

Making a profit is fine, provided it’s done morally. Giving those profits to the rich is morally wrong and terrible practice. It’s also not an investment. R/D, capex, raising wages, community programs — those are good investments potentially.

So yes, it’s terrible practice. We see the results for business, too. Maximizing short term profits and giving 90% back to shareholders, which is what’s been happening these last 40 years, has been a disaster. True, not a disaster for Carl Icahn and the like— if that’s what you mean by success, you’re welcome. -

ssu

9.8k

ssu

9.8k

Obviously you don't like capitalism, but the fact is profit is given to those that are the owners. Workers get salaries, owners profits.. Giving those profits to the rich is morally wrong and terrible practice. — Mikie

The issue is just to look at what has the biggest effect on the issues. Yes, some large corporations indeed have pricing power and can protect their profits. However, it's still a response to the situation: raw materials and others cost rose, hence they could raise prices. And it's basically the same talking point, that it's the greedy corporations, that Gerald Ford had when inflation rose to 12% during his administration. And that's how the political discourse will be set: talk about greedy corporations, the war in ukraine, supply shortages and total silence about monetary policy.

And thus I keep repeating on the absolutely massive Trump era COVID stimulus packages in addition to the out of control spending that the US has. A jump from a debt-to-gdp ratio of 100% level to 120% level in a year or so simply has consequences. That public spending went from 4 trillion to the 7 trillion range has consequences. It's unpopular in the US as both Democrat and GOP administrations are the culprits here and thus the other side cannot simply blame the other.

Similarly, that just now the balance sheet of the Federal Reserve has double again in a very short time is telling.

And now that money didn't go to re-inflate a burst speculative bubble and keep the financial system afloat, but to prevent the COVID lockdowns causing an economic downturn.

Likely in the end the international dollar system will simply collapse. Likely then the bad guy for all this in addition to the "greedy corporations" will be said to be China. Never fiscal spending by central bank printing money as the culprit. -

frank

18.9kAnd thus I keep repeating on the absolutely massive Trump era COVID stimulus packages in addition to the out of control spending that the US has. — ssu

frank

18.9kAnd thus I keep repeating on the absolutely massive Trump era COVID stimulus packages in addition to the out of control spending that the US has. — ssu

I think you're forgetting that the US is part of a global system. The US can overspend without developing hyper-inflation as long as China doesn't have high inflation. The problem right now is that everybody's inflation is on the high side. Even Japan's inflation rate is going up (which usually never happens).

Right now we're in a self-propelling cycle. Wages are up because spending is up, and vice versa. Even though there are signs that we may already be in a recession, inflation continues along it's own trail. -

ssu

9.8k

ssu

9.8k

All nations are following the same example. And that's why a dollar crisis wouldn't be a crisis of the US, it would be a crisis for the West. We are in the same boat. And that's why the saying has gone that in the end the US is the best of the bad. I'd say the end result is monetary crisis of the whole system. Just like Nixon had in the 1970's.I think you're forgetting that the US is part of a global system. The US can overspend without developing hyper-inflation as long as China doesn't have high inflation. The problem right now is that everybody's inflation is on the high side. Even Japan's inflation rate is going up (which usually never happens). — frank

It would be good actually to see what economists and commentators said earlier. Reasons like why there wouldn't be any inflation because of the COVID stimulus packages and the huge increase in spending. There was even the Modern Monetary Theory (MMT) that was eagerly listened to. Even if the MMT did understand that somewhere inflation would be a problem, it wouldn't be now. Especially not for the US.Right now we're in a self-propelling cycle. Wages are up because spending is up, and vice versa. Even though there are signs that we may already be in a recession, inflation continues along it's own trail. — frank

And comments were like this when the trillions level stimulus bills happened:

(Washington Post, March 4th, 2021) This time, the proximate cause is the Biden administration’s $1.9 trillion coronavirus rescue package, coupled with the Fed’s new approach, which aims to let inflation hover near 2 percent (and go slightly above it when necessary), instead of strictly targeting 2 percent. What happens, the inflation hawks ask, if we emerge from the pandemic with an economic boom? If everyone gets back to work and uses that government money, will wages and prices suddenly shoot up? It’s not an outrageous question: Theory holds that goods will cost more and our money will buy less. But that’s not happening yet. And it hasn’t happened in a very long time. Our understanding of inflation has changed, our ability to control it has improved and the danger is more remote than we once believed. *** From a human standpoint, it seems like a no-brainer. Stop overly worrying about unlikely inflation and support a roaring economy, one that’s inclusive enough to pull people off the sidelines. It’s essential medicine. If only the hawks can be convinced to let us take it.

It's the age old thing of people believing that "this times it's different". As if what held earlier in history wouldn't hold know. And when something is brewing on for decades yet isn't upon us and the crisis hasn't happened yet, nobody cares. -

frank

18.9kAll nations are following the same example. And that's why a dollar crisis wouldn't be a crisis of the US, it would be a crisis for the West. — ssu

frank

18.9kAll nations are following the same example. And that's why a dollar crisis wouldn't be a crisis of the US, it would be a crisis for the West. — ssu

China isn't in the west. China doesn't follow western policies.

It would be good actually to see what economists and commentators said earlier. Reasons like why there wouldn't be any inflation because of the COVID stimulus packages and the huge increase in spending. There was even the Modern Monetary Theory (MMT) that was eagerly listened to. Even if the MMT did understand that somewhere inflation would be a problem, it wouldn't be now. Especially not for the US. — ssu

I guess, but the stimulus was meant to keep the global economy from crashing, so what would you have advised instead? -

ssu

9.8k

ssu

9.8k

Especially after the sanctions now imposed on Russia, China can fear that similar things would happen to itself. And thus the globalization bromance between China and the US is over and globalization is now going backwards. China is also focused on trying to increase it's domestic market and doesn't see anymore the link to the US or the West's technology and investment as crucial as earlier.China isn't in the west. China doesn't follow western policies. — frank

As Harvard Business Review put it:

But for more than 15 years—spanning the Bush, Obama, and Trump administrations—China has followed a strategy of reducing its dependence on foreign technology and capabilities. Moreover, it has projected that strategy forward another 15 years.

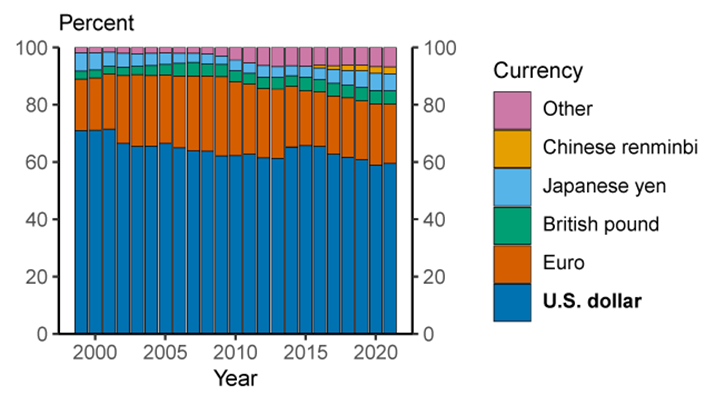

This transformation doesn't happen quickly, but is happening. Still the majority of all foreign currency holdings that nations have are in US dollars. And the fact is that even if the USD has an oversized role on the markets, the US still has the largest economy.

Below a graph showing the foreign currency reserves held in the World:

The fact that now the biggest holder and the biggest buyer of US Treasuries isn't China or Japan, but the Federal Reserve. Yet the real problem is that US public finance has totally decoupled from actual tax income and is totally dependent basically structurally on acquiring more and more debt. The problem is the rapid growth of this, which will be increasingly difficult to manage.

When the global economy crashed in March 2020 and markets went into free fall, the U.S. Treasury market — the $25 trillion bedrock of the global financial system — broke down. Sellers struggled to find buyers, and prices whipsawed higher and lower. The Fed stepped in, devoting trillions of dollars to steadying the market.

The importance of the Treasury market is hard to overstate. It is the main source of funding for the U.S. government and underpins borrowing costs around the globe, for a huge variety of assets. If you have a mortgage, the interest rate you received was probably priced in relation to Treasuries. The same goes for credit cards, business loans and just about anything with an interest rate attached to it. The proper functioning of this market is paramount.

That’s why even small wobbles in this market can generate huge worries. At its worst, a Treasury trading breakdown could cause the value of the dollar, stocks and other bonds to tumble.

You can pay that debt away with inflation. And that's why even if we can have temporary lulls in inflation, it won't go away. -

ssu

9.8k

ssu

9.8k

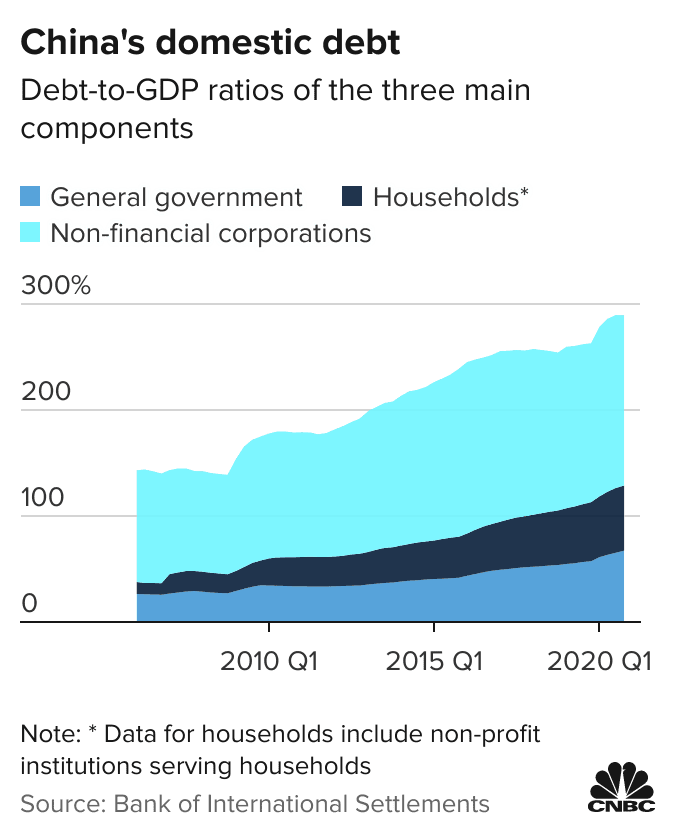

What Chinese policies then you had in mind?I dont think much of what you wrote there is directly related to the present situation. — frank

Besides, China has followed a quite similar path as the West when it comes to debt, yet it's public sector isn't as heavily in debt as for example the US is being under 100% of debt-to-gdp. (If the total debt to gdp is for China in the 300% level, it's for the US somewhere in the 700% level)

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum