-

ssu

9.8k

ssu

9.8k

When the Federal Reserve doubled it's monetary base from September 2020 to December 2021, you think that isn't a lot of extra money?I don't think the US government prints a lot of extra money. — Tate

Sure...the people need those COVID money transfers when prices have risen...:snicker:

That was then bought by the Federal Reserve, right.They sell treasury bonds to pay for things like the COVID response. — Tate

It's not the foreigners who have continued to buy it:

-

Tate

1.4kWhen the Federal Reserve doubled it's monetary base from September 2020 to December 2021, you think that isn't a lot of extra money? — ssu

Tate

1.4kWhen the Federal Reserve doubled it's monetary base from September 2020 to December 2021, you think that isn't a lot of extra money? — ssu

I just meant they borrow it, they don't print it. Maybe that's not an important distinction?

It's not the foreigners who have continued to buy it: — ssu

I think American banks have always been the primary lenders, haven't they? But yes, the Fed was buying too. The Fed was probably damned either way.

Stagflation, here we come. -

ssu

9.8k

ssu

9.8k

No, it isn't an important distinction. With money printing I don't mean the actual printing of money, although they do that too.I just meant they borrow it, they don't print it. Maybe that's not an important distinction? — Tate

Let's just listen to what the actual chairman of the Federal Reserve says about this:

-

ssu

9.8kThis isn't only an US problem.

ssu

9.8kThis isn't only an US problem.

This is a global problem.

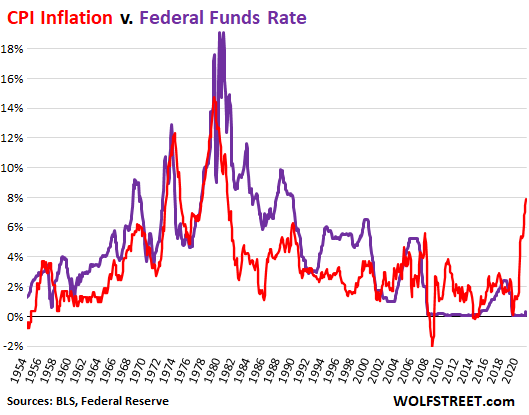

When Paul Volcker raised the interest rates above the inflation rate, I guess the US debt to GDP ratio was something like 13%. Now it's over 130%. That's a big difference when the central bank ought to raise interest rates so that the real interest rates aren't negative. Or anything close to that.

Now the Fed funds rate is 1,75% and the inflation rate 8,6%. That's highly negative.

In fact, Japan is already in this quagmire: they simply cannot have higher interest rates or the government will have real problems.

I have no idea how long this will last. -

ssu

9.8k

ssu

9.8k

Learn just what?We'll see if they repeat it or learn from the lesson. — Tate

Actually the real interest hikes happened in the 1980's. Paul Volcker was the Fed chief in 1979-1987.

Here's the fed funds rate along with the CPI from that time:

Now, just look how scary it looks just now. Rates are nowhere close to confine the inflation.

This time I think they will let inflation run wild. There's enough scapegoats around and simply the Fed is between a rock and a hard place.

A lot of people will be poorer in the future than now.

That the policies will be of "relief", "stimulus" and "assistance" is quite clear. Just look at how Biden tries to engage with high fuel prices:

-

ssu

9.8kJoe Manchin isn't looking so stupid all of the sudden. — Tate

ssu

9.8kJoe Manchin isn't looking so stupid all of the sudden. — Tate

I've not followed what he has said. And I think the real problem is that into this issue will also be engraved the political mudslinging, the "culture war" or whatever you will call the feuding by the two parties in the US. Just to talk about the issue, or any issue close to this, will immediately treated as some kind of dog whistle if one or the other side talks about the issue enough. And then... no more of any kind of educative debate about the issue.

The only fairly universal guideline is that those not in opposition and not power can talk about the problem clearly while those in power have to handle the issue.

Hence, it's not at all surprising that who has talked about the issue most clearly is Vladimir Putin: he genuinely has nothing to lose on this, and will be happy about the possible demise of the dollar / the Western financial system. -

Tate

1.4kHence, it's not at all surprising that who has talked about the issue most clearly is Vladimir Putin: he genuinely has nothing to lose on this, and will be happy about the possible demise of the dollar / the Western financial system. — ssu

Tate

1.4kHence, it's not at all surprising that who has talked about the issue most clearly is Vladimir Putin: he genuinely has nothing to lose on this, and will be happy about the possible demise of the dollar / the Western financial system. — ssu

A lot of Americans feel the same way. 'Let it all go up in flames and start over, or not even that, just let it all be ended'. It's the nihilism @Olivier5 was talking about in the Ukraine thread. -

ssu

9.8k

ssu

9.8k

Ah, the decadence of the West!A lot of Americans feel the same way. 'Let it all go up in flames and start over, or not even that, just let it all be ended'. It's the nihilism Olivier5 was talking about in the Ukraine thread. — Tate

Well, both Americans and we foreigners likely don't understand just how much of that wealth and awesomeness of the US economy is based on the position the US dollar enjoys.

Yet why we have now (and will have in the future) high inflation is because finally the MMT (Modern Monetary Theory) experiment has been done, and it's effects are to be seen now. Here's a perfect example of the MMT thinking:

It should be noted that Kelton as supporter of MMT does say the obvious, that with deficit spending the real limit is inflation (or in the end, basically the trust in the currency). But as we know, we have a lot of excuses for inflation to be "transitory": the war in Ukraine and Putin, supply shortages and, why not, even climate change. Anything else but that deficit spending by our governments. -

Tate

1.4kWell, both Americans and we foreigners likely don't understand just how much of that wealth and awesomeness of the US economy is based on the position the US dollar enjoys — ssu

Tate

1.4kWell, both Americans and we foreigners likely don't understand just how much of that wealth and awesomeness of the US economy is based on the position the US dollar enjoys — ssu

That's not controlled by the US, though. The whole global economy is doing that, much of it by the will of the Chinese.

It's all integrated. -

ssu

9.8k

ssu

9.8k

Not actually. There's no alternative now for the US dollar. For now.That's not controlled by the US, though. The whole global economy is doing that, much of it by the will of the Chinese. — Tate

Basically the US just can fuck up and have the dollar lose it's status as the reserve currency. It's not like the World's countries will choose an alternative system. It's just that they will have to admit that the system doesn't work anymore. And only the Americans themselves can mess things so badly, if they want.

Good way to do that is to send those stimulus checks again for the people and just spend, spend and spend. It's totally possible to wreck the dollar, but will take a lot of work! -

Mikie

7.3kHow long should you believe this "supply shock" argument? — ssu

Mikie

7.3kHow long should you believe this "supply shock" argument? — ssu

How long are you going to believe the demand-side argument? Apparently it’s unfalsifiable.

Again— inflation was predicted after all the spending in 2009. Didn’t happen. But to save the theory, we make up excuses. 13 years later, inflation happens after an unprecedented global pandemic — inflation that’s occurring all over the world — and the same believers say “See? Told you so.” It’s simply nonsense.

Before it was Covid. Fine. But now? — ssu

Well interest rates have been raised— inflation persists. So how long are we going to believe this is the solution?

The point is: these things have lingering effects. Supply lines are still very much disturbed.

War in Ukraine? Really? — ssu

Yes, really. That’s had a huge impact. Also unprecedented and has nothing whatsoever to do with the Fed.

However, it seems that all those who blame inflationary pressures on commodities continue to ignore the massive price increases in housing, healthcare, and education, as well as in goods and services where there was evident overcapacity.

I’ve actually addressed all of that. They have different causes. Commodities effect homebuilding as well.

Nothing else has inflated more than energy. A quick look at the CPI shows this.

Yet history and economic history point the finger on government policies. — ssu

History points to multiple causes in multiple asset classes.

There simply aren’t easy answers to what’s happening. The evidence points to supply-side issues more than to demand in the current case. -

ssu

9.8k

ssu

9.8k

After the bursting of a speculative housing bubble inflation won't pick up as the bubble bursting is highly deflationary. Banks and the financial sector are the ones in focus and they won't continue lending as they did before. And the inflation the QE created basically went afterwards to asset inflation, to refilling the bubble.Again— inflation was predicted after all the spending in 2009. Didn’t happen. — Xtrix

Why do think so?3 years later, inflation happens after an unprecedented global pandemic — inflation that’s occurring all over the world — and the same believers say “See? Told you so.” It’s simply nonsense. — Xtrix -

Mikie

7.3kAfter the bursting of a speculative housing bubble inflation won't pick up as the bubble bursting is highly deflationary. — ssu

Mikie

7.3kAfter the bursting of a speculative housing bubble inflation won't pick up as the bubble bursting is highly deflationary. — ssu

This is a story. But the fact remains that it was predicted at the time, and it didn’t happen.

Furthermore— stimulus was given and QE was implemented. Interest rates were extremely low. Lots of money pumped into the economy. No inflation.

Scramble for excuses if you wish. Just proves it a dogma, not a serious theory.

Why do think so? — ssu

Because they’ve been screaming about debt and inflation for decades. A broken clock is right twice a day.

All this is, in the end, is a conservative talking point. It’s an excuse to ignore supply-side issues like line distributions, price gouging, profiteering, and oligopoly. Rather they want us to believe it’s because some poor people got $1200 bucks and wages increased by 4%. Give me a break.

Complete bullshit. -

ssu

9.8k

ssu

9.8k

Some have, that's true. I do know those permabears. They have their niche audience, just like every perma-something or conspiracy theorists has. And if they change their minds, oh boy, their audience will revolt!Because they’ve been screaming about debt and inflation for decades. A broken clock is right twice a day. — Xtrix

(I only really listen to those that can truly change their stance from bearish to bullish. Those who acknowledge that basically the fiat system can go on for decades and even our lifetime, even if it could crash also.)

But if you think inflation is just a conservative talking point, which I would correct it is when the conservatives aren't in power, then there is not much else for you to contribute in this thread.All this is, in the end, is a conservative talking point. It’s an excuse to ignore supply-side issues like line distributions, price gouging, profiteering, and oligopoly. Rather they want us to believe it’s because some poor people got $1200 bucks and wages increased by 4%. Give me a break.

Complete bullshit. — Xtrix

What I've learned that usually economists of different school do have a point. Something that is true and should be thought about. Yet likely they miss something else also. Hence there aren't economists or economic schools that are RIGHT and others that are WRONG. But many do have this idea, especially when politics comes to the picture. They will have their real economists and others being the phony ones. And basically the whole issue becomes a political fight, perhaps part of the culture war. And then what people hear are only supposed dog whistles. -

Mikie

7.3kBut if you think inflation is just a conservative talking point, which I would correct it is when the conservatives aren't in power, then there is not much else for you to contribute in this thread. — ssu

Mikie

7.3kBut if you think inflation is just a conservative talking point, which I would correct it is when the conservatives aren't in power, then there is not much else for you to contribute in this thread. — ssu

No, I didn’t say inflation is a talking point— I said attributing inflation to raising wages and handing out stimulus checks is a talking point.

Oligopoly and profiteering are far more a problem then child tax credits. -

ssu

9.8k

ssu

9.8k

With inflation, wage increases are usually viewed as the bad guy. And of course the government did basically shut down businesses during the pandemic, so the stimulus checks should be a truly exceptional case. The real question is will they be so exceptional.No, I didn’t say inflation is a talking point— I said attributing inflation to raising wages and handing out stimulus checks is a talking point. — Xtrix

And then there is the question government finances. Which looked like this in 2020.

So that was the "exception". How does it look now? Does it look like the 2020 budget? -

ssu

9.8k

ssu

9.8k

I agree. Those who get the money before the inflation kicks in are the real winners. And usually the wage earners are the last to demand higher compensation due to the higher prices. Yet there's ample amount of literature of wage inflation.Right— and it’s complete nonsense. Anyone who buys into that really just hasn’t looked into the matter closely enough. — Xtrix

But even if it's nonsense, it's politically quite convenient. Just as is the idea that high inflation ought to be best fought by lowering salaries! -

ssu

9.8k

ssu

9.8k

Devaluation (or revaluation) of a currency is a different thing. Remember that other countries had similar policies as the US and in many cases the US dollar / US markets are thought to be the most safest (still).If your point is that American pandemic payouts have now devalued the dollar, I don't think it works that way. — Tate -

ssu

9.8kFrom last Thursday:

ssu

9.8kFrom last Thursday:

Chairman Jerome Powell has said that US government debt is on an 'unsustainable path' while admitting that he underestimated the threat of inflation and warning that a recession is possible.

Powell's remarks came in testimony before the House Financial Services Committee on Thursday, as the powerful Fed chair wrapped up a second day of appearances on Capitol Hill.

'The US is on an unsustainable fiscal path, meaning the debt is growing faster than the economy,' said Powell. 'By definition, that is unsustainable.'

The Congressional Budget Office (CBO) estimates in it's latest report that this year total federal revenue will be 4,8 trillion and the deficit that was 2,7 trillion last year (and earlier in 2020 basically as large as the total revenue) will be just be one trillion. Yet they (the CBO) also forecast that there won't be any recession. -

ssu

9.8kAn insightful and interesting interview with Jeffrey Sachs. I think Sachs puts the "doom & gloom" into a reasonable perspective.

ssu

9.8kAn insightful and interesting interview with Jeffrey Sachs. I think Sachs puts the "doom & gloom" into a reasonable perspective.

As Sachs points out, Ukraine could easily see hyperinflation because of the war.

As the war against Russia enters its seventh month, Ukraine is stuck between a financial rock and a hard place as it seeks to stay afloat while fighting off Moscow's invading forces.

Tax revenues have plummeted due to an economy in free fall while military spending has skyrocketed, leaving the government facing a budget shortfall of $5 billion (€5.02 billion) per month.

To make up for the lack of cash, the country's central bank has effectively been printing money — buying government bonds to the tune of $7.7 billion over the past six months. The Financial Times reported that the printing presses effectively created $3.6 billion in June alone.

Inflation in Ukraine is now about 20% and is going to 30%. The Baltic States have endured high inflation too in the euro area:

-

Tzeentch

4.4kInflation as caused by the increase in the quantity of a currency ('money printing') is a form of devaluation or debasement of currency. It's quite literally a hidden tax.

Tzeentch

4.4kInflation as caused by the increase in the quantity of a currency ('money printing') is a form of devaluation or debasement of currency. It's quite literally a hidden tax.

So there's not much difference, really. That may have been your point.

Welcome to The Philosophy Forum!

Get involved in philosophical discussions about knowledge, truth, language, consciousness, science, politics, religion, logic and mathematics, art, history, and lots more. No ads, no clutter, and very little agreement — just fascinating conversations.

Categories

- Guest category

- Phil. Writing Challenge - June 2025

- The Lounge

- General Philosophy

- Metaphysics & Epistemology

- Philosophy of Mind

- Ethics

- Political Philosophy

- Philosophy of Art

- Logic & Philosophy of Mathematics

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Language

- Interesting Stuff

- Politics and Current Affairs

- Humanities and Social Sciences

- Science and Technology

- Non-English Discussion

- German Discussion

- Spanish Discussion

- Learning Centre

- Resources

- Books and Papers

- Reading groups

- Questions

- Guest Speakers

- David Pearce

- Massimo Pigliucci

- Debates

- Debate Proposals

- Debate Discussion

- Feedback

- Article submissions

- About TPF

- Help

More Discussions

- Other sites we like

- Social media

- Terms of Service

- Sign In

- Created with PlushForums

- © 2026 The Philosophy Forum