-

hypericin

2.1kWhat do you guys think of the notion of scarcity in cryptocurrency? It is a given that scarcity alone is not value, scarcity is a necessary but insufficient condition of value.

hypericin

2.1kWhat do you guys think of the notion of scarcity in cryptocurrency? It is a given that scarcity alone is not value, scarcity is a necessary but insufficient condition of value.

But are cryptocurrencies truly scarse at all? On the one hand many cryptocurrencies, most famously Bitcoin, are in one sense strictly scarse. There will only ever be so many Bitcoin. On the other hand, any number of derivative cryptocurrencies with similar or identical properties to Bitcoin can be and are created. Both sharing a lineage on the block chain (Bitcoin cash, SV) and not (Litecoin?). There are probably hundreds or thousands of Bitcoin-like cryptos floating around, most ignored and valueless.

Generally, there are thousands (at least) of cryptocurrencies, and there will be thousands more created in the future. The barrier to creating them is quite low. Given this, are cryptocurrencies truly scarse? -

Tzeentch

4.4kThe biggest problem with crypto is their trustworthiness, so cryptos which are perceived as more trustworthy, like BitCoin, are a distinctly different product from ShitCoin XYZ.

Tzeentch

4.4kThe biggest problem with crypto is their trustworthiness, so cryptos which are perceived as more trustworthy, like BitCoin, are a distinctly different product from ShitCoin XYZ.

The process of building up a trustworthy reputation takes time, thus it is not easy to recreate the product, thus it remains scarce.

What do you think? -

BitconnectCarlos

2.8kWhat do you guys think of the notion of scarcity in cryptocurrency? It is a given that scarcity alone is not value, scarcity is a necessary but insufficient condition of value. — hypericin

BitconnectCarlos

2.8kWhat do you guys think of the notion of scarcity in cryptocurrency? It is a given that scarcity alone is not value, scarcity is a necessary but insufficient condition of value. — hypericin

At first I agreed with this 100% and this is certainly the traditional view, but then I remembered the sudden rise in dogecoin's value which is the furthest thing from scarce.

Given this, are cryptocurrencies truly scarse? — hypericin

It's not that cryptocurrencies are scarce, but certain cryptocurrencies, like bitcoin, are scarce. The devs determine the supply distribution. -

hypericin

2.1kAt first I agreed with this 100% and this is certainly the traditional view, but then I remembered the sudden rise in dogecoin's value which is the furthest thing from scarce. — BitconnectCarlos

hypericin

2.1kAt first I agreed with this 100% and this is certainly the traditional view, but then I remembered the sudden rise in dogecoin's value which is the furthest thing from scarce. — BitconnectCarlos

No, even dogecoin is scarce. Unlike Bitcoin it is inflationary, there is no cap on the total supply. But dogecoin must still be "mined", it cannot be otherwise created or found. Just as there is no cap on the usd that will ultimately be created. But that creation is still tightly controlled, creating scarcity.

All cryptocurrency, at least all that is valuable, is scarce. -

Tzeentch

4.4kPeople's perception of the longevity and value of the currency, I suppose.

Tzeentch

4.4kPeople's perception of the longevity and value of the currency, I suppose.

Certain cryptos have turned out to be scams, or became completely valueless. This is of course the investor's nightmare.

BitCoin has survived some serious drops, and recently experienced some big rises. These trends seem to suggest it is able to hold its value over time.

And of course, the longer it continues to exist, the stronger its reputation as being reliable will become. -

hypericin

2.1kPeople's perception of the longevity and value of the currency, I suppose. — Tzeentch

hypericin

2.1kPeople's perception of the longevity and value of the currency, I suppose. — Tzeentch

Sure. It was this basic feeling that kept me and most of us from being early investors. And it is this doubt that combined with greed makes the price so volatile.

They are willing to buy to the degree it is scarce. As I said scarcity is a necessary but insufficient condition for value.If people think something is valuable and are willing to buy it, it's valuable. — ssu -

Leontiskos

5.6kGenerally, there are thousands (at least) of cryptocurrencies, and there will be thousands more created in the future. The barrier to creating them is quite low. Given this, are cryptocurrencies truly scarse? — hypericin

Leontiskos

5.6kGenerally, there are thousands (at least) of cryptocurrencies, and there will be thousands more created in the future. The barrier to creating them is quite low. Given this, are cryptocurrencies truly scarse? — hypericin

I suppose their scarcity presupposes investment in a single kind. They are not scarce in their genus, for there are many species of cryptocurrency. But they tend to be scarce in their species, e.g. Bitcoin is designed to include scarcity.

Fast-forwarding to the end: cryptocurrency is silly. The means of exchange probably needs to have some kind of inherent value, such as gold has. -

ssu

9.8k

ssu

9.8k

Not actually.They are willing to buy to the degree it is scarce. As I said scarcity is a necessary but insufficient condition for value. — hypericin

There's no scarcity of let's say the US dollar. Only that the Central Bank won't do this. But with a few pushes on a computer, they could make tomorrow 100 trillion dollars. Just as no bank can give you a 50 year 100 trillion dollar bullet loan to mine the Asteroid belt, even if you would have this awesome business plan to do it. Likely the Central Bank or the Financial Regulator would halt the bank giving you such a loan.

Yet if they would go along with your loan plan, once you sign it, you have just created that 100 trillion.

How could that be scarcity in the meaning that we usually understand it? -

Tzeentch

4.4kThey are willing to buy to the degree it is scarce. As I said scarcity is a necessary but insufficient condition for value. — hypericin

Tzeentch

4.4kThey are willing to buy to the degree it is scarce. As I said scarcity is a necessary but insufficient condition for value. — hypericin

I think cryptocurrency derives its value from the fact that it is an independent means of exchange. It's much less stable in value than gold, but it is much easier to make transactions with.

The means of exchange probably needs to have some kind of inherent value, such as gold has. — Leontiskos

I'm not sure whether I agree gold has inherent value. Its main guarantor of value is its track record of several thousand years. Gold has the property of being an incredibly stable compound, but this is probably not as important in the modern age as it was historically.

There's no scarcity of let's say the US dollar. Only that the Central Bank won't do this. But with a few pushes on a computer, they could make tomorrow 100 trillion dollars. — ssu

That's a possibility, albeit an unrealistic one. I think that's why the US dollar can still be said to be scarce. For it to be considered 'not scarce' there would have to be more dollar bills than people know what to do with. That may happen during a hyper inflation.

The common problem money printing creates isn't necessarily a lack of scarcity, but a lack of value stability. -

hypericin

2.1kThe means of exchange probably needs to have some kind of )inherent value, such as gold has. — Leontiskos

hypericin

2.1kThe means of exchange probably needs to have some kind of )inherent value, such as gold has. — Leontiskos

Gold has some "inherent value" (as problematic as that is) but that (decoration, electronics) has little relation to it's value, the bulk of which derives from it's status as a store of value. Cryptos have acquired this status (during which process it is possible to become rich), like it or not.

. But with a few pushes on a computer, they could make tomorrow 100 trillion dollars. — ssu

What matters is not "actual" scarcity but perception of scarcity. If the belief spread that they might do this, the value of the dollar would plummet to 0, due to the belief in an imminent loss of scarcity.

How could that be scarcity in the meaning that we usually understand it? — ssu

Despite that, people labor long hours performing unpleasant tasks to acquire a few dollars. No one would spend a third or more if their waking time working if dollars were not scarse: that is, if they could be gathered on trees , or printed on a printer.

The common problem money printing creates isn't necessarily a lack of scarcity, but a lack of value stability. — Tzeentch

Loss of "value stability"(that is, decline) happens in proportion to loss of scarcity and loss of confidence in future scarcity. -

fishfry

3.4kGold has some "Internet value" (as problematic as that is) but that (decoration, electronics) has little relation to it's value, the bulk of which derives from it's status as a store of value. Cryptos have acquired this status (during which process it is possible to become rich), like it or not. — hypericin

fishfry

3.4kGold has some "Internet value" (as problematic as that is) but that (decoration, electronics) has little relation to it's value, the bulk of which derives from it's status as a store of value. Cryptos have acquired this status (during which process it is possible to become rich), like it or not. — hypericin

When the grid goes down, the crypto-heads will discover the difference between gold and crypto as a store of value. -

kazan

485@fishfry,

kazan

485@fishfry,

"When the grid goes down..." most investors holding gold investments won't have access to "their" physical gold. Isn't it held in trust in some Fort Knox like depositories? The securities of which are both grid dependent and have some physical blunt force inaccessibilities built into the structures.

Isn't Value a function of demand, supply and (perceived) usefulness where all Commodities (i.e. all things tradeable) are concerned? Or is that just too naive a view to be applied to cryptocurrencies?

Curious smile -

fishfry

3.4kWhen the grid goes down..." most investors holding gold investments won't have access to "their" physical gold. Isn't it held in trust in some Fort Knox like depositories? The securities of which are both grid dependent and have some physical blunt force inaccessibilities built into the structures — kazan

fishfry

3.4kWhen the grid goes down..." most investors holding gold investments won't have access to "their" physical gold. Isn't it held in trust in some Fort Knox like depositories? The securities of which are both grid dependent and have some physical blunt force inaccessibilities built into the structures — kazan

Well that's a good point too, especially as a lot of gold investment is in ETFs ... so when the grid goes down, everything goes to zero. You're right. -

ssu

9.8k

ssu

9.8k

Not actually...money doesn't work that way. It's not about scarcity, it's money moving in the economy and being used to buy stuff.If the belief spread that they might do this, the value of the dollar would plummet to 0, due to the belief in an imminent loss of scarcity. — hypericin

Assume a bank would give you the loan for mining the asteroid belt (perhaps the banker was high and thought it was just 100 million, not 100 trillion). Then it's in the books before anyone notices and later the people in the bank have this WTF-moment. Naturally some other bankers (who aren't high) don't think your collateral was OK to get the loan and let's say state a credit loss of 100 trillion (because you forgot where you put the money).

Now comes the Fed to rescue and simply bails out the bank. The loss of 100 trillion is written away and nothing has happened.Really, the dollar is just fine. (They might not publish to avoid embarrassment the data of money supply for some days you got those 100 trillion, but anyway...)

You see, the value of the dollar only goes down if that 100 trillion enters the economic system. Only then it will drive up prices and thus lowers the value of the currency. But as you have only had the time to buy a Ferrari and fifty boxes of Champagne before forgetting just where you parked the money, your actions haven't crashed the dollar. Yet if you, as the computer hack as you are, immediately donated that 100 trillion dollars to every American citizen (that's like 330 million people), who then get 303 000 dollars each, you bet there's going to be a huge inflation spike and the dollar will go down, not to zero, but down. Think about it: what would you do if you are given 303 000 dollars? Especially when you understand that everybody else has been given 303 000 dollars. Perhaps people would simply first pay their loans back, but then they would simply start to compete on what they can buy with the money.

And this in a way has already happened in real life: during the Covid pandemic the government sent helicopter money to Americans, because there were the restrictions on working. The bout of inflation was totally foreseeable, even if usual, they lied about the effects of this. Yet when the banking crisis hit and the financial sector had huge losses, the aid the Fed gave to the banks didn't create inflation. The Fed just covered the losses, no money went into the economy. The banks didn't lend so nothing happened (except perhaps mild deflation and a recession).

Hence if there's 100 trillion in some obscure derivatives market, that amount won't wreck the price of the dollar... as long as those 100 trillion stay in the obscure derivatives market! And this is why if there really would be an Uncle Scrooge McDuck, who would be the richest person (duck) in the World who would have his wealth in coins, he could be out there. As he uses the money simply to swim in it, the value of the currency is totally Ok. Sitting (or swimming) on the money doesn't create inflation, hence it isn't the amount itself that is important, because the miserly duck won't use the money to buy stuff.

-

Tzeentch

4.4kAll cryptocurrency, at least all that is valuable, is scarce. — hypericin

Tzeentch

4.4kAll cryptocurrency, at least all that is valuable, is scarce. — hypericin

Is it? Or just expensive and sometimes artificially so? — Benkei

Loss of "value stability"(that is, decline) happens in proportion to loss of scarcity and loss of confidence in future scarcity. — hypericin

Scarcity means that something is in limited supply. Colloquially one may refer to goods which are 'very scarce' (like precious metals) and goods which are 'less scarce' (like food), but ultimately both are scarce.

In order for a good to be considered 'not scarce' it must be so readily available it has no value whatsoever. Like seawater, earth, air, etc. - obviously such goods are unsuitable as a means of exchange.

The lack of value stability with cryptos does not have anything to do with a changing nature of its scarcity, nor with sudden increases in supply, which is what some people mistakenly believe.

To illustrate, even if the cryptomarket would be flooded with ShitCoin XYZ, BitCoin would remain largely unaffected, because ShitCoin XYZ is not the same product as BitCoin.

It's also not clear whether the aforementioned rapid changes of perception are inherent to cryptocurrency, or simply inherent to a new and experimental market as it slowly gravitates towards the 'true' value of the good.

Long story short, this has nothing to do with scarcity. -

hypericin

2.1kYou see, the value of the dollar only goes down if that 100 trillion enters the economic system. Only then it will drive up prices and thus lowers the value of the currency. But as you have only had the time to buy a Ferrari and fifty boxes of Champagne before forgetting just where you parked the money, your actions haven't crashed the dollar. — ssu

hypericin

2.1kYou see, the value of the dollar only goes down if that 100 trillion enters the economic system. Only then it will drive up prices and thus lowers the value of the currency. But as you have only had the time to buy a Ferrari and fifty boxes of Champagne before forgetting just where you parked the money, your actions haven't crashed the dollar. — ssu

I don't think so. Of course in reality this loan would have been flagged instantly. If this titanic mistake was somehow made, quintupling the total money supply in an instant, the dollar would crash. All confidence in the government's competence to maintain the scarcity of the dollar would be lost. The mere threat that the 100 trillion might be discovered and enter circulation would crash the dollar. Whether or not it ever actually does.

It's not just actual circulating money that matters. Perception also matters. Just imagine that the Fed announced that they were stimulating the economy by printing 100 trillion dollars. The dollar would absolutely tank, as everyone would try to unload them all at once. But then the Fed announces it was just an April Fools joke. The dollar tanked, yet not a extra single actual additional dollar entered circulation.

Hence if there's 100 trillion in some obscure derivatives market, that amount won't wreck the price of the dollar... as long as those 100 trillion stay in the obscure derivatives market! — ssu

That is not how it works. Some obscure derivatives market might have a market cap of 100 trillion. But that money can't actually be accessed. Only a fraction of it can. For the money to be accessed, the derivative must be sold. Selling en masse would crash the market for the derivative, evaporating the 100 trillion. .

Moreover, for a derivative to be sold, it must be exchanged for dollars. If the derivative is notionally more valuable than all the dollars in existence, where would the additional dollars come from? -

ssu

9.8k

ssu

9.8k

Was in reality the one trillion, doubling of the Fed balance sheet, flagged instantly? Nope. We actually only later found out close the system had been at a total collapse. Or that corporations that didn't have any financial problems were given money, because it otherwise "would look bad".I don't think so. Of course in reality this loan would have been flagged instantly. — hypericin

First of all, the Fed doesn't have to announce and it didn't announce just how much it aided the markets during the financial crisis. Then it loaned over 1 trillion dollars. I remember that time well, nowhere was it stated that the Fed lent 1 trillion dollars. And furthermore, the way it really did assist the banks and financial institutions was very generous:Just imagine that the Fed announced that they were stimulating the economy by printing 100 trillion dollars. — hypericin

Broadly stated, the Fed chose to provide a "blank cheque" for the banks, instead of providing liquidity and taking over. It did not shut down or clean up most troubled banks; and did not force out bank management or any bank officials responsible for taking bad risks, despite the fact that most of them had major roles in driving to disaster their institutions and the financial system as a whole. This lavishing of cash and gentle treatment was the opposite of the harsh terms the U.S. had demanded when the financial sectors of emerging market economies encountered crises in the 1990s.

The Fed's balance sheet was doubled during the financial crisis. That didn't create inflation as that one trillion didn't go into the economy, because the velocity of circulation was low.

Just think for a moment: in 2003 total assets of the Federal Reserve were 730 million, less than one trillion, last Wednesday 2nd of October 2024 it was 7,046 trillion and total assets have been as high as 9 trillion in 2022. We don't see anymore the most important indicator of monetary growth, M3, but even the M2 monetary base has gone from 6 trillion to 21 trillion. Now if your simple idea of the value coming from "scarcity" be right, the a tenfold increase in Fed assets and the tripling+ of the M2 monetary base would have severe inflationary effects. Well, the annual inflation rate between 2003 and 2024 has been 2,59% annually.

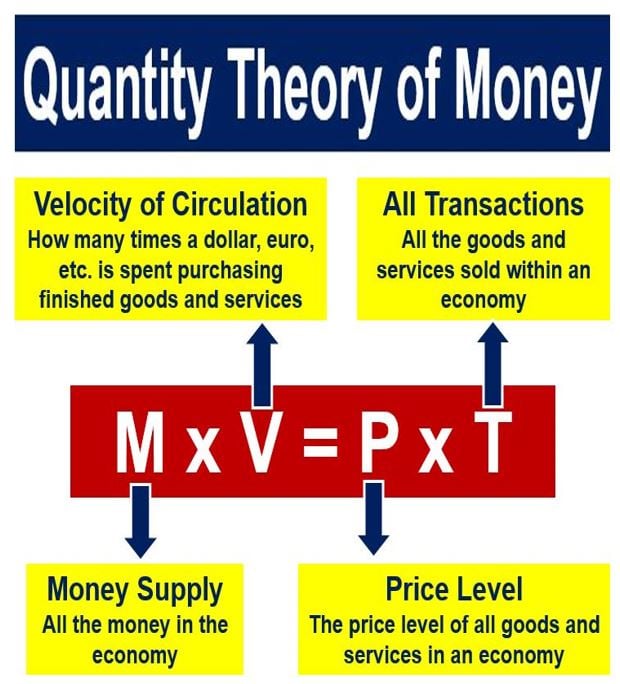

Behind my example is the Fisher equation, which has a lot of truth in it: MV=PT or written out is Money Supply x Velocity of circulation = Price Level x Transactions.

In the example the money supply is hugely increased (over tenfold), yet as you just bought a Ferrari and some bottles of Champagne, the velocity of circulation is basically extremely close to 0. Yet if you give that 100 trillion to every American (which get that 303 000), the effects are devastating, because not all will just park it in the bank, it's also goes to bying stuff and services. Yet, if you just give PF members here (who can be dubious foreigners, but anyway) that 303000 dollars, then the members can enjoy the fruits of dollar having still worth. And here we see just how inflation works: those who get the "new" money first, benefit. The last one's are usually the workers that respond to seeing everything going in prices up and then start demaning increases in wages. And conveniently, they are the ones then blamed for inflation.

This is actually very important to understand, because especially the crypto-fans and the goldbugs usually just give as the sales pitch for their investment how the Fed has ballooned it's balance sheet and utter destruction of hyperinflation is just around the corner. Well, that corner can be still some way off, even if the signs aren't good when the Fed is the largest owner of US government debt and the US will continue spending as it has done until a crisis erupts. -

Leontiskos

5.6kWhen the grid goes down, the crypto-heads will discover the difference between gold and crypto as a store of value. — fishfry

Leontiskos

5.6kWhen the grid goes down, the crypto-heads will discover the difference between gold and crypto as a store of value. — fishfry

They will. :up: -

hypericin

2.1kNow if your simple idea of the value coming from "scarcity" be right — ssu

hypericin

2.1kNow if your simple idea of the value coming from "scarcity" be right — ssu

Is that what you think you are arguing against? The second sentence in my op:

It is a given that scarcity alone is not value, scarcity is a necessary but insufficient condition of value. — hypericin

You say

money doesn't work that way. It's not about scarcity, it's money moving in the economy and being used to buy stuff. — ssu

And yet in the quantity theory of money graphic you posted, both scarcity (money supply) and velocity determine price. I agree with the graphic.

Now if your simple idea of the value coming from "scarcity" be right, the a tenfold increase in Fed assets and the tripling+ of the M2 monetary base would have severe inflationary effects. Well, the annual inflation rate between 2003 and 2024 has been 2,59% annually. — ssu

This increase in supply does not sit stagnant like you suggest. It is invested in the stock market, in real estate, and other assets. If you measure inflation by the cost of goods you need to survive, inflation might actually be 2.59. If you measure by your ability to buy a house, inflation is quite a bit higher. -

ssu

9.8k

ssu

9.8k

Good that you agree with the Fischer equation. Yet it's actually very important to understand it, because the increase in the money supply doesn't automatically mean that it's value goes down. For example when a speculative bubble bursts creating a banking crisis, the velocity of circulation tanks. Banks won't be lending anymore, but will sit on their money like Scrooge McDuck. Hence if the Central Bank prints more money or in the Nordic model, creates a "bad bank" where all the toxic garbage loans are parked, this doesn't create inflation.And yet in the quantity theory of money graphic you posted, both scarcity (money supply) and velocity determine price. I agree with the graphic. — hypericin

This is a policy decision. If you just bail out the people that where carelessly creating the bubble at the first place, then the game will just continue. If you let large banks go bust or put away to jail the most reckless bankers, that sends a totally different message.This increase in supply does not sit stagnant like you suggest. It is invested in the stock market, in real estate, and other assets. — hypericin

The effect of true power can be seen in the actions of the US government: in the Savings & Loans crisis many bankers went to jail and the US handled the situation as law basically requires. In the case of 2008 Financial Crisis where it was the big guys at Wall Street, nobody went to jail and all were bailed out. The only one that went to jail voluntarily gave himself up as the ponzi scheme was too much for him. Yet if Bernard Madoff had just kept a cool head, he might have totally survived 2008 and still could have died as a respected fund manager.

Well, usually inflation is measured by an average of what people consume and the price of housing ought to be taken into account. Usually it isn't and statisticians use things like hedonics to lower the inflation statistics. There is a real economic and political incentive to report inflation being far lower than it actually is.If you measure inflation by the cost of goods you need to survive, inflation might actually be 2.59. If you measure by your ability to buy a house, inflation is quite a bit higher. — hypericin -

hypericin

2.1k

hypericin

2.1k

They were saying that when the crypto market cap was much much smaller, and they were much less institutionally entrenched than they are now. By any measure, they were wrong, the annoying zoomer enthusiasts were right all along.

When it comes to paradigm shifts like this, the intuition of an uneducated kid might count for more than an old investing past master. -

Shawn

13.5kIt's important to note that the first investors of bitcoin were the people who mined the easy to mine bitcoin. All you could expect from them and everyone else was to hold until the price increases for bitcoin. Further, the more hype you added when it first came out, the higher the demand for mining bitcoins. Its sort of complicated to see; but, over time as the price rises and difficulty of discovery is drastically higher you would expect less supply and higher demand given how popular it became.

Shawn

13.5kIt's important to note that the first investors of bitcoin were the people who mined the easy to mine bitcoin. All you could expect from them and everyone else was to hold until the price increases for bitcoin. Further, the more hype you added when it first came out, the higher the demand for mining bitcoins. Its sort of complicated to see; but, over time as the price rises and difficulty of discovery is drastically higher you would expect less supply and higher demand given how popular it became.

Just some observations of the bitcoin market.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum